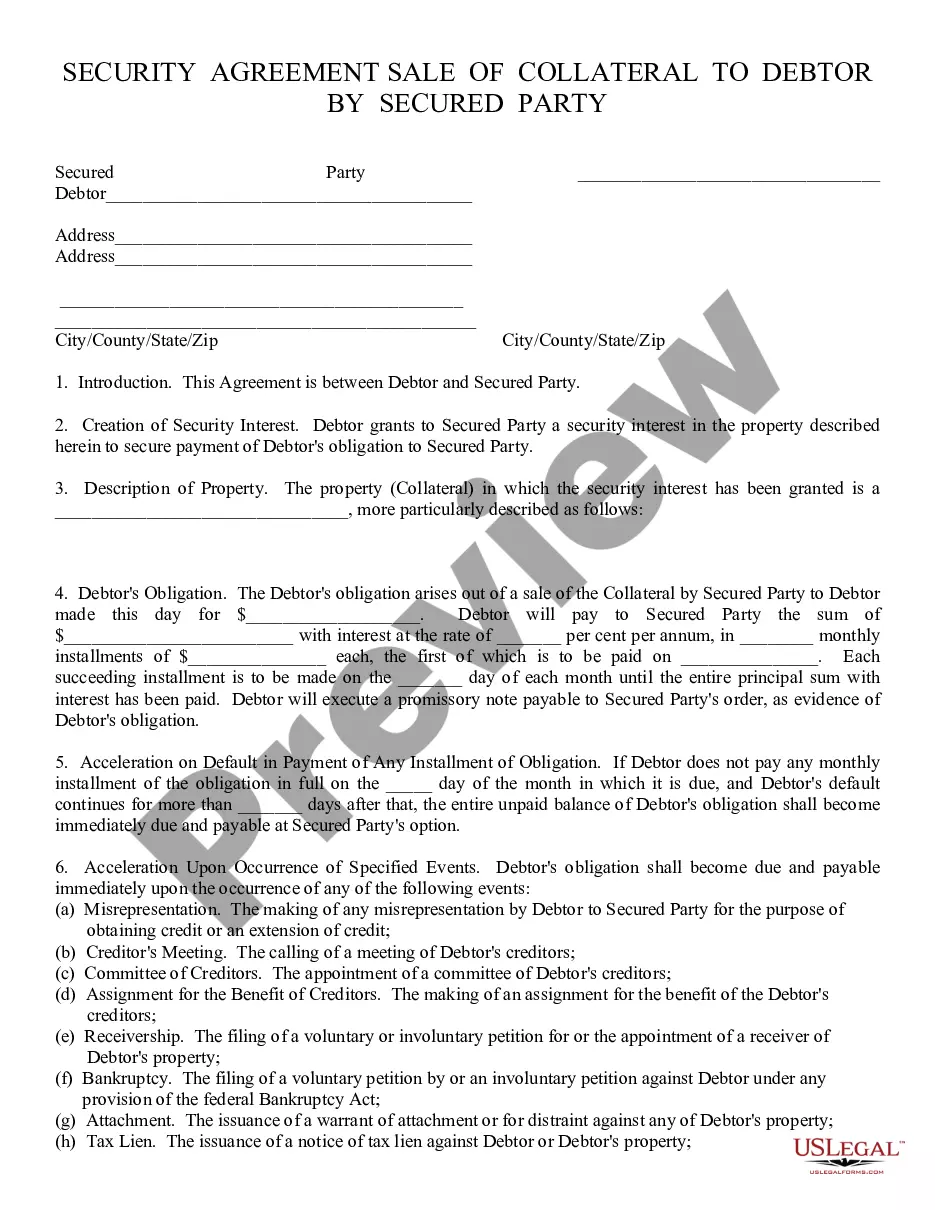

Security Agreement: This is an Agreement between a Debtor and Secured Party. The Debtor uses as collateral some type of property, and then agrees to pay the Secured Party monthly until his/her debt to them is satisfied. If the Debtor does not satisfy the debt, the property used as collateral, becomes the property of the Secured Party. This form is available in both Word and Rich Text formats.

Tucson Arizona Security Agreement is a legally binding contract that outlines the terms and conditions of securing assets, such as property, vehicles, or personal possessions, to ensure the fulfillment of an agreement between two parties. This agreement is commonly used in various contexts, including loans, lease agreements, and business transactions, to provide assurance and protection to the parties involved. One of the types of Tucson Arizona Security Agreement is the Mortgage Agreement, which is typically used in real estate transactions. It involves a borrower (mortgagor) pledging their property as collateral to the lender (mortgagee) in exchange for a loan. This agreement ensures that if the borrower fails to repay the loan, the lender has the right to foreclose on the property and recover the outstanding amount. Another type is the Security Interest Agreement, commonly used in business transactions. In this agreement, a debtor grants a security interest in their assets (such as inventory, equipment, or accounts receivable) to a creditor to secure the repayment of a debt or obligation. This agreement grants the creditor the right to repossess and sell the assets if the debtor fails to fulfill their obligations. Tucson Arizona Security Agreement is crucial for both parties involved as it minimizes the risks associated with lending or entering into agreements. It ensures that lenders and creditors have a legal claim to specific assets in case of default, providing them with a means to recover their investment. Similarly, borrowers and debtors benefit as they can secure loans or business transactions by pledging collateral, often resulting in better terms and lower interest rates. When drafting a Tucson Arizona Security Agreement, it is important to include detailed descriptions of the collateral being pledged, the obligations of both parties, and the consequences of default. The agreement should clearly outline the rights and responsibilities of each party, the duration of the security interest, and any conditions that may release the collateral. In conclusion, a Tucson Arizona Security Agreement is a binding contract used in various transactional scenarios to secure assets and protect the interests of both lenders and borrowers or creditors and debtors. By understanding the different types and components of such agreements, individuals and businesses can effectively protect their financial interests and ensure fair dealings in Tucson, Arizona.Tucson Arizona Security Agreement is a legally binding contract that outlines the terms and conditions of securing assets, such as property, vehicles, or personal possessions, to ensure the fulfillment of an agreement between two parties. This agreement is commonly used in various contexts, including loans, lease agreements, and business transactions, to provide assurance and protection to the parties involved. One of the types of Tucson Arizona Security Agreement is the Mortgage Agreement, which is typically used in real estate transactions. It involves a borrower (mortgagor) pledging their property as collateral to the lender (mortgagee) in exchange for a loan. This agreement ensures that if the borrower fails to repay the loan, the lender has the right to foreclose on the property and recover the outstanding amount. Another type is the Security Interest Agreement, commonly used in business transactions. In this agreement, a debtor grants a security interest in their assets (such as inventory, equipment, or accounts receivable) to a creditor to secure the repayment of a debt or obligation. This agreement grants the creditor the right to repossess and sell the assets if the debtor fails to fulfill their obligations. Tucson Arizona Security Agreement is crucial for both parties involved as it minimizes the risks associated with lending or entering into agreements. It ensures that lenders and creditors have a legal claim to specific assets in case of default, providing them with a means to recover their investment. Similarly, borrowers and debtors benefit as they can secure loans or business transactions by pledging collateral, often resulting in better terms and lower interest rates. When drafting a Tucson Arizona Security Agreement, it is important to include detailed descriptions of the collateral being pledged, the obligations of both parties, and the consequences of default. The agreement should clearly outline the rights and responsibilities of each party, the duration of the security interest, and any conditions that may release the collateral. In conclusion, a Tucson Arizona Security Agreement is a binding contract used in various transactional scenarios to secure assets and protect the interests of both lenders and borrowers or creditors and debtors. By understanding the different types and components of such agreements, individuals and businesses can effectively protect their financial interests and ensure fair dealings in Tucson, Arizona.