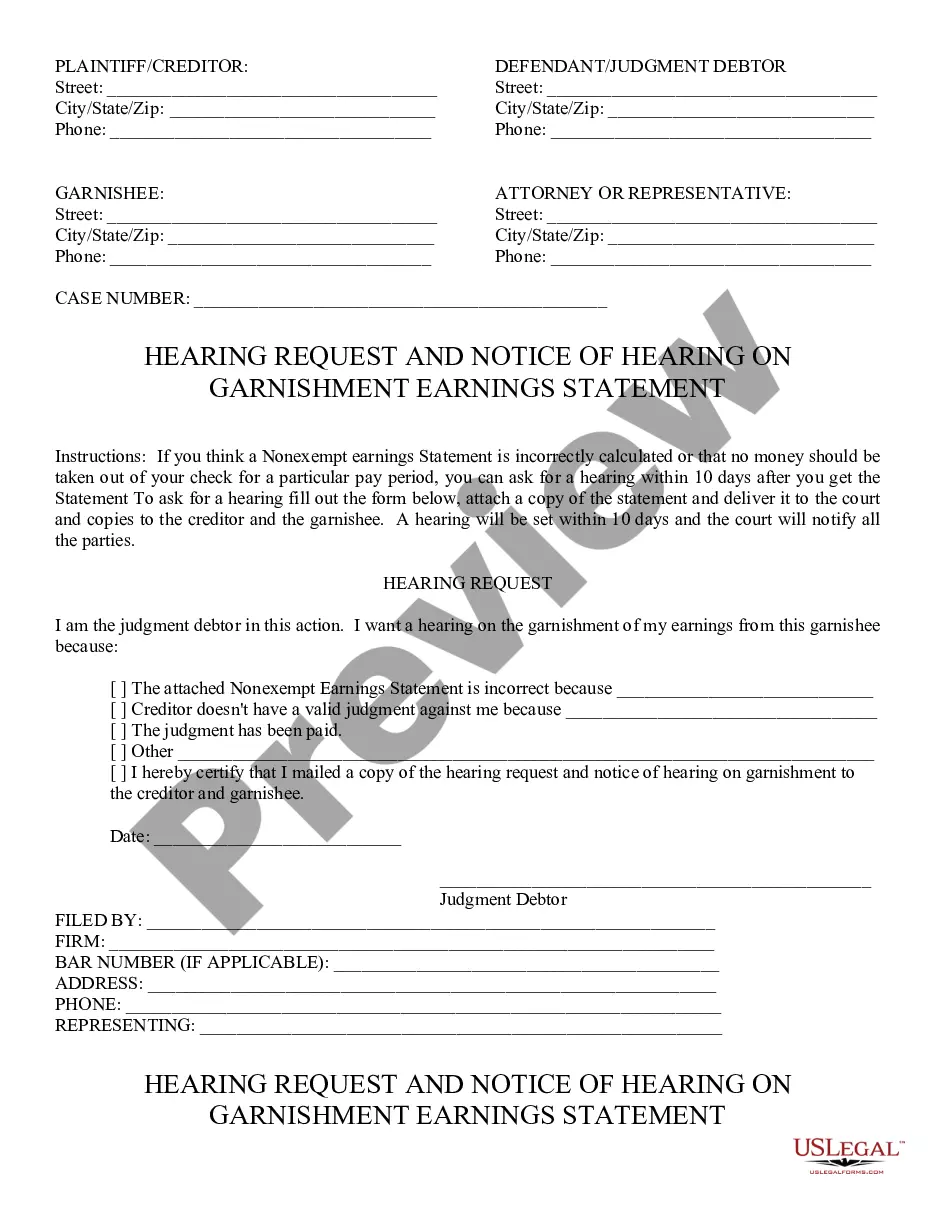

Request; Notice of Hearing on Garnishment Earnings Statement: If a debtor feels the amount garnished is incorrect, he/she files this request for a hearing on the matter. Upon filing the request for a hearing, he/she then files a notice of said hearing, including both the date and time. This form is available for download in both Word and Rich Text formats.

Title: Scottsdale, Arizona Request and Notice of Hearing on Garnishment Earnings Statement: Detailed Overview and Types Introduction: In Scottsdale, Arizona, a Request and Notice of Hearing on Garnishment Earnings Statement is a legal document that plays a crucial role in the garnishment process. This comprehensive description will provide an in-depth understanding of this document, its purpose, and its various subtypes. 1. Understanding the Request and Notice of Hearing on Garnishment Earnings Statement: The Scottsdale Request and Notice of Hearing on Garnishment Earnings Statement is a legal form filed by a creditor seeking to collect unpaid debts. When an individual owes money and fails to make timely payments, their wages may be garnished, which involves deducting a portion of their earnings to satisfy the outstanding debt. 2. Purpose of the Request and Notice of Hearing on Garnishment Earnings Statement: The primary purpose of this legal document is to notify the debtor (the person owing money) about the garnishment proceedings and to inform them of their rights and obligations. It allows them the opportunity to request a hearing to contest the garnishment or provide information to the court regarding their financial circumstances. 3. Key Components of the Request and Notice of Hearing on Garnishment Earnings Statement: a. Debtor Information: The document includes details about the debtor, such as their name, address, social security number, and employer information. b. Creditor Information: It also mentions the creditor's name, address, and contact information. c. Earnings Statement: The form requires the debtor's personal and financial details, including their income, deductions, and supporting documentation. d. Court Information: The document indicates the court where the hearing will take place and the date and time of the scheduled hearing. 4. Types of Scottsdale Request and Notice of Hearing on Garnishment Earnings Statement: a. Initial Garnishment Request and Notice: This type of request is filed by the creditor for the first time to initiate the garnishment process. b. Renewal Garnishment Request and Notice: If the debtor's financial situation warrants continued garnishment, the creditor may file this request to extend the garnishment period. c. Modification Garnishment Request and Notice: In case the debtor's financial circumstances change significantly, either party can request a modification of the existing garnishment arrangement. d. Termination Garnishment Request and Notice: This type of request is filed by the debtor or creditor to cease the garnishment process once the debt is repaid or when circumstances permit. Conclusion: The Scottsdale, Arizona Request and Notice of Hearing on Garnishment Earnings Statement is a vital legal document that ensures transparency and protection for both debtors and creditors during the wage garnishment process. Understanding the purpose and different types of this document helps both parties navigate the legal requirements with clarity and fairness.