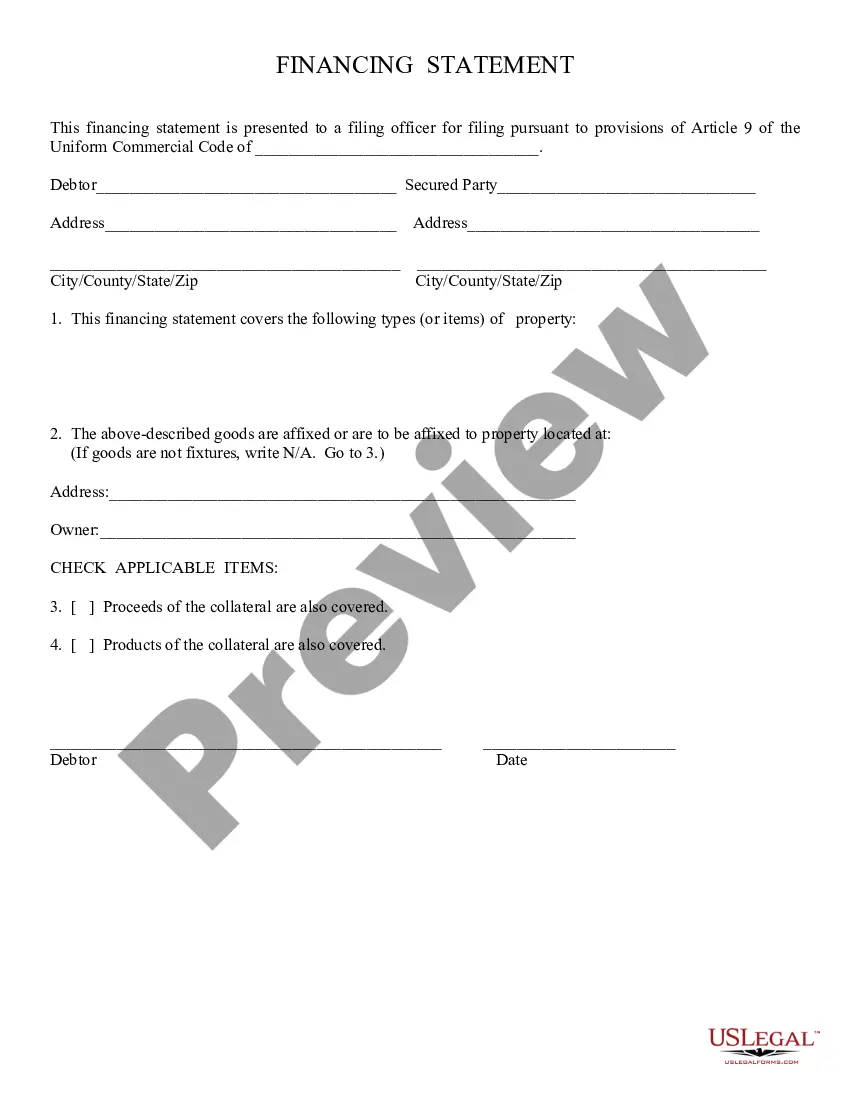

Financing Statement:

A Surprise Arizona Financing Statement is a legal document filed to secure a lender's interest in the property of a debtor. This statement provides public notice that the lender has a security interest or lien on certain assets or property of the debtor in Surprise, Arizona. It is an essential tool used in various financial transactions, including loans, leases, and other credit arrangements. The Surprise Arizona Financing Statement is governed by the rules and regulations of the Arizona Revised Statutes (A.R.S.), specifically under the provisions of the Uniform Commercial Code (UCC). The UCC is a set of laws that standardize commercial transactions across the United States, including the creation, perfection, and enforcement of security interests. In Surprise, Arizona, there are different types of Financing Statements that can be filed, depending on the circumstances and nature of the transaction. These may include: 1. UCC-1 Financing Statement: The most common type of financing statement filed in Surprise, Arizona. It provides a general description of the collateral (assets pledged as security) and includes information about the debtor and secured party. 2. UCC-1 Multiple Debtor Addendum: When there are multiple debtors involved in a transaction, this addendum is attached to the UCC-1 Financing Statement. It provides additional information about the debtors and clarifies their respective roles. 3. UCC-3 Financing Statement Amendment: This form is used to make changes or amendments to the original financing statement. It can be used to update debtor information, add or remove collateral, or extend the duration of the original statement. 4. UCC-5 Financing Statement Addendum: In certain cases, additional information is required to provide more comprehensive details about the collateral. This addendum is attached to the UCC-1 Financing Statement to fulfill such requirements. By filing a Surprise Arizona Financing Statement, the secured party establishes a legal claim or priority interest in the debtor's assets. This helps to protect their investment and ensures that they have a right to reclaim the collateral if the debtor defaults on the loan or obligation. It is crucial for lenders, debtors, and interested parties to understand the regulations surrounding Surprise Arizona Financing Statements, as they play a pivotal role in the financial landscape of the region. Precise and accurate completion of these statements is vital to secure and enforce the rights of the parties involved.A Surprise Arizona Financing Statement is a legal document filed to secure a lender's interest in the property of a debtor. This statement provides public notice that the lender has a security interest or lien on certain assets or property of the debtor in Surprise, Arizona. It is an essential tool used in various financial transactions, including loans, leases, and other credit arrangements. The Surprise Arizona Financing Statement is governed by the rules and regulations of the Arizona Revised Statutes (A.R.S.), specifically under the provisions of the Uniform Commercial Code (UCC). The UCC is a set of laws that standardize commercial transactions across the United States, including the creation, perfection, and enforcement of security interests. In Surprise, Arizona, there are different types of Financing Statements that can be filed, depending on the circumstances and nature of the transaction. These may include: 1. UCC-1 Financing Statement: The most common type of financing statement filed in Surprise, Arizona. It provides a general description of the collateral (assets pledged as security) and includes information about the debtor and secured party. 2. UCC-1 Multiple Debtor Addendum: When there are multiple debtors involved in a transaction, this addendum is attached to the UCC-1 Financing Statement. It provides additional information about the debtors and clarifies their respective roles. 3. UCC-3 Financing Statement Amendment: This form is used to make changes or amendments to the original financing statement. It can be used to update debtor information, add or remove collateral, or extend the duration of the original statement. 4. UCC-5 Financing Statement Addendum: In certain cases, additional information is required to provide more comprehensive details about the collateral. This addendum is attached to the UCC-1 Financing Statement to fulfill such requirements. By filing a Surprise Arizona Financing Statement, the secured party establishes a legal claim or priority interest in the debtor's assets. This helps to protect their investment and ensures that they have a right to reclaim the collateral if the debtor defaults on the loan or obligation. It is crucial for lenders, debtors, and interested parties to understand the regulations surrounding Surprise Arizona Financing Statements, as they play a pivotal role in the financial landscape of the region. Precise and accurate completion of these statements is vital to secure and enforce the rights of the parties involved.