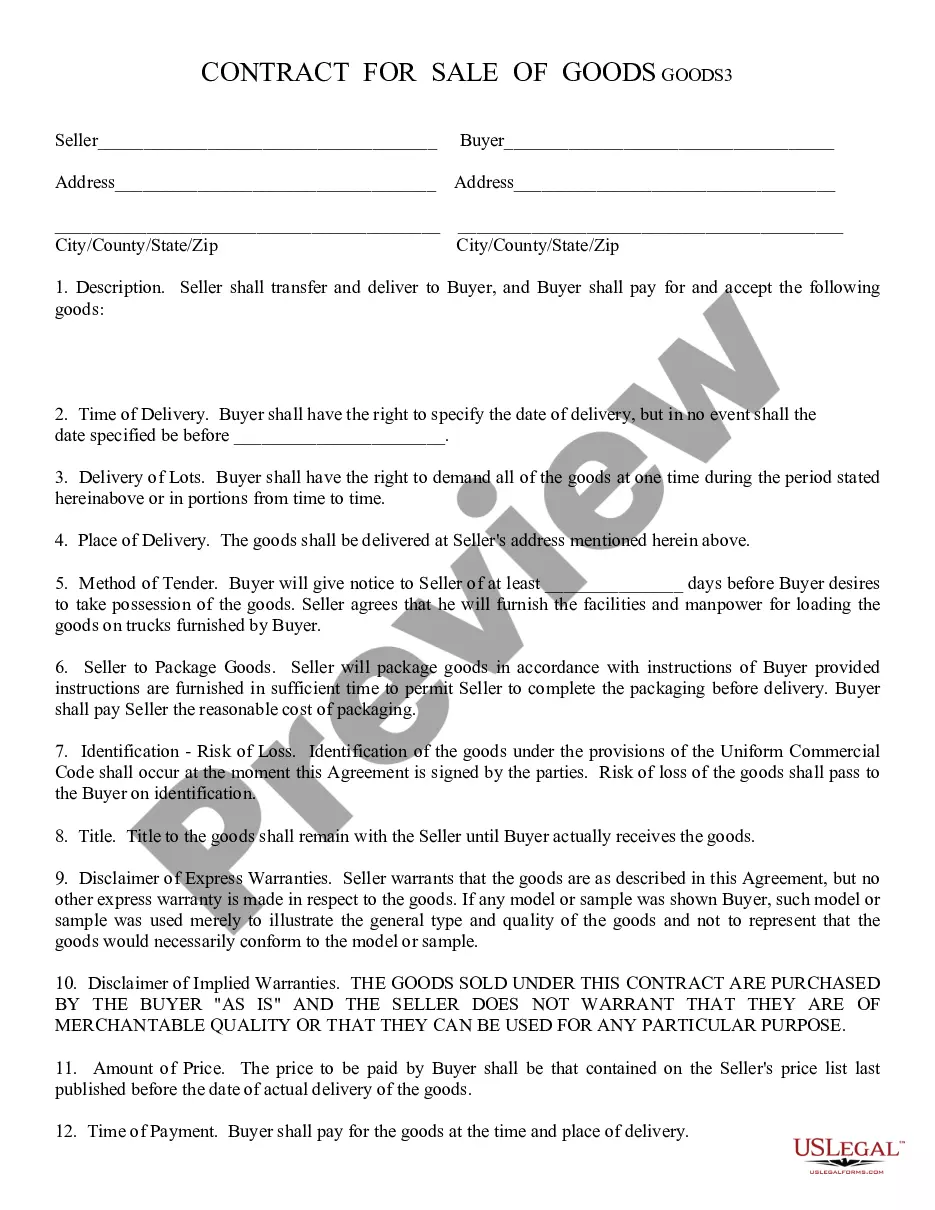

Contract - Sale of Goods: This is a Sales Contract between the Buyer and Seller of any type of goods and/or merchandise. It details the responsibilities to each other, and must be signed by both parties.

Surprise Arizona Contract — Sale of Goods: A Comprehensive Guide Keywords: Surprise Arizona, contract, sale of goods, types Introduction: A Surprise Arizona Contract — Sale of Goods is a legally binding agreement between two parties, where one party (the seller) agrees to transfer the ownership of certain goods to the other party (the buyer) in exchange for payment. In Surprise, Arizona, contracts for the sale of goods are governed by both federal and state laws, including the Uniform Commercial Code (UCC). Types of Surprise Arizona Contracts — Sales of Goods: 1. Standard Sale of Goods Contract: This type of contract involves the straightforward sale of goods between two parties. It includes essential elements such as the identification of the goods to be sold, the purchase price, payment terms, delivery details, warranties, and remedies in case of breach of contract. These contracts can be written, oral, or based on the conduct of the parties. 2. Installment Sales Contract: An installment sales contract is a subset of sales contracts where the buyer agrees to make payments in installments over a certain period. The ownership of the goods passes to the buyer upon signing the contract, but the title remains with the seller until the full payment is made. This type of contract is commonly used for high-value goods, such as furniture, appliances, or vehicles. 3. Consignment Sales Contract: A consignment sales contract occurs when a party (consignor) places their goods with another party (consignee) to be sold on their behalf. The consignor retains ownership of the goods until they are sold, and the consignee acts as an agent to sell them. This type of contract usually includes terms related to pricing, commission, return of unsold goods, and the consignee's responsibilities. 4. Bulk Sales Contract: A bulk sales contract is specific to the sale of business assets, typically involving the sale of the entire inventory or substantial parts of it. The buyer intends to continue or establish a similar business and purchases the assets in bulk. This type of contract is subject to additional requirements, such as obtaining a notice from the seller to protect creditors and ensuring compliance with tax and licensing regulations. Key Considerations in Surprise Arizona Contracts — Sales of Goods: 1. Offer and Acceptance: Both parties must agree upon the terms and conditions of the sale, including the goods, price, and delivery terms. An offer can be made through different means, such as oral communication, written proposals, or even conduct, and must be accepted by the other party without any modifications. 2. Payment and Delivery Terms: The contract should clearly establish the payment terms, including the amount, currency, and timeline for payment. It should also specify the delivery details, such as shipping methods, insurance, and the transfer of risk from the seller to the buyer. 3. Warranties and Remedies: Both parties should understand the warranties provided for the goods being sold. These warranties may include specifications about the merchantability or fitness for a particular purpose. The contract should also outline the remedies available to the buyer in case of defects or non-conformance with the contract's terms. Conclusion: A Surprise Arizona Contract — Sale of Goods serves as the foundation for a successful transaction between a buyer and a seller. By clearly defining the terms, conditions, and expectations, such contracts protect the rights and interests of both parties while ensuring a smooth exchange of goods and payment. It is essential to consult with legal professionals when drafting or entering into such contracts to ensure compliance with Arizona laws and to address any specific circumstances in the agreement.Surprise Arizona Contract — Sale of Goods: A Comprehensive Guide Keywords: Surprise Arizona, contract, sale of goods, types Introduction: A Surprise Arizona Contract — Sale of Goods is a legally binding agreement between two parties, where one party (the seller) agrees to transfer the ownership of certain goods to the other party (the buyer) in exchange for payment. In Surprise, Arizona, contracts for the sale of goods are governed by both federal and state laws, including the Uniform Commercial Code (UCC). Types of Surprise Arizona Contracts — Sales of Goods: 1. Standard Sale of Goods Contract: This type of contract involves the straightforward sale of goods between two parties. It includes essential elements such as the identification of the goods to be sold, the purchase price, payment terms, delivery details, warranties, and remedies in case of breach of contract. These contracts can be written, oral, or based on the conduct of the parties. 2. Installment Sales Contract: An installment sales contract is a subset of sales contracts where the buyer agrees to make payments in installments over a certain period. The ownership of the goods passes to the buyer upon signing the contract, but the title remains with the seller until the full payment is made. This type of contract is commonly used for high-value goods, such as furniture, appliances, or vehicles. 3. Consignment Sales Contract: A consignment sales contract occurs when a party (consignor) places their goods with another party (consignee) to be sold on their behalf. The consignor retains ownership of the goods until they are sold, and the consignee acts as an agent to sell them. This type of contract usually includes terms related to pricing, commission, return of unsold goods, and the consignee's responsibilities. 4. Bulk Sales Contract: A bulk sales contract is specific to the sale of business assets, typically involving the sale of the entire inventory or substantial parts of it. The buyer intends to continue or establish a similar business and purchases the assets in bulk. This type of contract is subject to additional requirements, such as obtaining a notice from the seller to protect creditors and ensuring compliance with tax and licensing regulations. Key Considerations in Surprise Arizona Contracts — Sales of Goods: 1. Offer and Acceptance: Both parties must agree upon the terms and conditions of the sale, including the goods, price, and delivery terms. An offer can be made through different means, such as oral communication, written proposals, or even conduct, and must be accepted by the other party without any modifications. 2. Payment and Delivery Terms: The contract should clearly establish the payment terms, including the amount, currency, and timeline for payment. It should also specify the delivery details, such as shipping methods, insurance, and the transfer of risk from the seller to the buyer. 3. Warranties and Remedies: Both parties should understand the warranties provided for the goods being sold. These warranties may include specifications about the merchantability or fitness for a particular purpose. The contract should also outline the remedies available to the buyer in case of defects or non-conformance with the contract's terms. Conclusion: A Surprise Arizona Contract — Sale of Goods serves as the foundation for a successful transaction between a buyer and a seller. By clearly defining the terms, conditions, and expectations, such contracts protect the rights and interests of both parties while ensuring a smooth exchange of goods and payment. It is essential to consult with legal professionals when drafting or entering into such contracts to ensure compliance with Arizona laws and to address any specific circumstances in the agreement.