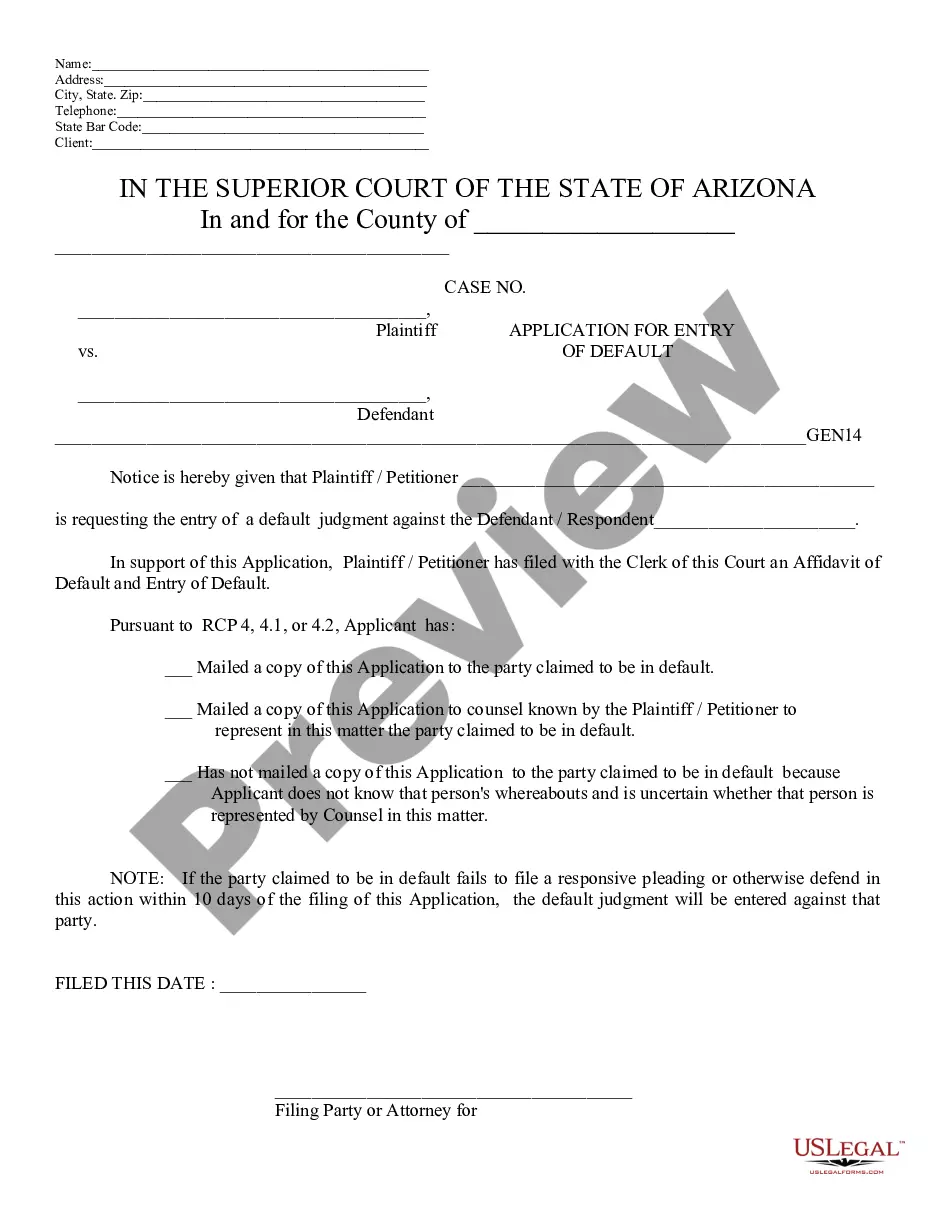

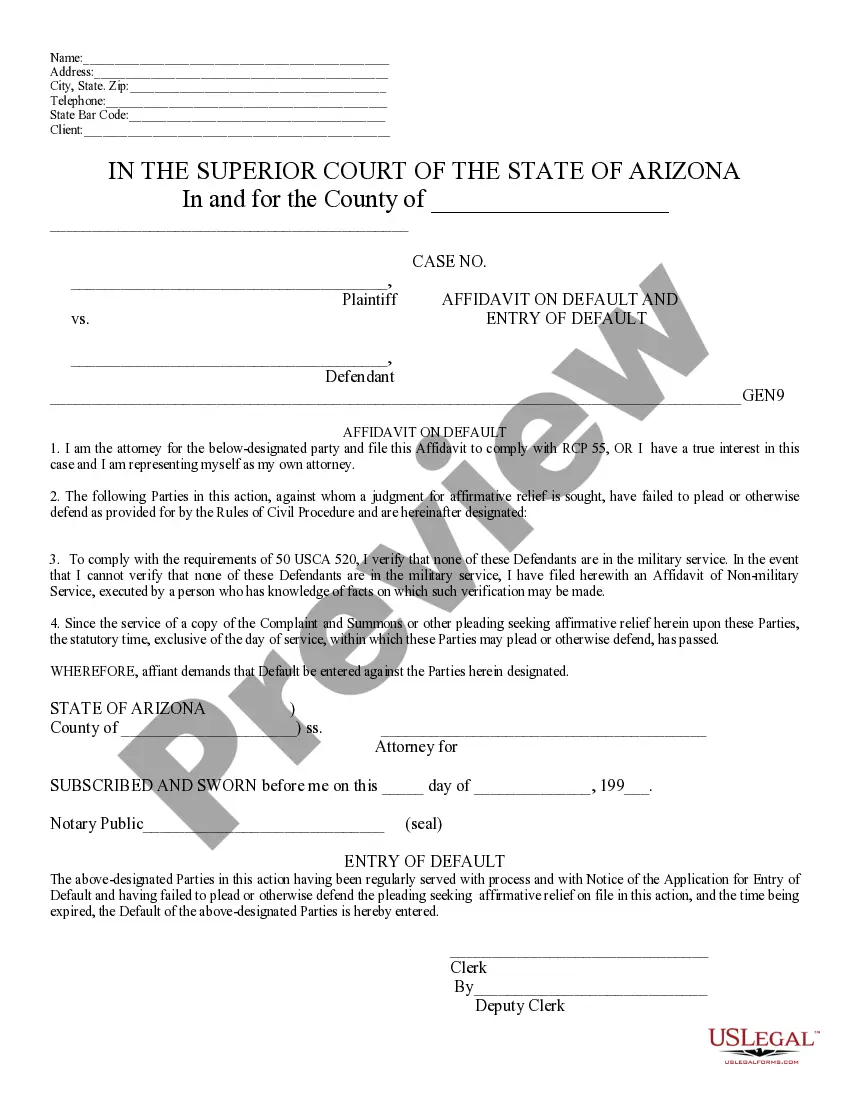

An affidavit is a written, sworn statement by an individual witnessed and signed by a Notary Public or other official person. The 'affiant' swears to the truth of the written statement. This form, a sample Application & Affidavit of Default, can be used as an affidavit on the named topic. Adapt the model language to fit your own circumstances and sign in the presence of a Notary. Available for download now in standard format(s).

The Phoenix Arizona Application and Affidavit of Default is a legal document used in foreclosure proceedings in the state of Arizona. It is a crucial part of the foreclosure process that helps lenders initiate the foreclosure and maintain documentation of the default. The purpose of this application is to request a default judgment against the borrower when they fail to make timely mortgage payments. When the borrower falls behind on their payments, the lender can file an Application and Affidavit of Default with the court to begin the foreclosure process. The Application and Affidavit of Default contains various essential information, including: 1. Identification Details: The application includes the names and contact information of both the lender and borrower, as well as the loan account number, property address, and other relevant identification details. 2. Loan and Default Information: This section outlines the terms of the loan, including the principal amount, interest rate, repayment schedule, and any applicable penalties for default. Furthermore, it provides a detailed account of the defaults incurred by the borrower, such as the number of missed payments and the dates they were due. 3. Amount Due and Owed: The document also specifies the total amount due at the time of default, including outstanding principal, interest, late fees, and any other charges incurred as a result of the borrower's default. 4. Foreclosure Rights and Notices: The application includes a statement affirming the lender's legal rights to proceed with foreclosure, citing relevant laws and statutes. Additionally, it may include any required notices that must be provided to the borrower before commencing foreclosure proceedings. In addition to the standard Application and Affidavit of Default, there may be different types or variations depending on the requirements of the lender or the specific circumstances of the foreclosure. Some possible variations could include: 1. Residential Application and Affidavit of Default: Used specifically for foreclosing on residential properties, this variation may include additional information related to applicable laws and regulations specific to residential foreclosures. 2. Commercial Application and Affidavit of Default: Designed for foreclosing on commercial properties, this variation may have distinct provisions tailored to the unique characteristics and legal requirements of commercial foreclosures. 3. Judicial vs. Non-judicial Foreclosure: Arizona allows both judicial and non-judicial foreclosures. The Application and Affidavit of Default may vary depending on the foreclosure process chosen by the lender, with specific provisions added or removed accordingly. It is important to note that while this description provides a general overview of the Phoenix Arizona Application and Affidavit of Default, it is always advisable to consult with a legal professional or appropriate authority to understand the specific requirements and implications of this document in a particular foreclosure case.The Phoenix Arizona Application and Affidavit of Default is a legal document used in foreclosure proceedings in the state of Arizona. It is a crucial part of the foreclosure process that helps lenders initiate the foreclosure and maintain documentation of the default. The purpose of this application is to request a default judgment against the borrower when they fail to make timely mortgage payments. When the borrower falls behind on their payments, the lender can file an Application and Affidavit of Default with the court to begin the foreclosure process. The Application and Affidavit of Default contains various essential information, including: 1. Identification Details: The application includes the names and contact information of both the lender and borrower, as well as the loan account number, property address, and other relevant identification details. 2. Loan and Default Information: This section outlines the terms of the loan, including the principal amount, interest rate, repayment schedule, and any applicable penalties for default. Furthermore, it provides a detailed account of the defaults incurred by the borrower, such as the number of missed payments and the dates they were due. 3. Amount Due and Owed: The document also specifies the total amount due at the time of default, including outstanding principal, interest, late fees, and any other charges incurred as a result of the borrower's default. 4. Foreclosure Rights and Notices: The application includes a statement affirming the lender's legal rights to proceed with foreclosure, citing relevant laws and statutes. Additionally, it may include any required notices that must be provided to the borrower before commencing foreclosure proceedings. In addition to the standard Application and Affidavit of Default, there may be different types or variations depending on the requirements of the lender or the specific circumstances of the foreclosure. Some possible variations could include: 1. Residential Application and Affidavit of Default: Used specifically for foreclosing on residential properties, this variation may include additional information related to applicable laws and regulations specific to residential foreclosures. 2. Commercial Application and Affidavit of Default: Designed for foreclosing on commercial properties, this variation may have distinct provisions tailored to the unique characteristics and legal requirements of commercial foreclosures. 3. Judicial vs. Non-judicial Foreclosure: Arizona allows both judicial and non-judicial foreclosures. The Application and Affidavit of Default may vary depending on the foreclosure process chosen by the lender, with specific provisions added or removed accordingly. It is important to note that while this description provides a general overview of the Phoenix Arizona Application and Affidavit of Default, it is always advisable to consult with a legal professional or appropriate authority to understand the specific requirements and implications of this document in a particular foreclosure case.