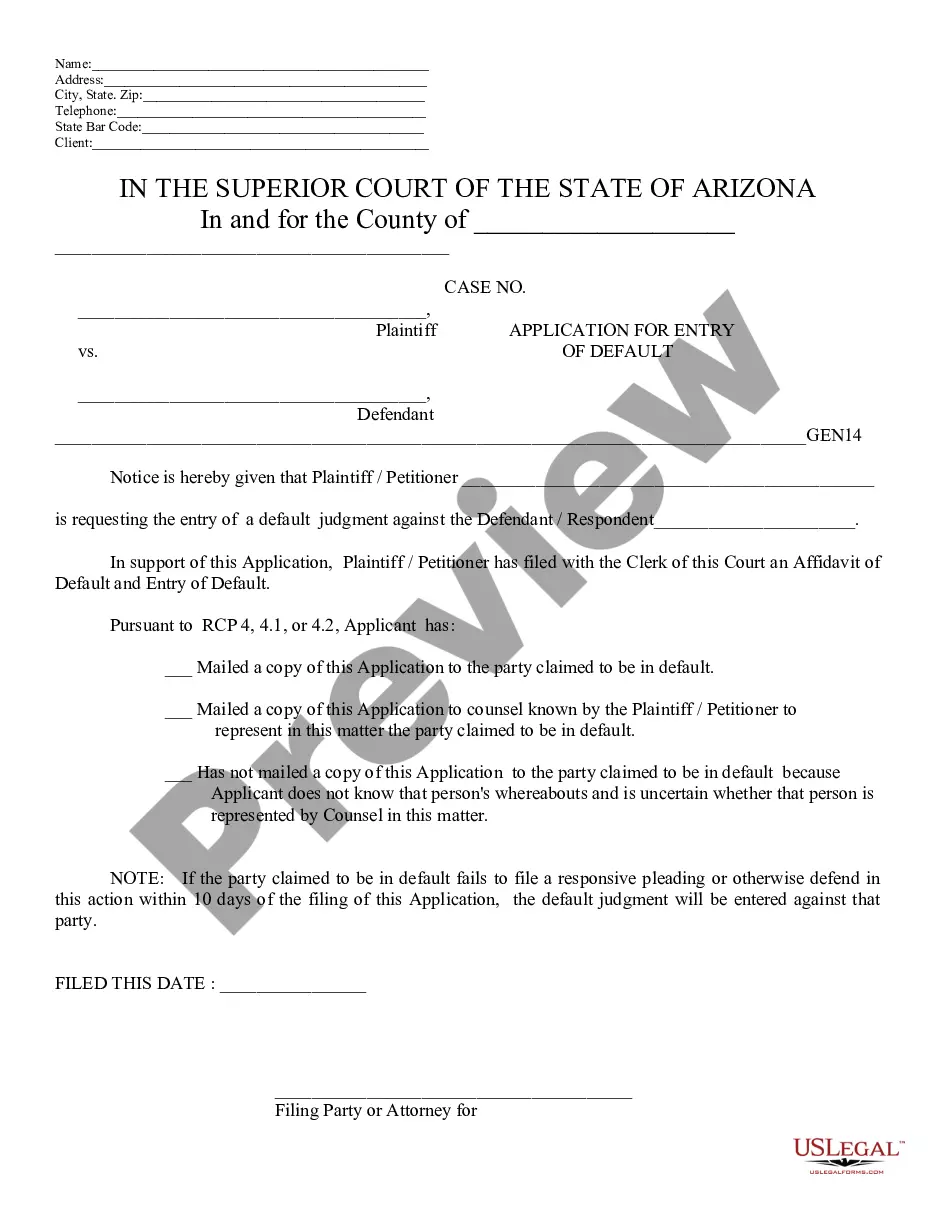

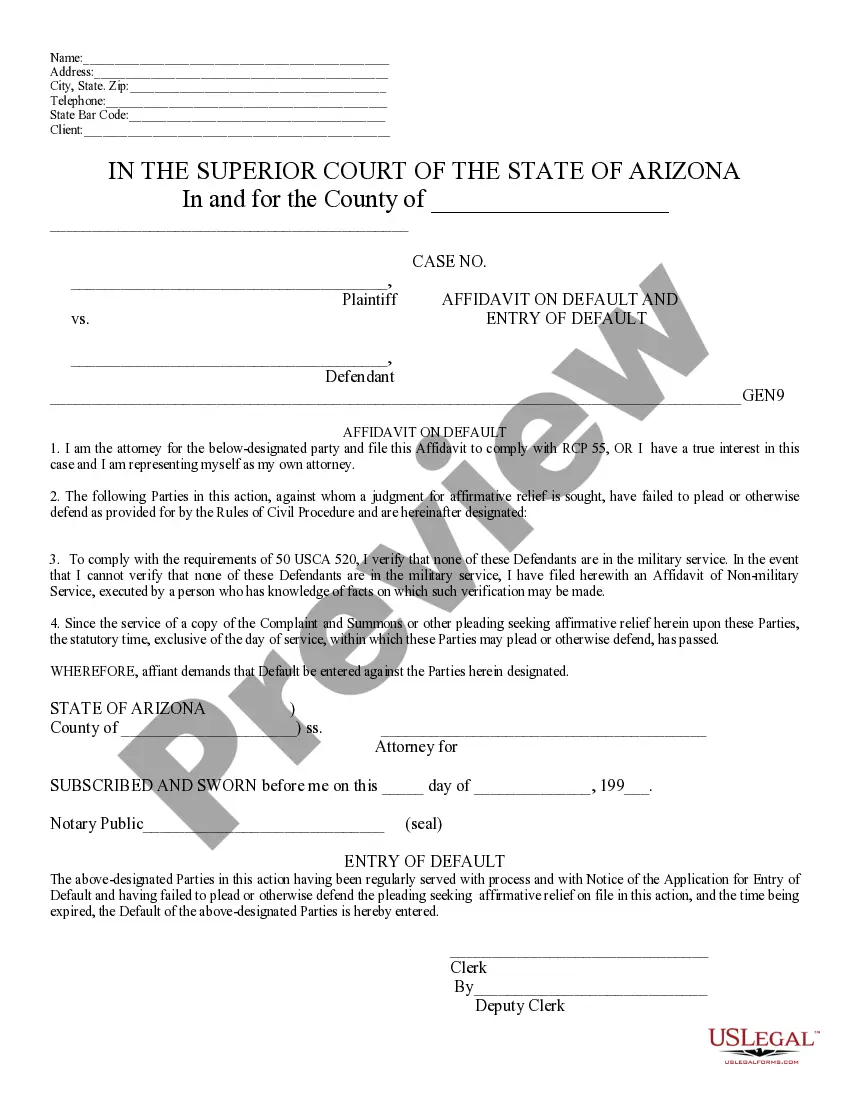

An affidavit is a written, sworn statement by an individual witnessed and signed by a Notary Public or other official person. The 'affiant' swears to the truth of the written statement. This form, a sample Application & Affidavit of Default, can be used as an affidavit on the named topic. Adapt the model language to fit your own circumstances and sign in the presence of a Notary. Available for download now in standard format(s).

In Glendale, Arizona, the Application and Affidavit of Default is a legal document used in foreclosure proceedings. Specifically, it is a formal request submitted by a lender or mortgage holder to the court when a borrower fails to make mortgage payments as agreed upon. The Application and Affidavit of Default serves as an important step in initiating the foreclosure process. It is designed to notify the court of the default and request authorization to proceed with a foreclosure sale of the property. This document outlines key details such as the borrower's name, the property address, the outstanding loan amount, the amounts and dates of missed payments, and any applicable fees or penalties. There are different types of Glendale Arizona Application and Affidavit of Default that vary based on the specific circumstances of the default. These may include: 1. Residential Application and Affidavit of Default: This type is used when the default occurs on a residential property, such as a single-family home or condominium. 2. Commercial Application and Affidavit of Default: This version is applicable when the default involves a commercial property, such as an office building, retail space, or industrial facility. 3. Judicial Application and Affidavit of Default: In cases where a judicial foreclosure is pursued, this type is used to initiate the legal process through the court system. 4. Non-Judicial Application and Affidavit of Default: This version is utilized in non-judicial foreclosure proceedings, which do not involve court oversight and follow a specific set of statutory requirements. It is crucial to note that the Application and Affidavit of Default must adhere to Arizona state laws and regulations. It is recommended to consult with a qualified attorney or legal professional experienced in foreclosure proceedings to ensure the accuracy and validity of the document. If you find yourself facing foreclosure or need to initiate the foreclosure process in Glendale, Arizona, the Application and Affidavit of Default plays a significant role. It is a legally binding document that provides the necessary information to establish the borrower's default and request permission to proceed with foreclosure proceedings.In Glendale, Arizona, the Application and Affidavit of Default is a legal document used in foreclosure proceedings. Specifically, it is a formal request submitted by a lender or mortgage holder to the court when a borrower fails to make mortgage payments as agreed upon. The Application and Affidavit of Default serves as an important step in initiating the foreclosure process. It is designed to notify the court of the default and request authorization to proceed with a foreclosure sale of the property. This document outlines key details such as the borrower's name, the property address, the outstanding loan amount, the amounts and dates of missed payments, and any applicable fees or penalties. There are different types of Glendale Arizona Application and Affidavit of Default that vary based on the specific circumstances of the default. These may include: 1. Residential Application and Affidavit of Default: This type is used when the default occurs on a residential property, such as a single-family home or condominium. 2. Commercial Application and Affidavit of Default: This version is applicable when the default involves a commercial property, such as an office building, retail space, or industrial facility. 3. Judicial Application and Affidavit of Default: In cases where a judicial foreclosure is pursued, this type is used to initiate the legal process through the court system. 4. Non-Judicial Application and Affidavit of Default: This version is utilized in non-judicial foreclosure proceedings, which do not involve court oversight and follow a specific set of statutory requirements. It is crucial to note that the Application and Affidavit of Default must adhere to Arizona state laws and regulations. It is recommended to consult with a qualified attorney or legal professional experienced in foreclosure proceedings to ensure the accuracy and validity of the document. If you find yourself facing foreclosure or need to initiate the foreclosure process in Glendale, Arizona, the Application and Affidavit of Default plays a significant role. It is a legally binding document that provides the necessary information to establish the borrower's default and request permission to proceed with foreclosure proceedings.