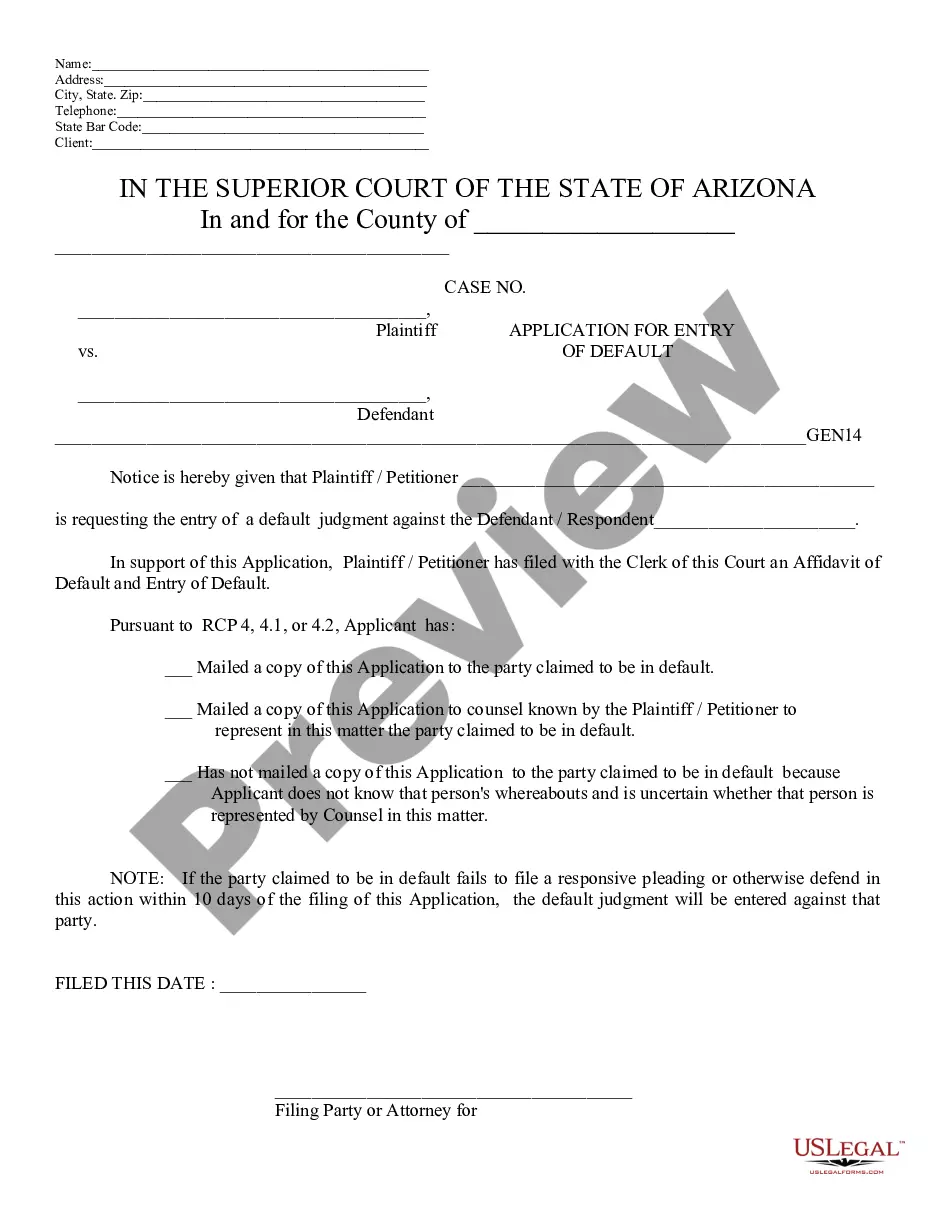

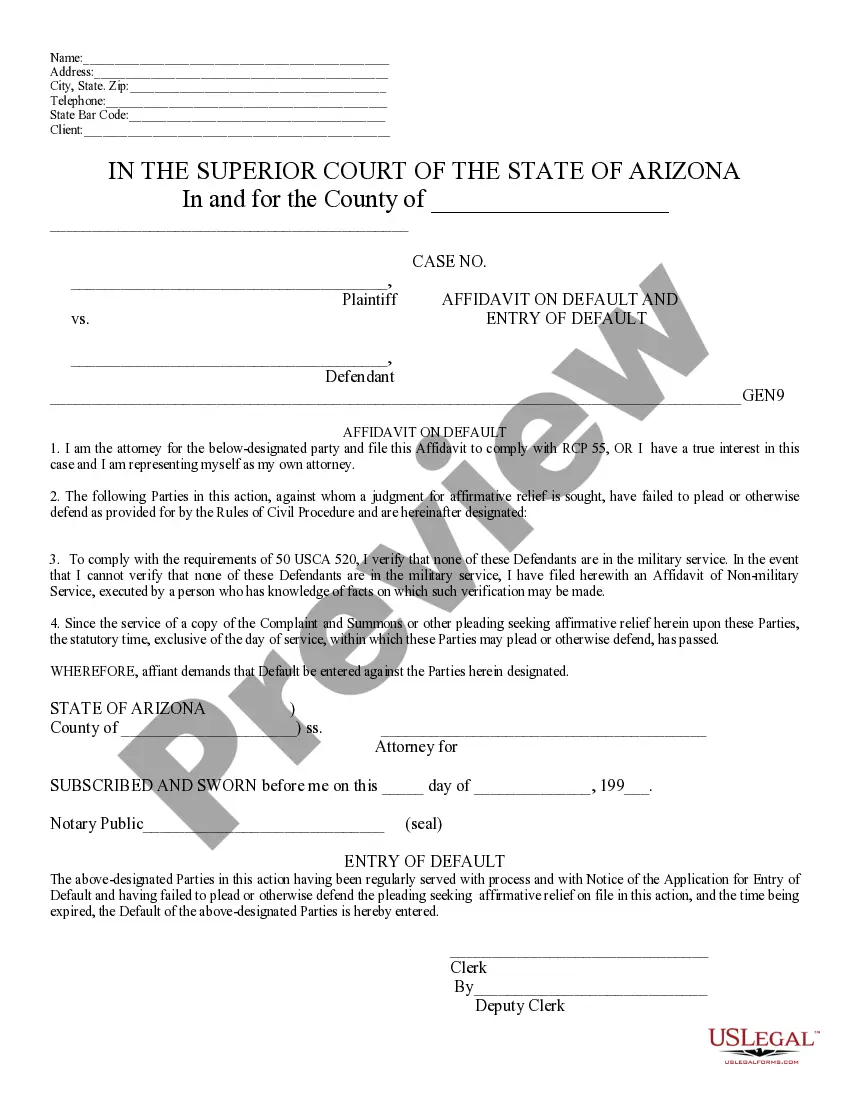

An affidavit is a written, sworn statement by an individual witnessed and signed by a Notary Public or other official person. The 'affiant' swears to the truth of the written statement. This form, a sample Application & Affidavit of Default, can be used as an affidavit on the named topic. Adapt the model language to fit your own circumstances and sign in the presence of a Notary. Available for download now in standard format(s).

Maricopa Arizona Application and Affidavit of Default is a legal document used in foreclosures to initiate the process of reclaiming a property due to mortgage default. This application and affidavit are specific to properties located in Maricopa County, Arizona, and are essential instruments in foreclosure proceedings. The Maricopa Arizona Application and Affidavit of Default serve as a formal request filed by the lender or their authorized representative, seeking to foreclose on a property when the borrower fails to meet the mortgage obligations. This document informs the court of the default and triggers the initiation of foreclosure. Keywords: Maricopa Arizona, Application and Affidavit of Default, foreclosure, mortgage default, legal document, properties, Maricopa County, lender, borrower, court, initiation of foreclosure. Different types of Maricopa Arizona Application and Affidavit of Default may be categorized based on the particular stage of foreclosure proceedings, including: 1. Preliminary Application and Affidavit of Default: This type is typically filed at the beginning of the foreclosure process, indicating the borrower's initial default on the mortgage payments. 2. Final Application and Affidavit of Default: This type is filed after the lender has exhausted all other options for resolving the default, such as loan modifications or repayment plans. It requests the court to authorize the foreclosure sale of the property. 3. Application and Affidavit Support Documentation: This type includes additional supporting documents required to strengthen the application, such as the copy of the mortgage contract, payment history, and evidence of the borrower's default. 4. Supplemental Application and Affidavit of Default: This type is filed when there are subsequent defaults or breaches of the mortgage agreement during the foreclosure process. It helps the lender request the court's permission to proceed with the foreclosure sale. 5. Withdrawal of Application and Affidavit of Default: This type is filed when the foreclosure action is halted due to successful resolution of the default, such as loan reinstatement, loan modification, or payoff. 6. Application and Affidavit of Default in Bankruptcy: This type may be filed by the lender in cases where the borrower has filed for bankruptcy protection, and the lender seeks permission from the bankruptcy court to continue with the foreclosure action. These different types of Maricopa Arizona Application and Affidavit of Default help streamline the foreclosure process in compliance with local regulations, allowing lenders to protect their interests and ensure a fair and efficient resolution to mortgage defaults in Maricopa County.Maricopa Arizona Application and Affidavit of Default is a legal document used in foreclosures to initiate the process of reclaiming a property due to mortgage default. This application and affidavit are specific to properties located in Maricopa County, Arizona, and are essential instruments in foreclosure proceedings. The Maricopa Arizona Application and Affidavit of Default serve as a formal request filed by the lender or their authorized representative, seeking to foreclose on a property when the borrower fails to meet the mortgage obligations. This document informs the court of the default and triggers the initiation of foreclosure. Keywords: Maricopa Arizona, Application and Affidavit of Default, foreclosure, mortgage default, legal document, properties, Maricopa County, lender, borrower, court, initiation of foreclosure. Different types of Maricopa Arizona Application and Affidavit of Default may be categorized based on the particular stage of foreclosure proceedings, including: 1. Preliminary Application and Affidavit of Default: This type is typically filed at the beginning of the foreclosure process, indicating the borrower's initial default on the mortgage payments. 2. Final Application and Affidavit of Default: This type is filed after the lender has exhausted all other options for resolving the default, such as loan modifications or repayment plans. It requests the court to authorize the foreclosure sale of the property. 3. Application and Affidavit Support Documentation: This type includes additional supporting documents required to strengthen the application, such as the copy of the mortgage contract, payment history, and evidence of the borrower's default. 4. Supplemental Application and Affidavit of Default: This type is filed when there are subsequent defaults or breaches of the mortgage agreement during the foreclosure process. It helps the lender request the court's permission to proceed with the foreclosure sale. 5. Withdrawal of Application and Affidavit of Default: This type is filed when the foreclosure action is halted due to successful resolution of the default, such as loan reinstatement, loan modification, or payoff. 6. Application and Affidavit of Default in Bankruptcy: This type may be filed by the lender in cases where the borrower has filed for bankruptcy protection, and the lender seeks permission from the bankruptcy court to continue with the foreclosure action. These different types of Maricopa Arizona Application and Affidavit of Default help streamline the foreclosure process in compliance with local regulations, allowing lenders to protect their interests and ensure a fair and efficient resolution to mortgage defaults in Maricopa County.