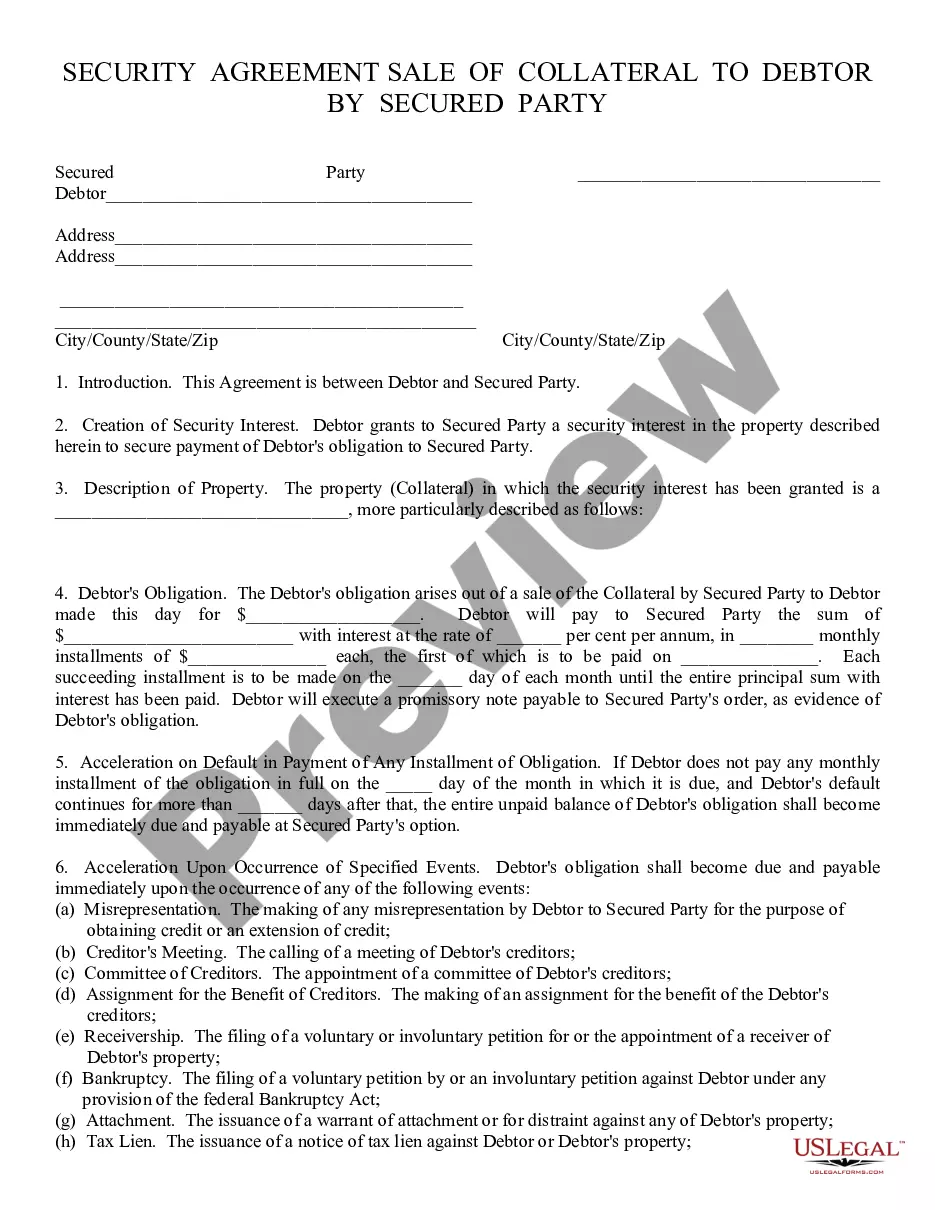

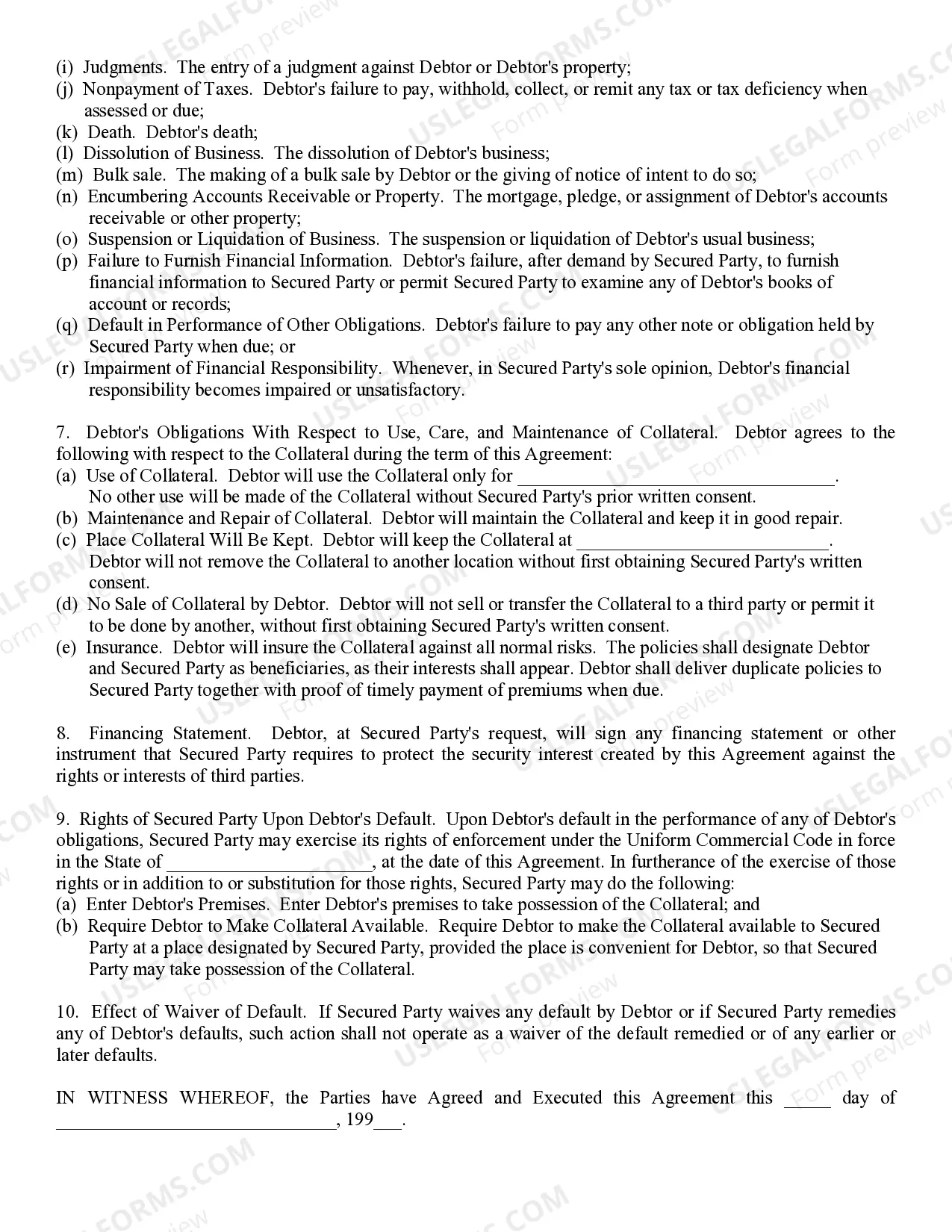

Security Agreement: This is an Agreement between a Debtor and Secured Party. The Debtor uses as collateral some type of property, and then agrees to pay the Secured Party monthly until his/her debt to them is satisfied. If the Debtor does not satisfy the debt, the property used as collateral, becomes the property of the Secured Party. This form is available in both Word and Rich Text formats.

Surprise Arizona Security Agreement is a legal document that outlines the terms and conditions regarding the security interest in a property. It is typically used in financial transactions where collateral is involved, such as loans or mortgages. The agreement ensures that the lender has the right to seize and sell the property in the event of default by the borrower. In Surprise, Arizona, there are different types of Security Agreements that may be used depending on the specific circumstances of the transaction. Some of these agreements include: 1. Personal Property Security Agreement: This type of agreement is used when the collateral involved is personal property, such as vehicles, equipment, or inventory. It establishes the lender's rights over the borrower's personal property until the loan is repaid. 2. Real Estate Security Agreement: This agreement is used when the collateral involved is real estate property, such as land or buildings. It establishes the lender's rights over the borrower's real property until the loan is repaid. 3. UCC-1 Financing Statement: A UCC-1 Financing Statement is a document filed with the Arizona Secretary of State to publicly establish the lender's security interest in the borrower's personal or real property. It is often used in conjunction with a Security Agreement to provide notice to other potential creditors or buyers. 4. Cross-Collateralization Agreement: In certain cases, a Cross-Collateralization Agreement may be used when multiple properties are offered as collateral for a loan. This agreement allows the lender to enforce their rights over all the properties involved if the borrower defaults on the loan. The Surprise Arizona Security Agreement typically includes detailed information about the parties involved, a clear description of the collateral, the amount of the loan, the repayment terms, and the lender's rights in case of default. It is essential for both parties to carefully review and understand the terms before signing, as it legally binds them to their obligations regarding the security interest in the property.Surprise Arizona Security Agreement is a legal document that outlines the terms and conditions regarding the security interest in a property. It is typically used in financial transactions where collateral is involved, such as loans or mortgages. The agreement ensures that the lender has the right to seize and sell the property in the event of default by the borrower. In Surprise, Arizona, there are different types of Security Agreements that may be used depending on the specific circumstances of the transaction. Some of these agreements include: 1. Personal Property Security Agreement: This type of agreement is used when the collateral involved is personal property, such as vehicles, equipment, or inventory. It establishes the lender's rights over the borrower's personal property until the loan is repaid. 2. Real Estate Security Agreement: This agreement is used when the collateral involved is real estate property, such as land or buildings. It establishes the lender's rights over the borrower's real property until the loan is repaid. 3. UCC-1 Financing Statement: A UCC-1 Financing Statement is a document filed with the Arizona Secretary of State to publicly establish the lender's security interest in the borrower's personal or real property. It is often used in conjunction with a Security Agreement to provide notice to other potential creditors or buyers. 4. Cross-Collateralization Agreement: In certain cases, a Cross-Collateralization Agreement may be used when multiple properties are offered as collateral for a loan. This agreement allows the lender to enforce their rights over all the properties involved if the borrower defaults on the loan. The Surprise Arizona Security Agreement typically includes detailed information about the parties involved, a clear description of the collateral, the amount of the loan, the repayment terms, and the lender's rights in case of default. It is essential for both parties to carefully review and understand the terms before signing, as it legally binds them to their obligations regarding the security interest in the property.