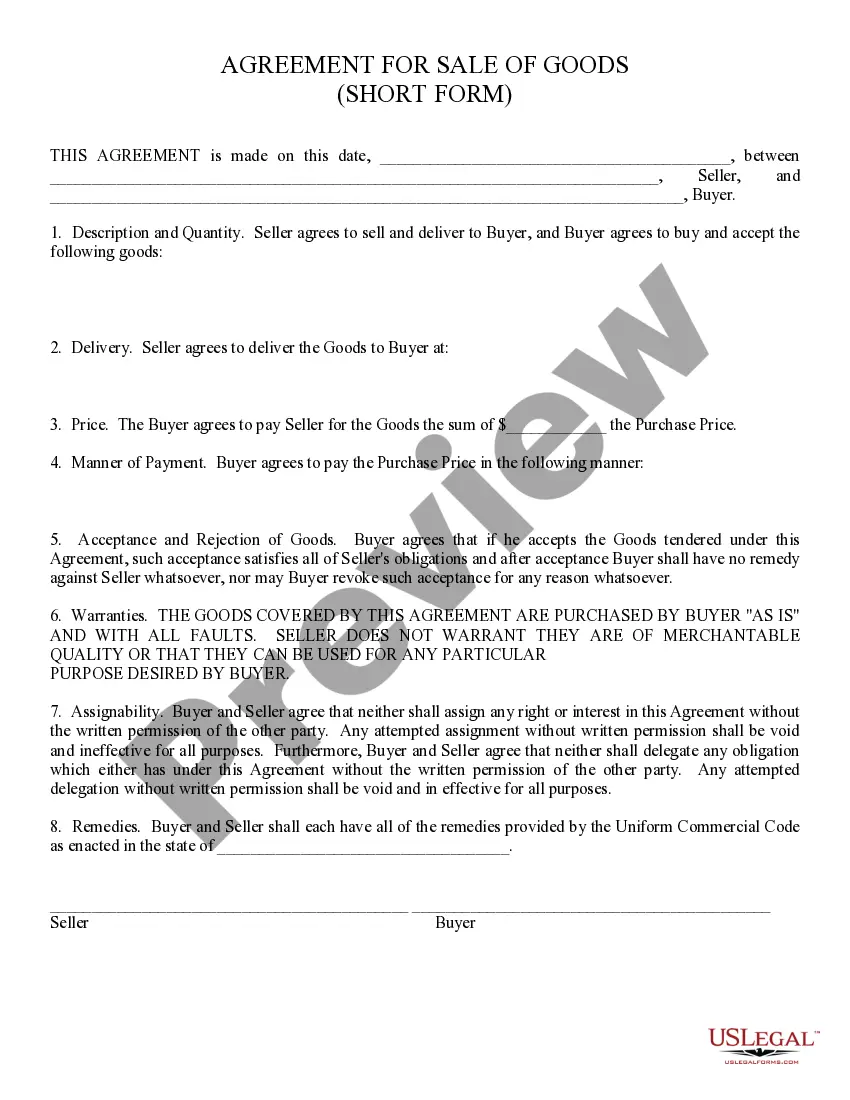

Sale of Goods, Short Form: This is a simple agreement between a Buyer and Seller for specific goods. It details what is to be sold, as well as the price. Both the Buyer and the Seller are to sign the contract. This form is available in both Word and Rich Text formats.

Mesa Arizona Sale of Goods, Short Form is a legal document used in Mesa, Arizona to facilitate the sale and purchase of goods between parties. This concise contract outlines specific terms and conditions surrounding the transaction, ensuring both the buyer and seller understand their rights and obligations. Keywords: Mesa Arizona, Sale of Goods, Short Form, legal document, purchase, transaction, terms and conditions, buyer, seller, rights, obligations. Different types of Mesa Arizona Sale of Goods, Short Form may include: 1. Mesa Arizona Sale of Goods, Short Form for Personal Property: This type of contract is used when individuals or businesses in Mesa, Arizona sell personal property, such as furniture, electronics, appliances, or vehicles. 2. Mesa Arizona Sale of Goods, Short Form for Commercial Goods: This form is specifically designed for the sale and purchase of commercial goods between businesses operating in Mesa, Arizona. It covers transactions involving inventory, equipment, machinery, or any other goods used for business purposes. 3. Mesa Arizona Sale of Goods, Short Form for Agricultural Products: This particular contract is utilized for the sale of agricultural goods, including crops, livestock, fertilizers, pesticides, or farming equipment, within the Mesa, Arizona region. 4. Mesa Arizona Sale of Goods, Short Form for Wholesale Goods: For businesses engaged in wholesale trade in Mesa, Arizona, this type of contract is used to formalize the sale of goods in large quantities to retailers or other wholesalers. 5. Mesa Arizona Sale of Goods, Short Form for Consignment: This contract specifies the terms and conditions for goods being sold on a consignment basis, where the owner retains ownership until the goods are sold. It is commonly used in Mesa, Arizona, for consignment stores or galleries. These different types of Mesa Arizona Sale of Goods, Short Form tailor the contract to specific goods and industry requirements, ensuring clarity and protection for both buyers and sellers in their respective fields.