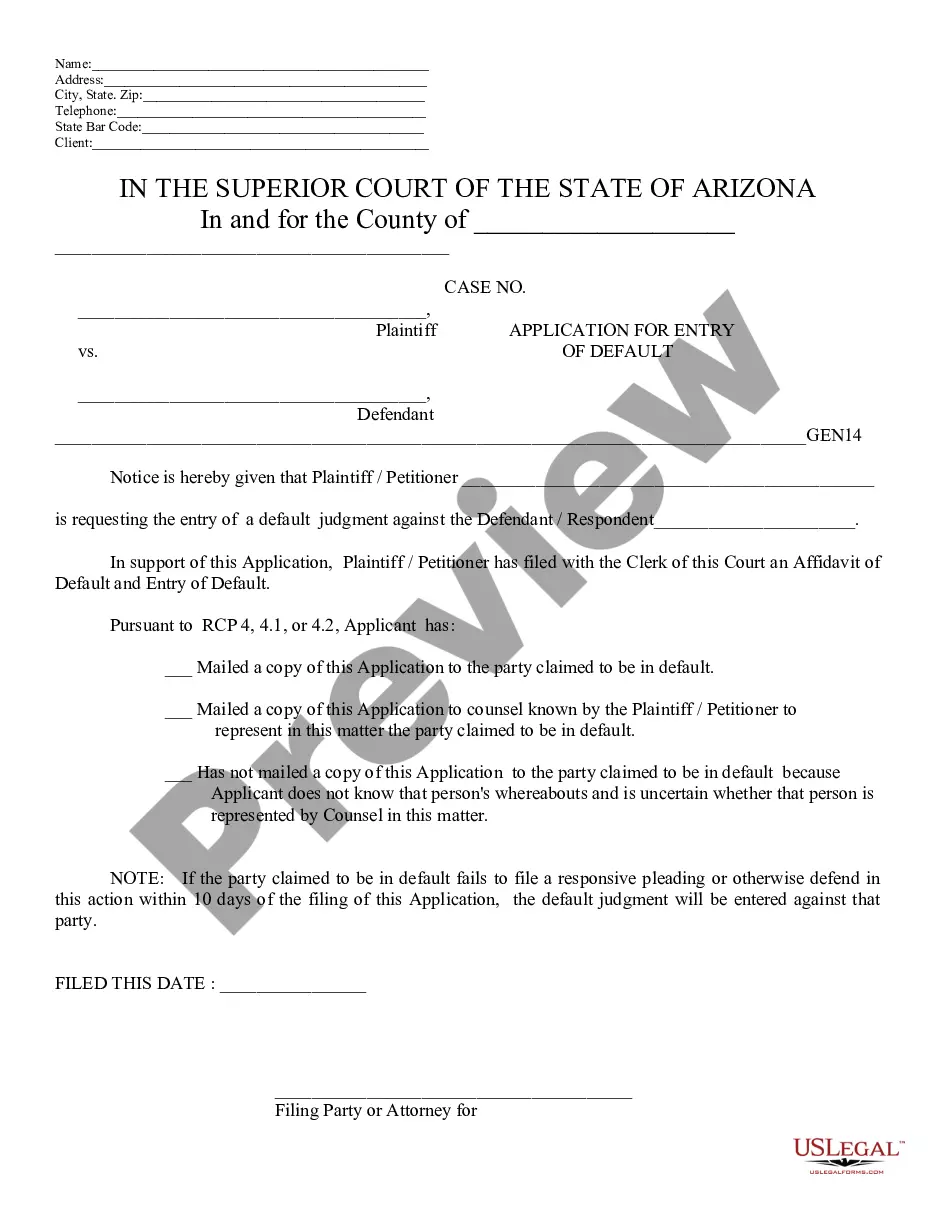

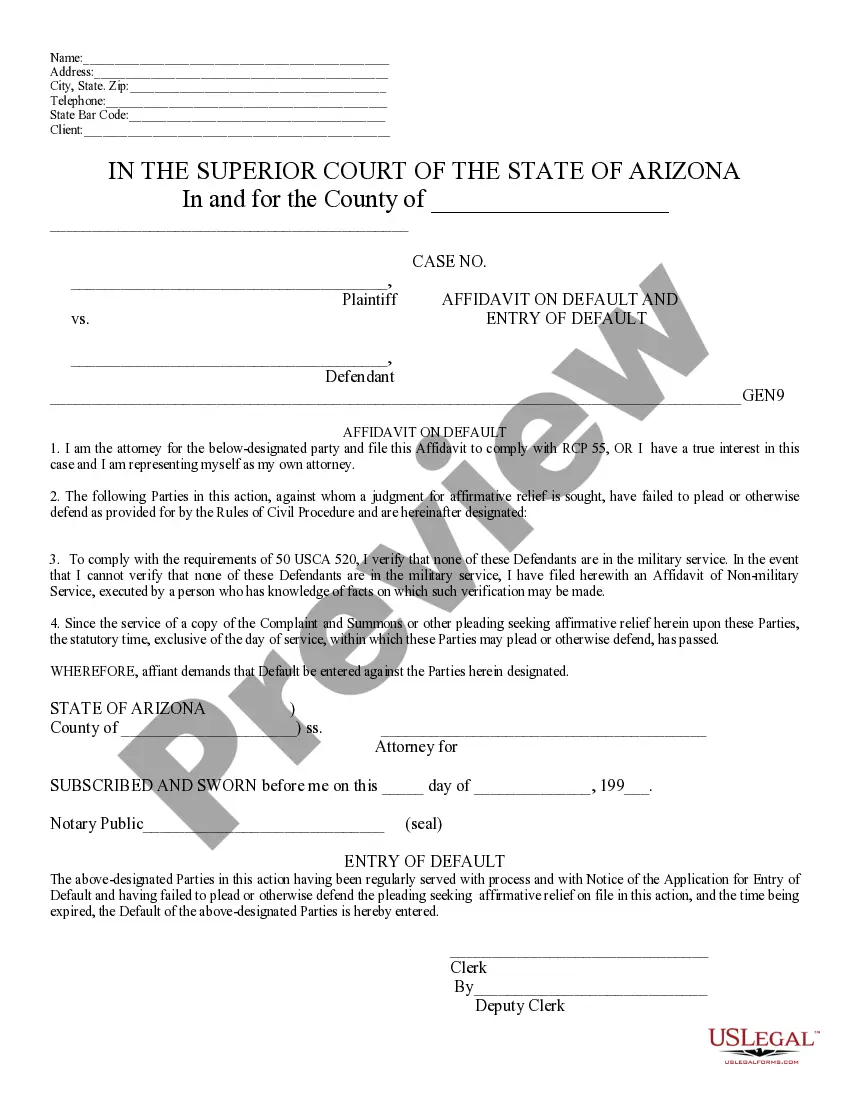

An affidavit is a written, sworn statement by an individual witnessed and signed by a Notary Public or other official person. The 'affiant' swears to the truth of the written statement. This form, a sample Application & Affidavit of Default, can be used as an affidavit on the named topic. Adapt the model language to fit your own circumstances and sign in the presence of a Notary. Available for download now in standard format(s).

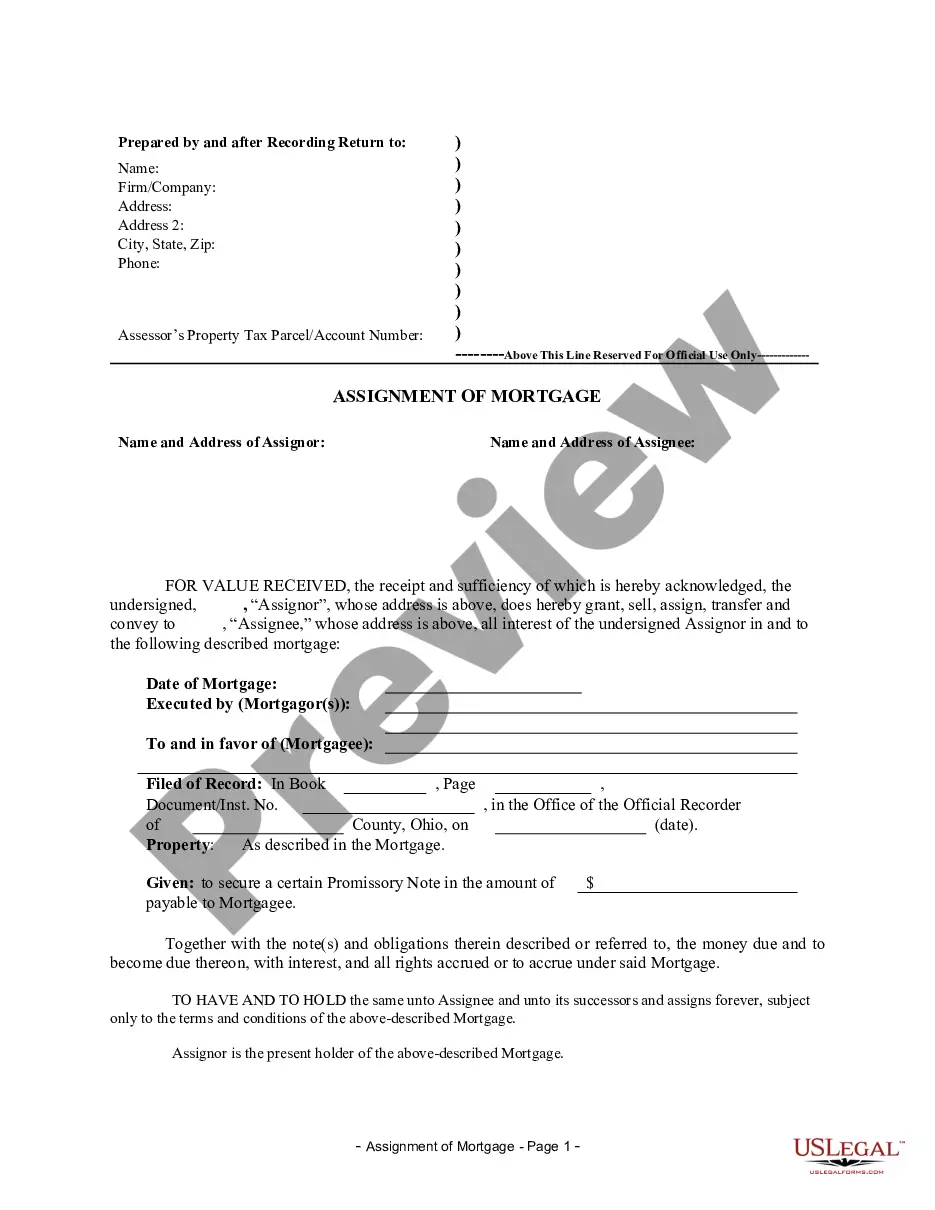

Chandler Arizona Application and Affidavit of Default is a legal document used in the state of Arizona for foreclosure proceedings. It is an essential part of the foreclosure process and provides the necessary information and details related to the default on a mortgage loan. The Chandler Arizona Application and Affidavit of Default serves as a formal declaration of default on a mortgage loan. It outlines the specifics of the default, including the borrower's name, the property address, the amount owed, and the timeline of the default. This document is typically submitted by the lender or their representative to initiate the foreclosure process. Keywords: Chandler Arizona, Application and Affidavit of Default, foreclosure proceedings, legal document, default, mortgage loan, borrower, property address, amount owed, timeline, lender, foreclosure process. There are different types of Chandler Arizona Application and Affidavit of Default, depending on the circumstances and the stage of the foreclosure process. Some variations include: 1. Preliminary Application and Affidavit of Default: This is usually the initial document filed by the lender after the borrower has missed several mortgage payments. It alerts the borrower of the impending foreclosure proceedings and provides them an opportunity to rectify the default. 2. Final Application and Affidavit of Default: This document is filed when the borrower fails to cure the default within the specified timeline provided in the preliminary application. It marks the final step before the foreclosure sale. 3. Motion to Vacate Application and Affidavit of Default: In some cases, borrowers may have valid reasons to challenge the default or request the court to reconsider the foreclosure proceedings. This type of application and affidavit is filed by the borrower to contest the default or ask for an extension. 4. Post-Foreclosure Application and Affidavit of Default: After the foreclosure sale, the lender may need to document the completion of the process for their records or any further legal action. This type of application and affidavit serves as evidence of the foreclosure and the lender's intent to move forward with any necessary actions. It is crucial to consult with a legal professional or an attorney to ensure the accurate completion of the specific Chandler Arizona Application and Affidavit of Default form applicable to your foreclosure situation.Chandler Arizona Application and Affidavit of Default is a legal document used in the state of Arizona for foreclosure proceedings. It is an essential part of the foreclosure process and provides the necessary information and details related to the default on a mortgage loan. The Chandler Arizona Application and Affidavit of Default serves as a formal declaration of default on a mortgage loan. It outlines the specifics of the default, including the borrower's name, the property address, the amount owed, and the timeline of the default. This document is typically submitted by the lender or their representative to initiate the foreclosure process. Keywords: Chandler Arizona, Application and Affidavit of Default, foreclosure proceedings, legal document, default, mortgage loan, borrower, property address, amount owed, timeline, lender, foreclosure process. There are different types of Chandler Arizona Application and Affidavit of Default, depending on the circumstances and the stage of the foreclosure process. Some variations include: 1. Preliminary Application and Affidavit of Default: This is usually the initial document filed by the lender after the borrower has missed several mortgage payments. It alerts the borrower of the impending foreclosure proceedings and provides them an opportunity to rectify the default. 2. Final Application and Affidavit of Default: This document is filed when the borrower fails to cure the default within the specified timeline provided in the preliminary application. It marks the final step before the foreclosure sale. 3. Motion to Vacate Application and Affidavit of Default: In some cases, borrowers may have valid reasons to challenge the default or request the court to reconsider the foreclosure proceedings. This type of application and affidavit is filed by the borrower to contest the default or ask for an extension. 4. Post-Foreclosure Application and Affidavit of Default: After the foreclosure sale, the lender may need to document the completion of the process for their records or any further legal action. This type of application and affidavit serves as evidence of the foreclosure and the lender's intent to move forward with any necessary actions. It is crucial to consult with a legal professional or an attorney to ensure the accurate completion of the specific Chandler Arizona Application and Affidavit of Default form applicable to your foreclosure situation.