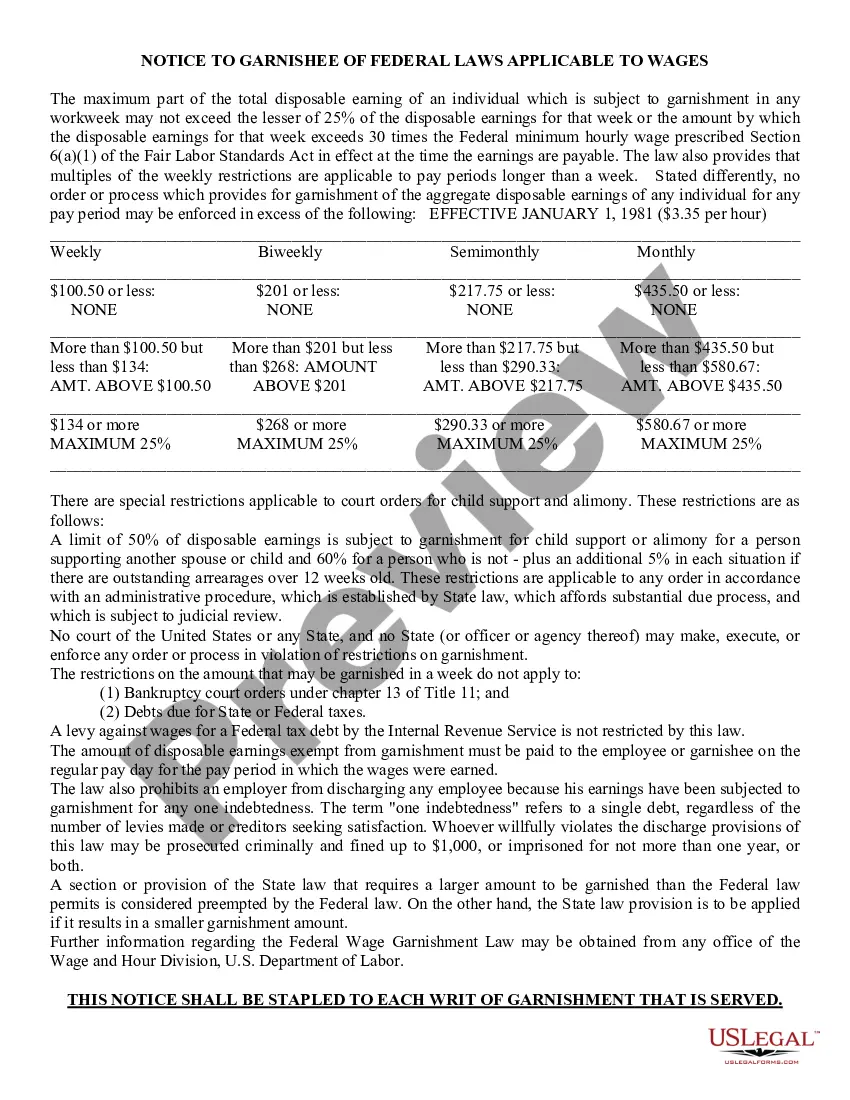

A Notice form provides legal notification to a party of an important aspect of a legal matter. Failure to provide proper notice is often the cause of delays in the progress of lawsuits and other legal matters. This model form, a Notice to Garnishee of Federal Law to Wages, provides notice of the stated matter. Because each case is unique, you will need to adapt the form to fit your specific facts and circumstances. Available for download now.

The Mesa Arizona Notice to Garnishee of Federal Law to Wages is a legal document issued by the court to employers, informing them of their obligations under federal law regarding wage garnishments. This notice serves as a means of enforcing the collection of unpaid debts owed by an employee. One type of Mesa Arizona Notice to Garnishee of Federal Law to Wages is the Initial Notice, which is typically sent to the employer as soon as the court order for wage garnishment is issued. This notice contains detailed instructions on how to comply with federal law and provides information on the specific case and debt that is being pursued. Another type is the Ongoing Notice, which is sent on a regular basis, usually monthly, to remind the employer of their ongoing obligations to withhold a certain amount from the employee's wages. This notice serves as a reminder to the employer to continue withholding funds until the debt is fully satisfied or until ordered otherwise by the court. The Mesa Arizona Notice to Garnishee of Federal Law to Wages requires the employer to calculate and withhold a specific percentage or amount from the employee's wages, as specified in the court order. It also instructs the employer on how to remit the withheld funds to the court or the designated entity responsible for collecting the debt. Employers receiving this notice must understand that failure to comply with federal wage garnishment laws can result in penalties and legal consequences. They are required to promptly and accurately withhold the specified amount from the employee's wages and remit these funds to the appropriate entity within the designated timeframe. It is essential for employers to maintain accurate records of all wage garnishments and to keep track of the amounts withheld and remitted. These records may be subject to audit by the court or the entities involved in debt collection to ensure compliance with federal law. Overall, the Mesa Arizona Notice to Garnishee of Federal Law to Wages aims to provide clear guidelines to employers, ensuring that wage garnishments are processed correctly and that employees' debts are appropriately collected. Employers must carefully review and comply with these notices to avoid legal complications and to fulfill their legal obligations under federal law.The Mesa Arizona Notice to Garnishee of Federal Law to Wages is a legal document issued by the court to employers, informing them of their obligations under federal law regarding wage garnishments. This notice serves as a means of enforcing the collection of unpaid debts owed by an employee. One type of Mesa Arizona Notice to Garnishee of Federal Law to Wages is the Initial Notice, which is typically sent to the employer as soon as the court order for wage garnishment is issued. This notice contains detailed instructions on how to comply with federal law and provides information on the specific case and debt that is being pursued. Another type is the Ongoing Notice, which is sent on a regular basis, usually monthly, to remind the employer of their ongoing obligations to withhold a certain amount from the employee's wages. This notice serves as a reminder to the employer to continue withholding funds until the debt is fully satisfied or until ordered otherwise by the court. The Mesa Arizona Notice to Garnishee of Federal Law to Wages requires the employer to calculate and withhold a specific percentage or amount from the employee's wages, as specified in the court order. It also instructs the employer on how to remit the withheld funds to the court or the designated entity responsible for collecting the debt. Employers receiving this notice must understand that failure to comply with federal wage garnishment laws can result in penalties and legal consequences. They are required to promptly and accurately withhold the specified amount from the employee's wages and remit these funds to the appropriate entity within the designated timeframe. It is essential for employers to maintain accurate records of all wage garnishments and to keep track of the amounts withheld and remitted. These records may be subject to audit by the court or the entities involved in debt collection to ensure compliance with federal law. Overall, the Mesa Arizona Notice to Garnishee of Federal Law to Wages aims to provide clear guidelines to employers, ensuring that wage garnishments are processed correctly and that employees' debts are appropriately collected. Employers must carefully review and comply with these notices to avoid legal complications and to fulfill their legal obligations under federal law.