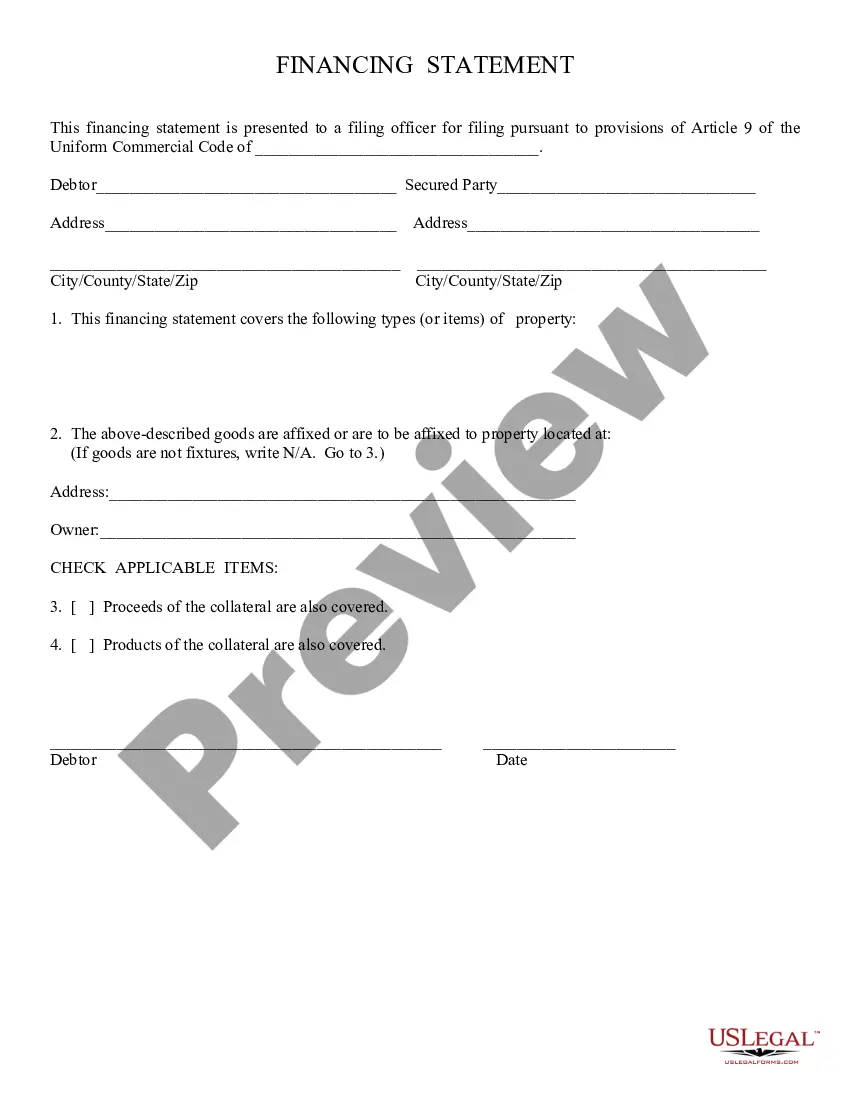

Financing Statement:

Scottsdale Arizona Financing Statement is a legal document that serves as public notice of a creditor's security interest in certain property owned by a debtor in Scottsdale, Arizona. It is filed with the Arizona Secretary of State to protect the creditor's rights in case of default or bankruptcy by the debtor. This financing statement contains important information such as the names and addresses of the creditor and debtor, a description of the collateral securing the debt, and any applicable financing statements or security agreements. It is governed by the Uniform Commercial Code (UCC) Article 9, which outlines the rules and regulations regarding secured transactions. There are different types of Scottsdale Arizona Financing Statements depending on the nature of the transaction: 1. UCC-1 Financing Statement: This is the most common type of financing statement filed to perfect a security interest in personal property. It typically covers assets such as equipment, inventory, and accounts receivable. 2. Real Estate Financing Statement: Also known as a UCC-1 fixture filing, this type of financing statement is used when the collateral is attached to real property. It provides notice that the creditor has an interest in fixtures, such as machinery or equipment, that have been installed or affixed to the property. 3. Agricultural Financing Statement: This type of financing statement is specific to agricultural transactions, covering crops, livestock, and farm products. It helps secure loans related to farming operations and provides notice of the creditor's interest in the debtor's agricultural assets. By filing a Scottsdale Arizona Financing Statement, creditors can protect their rights and priority over other creditors in case of debtor default or bankruptcy. It establishes a public record of the security interest and allows future lenders or buyers to determine existing liens on the debtor's property.Scottsdale Arizona Financing Statement is a legal document that serves as public notice of a creditor's security interest in certain property owned by a debtor in Scottsdale, Arizona. It is filed with the Arizona Secretary of State to protect the creditor's rights in case of default or bankruptcy by the debtor. This financing statement contains important information such as the names and addresses of the creditor and debtor, a description of the collateral securing the debt, and any applicable financing statements or security agreements. It is governed by the Uniform Commercial Code (UCC) Article 9, which outlines the rules and regulations regarding secured transactions. There are different types of Scottsdale Arizona Financing Statements depending on the nature of the transaction: 1. UCC-1 Financing Statement: This is the most common type of financing statement filed to perfect a security interest in personal property. It typically covers assets such as equipment, inventory, and accounts receivable. 2. Real Estate Financing Statement: Also known as a UCC-1 fixture filing, this type of financing statement is used when the collateral is attached to real property. It provides notice that the creditor has an interest in fixtures, such as machinery or equipment, that have been installed or affixed to the property. 3. Agricultural Financing Statement: This type of financing statement is specific to agricultural transactions, covering crops, livestock, and farm products. It helps secure loans related to farming operations and provides notice of the creditor's interest in the debtor's agricultural assets. By filing a Scottsdale Arizona Financing Statement, creditors can protect their rights and priority over other creditors in case of debtor default or bankruptcy. It establishes a public record of the security interest and allows future lenders or buyers to determine existing liens on the debtor's property.