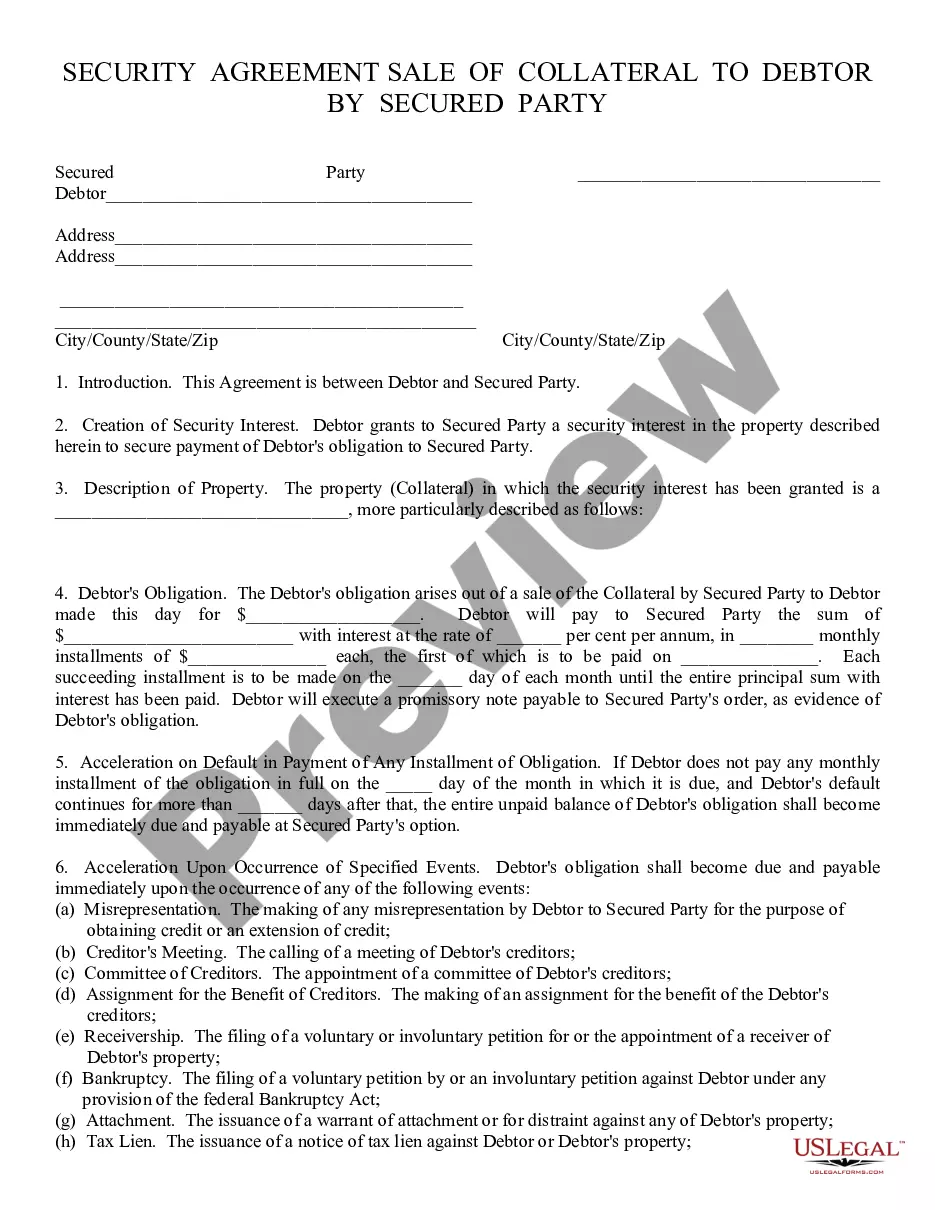

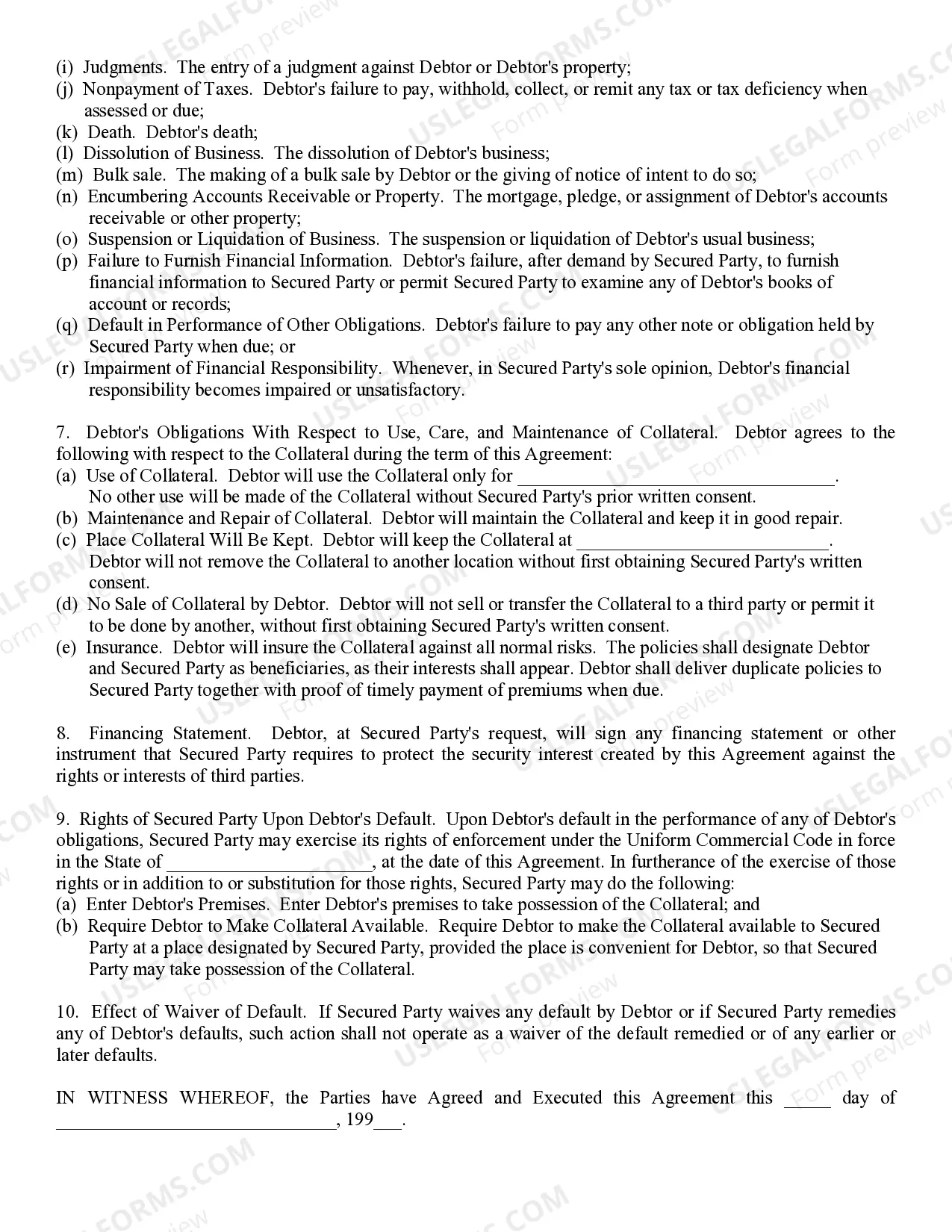

Security Agreement: This is an Agreement between a Debtor and Secured Party. The Debtor uses as collateral some type of property, and then agrees to pay the Secured Party monthly until his/her debt to them is satisfied. If the Debtor does not satisfy the debt, the property used as collateral, becomes the property of the Secured Party. This form is available in both Word and Rich Text formats.

Gilbert, Arizona Security Agreement: Understanding the Basics In Gilbert, Arizona, the concept of a security agreement plays a vital role in various legal transactions. A security agreement is a legally binding contract between a borrower and a lender that outlines the terms and conditions regarding the collateral provided by the borrower to secure a loan. This agreement ensures that in case of a default, the lender has the right to claim the collateral to recover their losses. Types of Gilbert Arizona Security Agreements: 1. Personal Property Security Agreement: This type of agreement comes into play when an individual or a business pledges personal property, such as vehicles, equipment, or inventory, as collateral to secure a loan. The agreement specifies the obligations of both parties and the conditions under which the lender can exercise their rights over the pledged assets. 2. Real Estate Security Agreement: In certain situations, when borrowers require substantial loans, they may need to offer real estate properties, such as land, houses, or buildings, as collateral. This agreement provides a detailed description of the property, the lien created on it, and the conditions under which the lender can take possession in case of default. Key terms and clauses within a Gilbert Arizona Security Agreement: — Identification of Parties: The agreement must clearly identify the borrower (debtor) and lender (secured party). — Description of Collateral: Detailed information about the assets offered as collateral, including their specifications, location, and ownership details. — Obligations of the Borrower: The borrower's responsibilities, such as making timely payments, maintaining the collateral, and complying with any insurance requirements. — Rights of the Lender: Specifies the rights granted to the lender, including the right to repossess, sell, or lease the collateral to recover their losses in case of default. — Events of Default: Enumerates specific circumstances, such as non-payment or breach of contract, which would trigger the lender's rights and remedies. — Dispute Resolution: Procedures and methods to resolve any disputes that may arise between the parties involved. — Governing Law: Identifies the laws of Gilbert, Arizona, that govern the interpretation, enforcement, and validity of the agreement. — Severability: Ensures that if any clause or provision of the agreement is determined to be unenforceable, the remaining portions remain intact. A Gilbert Arizona Security Agreement is a crucial legal instrument that protects the interests of both borrowers and lenders. It provides transparency, clarity, and a framework for managing risks associated with lending and borrowing transactions.Gilbert, Arizona Security Agreement: Understanding the Basics In Gilbert, Arizona, the concept of a security agreement plays a vital role in various legal transactions. A security agreement is a legally binding contract between a borrower and a lender that outlines the terms and conditions regarding the collateral provided by the borrower to secure a loan. This agreement ensures that in case of a default, the lender has the right to claim the collateral to recover their losses. Types of Gilbert Arizona Security Agreements: 1. Personal Property Security Agreement: This type of agreement comes into play when an individual or a business pledges personal property, such as vehicles, equipment, or inventory, as collateral to secure a loan. The agreement specifies the obligations of both parties and the conditions under which the lender can exercise their rights over the pledged assets. 2. Real Estate Security Agreement: In certain situations, when borrowers require substantial loans, they may need to offer real estate properties, such as land, houses, or buildings, as collateral. This agreement provides a detailed description of the property, the lien created on it, and the conditions under which the lender can take possession in case of default. Key terms and clauses within a Gilbert Arizona Security Agreement: — Identification of Parties: The agreement must clearly identify the borrower (debtor) and lender (secured party). — Description of Collateral: Detailed information about the assets offered as collateral, including their specifications, location, and ownership details. — Obligations of the Borrower: The borrower's responsibilities, such as making timely payments, maintaining the collateral, and complying with any insurance requirements. — Rights of the Lender: Specifies the rights granted to the lender, including the right to repossess, sell, or lease the collateral to recover their losses in case of default. — Events of Default: Enumerates specific circumstances, such as non-payment or breach of contract, which would trigger the lender's rights and remedies. — Dispute Resolution: Procedures and methods to resolve any disputes that may arise between the parties involved. — Governing Law: Identifies the laws of Gilbert, Arizona, that govern the interpretation, enforcement, and validity of the agreement. — Severability: Ensures that if any clause or provision of the agreement is determined to be unenforceable, the remaining portions remain intact. A Gilbert Arizona Security Agreement is a crucial legal instrument that protects the interests of both borrowers and lenders. It provides transparency, clarity, and a framework for managing risks associated with lending and borrowing transactions.