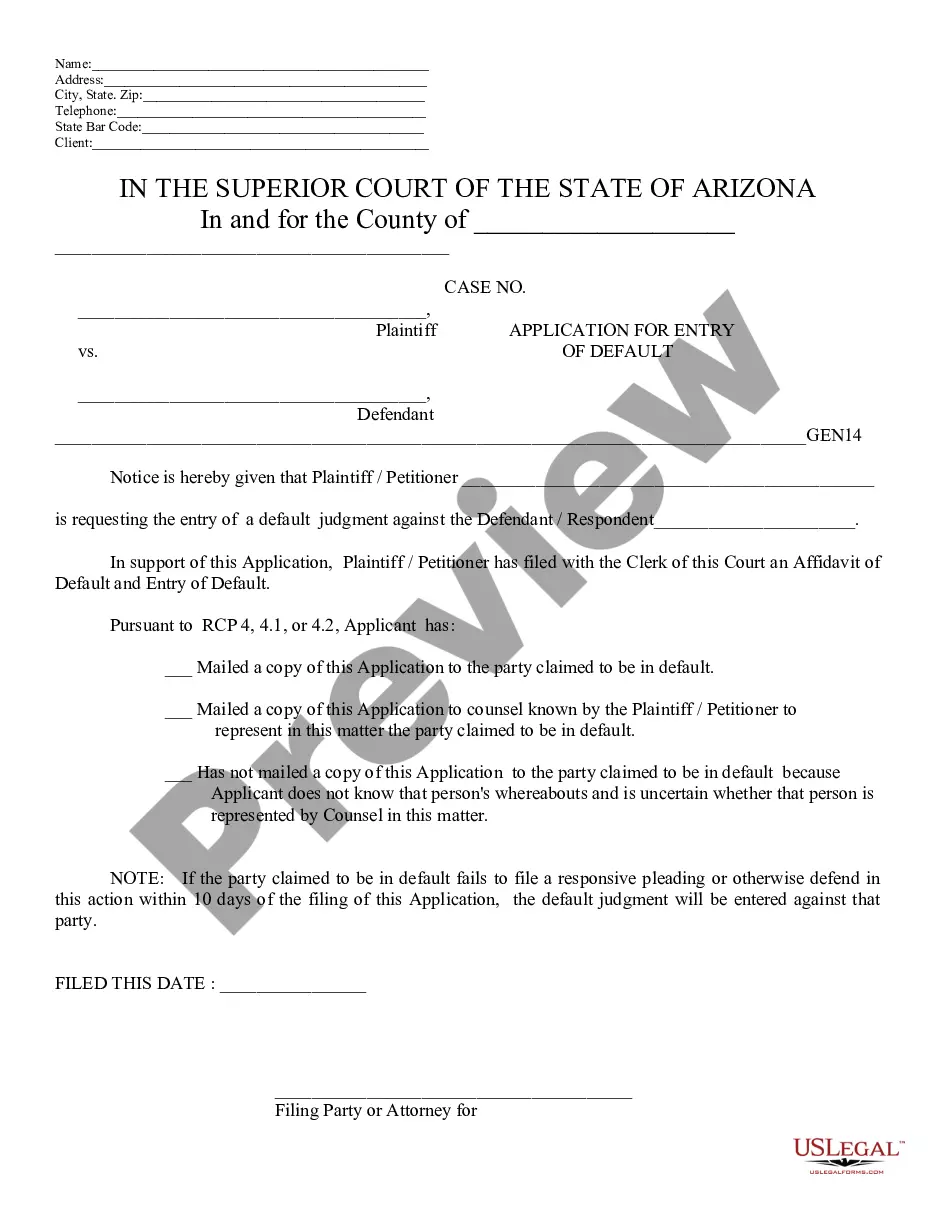

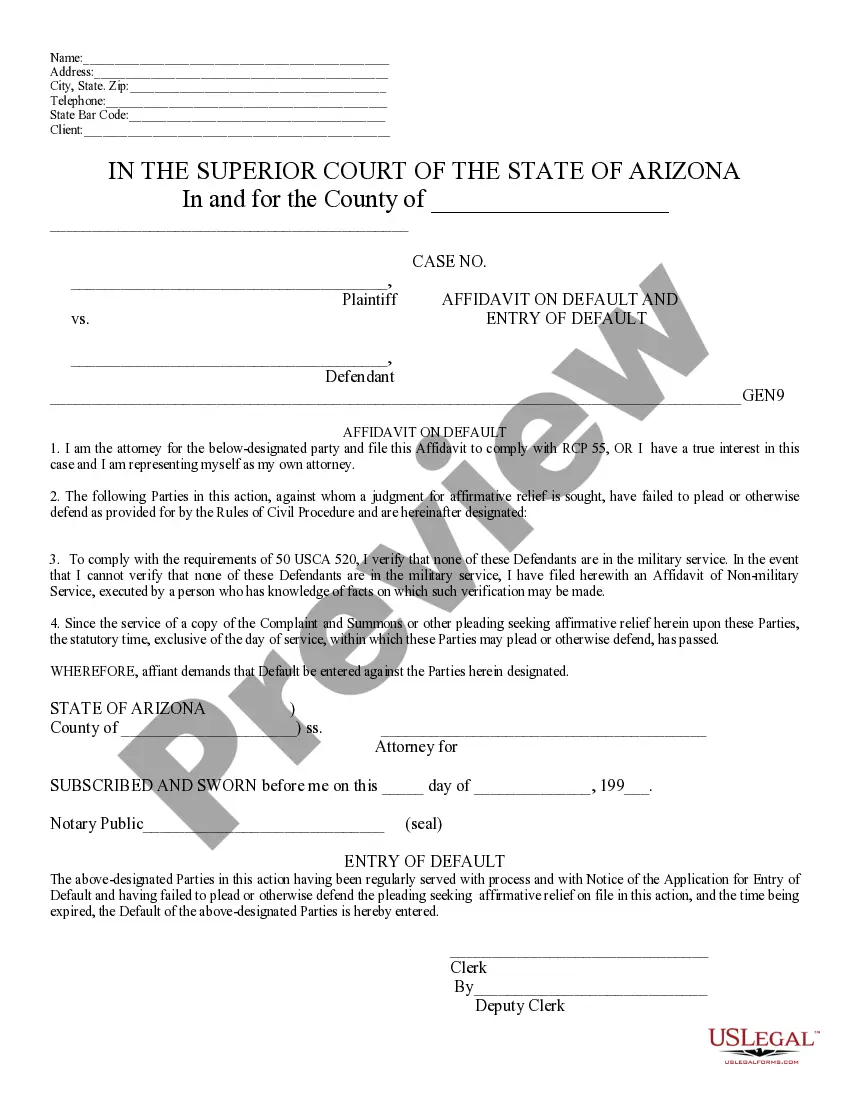

An affidavit is a written, sworn statement by an individual witnessed and signed by a Notary Public or other official person. The 'affiant' swears to the truth of the written statement. This form, a sample Application & Affidavit of Default, can be used as an affidavit on the named topic. Adapt the model language to fit your own circumstances and sign in the presence of a Notary. Available for download now in standard format(s).

Surprise, Arizona Application and Affidavit of Default is a legal document filed by lenders or lien holders in the state of Surprise, Arizona. It is a crucial step in the foreclosure process where the lenders initiate legal proceedings against borrowers who have defaulted on their mortgage or loan payments. This application and affidavit enable the lender to reclaim the property securing the loan in case of non-payment. The Surprise Arizona Application and Affidavit of Default include essential information about the borrower, property details, loan information, and the reason for default. It serves as a formal notice to the borrower, informing them about the impending foreclosure action and providing them with an opportunity to rectify the default or negotiate a resolution. Different types of Surprise Arizona Application and Affidavit of Default may include: 1. Residential Property Affidavit of Default: This type of application and affidavit is specific to residential properties where homeowners have defaulted on their mortgage payments. 2. Commercial Property Affidavit of Default: This application and affidavit pertain to commercial properties, such as office buildings or shopping centers, where borrowers have defaulted on their loan obligations. 3. Judicial Foreclosure Application and Affidavit of Default: In some cases, lenders may opt for a judicial foreclosure process to reclaim the property. This type of application and affidavit is submitted to the court as part of the foreclosure proceedings. 4. Non-Judicial Foreclosure Application and Affidavit of Default: Unlike the judicial foreclosure process, non-judicial foreclosures do not involve court intervention. However, lenders still need to file a specific application and affidavit of default with the relevant state agencies. 5. Second Mortgage/Deed of Trust Affidavit of Default: This application and affidavit are used when a borrower has defaulted on a second mortgage or deed of trust, which is a subordinate lien to the primary mortgage. Overall, the Surprise Arizona Application and Affidavit of Default is a critical legal document that lenders utilize to initiate the foreclosure process and protect their rights as creditors. It ensures transparency and provides borrowers an opportunity to address the default situation before facing the loss of their property.Surprise, Arizona Application and Affidavit of Default is a legal document filed by lenders or lien holders in the state of Surprise, Arizona. It is a crucial step in the foreclosure process where the lenders initiate legal proceedings against borrowers who have defaulted on their mortgage or loan payments. This application and affidavit enable the lender to reclaim the property securing the loan in case of non-payment. The Surprise Arizona Application and Affidavit of Default include essential information about the borrower, property details, loan information, and the reason for default. It serves as a formal notice to the borrower, informing them about the impending foreclosure action and providing them with an opportunity to rectify the default or negotiate a resolution. Different types of Surprise Arizona Application and Affidavit of Default may include: 1. Residential Property Affidavit of Default: This type of application and affidavit is specific to residential properties where homeowners have defaulted on their mortgage payments. 2. Commercial Property Affidavit of Default: This application and affidavit pertain to commercial properties, such as office buildings or shopping centers, where borrowers have defaulted on their loan obligations. 3. Judicial Foreclosure Application and Affidavit of Default: In some cases, lenders may opt for a judicial foreclosure process to reclaim the property. This type of application and affidavit is submitted to the court as part of the foreclosure proceedings. 4. Non-Judicial Foreclosure Application and Affidavit of Default: Unlike the judicial foreclosure process, non-judicial foreclosures do not involve court intervention. However, lenders still need to file a specific application and affidavit of default with the relevant state agencies. 5. Second Mortgage/Deed of Trust Affidavit of Default: This application and affidavit are used when a borrower has defaulted on a second mortgage or deed of trust, which is a subordinate lien to the primary mortgage. Overall, the Surprise Arizona Application and Affidavit of Default is a critical legal document that lenders utilize to initiate the foreclosure process and protect their rights as creditors. It ensures transparency and provides borrowers an opportunity to address the default situation before facing the loss of their property.