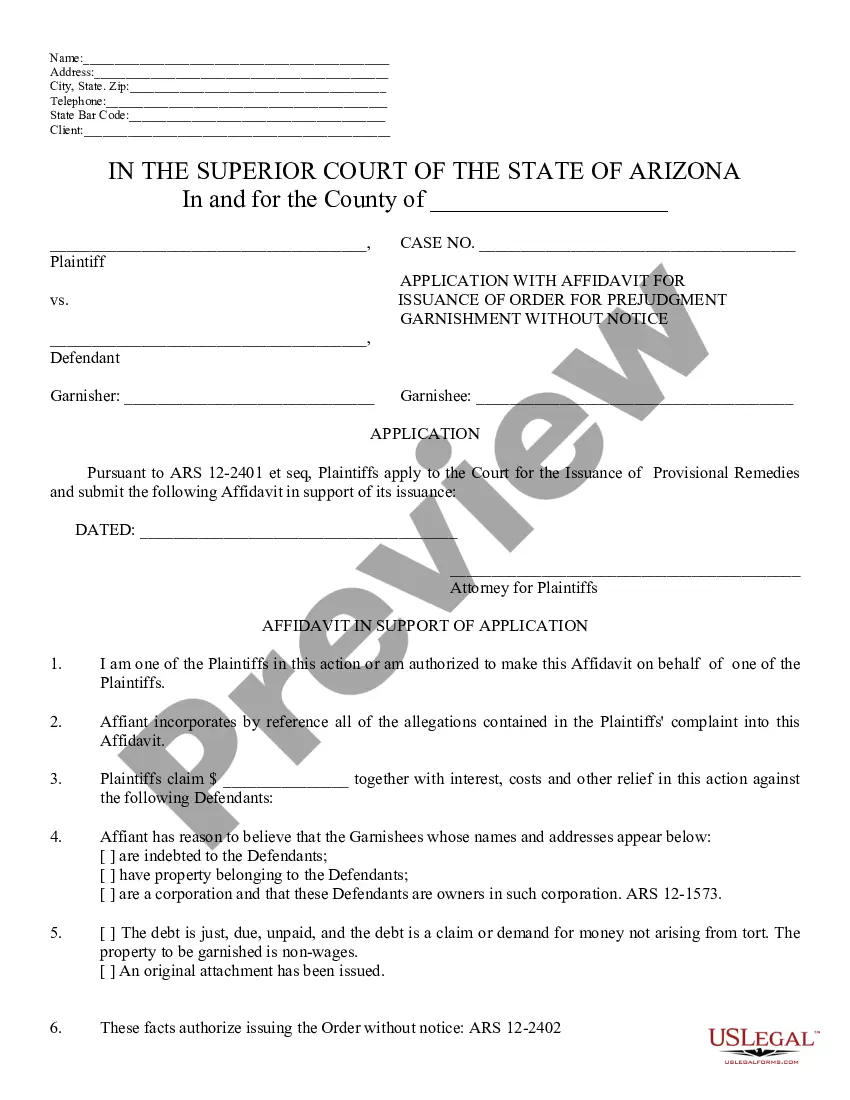

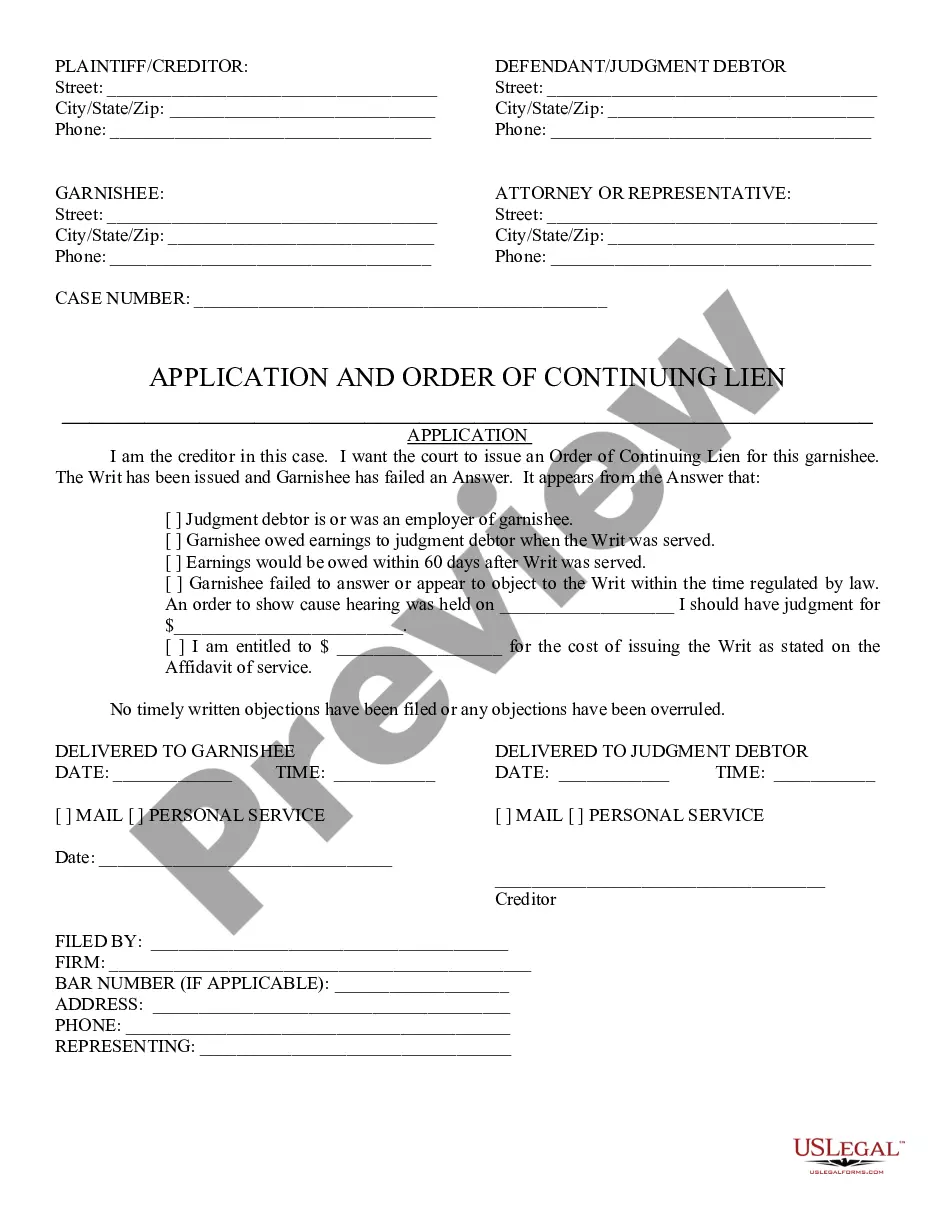

Application for Order of Continuing Lien: An Application for Order of Continuing Lien simply requests that the court continue a lien previously established on the Defendant. Further, it asks the court to continue the lien until such time the judgment is satisfied. This form is available in both Word and Rich Text formats.

Phoenix Arizona Application for Order of Continuing Lien

Description

How to fill out Arizona Application For Order Of Continuing Lien?

Do you require a reliable and cost-effective legal document provider to obtain the Phoenix Arizona Application for Order of Continuing Lien? US Legal Forms is your ideal choice.

Whether you need a straightforward arrangement to establish rules for living with your partner or a collection of documents to further your divorce through the judicial system, we have you covered. Our platform offers over 85,000 current legal document templates for personal and business applications. All templates we provide aren’t one-size-fits-all but are tailored according to the specifications of different states and regions.

To obtain the form, you need to Log In to your account, find the desired form, and click the Download button next to it. Please remember that you can download your previously acquired document templates at any time from the My documents section.

Is this your first time visiting our platform? No problem. You can easily set up an account, but first, ensure you do the following.

Now you can create your account. After that, select the subscription option and move forward to payment. Once the payment is processed, download the Phoenix Arizona Application for Order of Continuing Lien in any of the offered file formats. You can return to the website anytime and redownload the form at no additional cost.

Obtaining current legal documents has never been simpler. Try US Legal Forms today and stop wasting hours researching legal documents online once and for all.

- Check if the Phoenix Arizona Application for Order of Continuing Lien meets the guidelines of your state and local jurisdiction.

- Review the form’s description (if available) to understand who the form is meant for and its intended use.

- Restart your search if the form does not suit your legal circumstances.

Form popularity

FAQ

To attach the lien, the creditor files and records a judgment with the county recorder in any Arizona county where the debtor owns property now or where they may own property in the future.

A judgment or judgment lien will be valid for ten years from its date of entry. A.R.S. § 12-1551. The deadline for renewing a judgment by filing a lawsuit or an affidavit will be ten years from the judgment's date of entry.

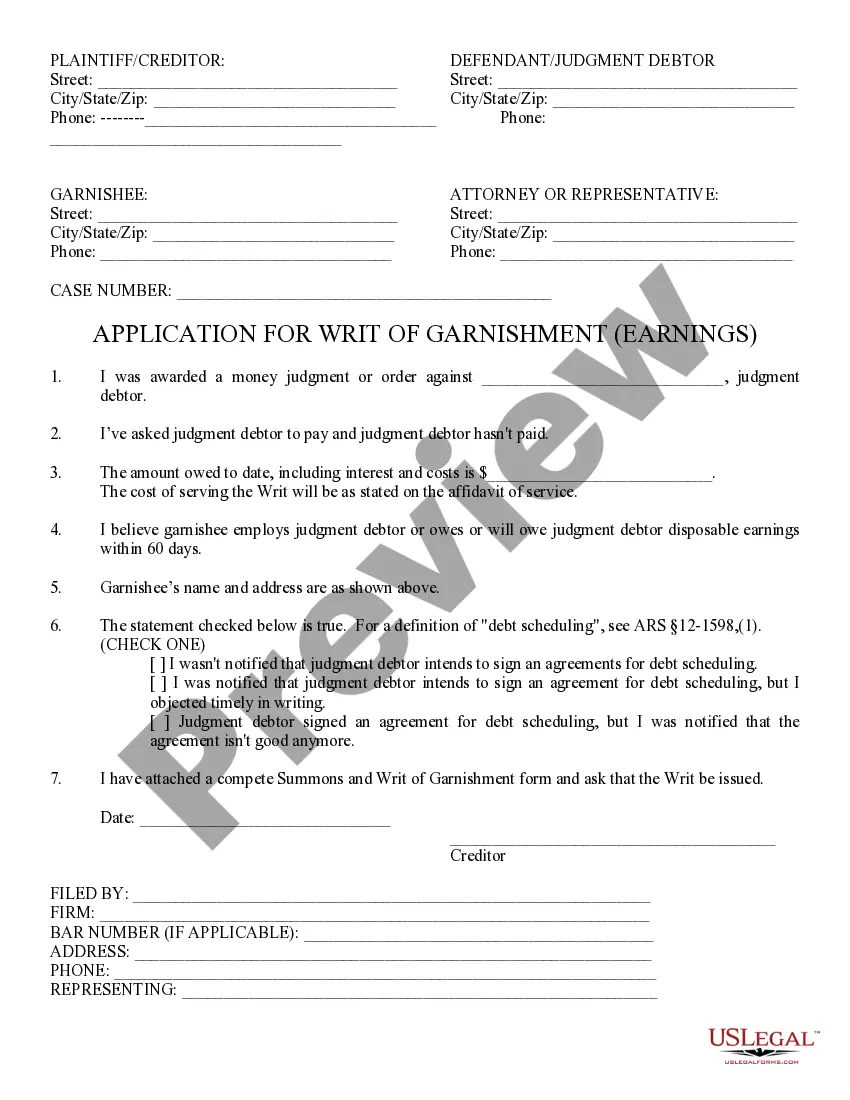

The garnishment amount is limited to 25% of your disposable earnings for that week (what's left after mandatory deductions) or the amount by which your disposable earnings for that week exceed 30 times the federal minimum hourly wage, whichever is less.

A certified copy of the judgment of any court in this state may be filed and recorded in the office of the county recorder in each county where the judgment creditor desires the judgment to become a lien on the real property of the judgment debtor.

As discussed hereinbelow, a judgment may be renewed either by filing a suit on it or by filing an affidavit renewal with the clerk of the appropriate court. A.R.S. §§ 12-1611, 1612(A). Such a renewal, however, does not automatically extend the judgment lien created by the recording of the original judgment.

The easy definition is that a judgment is an official decision rendered by the court with regard to a civil matter. A judgment lien, sometimes referred to as an ?abstract of judgment,? is an involuntary lien that is filed to give constructive notice and is to attach to the Judgment Debtor's property and/or assets.

How do I stop a garnishment? Option 1: Don't allow a judgment to be entered against you. Option 2: Challenge the judgment. Option 3: Don't expose assets to garnishment. Option 4: Reduce the amount that is being garnished (wage garnishments only) Option 5: Settlement. Option 6: Bankruptcy.

Up to 25% of Wages Are Garnished Until Debt is Repaid Wage garnishment in Arizona is limited in accordance with the federal Consumer Credit Protection Act (CCPA). This means that garnishees may withhold no more than 25% of your non-exempt disposable earnings to be paid to a single judgment creditor.

Even after a garnishment has started, you can still try and negotiate a resolution with the creditor, especially if your circumstances change.

You can STOP the garnishment any time by paying the Clerk's Office what you owe. The Clerk will give you a receipt. Take the receipt to your employer right away. They should stop taking money from your pay as soon as they get the receipt.