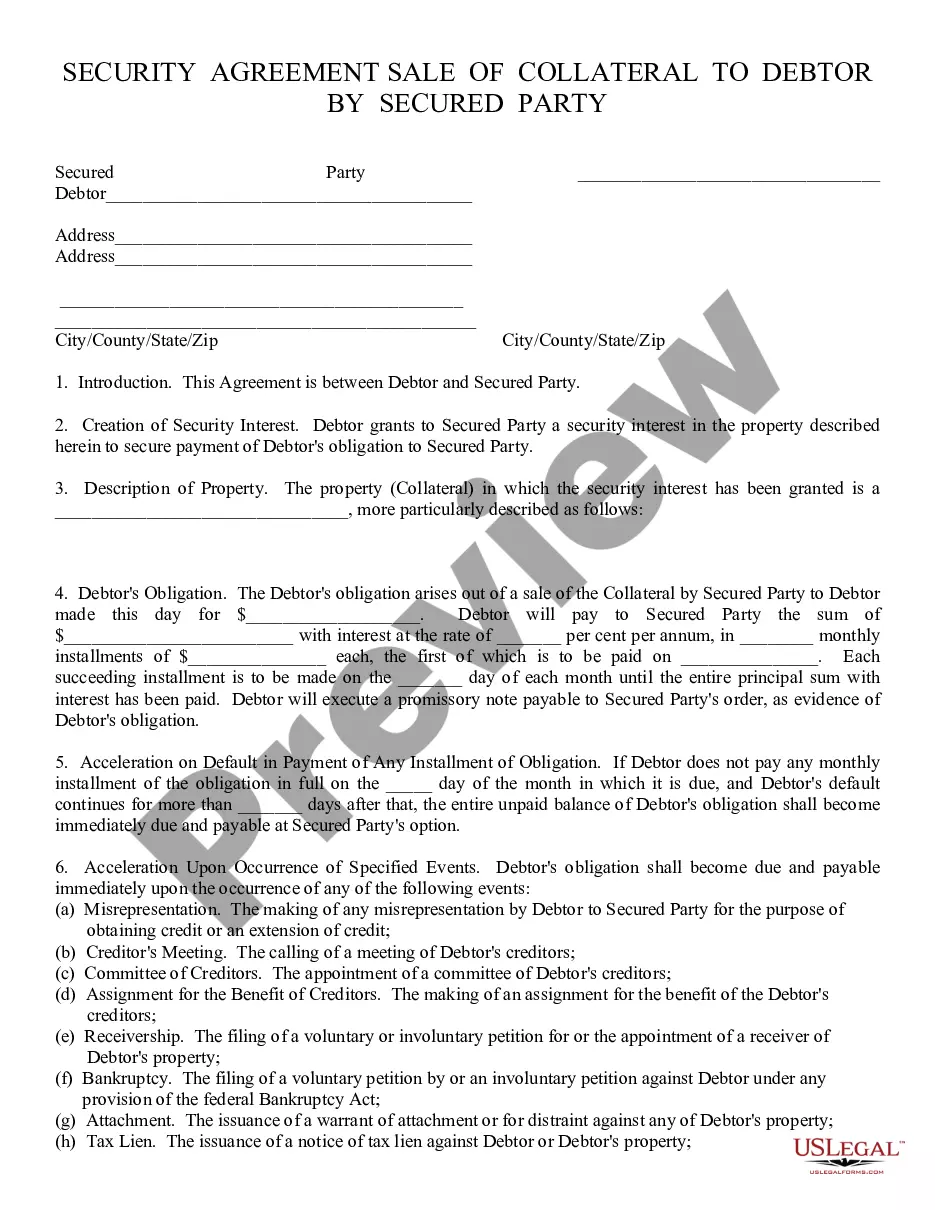

Security Agreement: This is an Agreement between a Debtor and Secured Party. The Debtor uses as collateral some type of property, and then agrees to pay the Secured Party monthly until his/her debt to them is satisfied. If the Debtor does not satisfy the debt, the property used as collateral, becomes the property of the Secured Party. This form is available in both Word and Rich Text formats.

Lima Arizona Security Agreement is a legally binding document that outlines the terms and conditions between a lender and borrower regarding the collateral used to secure a loan. This agreement is specific to the state of Arizona, particularly the town of Lima. The Lima Arizona Security Agreement serves as a means to protect the interests of both parties involved in a loan transaction. It establishes a security interest or lien on the collateral, which typically includes assets such as real estate, vehicles, equipment, or inventory. This ensures that the lender has the right to take possession of and sell the collateral in the event of the borrower's default on the loan. Being a legal document, the Lima Arizona Security Agreement contains various clauses and provisions to define and protect the rights and responsibilities of both parties. These may include details about the loan amount, repayment terms, interest rates, and conditions for default and repossession. The agreement also generally outlines the process for resolving disputes and the lender's rights to pursue legal action if necessary. There can be different types of Lima Arizona Security Agreements depending on the nature of the loan and the specific collateral involved. Some common variants include: 1. Real Estate Security Agreement: This type of agreement is specifically used when real estate properties are used as collateral for the loan. It outlines the terms and conditions related to the mortgage or lien placed on the property. 2. Chattel Security Agreement: This agreement is used when movable personal property, such as vehicles or equipment, is pledged as collateral. It defines the terms for securing and releasing the lien on the chattel. 3. Inventory Security Agreement: In cases where a borrower offers their inventory as collateral, this agreement is utilized. It establishes the rights and obligations related to the lender's security interest in the borrower's inventory. 4. Accounts Receivable Security Agreement: This type of agreement is employed when a borrower pledges their accounts receivable as collateral. It outlines the terms for the lender to collect and apply the proceeds of the accounts receivable in the event of default. It's worth noting that the language and specific terms of the Lima Arizona Security Agreement may vary depending on the individual lender, borrower, and the circumstances of the loan. Therefore, it's crucial for both parties to thoroughly review and understand the agreement before signing to ensure they are fully aware of their rights and obligations.Lima Arizona Security Agreement is a legally binding document that outlines the terms and conditions between a lender and borrower regarding the collateral used to secure a loan. This agreement is specific to the state of Arizona, particularly the town of Lima. The Lima Arizona Security Agreement serves as a means to protect the interests of both parties involved in a loan transaction. It establishes a security interest or lien on the collateral, which typically includes assets such as real estate, vehicles, equipment, or inventory. This ensures that the lender has the right to take possession of and sell the collateral in the event of the borrower's default on the loan. Being a legal document, the Lima Arizona Security Agreement contains various clauses and provisions to define and protect the rights and responsibilities of both parties. These may include details about the loan amount, repayment terms, interest rates, and conditions for default and repossession. The agreement also generally outlines the process for resolving disputes and the lender's rights to pursue legal action if necessary. There can be different types of Lima Arizona Security Agreements depending on the nature of the loan and the specific collateral involved. Some common variants include: 1. Real Estate Security Agreement: This type of agreement is specifically used when real estate properties are used as collateral for the loan. It outlines the terms and conditions related to the mortgage or lien placed on the property. 2. Chattel Security Agreement: This agreement is used when movable personal property, such as vehicles or equipment, is pledged as collateral. It defines the terms for securing and releasing the lien on the chattel. 3. Inventory Security Agreement: In cases where a borrower offers their inventory as collateral, this agreement is utilized. It establishes the rights and obligations related to the lender's security interest in the borrower's inventory. 4. Accounts Receivable Security Agreement: This type of agreement is employed when a borrower pledges their accounts receivable as collateral. It outlines the terms for the lender to collect and apply the proceeds of the accounts receivable in the event of default. It's worth noting that the language and specific terms of the Lima Arizona Security Agreement may vary depending on the individual lender, borrower, and the circumstances of the loan. Therefore, it's crucial for both parties to thoroughly review and understand the agreement before signing to ensure they are fully aware of their rights and obligations.