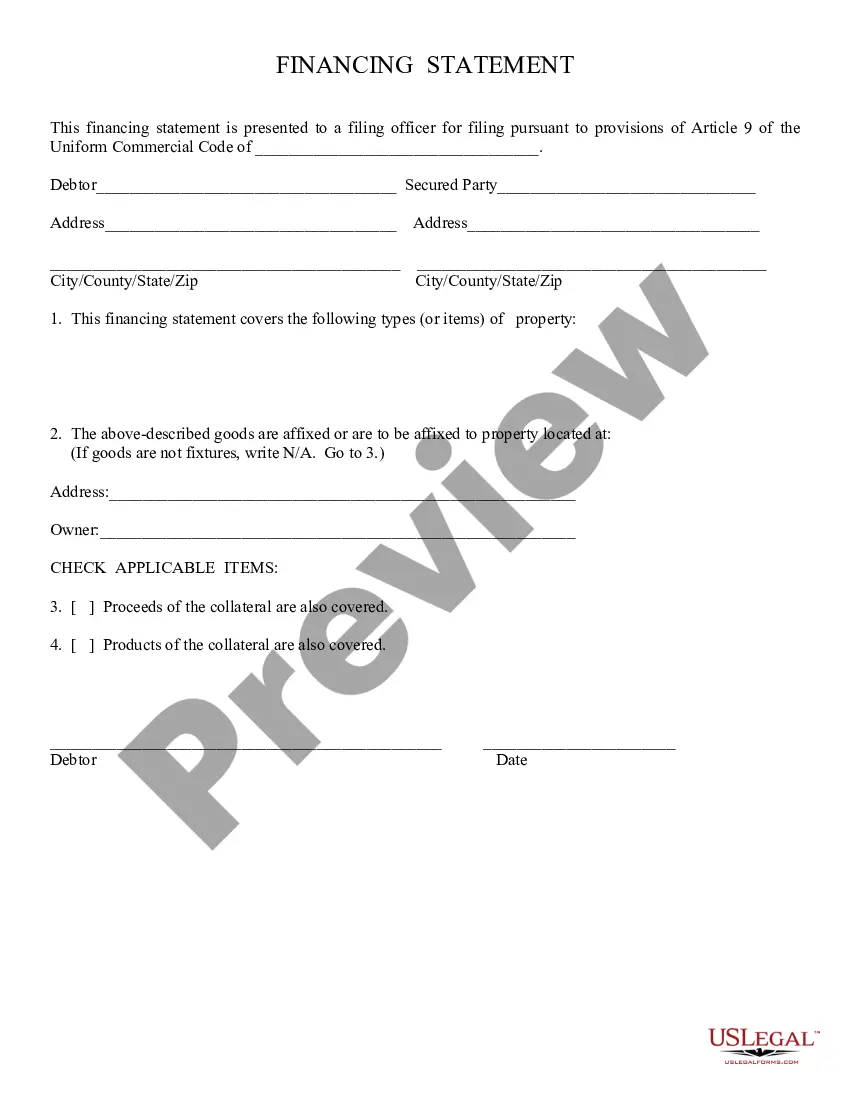

Financing Statement:

A Phoenix Arizona Financing Statement refers to a legal document that is filed with the Arizona Secretary of State as part of the Uniform Commercial Code (UCC). It serves as a notice to all interested parties about the security interests a creditor has in specific collateral owned by a debtor. The purpose of the financing statement is to establish priority rights for the creditor in case of default or insolvency. The Phoenix Arizona Financing Statement typically includes the names and addresses of both the debtor (the person or entity borrowing the funds) and the creditor (the person or entity providing the funds). It provides a detailed description of the collateral pledged as security for the loan. This description can include various types of property, such as equipment, inventory, livestock, vehicles, or even intangible assets like accounts receivable or intellectual property. It is essential to note that the Financing Statement is not a method of transferring ownership but rather acts as a public notice of the creditor's security interest. This allows other potential creditors to be aware of the existing lien or encumbrance on the collateral. It also allows creditors to determine the priority of their claims based on the filing order. When it comes to the different types of Phoenix Arizona Financing Statements, there are primarily two main categories: 1. UCC-1 Financing Statement: This is the most common type of financing statement, used for securing most types of collateral. It is filed by the creditor to establish their security interest in the debtor's assets. 2. UCC-3 Financing Statement: This refers to an amendment, continuation, or termination of an existing financing statement. It is typically filed if there are changes to the initial financing statement, such as a change in collateral, the addition of new collateral, or the release of the security interest. Both types of financing statements play a crucial role in the lending and borrowing process by providing transparency and ensuring that creditors have proper documentation to protect their interests. They allow for efficient tracking of potential risks, establish priority rights, and facilitate smooth financial transactions in Phoenix, Arizona.A Phoenix Arizona Financing Statement refers to a legal document that is filed with the Arizona Secretary of State as part of the Uniform Commercial Code (UCC). It serves as a notice to all interested parties about the security interests a creditor has in specific collateral owned by a debtor. The purpose of the financing statement is to establish priority rights for the creditor in case of default or insolvency. The Phoenix Arizona Financing Statement typically includes the names and addresses of both the debtor (the person or entity borrowing the funds) and the creditor (the person or entity providing the funds). It provides a detailed description of the collateral pledged as security for the loan. This description can include various types of property, such as equipment, inventory, livestock, vehicles, or even intangible assets like accounts receivable or intellectual property. It is essential to note that the Financing Statement is not a method of transferring ownership but rather acts as a public notice of the creditor's security interest. This allows other potential creditors to be aware of the existing lien or encumbrance on the collateral. It also allows creditors to determine the priority of their claims based on the filing order. When it comes to the different types of Phoenix Arizona Financing Statements, there are primarily two main categories: 1. UCC-1 Financing Statement: This is the most common type of financing statement, used for securing most types of collateral. It is filed by the creditor to establish their security interest in the debtor's assets. 2. UCC-3 Financing Statement: This refers to an amendment, continuation, or termination of an existing financing statement. It is typically filed if there are changes to the initial financing statement, such as a change in collateral, the addition of new collateral, or the release of the security interest. Both types of financing statements play a crucial role in the lending and borrowing process by providing transparency and ensuring that creditors have proper documentation to protect their interests. They allow for efficient tracking of potential risks, establish priority rights, and facilitate smooth financial transactions in Phoenix, Arizona.