A Notice form provides legal notification to a party of an important aspect of a legal matter. Failure to provide proper notice is often the cause of delays in the progress of lawsuits and other legal matters. This model form, a Notice to Garnishee of Federal Law to Wages, provides notice of the stated matter. Because each case is unique, you will need to adapt the form to fit your specific facts and circumstances. Available for download now.

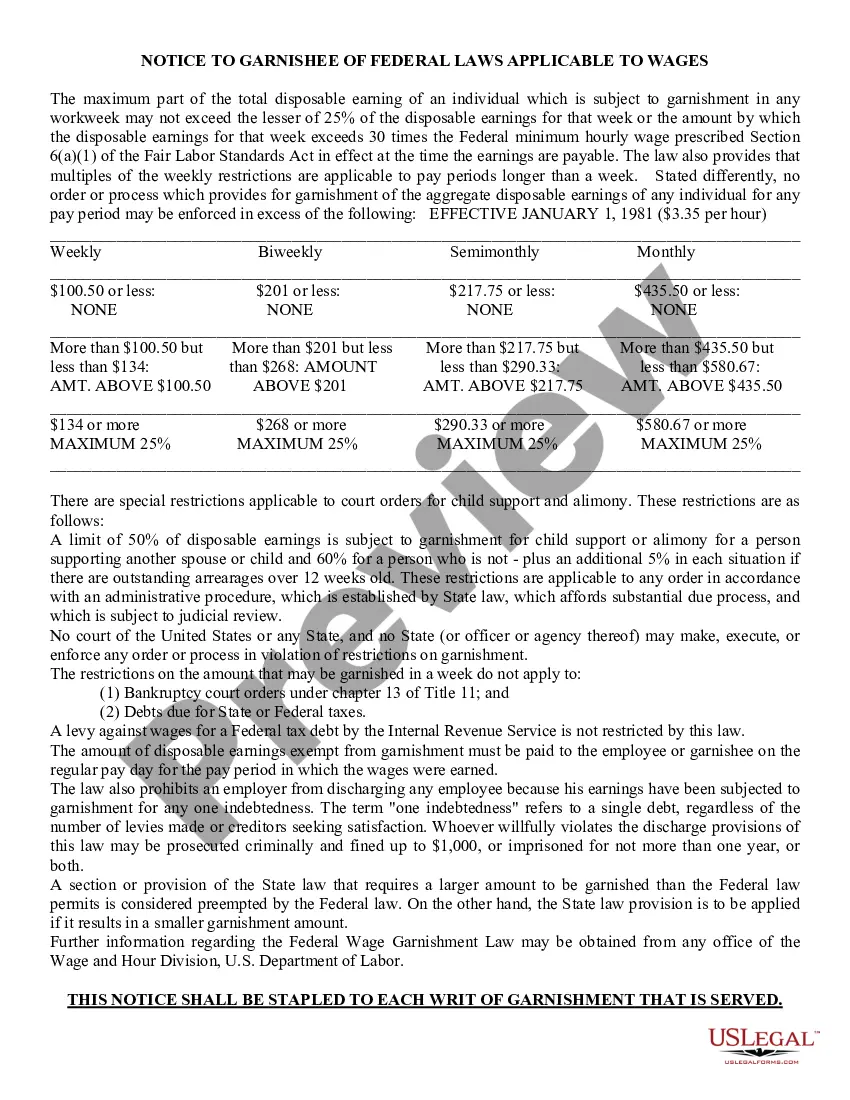

Maricopa Arizona Notice to Garnishee of Federal Law to Wages is a legal document that pertains to the garnishment of wages in Maricopa, Arizona, in compliance with federal laws. This notice is a vital part of the wage garnishment process, and it aims to inform employers (referred to as garnishees) about their legal obligations and responsibilities. The Maricopa Arizona Notice to Garnishee of Federal Law to Wages serves as a notification tool that creditors utilize to enforce judgment against debtors by seizing a portion of their wages. When creditors obtain a court order to garnish an employee's wages, they are required to provide this notice to the employer, who acts as the garnishee in Maricopa, Arizona. This notice outlines the specific details and requirements that employers must adhere to when implementing wage garnishment, ensuring they comply with federal laws, regulations, and restrictions. It provides information regarding the maximum amount that can be deducted from an employee's wages, the calculation process, and the duration of the garnishment order. Different types of Maricopa Arizona Notice to Garnishee of Federal Law to Wages may exist depending on factors such as: 1. Initial Notice: This type of notice is typically sent by the creditor to the employer, informing them of the intent to initiate wage garnishment against an employee owing a debt. 2. Order of Garnishment: Once the court has approved the garnishment, this notice confirms the legal authorization for the employer to withhold a portion of the employee's wages and remit them to the creditor. 3. Notice of Termination: When the garnishment period ends or the debt is satisfied, this notice informs the employer that they are no longer required to withhold any further amounts from the employee's wages. Keywords: Maricopa Arizona, Notice to Garnishee, Federal Law, Wages, Wage Garnishment, Garnishment Process, Legal Document, Employers, Compliance, Court Order, Debtors, Creditors, Regulations, Restrictions, Deduction, Calculation, Duration, Initial Notice, Order of Garnishment, Notice of Termination.Maricopa Arizona Notice to Garnishee of Federal Law to Wages is a legal document that pertains to the garnishment of wages in Maricopa, Arizona, in compliance with federal laws. This notice is a vital part of the wage garnishment process, and it aims to inform employers (referred to as garnishees) about their legal obligations and responsibilities. The Maricopa Arizona Notice to Garnishee of Federal Law to Wages serves as a notification tool that creditors utilize to enforce judgment against debtors by seizing a portion of their wages. When creditors obtain a court order to garnish an employee's wages, they are required to provide this notice to the employer, who acts as the garnishee in Maricopa, Arizona. This notice outlines the specific details and requirements that employers must adhere to when implementing wage garnishment, ensuring they comply with federal laws, regulations, and restrictions. It provides information regarding the maximum amount that can be deducted from an employee's wages, the calculation process, and the duration of the garnishment order. Different types of Maricopa Arizona Notice to Garnishee of Federal Law to Wages may exist depending on factors such as: 1. Initial Notice: This type of notice is typically sent by the creditor to the employer, informing them of the intent to initiate wage garnishment against an employee owing a debt. 2. Order of Garnishment: Once the court has approved the garnishment, this notice confirms the legal authorization for the employer to withhold a portion of the employee's wages and remit them to the creditor. 3. Notice of Termination: When the garnishment period ends or the debt is satisfied, this notice informs the employer that they are no longer required to withhold any further amounts from the employee's wages. Keywords: Maricopa Arizona, Notice to Garnishee, Federal Law, Wages, Wage Garnishment, Garnishment Process, Legal Document, Employers, Compliance, Court Order, Debtors, Creditors, Regulations, Restrictions, Deduction, Calculation, Duration, Initial Notice, Order of Garnishment, Notice of Termination.