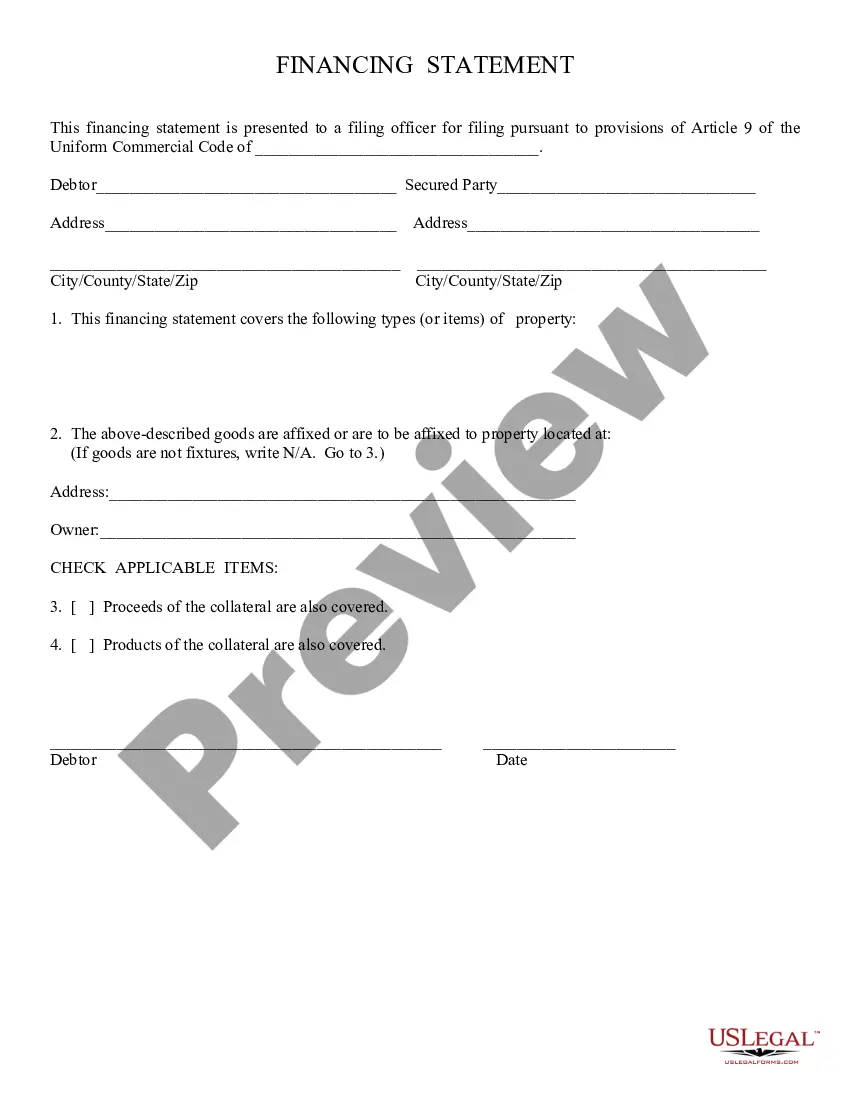

Financing Statement:

Tucson Arizona Financing Statement is a legal document filed to publicly record a secured transaction between a debtor and a secured party in Tucson, Arizona. This statement is an essential part of the Uniform Commercial Code (UCC) and provides crucial information about the collateral used to secure the loan or credit. The Tucson Arizona Financing Statement contains various important details, including the names and addresses of both the debtor and the secured party. It also identifies the collateral being used to secure the transaction and may provide a description or indication of the type of collateral involved. Different types of financing statements that can be filed in Tucson, Arizona include: 1. General Financing Statement: This is the most common type of financing statement filed to indicate a general security agreement between the debtor and the secured party. It ensures that the secured party has a legal claim to the collateral in case of default by the debtor. 2. Agricultural Financing Statement: Specifically designed for transactions related to agricultural products, livestock, or crops, this type of financing statement provides additional provisions and specific requirements relevant to agricultural financing. 3. Fixture Filing: A fixture filing is made when the collateral involved is a fixture, which refers to any item permanently attached to real estate. This type of financing statement ensures that the secured party's interest in fixtures is protected and allows them to assert their rights against any subsequent parties. By filing a Tucson Arizona Financing Statement, secured parties can establish their priority in case there are multiple parties claiming an interest in the same collateral. Once filed with the appropriate authority, the financing statement becomes a public record and serves as notice to other potential creditors or interested parties. In conclusion, the Tucson Arizona Financing Statement is a crucial legal document used to record and establish the rights of a secured party over collateral involved in a secured transaction in Tucson, Arizona. It is important to accurately complete and file this statement to protect the interests of both debtors and secured parties.