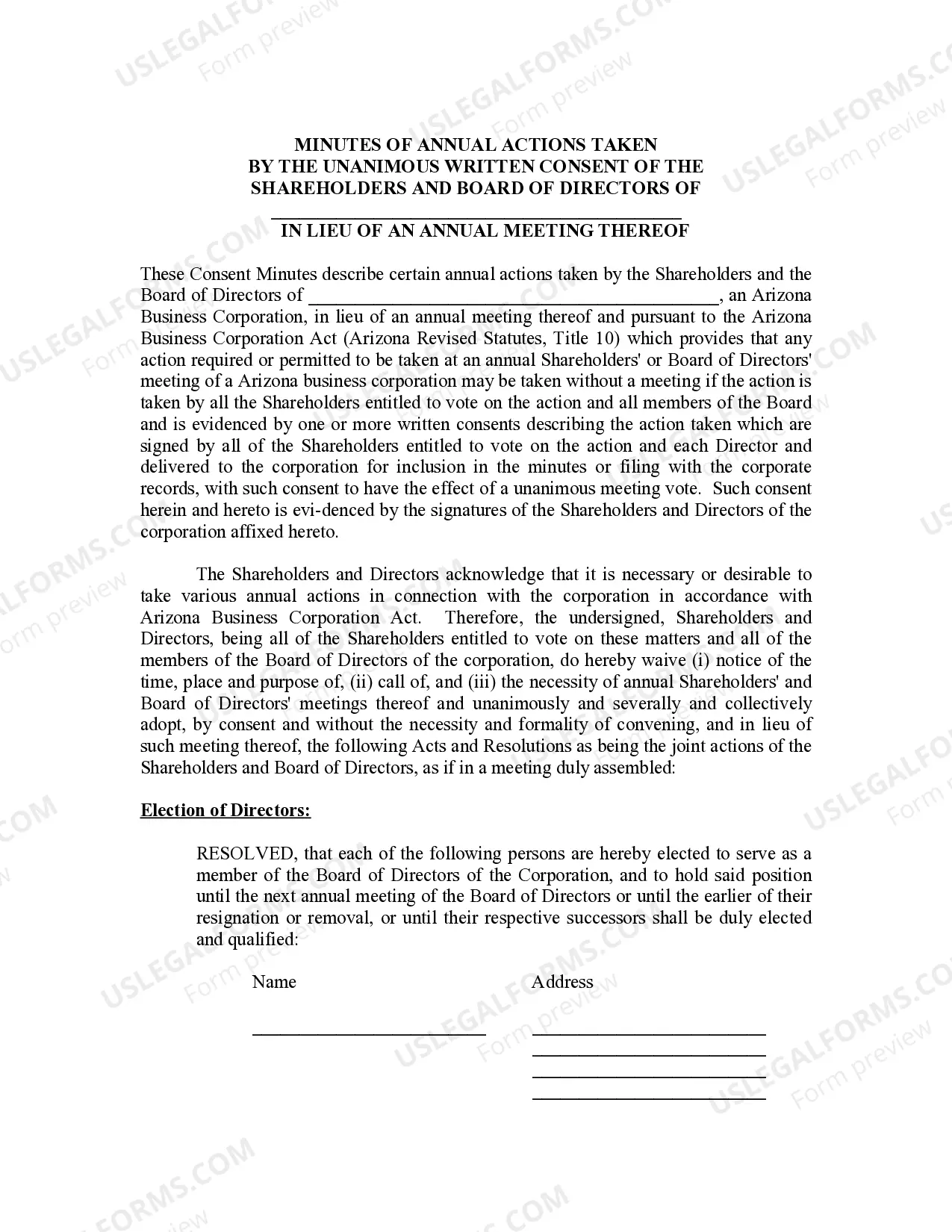

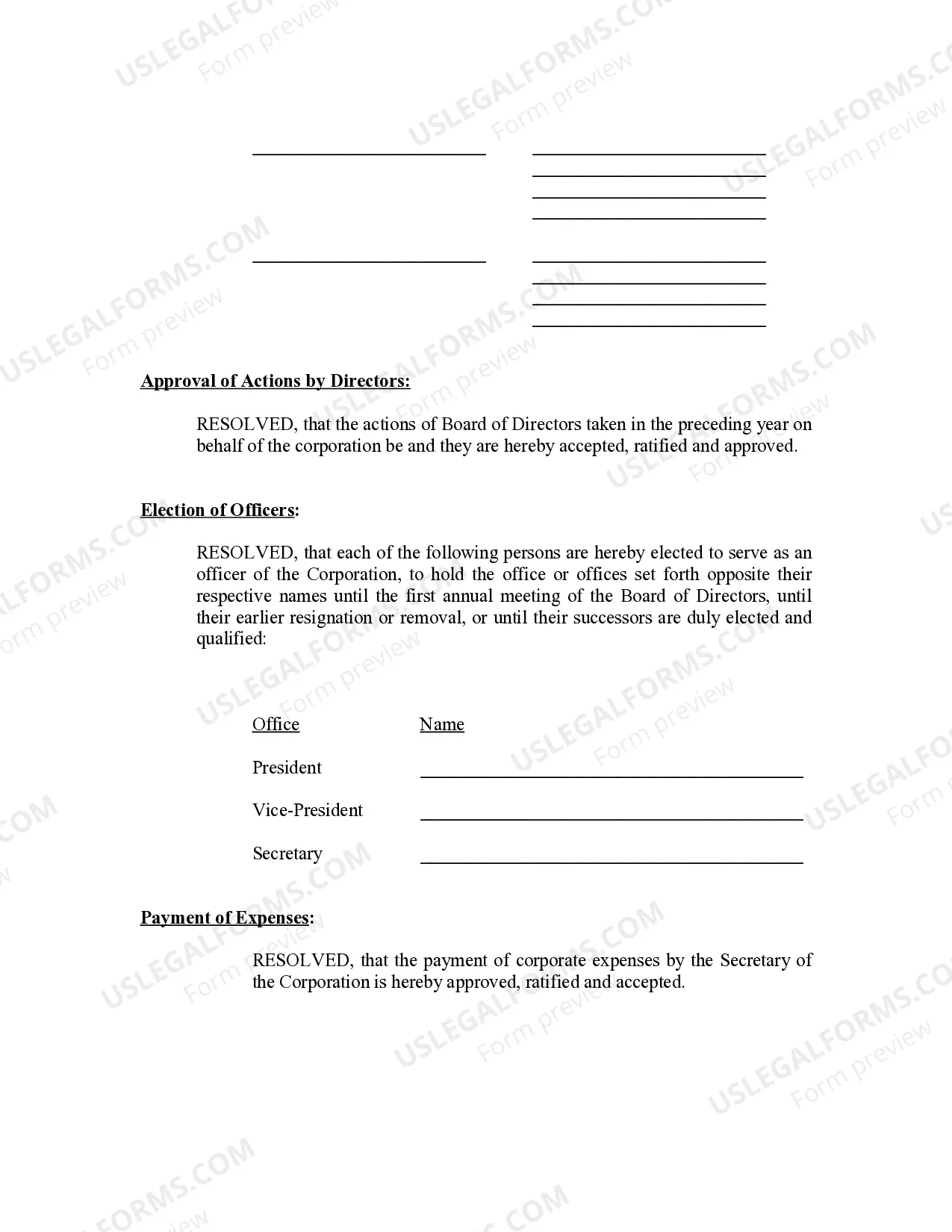

The Annual Minutes form is used to document any changes or other organizational activities of the Corporation during a given year.

Phoenix Arizona Annual Minutes

Description

How to fill out Arizona Annual Minutes?

If you’ve previously taken advantage of our service, Log In to your account and retrieve the Phoenix Annual Minutes - Arizona on your device by selecting the Download button. Ensure your subscription is active. If it isn't, renew it as per your payment option.

If this is your initial interaction with our service, follow these straightforward steps to obtain your document.

You have perpetual access to every document you have purchased: you can find it in your profile under the My documents section whenever you need to use it again. Utilize the US Legal Forms service to efficiently find and save any template for your personal or business requirements!

- Ensure you've found a suitable document. Browse through the description and utilize the Preview feature, if available, to verify that it matches your needs. If it doesn’t suit you, use the Search tab above to discover the right one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and process your payment. Enter your credit card information or select the PayPal option to finalize the purchase.

- Download your Phoenix Annual Minutes - Arizona. Choose the file format for your document and save it on your device.

- Fill out your template. Print it or use professional online editors to complete and sign it electronically.

Form popularity

FAQ

Corporations Division Customer Service: (602) 542-3026. Toll Free In-State Only: 1-(800) 345-5819. Email: answers@azcc.gov.

LLCs, corporations, and nonprofits are required to file annual reports to maintain good standing. Due dates, filing fees, and forms vary greatly by entity type and whether the entity is domestic or foreign to the state.

LLC Tax Returns Arizona Tax: The corporate tax rate is 6.968% of net income. If the LLC elects to be taxed as a Corporation, the minimum tax will be $50.

How to Start an S Corp in Arizona Choose a Business Name.Appoint a Statutory Agent in Arizona.Choose Directors or Managers.File Articles of Incorporation/Organization with the Arizona Corporation Commission.Publish Arizona State Articles of Incorporation/Organization.File Form 2553 to turn business into an S Corp.

How do I file my corporation annual report? Submit the annual report electronically by logging into ecorp.azcc.gov If you do not have any account, you will need to register for one.

FILE WITH THE ARIZONA CORPORATION COMMISSION CORPORATIONS DIVISION. Submit your formation documentation with the A.C.C. The fastest, most convenient way to submit your documentation is by using the A.C.C.'s online services at . If you are forming an LLC, you will submit Articles of Organization.

For Arizona filing purposes, full-year residents figure their gross income the same way they do for federal income tax filing purposes....Income Tax Filing Requirements. Individuals must file if they are:AND gross income is more than:Single$12,550Married filing joint$25,1002 more rows

How do I file my corporation annual report? Submit the annual report electronically by logging into ecorp.azcc.gov If you do not have any account, you will need to register for one.

Arizona does not require LLCs to file an annual report. Taxes. For complete details on state taxes for Arizona LLCs, visit Business Owner's Toolkit or the State of Arizona . Federal tax identification number (EIN).

How to File Your Arizona Articles of Organization Submit your LLC's official name. Add a copy of the name reservation application. Provide the name and address of your statutory agent. Certify your LLC has at least one member. Select the type of LLC you're forming. Choose a filing date. Attach any needed statements.