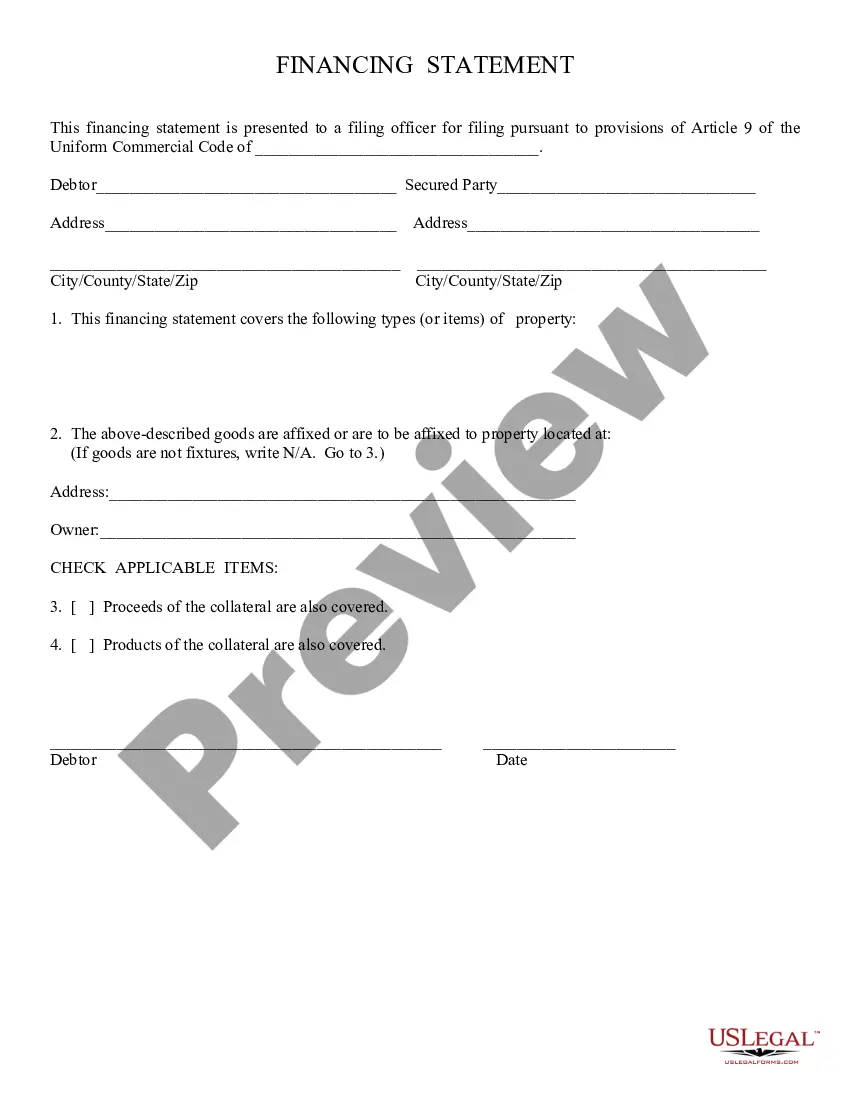

Financing Statement:

Glendale Arizona Financing Statement is a legal document that serves as a public notice to protect the rights of lenders who claim an interest in a debtor's collateral located in Glendale, Arizona. It is an essential tool in documenting and securing financial transactions, ensuring that creditors have a priority claim against specific assets owned by the debtor. The Glendale Arizona Financing Statement is governed by the Uniform Commercial Code (UCC), a set of laws that regulates commercial transactions across the United States. It is filed with the Arizona Secretary of State or the County Recorder's Office to establish the creditor's legal claim and provide notice to other potential creditors. Keyword: Glendale Arizona Financing Statement There are different types of Glendale Arizona Financing Statement that vary based on the nature of the transaction and the collateral involved. These types include: 1. UCC-1 Financing Statement: This is the most common form of a financing statement used to secure a creditor's interest in personal property, such as machinery, equipment, inventory, accounts receivable, or fixtures. It typically requires information about the debtor, creditor, and collateral being claimed. 2. UCC-1AD Financing Statement Addendum: This form is used as an attachment to the UCC-1 Financing Statement to provide additional information or include necessary clauses that cannot fit within the main form's limited space. 3. UCC-1AP Financing Statement Additional Party: This form is used when adding additional parties to the original UCC-1 Financing Statement, such as co-debtors or secondary creditors. It ensures that all relevant parties are notified and their interests are protected. 4. UCC-3 Financing Statement Amendment: This form is used to revise or modify information included in the original UCC-1 Financing Statement. It may involve changes in collateral, debtor information, or creditor's legal name. 5. UCC-5 Financing Statement Information Request: This form is used to request information about a specific financing statement already filed with the Secretary of State or County Recorder's Office. It allows interested parties to obtain essential details regarding a debtor's existing financial obligations. It is important to consult legal professionals or use online filing services to ensure the accurate completion and submission of Glendale Arizona Financing Statements. Filing errors or omissions may result in a loss of priority and potentially hinder a creditor's ability to claim their interests in the debtor's collateral.Glendale Arizona Financing Statement is a legal document that serves as a public notice to protect the rights of lenders who claim an interest in a debtor's collateral located in Glendale, Arizona. It is an essential tool in documenting and securing financial transactions, ensuring that creditors have a priority claim against specific assets owned by the debtor. The Glendale Arizona Financing Statement is governed by the Uniform Commercial Code (UCC), a set of laws that regulates commercial transactions across the United States. It is filed with the Arizona Secretary of State or the County Recorder's Office to establish the creditor's legal claim and provide notice to other potential creditors. Keyword: Glendale Arizona Financing Statement There are different types of Glendale Arizona Financing Statement that vary based on the nature of the transaction and the collateral involved. These types include: 1. UCC-1 Financing Statement: This is the most common form of a financing statement used to secure a creditor's interest in personal property, such as machinery, equipment, inventory, accounts receivable, or fixtures. It typically requires information about the debtor, creditor, and collateral being claimed. 2. UCC-1AD Financing Statement Addendum: This form is used as an attachment to the UCC-1 Financing Statement to provide additional information or include necessary clauses that cannot fit within the main form's limited space. 3. UCC-1AP Financing Statement Additional Party: This form is used when adding additional parties to the original UCC-1 Financing Statement, such as co-debtors or secondary creditors. It ensures that all relevant parties are notified and their interests are protected. 4. UCC-3 Financing Statement Amendment: This form is used to revise or modify information included in the original UCC-1 Financing Statement. It may involve changes in collateral, debtor information, or creditor's legal name. 5. UCC-5 Financing Statement Information Request: This form is used to request information about a specific financing statement already filed with the Secretary of State or County Recorder's Office. It allows interested parties to obtain essential details regarding a debtor's existing financial obligations. It is important to consult legal professionals or use online filing services to ensure the accurate completion and submission of Glendale Arizona Financing Statements. Filing errors or omissions may result in a loss of priority and potentially hinder a creditor's ability to claim their interests in the debtor's collateral.