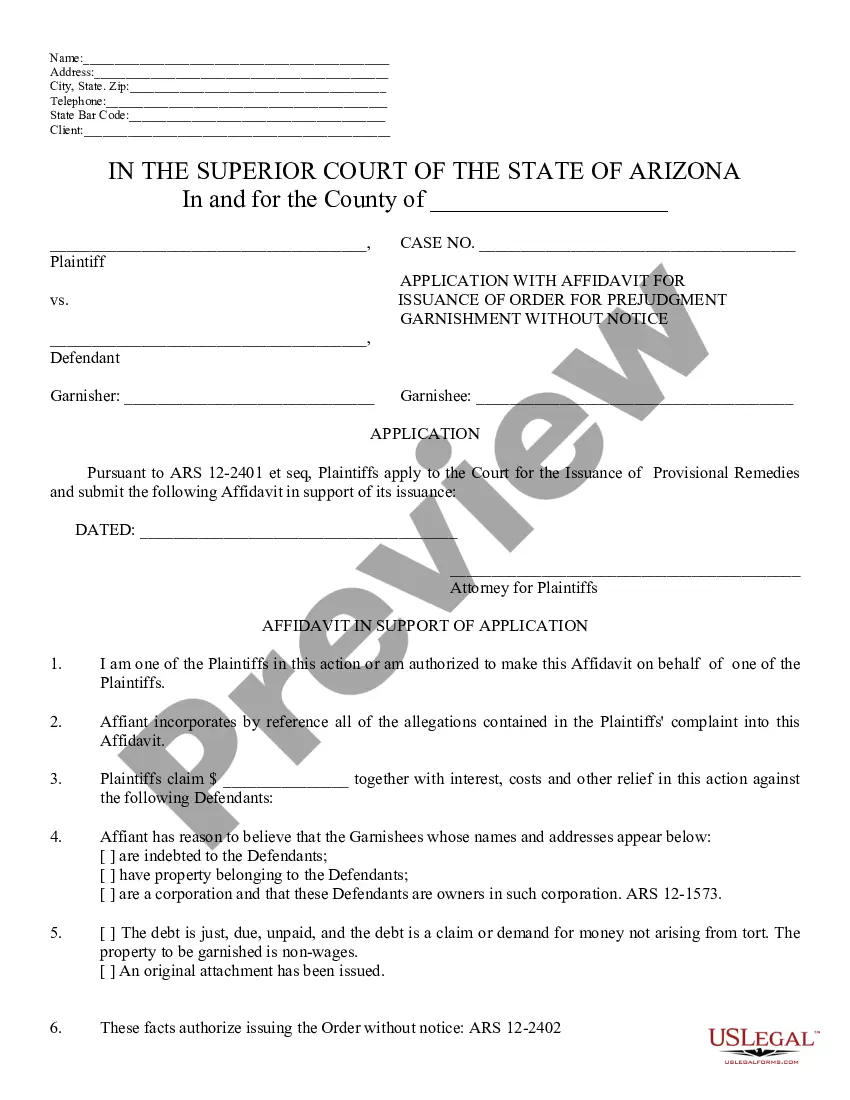

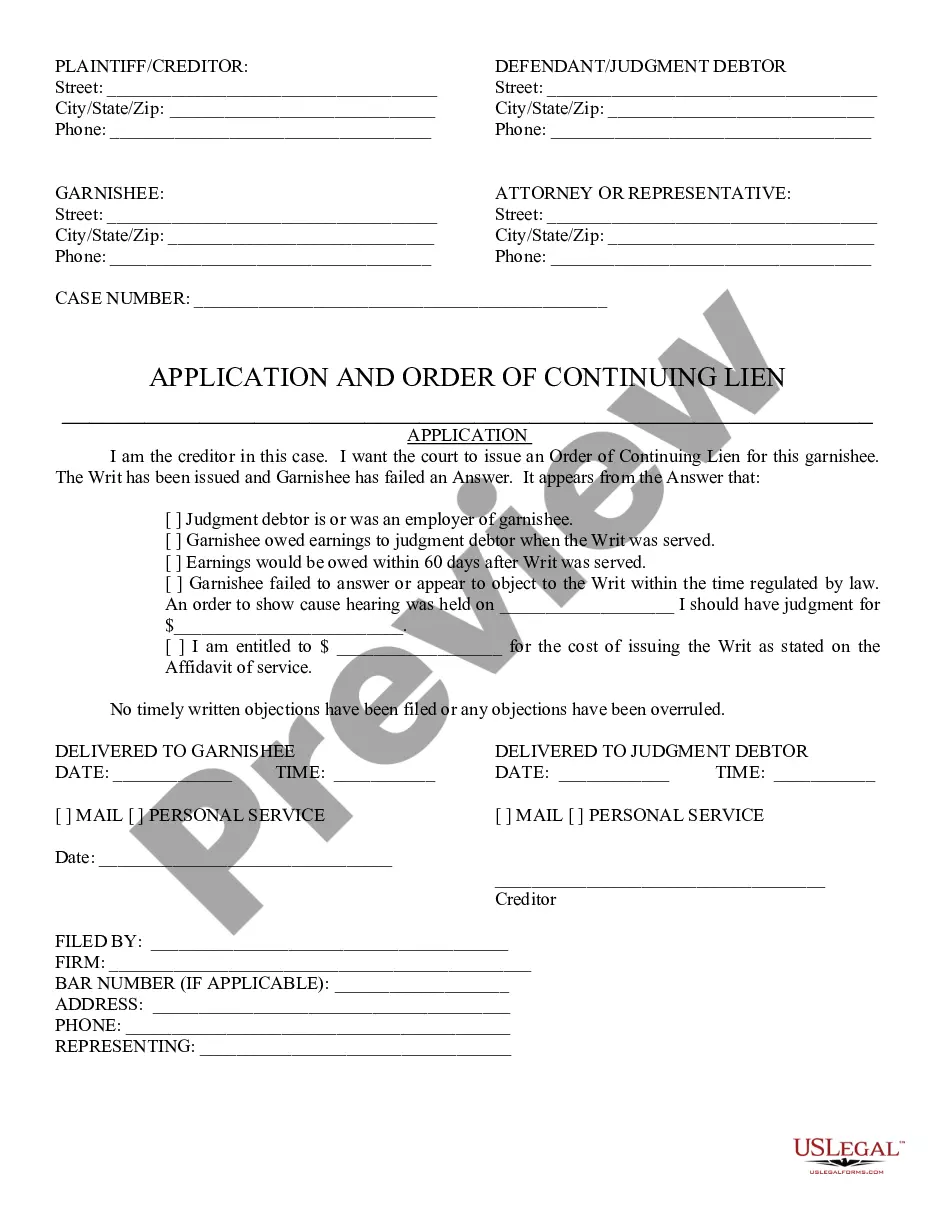

Application for Order of Continuing Lien: An Application for Order of Continuing Lien simply requests that the court continue a lien previously established on the Defendant. Further, it asks the court to continue the lien until such time the judgment is satisfied. This form is available in both Word and Rich Text formats.

Surprise Arizona Application for Order of Continuing Lien

Description

How to fill out Arizona Application For Order Of Continuing Lien?

If you are searching for a legitimate form, it’s exceptionally challenging to discover a more convenient service than the US Legal Forms site – one of the largest libraries online.

Here you can locate a vast array of document templates for business and personal use categorized by types and areas, or keywords.

Utilizing our enhanced search feature, locating the most recent Surprise Arizona Application for Order of Continuing Lien is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration steps.

Acquire the form. Select the file format and download it to your device. Edit your details. Complete, modify, print, and sign the acquired Surprise Arizona Application for Order of Continuing Lien.

- Moreover, the validity of each document is confirmed by a team of proficient attorneys who regularly review the templates on our platform and update them according to the latest state and county regulations.

- If you are already familiar with our system and possess a registered account, all you need to do to obtain the Surprise Arizona Application for Order of Continuing Lien is to Log In to your user account and click the Download button.

- If this is your first time using US Legal Forms, just adhere to the instructions outlined below.

- Ensure you have located the template you need. Review its description and utilize the Preview feature to examine its contents. If it doesn’t match your needs, use the Search function found at the top of the page to find the suitable document.

- Confirm your selection. Click the Buy now button. Then, select the desired pricing option and provide the necessary details to create an account.

Form popularity

FAQ

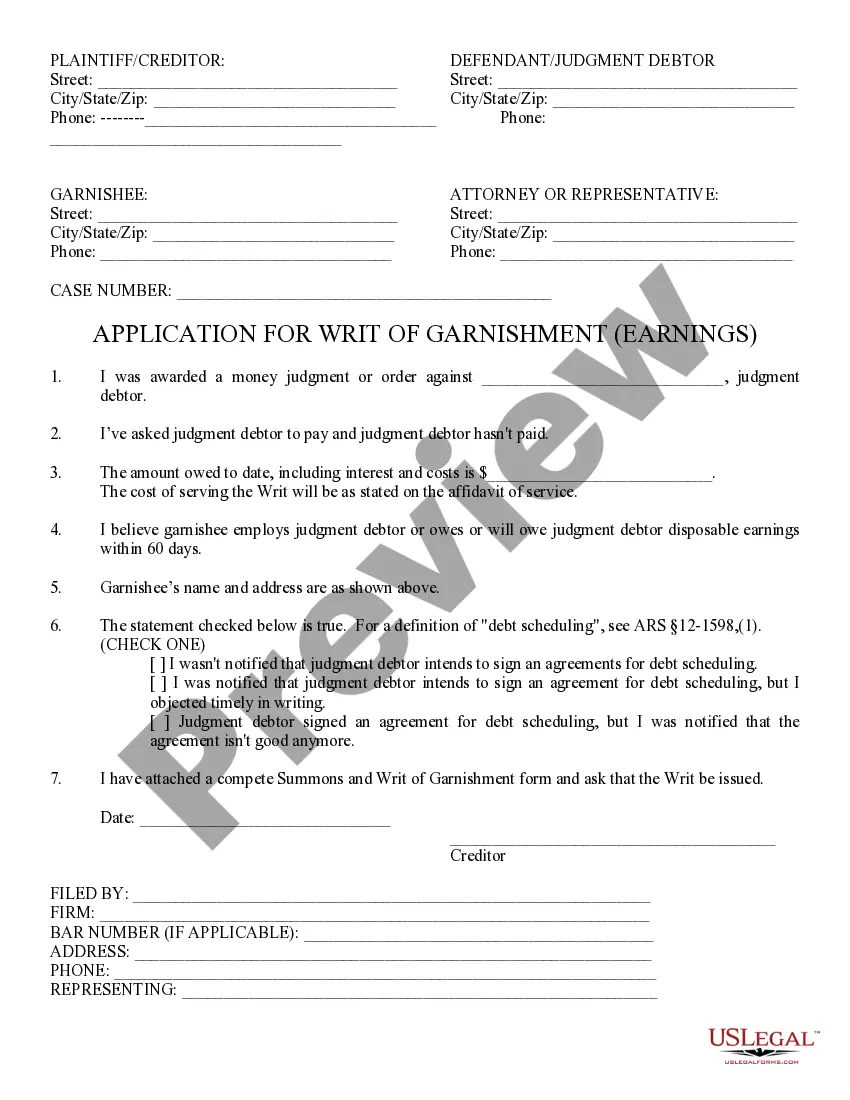

A continuing garnishment is a court order that requires an employer or financial institution to withhold a certain amount from your earnings or accounts until a debt is settled. This type of garnishment differs from one-time garnishments, as it continues over a specified period. If you wish to maintain control over this situation, consider a Surprise Arizona Application for Order of Continuing Lien. Uslegalforms can assist in streamlining this application process.

Ignoring a garnishment can lead to serious financial consequences. The court may proceed with automatic deductions from your wages or bank account without further notice. This often adds additional fees and could even result in legal action against you. If you’re facing such issues, consider a Surprise Arizona Application for Order of Continuing Lien to manage the situation properly.

To record a judgment in Arizona, you need to file the judgment with the county recorder's office where the judgment was rendered. It’s important to complete a Surprise Arizona Application for Order of Continuing Lien if you aim to ensure that the lien persists on the property of the debtor. This process helps establish your claim legally. You can also utilize uslegalforms to access the necessary forms and guidance.

The three types of liens generally include consensual liens, statutory liens, and judgment liens. Consensual liens arise from voluntary agreements, such as mortgages, while statutory liens are created by law to secure payment for services rendered or taxes owed. A judgment lien is a result of a court ruling, and pursuing a Surprise Arizona Application for Order of Continuing Lien can support creditors in securing their claims effectively.

A continuous lien is a type of lien that remains in effect over a period of time, allowing creditors to secure their interests in a debtor's property continuously. When you file a Surprise Arizona Application for Order of Continuing Lien, you essentially create a continuous lien that helps protect your rights over the duration of the debt. It is important for both creditors and debtors to understand the implications and responsibilities associated with continuous liens.

A writ of garnishment is a legal order allowing a creditor to collect funds directly from a debtor's wages or accounts without requiring a court appearance. In the state of Arizona, this can be particularly useful when filing a Surprise Arizona Application for Order of Continuing Lien. This process helps to secure payments and ensures that creditors can access funds owed to them.

Continuing garnishment involves regular deductions from a debtor's wages or bank accounts over a period of time, while non-continuing garnishment is typically a one-time deduction. When pursuing a Surprise Arizona Application for Order of Continuing Lien, understanding this distinction can aid creditors in choosing the best approach to recover what is owed. Continuing garnishment ensures that repayments are ongoing until the debt is settled.

A lien continuation is a legal process that allows a creditor to maintain their claim against a debtor's property or assets over time. In the context of filing a Surprise Arizona Application for Order of Continuing Lien, this can help secure payment for outstanding debts. By extending the lien, the creditor reduces the risk of losing their claim, particularly if the debtor's financial situation changes.

To file a judgment lien in Arizona, gather necessary documents including the judgment and a completed lien form. You must then submit these documents to the county recorder's office where the property is located. By using a Surprise Arizona Application for Order of Continuing Lien, you can navigate the filing process more easily, helping you secure your financial rights.

A continuing lien is a legal claim that remains active over time, covering future transactions or debts related to the property. This type of lien provides long-term security for creditors, ensuring they have a claim against the debtor's assets. By applying for a Surprise Arizona Application for Order of Continuing Lien, you can secure a continuing lien that covers evolving financial interactions.