A Notice form provides legal notification to a party of an important aspect of a legal matter. Failure to provide proper notice is often the cause of delays in the progress of lawsuits and other legal matters. This model form, a Notice to Garnishee of Federal Law to Wages, provides notice of the stated matter. Because each case is unique, you will need to adapt the form to fit your specific facts and circumstances. Available for download now.

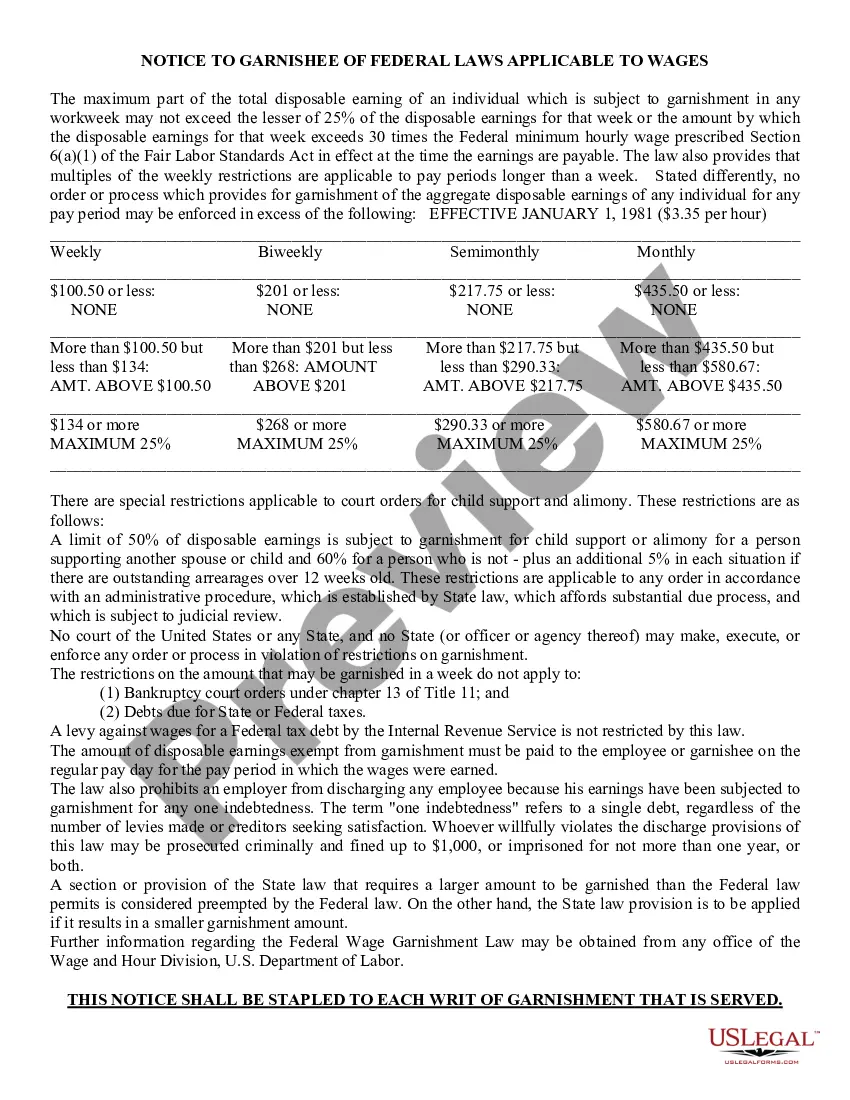

Title: Understanding the Tempe, Arizona Notice to Garnishee of Federal Law to Wages Keywords: Tempe Arizona, Notice to Garnishee, Federal Law, Wages, Garnishment process, Types of notices Introduction: The Tempe, Arizona Notice to Garnishee of Federal Law to Wages is a crucial document used in wage garnishment cases. This detailed description aims to provide comprehensive information regarding this notice and its various types, serving as a valuable resource for residents, employers, and legal professionals in Tempe, Arizona. 1. What is the Tempe Arizona Notice to Garnishee of Federal Law to Wages? The Tempe Arizona Notice to Garnishee of Federal Law to Wages is a legal notice issued to employers (garnishees) informing them of their obligation to withhold a certain portion of an employee's wages, as directed under federal law, to satisfy a debt owed by the employee. 2. Understanding the Garnishment Process: The garnishment process begins with a creditor obtaining a judgment against a debtor. Once the judgment is obtained, the creditor can then request a court order to garnish the debtor's wages. This court order is communicated to the employer through the Tempe Arizona Notice to Garnishee of Federal Law to Wages. 3. Types of Tempe Arizona Notice to Garnishee of Federal Law to Wages: a) Standard Notice: This type of notice is the common form used when an employer must withhold a portion of an employee's wages to satisfy a debt owed. It provides detailed instructions regarding how much should be withheld from each paycheck until the debt is settled. b) Continuous Notice: In certain cases, a creditor may request a continuous wage garnishment, meaning the garnishment will continue until the entire debt is paid off. This notice type informs the employer about the continuous wage garnishment order, specifying the amount to be deducted from each paycheck until the debt is satisfied. c) Termination Notice: When a debt is fully paid or settled, the creditor is responsible for providing a Termination Notice to the garnishee, ensuring that wage deductions cease immediately. 4. Compliance with Federal Law: The Tempe Arizona Notice to Garnishee of Federal Law to Wages is designed to ensure employers are aware of their legal obligations under federal law regarding wage garnishment. Employers must comply with the notice requirements, accurately calculate and withhold the specified amounts, and remit them to the appropriate authority. Conclusion: Understanding the Tempe Arizona Notice to Garnishee of Federal Law to Wages is essential for both employers and employees involved in wage garnishment cases. By adhering to federal law and following the guidelines outlined in these notices, employers can ensure compliance and protect the rights of all parties involved.Title: Understanding the Tempe, Arizona Notice to Garnishee of Federal Law to Wages Keywords: Tempe Arizona, Notice to Garnishee, Federal Law, Wages, Garnishment process, Types of notices Introduction: The Tempe, Arizona Notice to Garnishee of Federal Law to Wages is a crucial document used in wage garnishment cases. This detailed description aims to provide comprehensive information regarding this notice and its various types, serving as a valuable resource for residents, employers, and legal professionals in Tempe, Arizona. 1. What is the Tempe Arizona Notice to Garnishee of Federal Law to Wages? The Tempe Arizona Notice to Garnishee of Federal Law to Wages is a legal notice issued to employers (garnishees) informing them of their obligation to withhold a certain portion of an employee's wages, as directed under federal law, to satisfy a debt owed by the employee. 2. Understanding the Garnishment Process: The garnishment process begins with a creditor obtaining a judgment against a debtor. Once the judgment is obtained, the creditor can then request a court order to garnish the debtor's wages. This court order is communicated to the employer through the Tempe Arizona Notice to Garnishee of Federal Law to Wages. 3. Types of Tempe Arizona Notice to Garnishee of Federal Law to Wages: a) Standard Notice: This type of notice is the common form used when an employer must withhold a portion of an employee's wages to satisfy a debt owed. It provides detailed instructions regarding how much should be withheld from each paycheck until the debt is settled. b) Continuous Notice: In certain cases, a creditor may request a continuous wage garnishment, meaning the garnishment will continue until the entire debt is paid off. This notice type informs the employer about the continuous wage garnishment order, specifying the amount to be deducted from each paycheck until the debt is satisfied. c) Termination Notice: When a debt is fully paid or settled, the creditor is responsible for providing a Termination Notice to the garnishee, ensuring that wage deductions cease immediately. 4. Compliance with Federal Law: The Tempe Arizona Notice to Garnishee of Federal Law to Wages is designed to ensure employers are aware of their legal obligations under federal law regarding wage garnishment. Employers must comply with the notice requirements, accurately calculate and withhold the specified amounts, and remit them to the appropriate authority. Conclusion: Understanding the Tempe Arizona Notice to Garnishee of Federal Law to Wages is essential for both employers and employees involved in wage garnishment cases. By adhering to federal law and following the guidelines outlined in these notices, employers can ensure compliance and protect the rights of all parties involved.