A Notice form provides legal notification to a party of an important aspect of a legal matter. Failure to provide proper notice is often the cause of delays in the progress of lawsuits and other legal matters. This model form, a Notice to Garnishee of Federal Law to Wages, provides notice of the stated matter. Because each case is unique, you will need to adapt the form to fit your specific facts and circumstances. Available for download now.

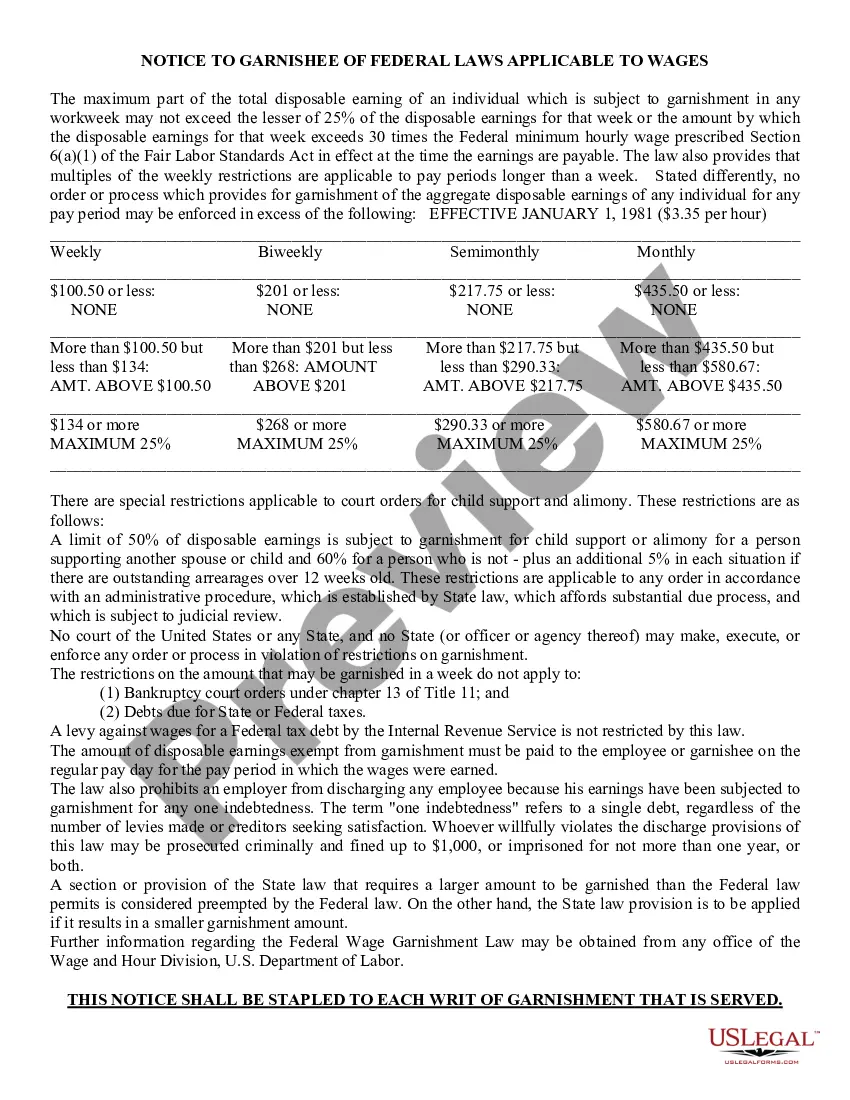

The Lima Arizona Notice to Garnishee of Federal Law to Wages is an important legal document used in Arizona to notify employers of their obligations under federal law regarding wage garnishments. This notice serves to inform employers of their duty to withhold a portion of an employee's wages to satisfy outstanding debts owed to creditors. Employers in Lima, Arizona are legally required to comply with federal law when it comes to wage garnishments. The notice outlines the specific obligations and responsibilities that employers must adhere to in order to ensure compliance. Some key points covered in the Lima Arizona Notice to Garnishee of Federal Law to Wages include: 1. Identification of the Employee: The notice requires the employer to provide the necessary information about the employee, such as their full name, social security number, and current address. 2. Introduction to Wage Garnishment: The notice explains the concept of wage garnishment and how it functions as a legal means to collect outstanding debts from an employee's wages. 3. Calculation of Garnishable Amount: The notice provides instructions on how to calculate the amount that can be deducted from the employee's wages, emphasizing the importance of adhering to federal guidelines and limitations. 4. Priority of Garnishments: If an employee is subjected to multiple garnishments, the notice clarifies the priority order in which they should be applied, ensuring compliance with federal law. 5. Timelines and Deadlines: The notice outlines the specific timeframes within which the employer must begin withholding and remitting the garnished wages to the appropriate creditor(s). It's important to note that there are different types of Lima Arizona Notice to Garnishee of Federal Law to Wages notices that may be issued depending on the nature of the debt and specific circumstances. These variations include: 1. Lima Arizona Notice to Garnishee of Federal Law to Wages — Child Support: This notice specifically pertains to wage garnishments initiated to fulfill child support obligations. It highlights the unique considerations and requirements associated with such garnishments. 2. Lima Arizona Notice to Garnishee of Federal Law to Wages — Tax Debt: This notice is used when the wage garnishment is being enforced to collect outstanding tax debts owed to federal or state taxing authorities. 3. Lima Arizona Notice to Garnishee of Federal Law to Wages — Consumer Debt: This notice is employed for wage garnishments related to consumer debts, such as unpaid credit card bills or personal loans. In summary, the Lima Arizona Notice to Garnishee of Federal Law to Wages is a critical document that ensures employers in Lima, Arizona understand and fulfill their obligations under federal law regarding wage garnishments. Various types of these notices exist, each catering to specific types of debts, such as child support, tax debts, and consumer debts. Adhering to these guidelines helps maintain compliance and protect the rights of both the employee and the creditor involved in the wage garnishment process.The Lima Arizona Notice to Garnishee of Federal Law to Wages is an important legal document used in Arizona to notify employers of their obligations under federal law regarding wage garnishments. This notice serves to inform employers of their duty to withhold a portion of an employee's wages to satisfy outstanding debts owed to creditors. Employers in Lima, Arizona are legally required to comply with federal law when it comes to wage garnishments. The notice outlines the specific obligations and responsibilities that employers must adhere to in order to ensure compliance. Some key points covered in the Lima Arizona Notice to Garnishee of Federal Law to Wages include: 1. Identification of the Employee: The notice requires the employer to provide the necessary information about the employee, such as their full name, social security number, and current address. 2. Introduction to Wage Garnishment: The notice explains the concept of wage garnishment and how it functions as a legal means to collect outstanding debts from an employee's wages. 3. Calculation of Garnishable Amount: The notice provides instructions on how to calculate the amount that can be deducted from the employee's wages, emphasizing the importance of adhering to federal guidelines and limitations. 4. Priority of Garnishments: If an employee is subjected to multiple garnishments, the notice clarifies the priority order in which they should be applied, ensuring compliance with federal law. 5. Timelines and Deadlines: The notice outlines the specific timeframes within which the employer must begin withholding and remitting the garnished wages to the appropriate creditor(s). It's important to note that there are different types of Lima Arizona Notice to Garnishee of Federal Law to Wages notices that may be issued depending on the nature of the debt and specific circumstances. These variations include: 1. Lima Arizona Notice to Garnishee of Federal Law to Wages — Child Support: This notice specifically pertains to wage garnishments initiated to fulfill child support obligations. It highlights the unique considerations and requirements associated with such garnishments. 2. Lima Arizona Notice to Garnishee of Federal Law to Wages — Tax Debt: This notice is used when the wage garnishment is being enforced to collect outstanding tax debts owed to federal or state taxing authorities. 3. Lima Arizona Notice to Garnishee of Federal Law to Wages — Consumer Debt: This notice is employed for wage garnishments related to consumer debts, such as unpaid credit card bills or personal loans. In summary, the Lima Arizona Notice to Garnishee of Federal Law to Wages is a critical document that ensures employers in Lima, Arizona understand and fulfill their obligations under federal law regarding wage garnishments. Various types of these notices exist, each catering to specific types of debts, such as child support, tax debts, and consumer debts. Adhering to these guidelines helps maintain compliance and protect the rights of both the employee and the creditor involved in the wage garnishment process.