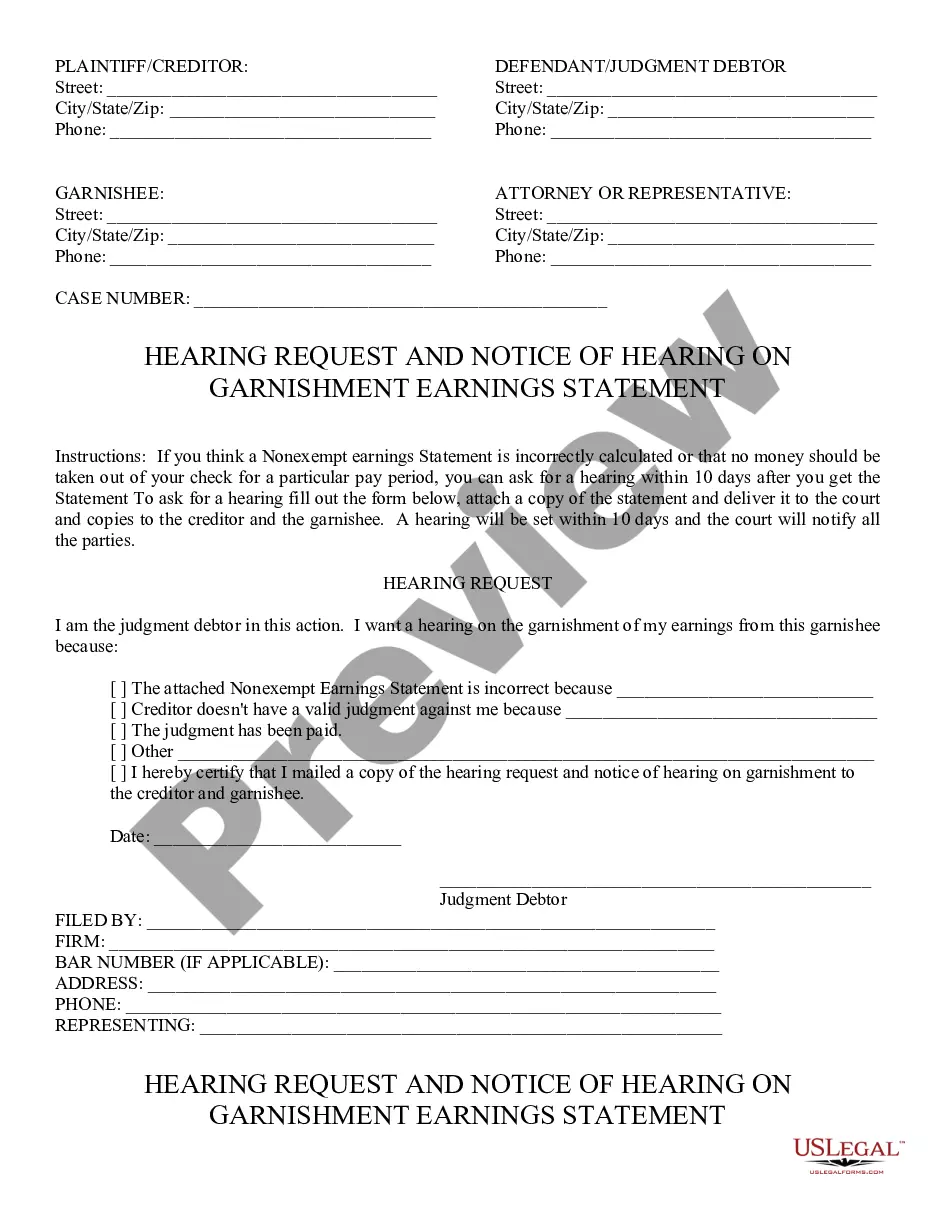

Request; Notice of Hearing on Garnishment Earnings Statement: If a debtor feels the amount garnished is incorrect, he/she files this request for a hearing on the matter. Upon filing the request for a hearing, he/she then files a notice of said hearing, including both the date and time. This form is available for download in both Word and Rich Text formats.

The Tucson Arizona Request and Notice of Hearing on Garnishment Earnings Statement is a legal document that serves as a formal request and notification sent to an employer regarding the garnishment of an employee's earnings. This document is specific to the Tucson, Arizona jurisdiction and is used for a variety of garnishment proceedings. Below are the different types of Tucson Arizona Request and Notice of Hearing on Garnishment Earnings Statement: 1. General Garnishment: This type of garnishment is the most common and occurs when a creditor obtains a court order to collect a debt owed by an individual. The Request and Notice of Hearing on Garnishment Earnings Statement is sent to the employer to initiate the wage garnishment process. 2. Child Support Garnishment: In cases where a parent fails to pay court-ordered child support, the custodial parent or the state's child support enforcement agency may initiate garnishment proceedings. The Request and Notice of Hearing on Garnishment Earnings Statement is used to inform the employer of the need to withhold a portion of the employee's wages for child support payments. 3. Tax Debt Garnishment: The Internal Revenue Service (IRS) or other tax authorities may utilize garnishment to collect unpaid taxes. In such cases, the Tucson Arizona Request and Notice of Hearing on Garnishment Earnings Statement is used to inform the employer that a portion of the employee's wages must be withheld to satisfy the outstanding tax debt. 4. Student Loan Garnishment: If an individual defaults on their federal student loans, the Department of Education or private loan services may initiate garnishment to recover the unpaid debt. The Request and Notice of Hearing on Garnishment Earnings Statement is sent to the employer to inform them about the wage garnishment order. 5. Creditor Judgment Garnishment: When a creditor obtains a judgment against a debtor in court, they may pursue garnishment to satisfy the debt. The Request and Notice of Hearing on Garnishment Earnings Statement is used to inform the employer to withhold a portion of the employee's wages to repay the judgment debt. The Tucson Arizona Request and Notice of Hearing on Garnishment Earnings Statement is a critical legal document that ensures compliance with garnishment laws and facilitates the collection of outstanding debts.The Tucson Arizona Request and Notice of Hearing on Garnishment Earnings Statement is a legal document that serves as a formal request and notification sent to an employer regarding the garnishment of an employee's earnings. This document is specific to the Tucson, Arizona jurisdiction and is used for a variety of garnishment proceedings. Below are the different types of Tucson Arizona Request and Notice of Hearing on Garnishment Earnings Statement: 1. General Garnishment: This type of garnishment is the most common and occurs when a creditor obtains a court order to collect a debt owed by an individual. The Request and Notice of Hearing on Garnishment Earnings Statement is sent to the employer to initiate the wage garnishment process. 2. Child Support Garnishment: In cases where a parent fails to pay court-ordered child support, the custodial parent or the state's child support enforcement agency may initiate garnishment proceedings. The Request and Notice of Hearing on Garnishment Earnings Statement is used to inform the employer of the need to withhold a portion of the employee's wages for child support payments. 3. Tax Debt Garnishment: The Internal Revenue Service (IRS) or other tax authorities may utilize garnishment to collect unpaid taxes. In such cases, the Tucson Arizona Request and Notice of Hearing on Garnishment Earnings Statement is used to inform the employer that a portion of the employee's wages must be withheld to satisfy the outstanding tax debt. 4. Student Loan Garnishment: If an individual defaults on their federal student loans, the Department of Education or private loan services may initiate garnishment to recover the unpaid debt. The Request and Notice of Hearing on Garnishment Earnings Statement is sent to the employer to inform them about the wage garnishment order. 5. Creditor Judgment Garnishment: When a creditor obtains a judgment against a debtor in court, they may pursue garnishment to satisfy the debt. The Request and Notice of Hearing on Garnishment Earnings Statement is used to inform the employer to withhold a portion of the employee's wages to repay the judgment debt. The Tucson Arizona Request and Notice of Hearing on Garnishment Earnings Statement is a critical legal document that ensures compliance with garnishment laws and facilitates the collection of outstanding debts.