Financing Statement:

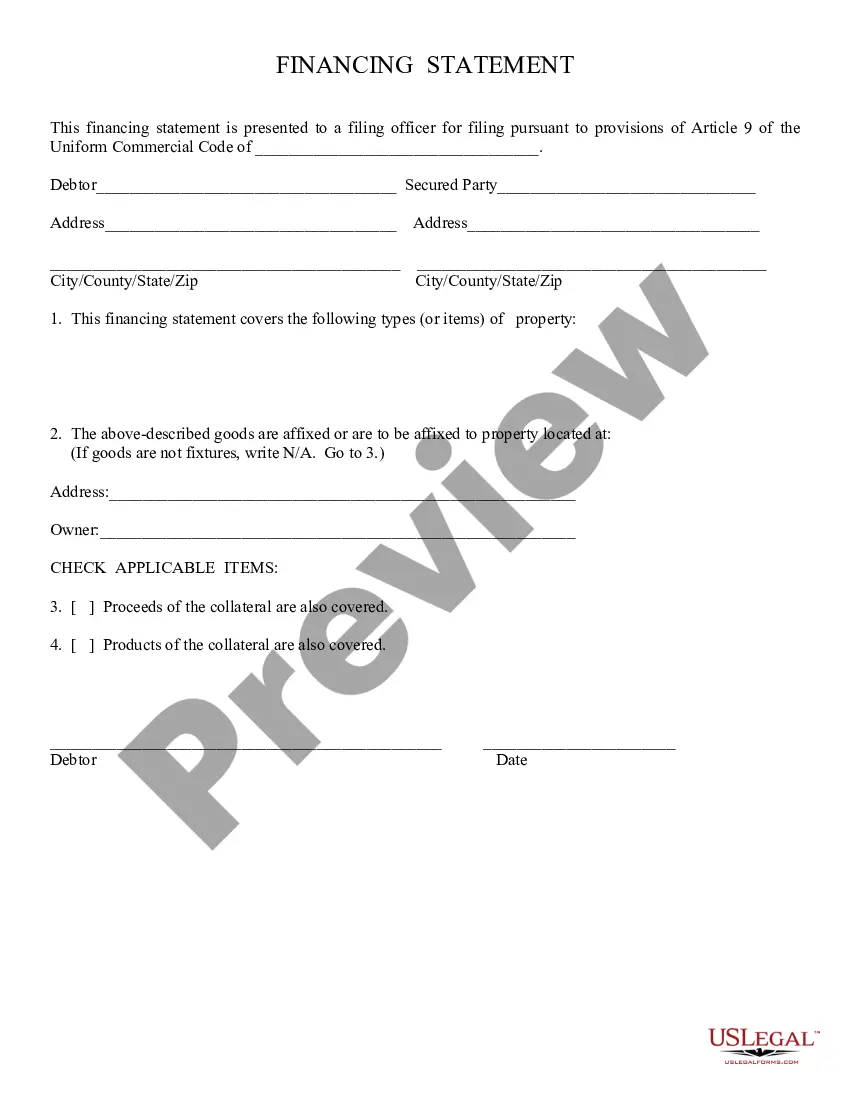

The Maricopa Arizona Financing Statement is a crucial legal document that establishes a creditor's security interest in a debtor's personal property. This detailed description will delve into the key aspects of this statement, including its purpose, required information, filing process, and the different types available. The primary purpose of the Maricopa Arizona Financing Statement is to publicly disclose specific details about a creditor's security interest in the debtor's personal property. By filing this statement, creditors provide notice to other potential creditors and interested parties that they have a legal claim to the specified assets. To ensure the effectiveness of a Maricopa Arizona Financing Statement, certain essential information must be included. These key elements encompass the debtor's name and address, the creditor's name and address, a detailed description of the collateral, and the duration of the creditor's interest. Accuracy in providing this information is crucial, as any mistakes or omissions might render the statement invalid. There are multiple types of Maricopa Arizona Financing Statements based on the nature of the transaction or the governing law. These include UCC-1 Financing Statements, which refer to statements filed under the uniform commercial code, and UCC-3 Financing Statements, typically used for making amendments such as termination, continuation, or assignment of the original UCC-1 statement. The process of filing a Maricopa Arizona Financing Statement involves submitting the document to the Maricopa County Recorder's Office. The statement must be signed by the debtor and the creditor, and it often requires a filing fee. Once filed, the statement becomes a public record accessible by interested parties, thus providing an easily searchable database for creditors and interested parties to assess any existing security interests. In summary, the Maricopa Arizona Financing Statement plays a vital role in establishing a creditor's legal claim to a debtor's personal property. This detailed document provides public notice about the creditor's interest and ensures clarity and transparency in financial transactions. By accurately filing the appropriate type of financing statement, creditors can protect their rights and interests, promoting fair and informed business practices within the Maricopa Arizona area.The Maricopa Arizona Financing Statement is a crucial legal document that establishes a creditor's security interest in a debtor's personal property. This detailed description will delve into the key aspects of this statement, including its purpose, required information, filing process, and the different types available. The primary purpose of the Maricopa Arizona Financing Statement is to publicly disclose specific details about a creditor's security interest in the debtor's personal property. By filing this statement, creditors provide notice to other potential creditors and interested parties that they have a legal claim to the specified assets. To ensure the effectiveness of a Maricopa Arizona Financing Statement, certain essential information must be included. These key elements encompass the debtor's name and address, the creditor's name and address, a detailed description of the collateral, and the duration of the creditor's interest. Accuracy in providing this information is crucial, as any mistakes or omissions might render the statement invalid. There are multiple types of Maricopa Arizona Financing Statements based on the nature of the transaction or the governing law. These include UCC-1 Financing Statements, which refer to statements filed under the uniform commercial code, and UCC-3 Financing Statements, typically used for making amendments such as termination, continuation, or assignment of the original UCC-1 statement. The process of filing a Maricopa Arizona Financing Statement involves submitting the document to the Maricopa County Recorder's Office. The statement must be signed by the debtor and the creditor, and it often requires a filing fee. Once filed, the statement becomes a public record accessible by interested parties, thus providing an easily searchable database for creditors and interested parties to assess any existing security interests. In summary, the Maricopa Arizona Financing Statement plays a vital role in establishing a creditor's legal claim to a debtor's personal property. This detailed document provides public notice about the creditor's interest and ensures clarity and transparency in financial transactions. By accurately filing the appropriate type of financing statement, creditors can protect their rights and interests, promoting fair and informed business practices within the Maricopa Arizona area.