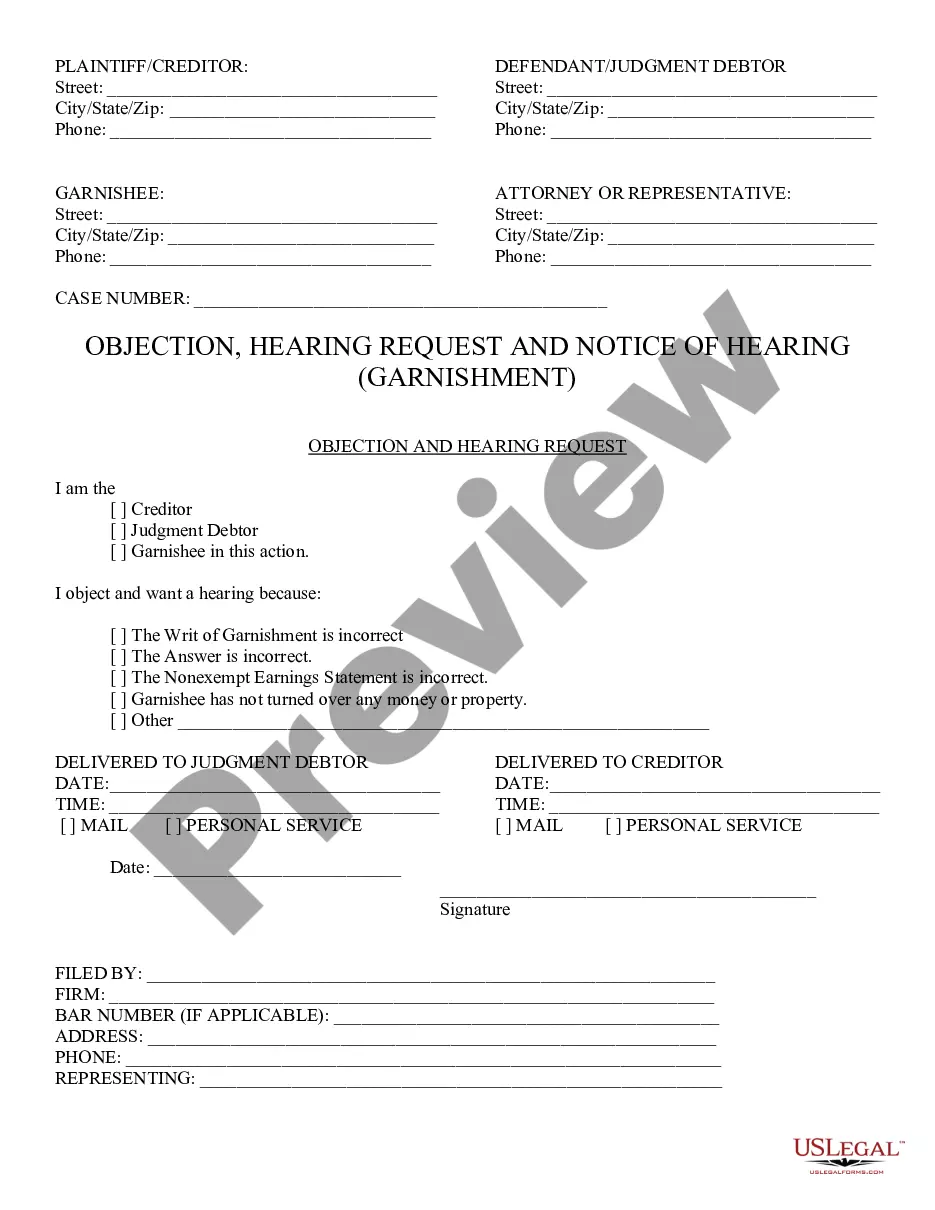

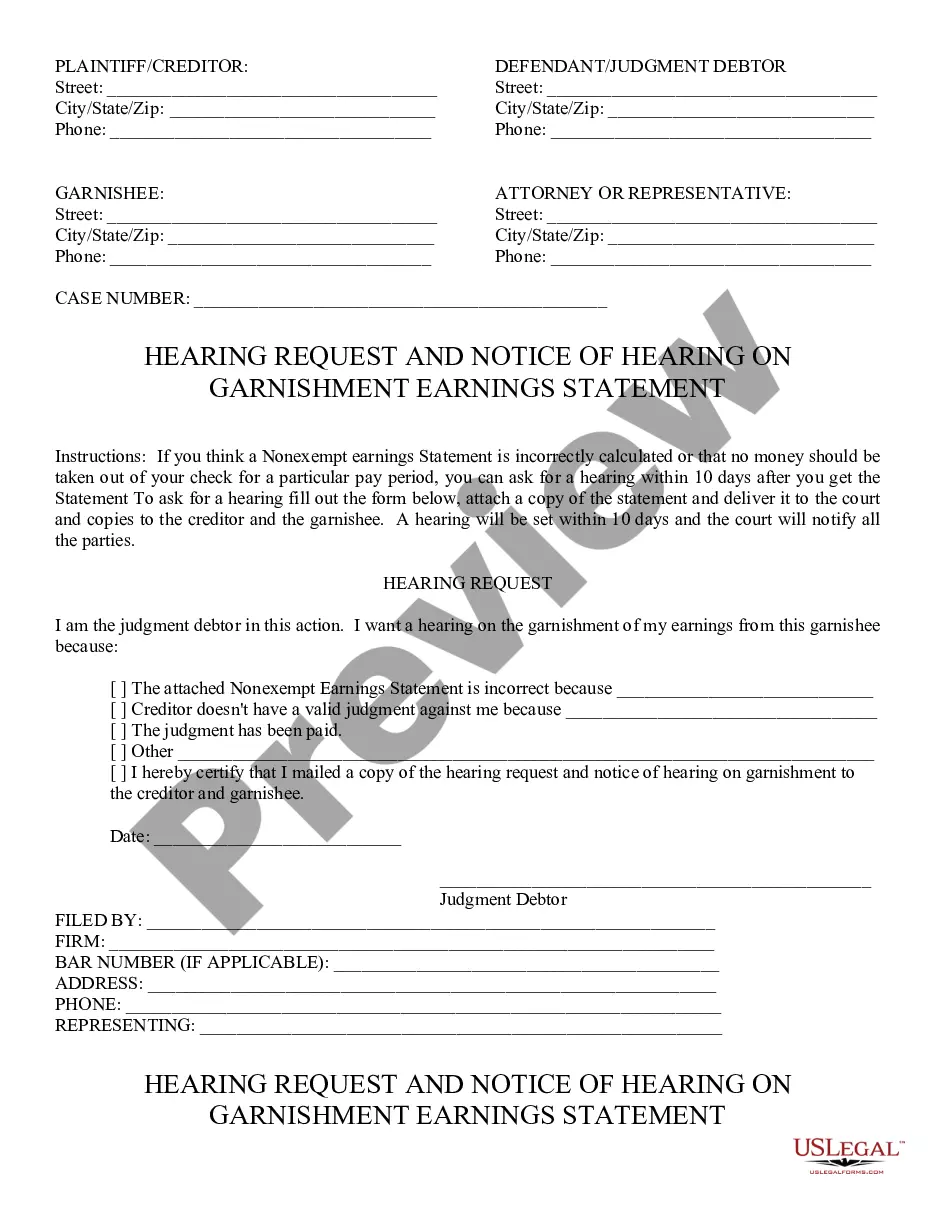

Objection, Request and Notice of Hearing: An Objection to Garnishment Amount, as well as the subsequent Request and Notice of Hearing, may be used by either the Debtor or Creditor. These documents are to be used when either party feels the amount garnished is incorrect. This form is available for download in both Word and Rich Text formats.

Phoenix Arizona Objection, Request and Notice of Hearing

Description

How to fill out Arizona Objection, Request And Notice Of Hearing?

Irrespective of societal or occupational rank, completing legal documents is a regrettable requirement in the current professional landscape.

Frequently, it’s nearly unfeasible for individuals without a legal background to draft such documents from scratch, primarily due to the intricate terminology and legal nuances they entail.

This is where US Legal Forms comes into play.

Confirm the form you’ve located is appropriate for your region, as regulations of one state or locality do not apply to another.

Review the form and read a brief summary (if available) of instances in which the document can be utilized.

- Our platform offers a vast repository of over 85,000 ready-to-use state-specific forms suitable for nearly any legal circumstance.

- US Legal Forms also acts as a valuable resource for associates or legal advisors aiming to enhance their time efficiency with our DIY documents.

- Whether you seek the Phoenix Arizona Objection, Request and Notice of Hearing or another document valid in your state or locality, everything is readily available with US Legal Forms.

- Here’s a quick guide on obtaining the Phoenix Arizona Objection, Request and Notice of Hearing using our reliable platform.

- If you are already a registered user, you can proceed to Log In and download the necessary form.

- However, if you are new to our library, ensure to follow these steps before downloading the Phoenix Arizona Objection, Request and Notice of Hearing.

Form popularity

FAQ

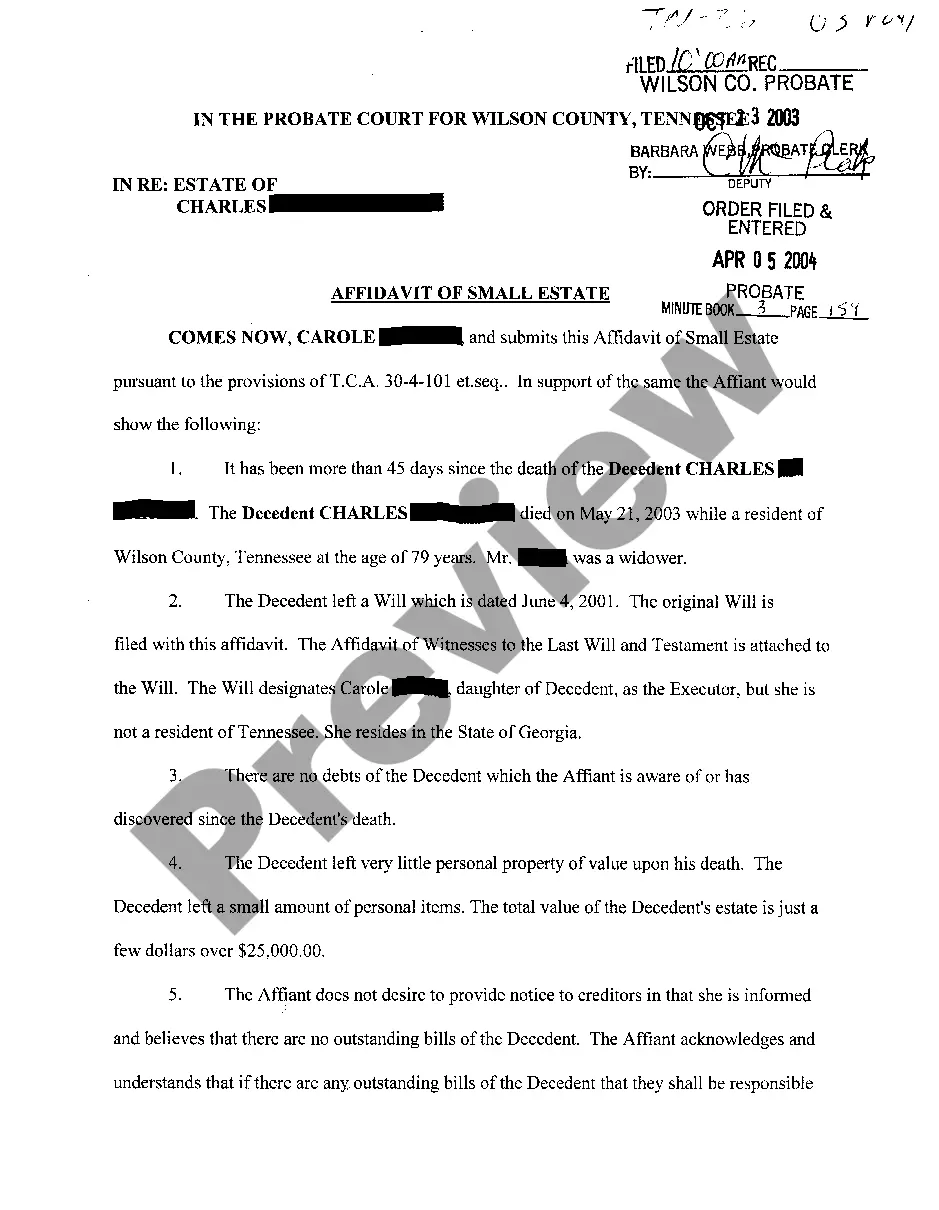

According to Arizona law (ARS14-3108), the executor of an estate has two years from the date of death to file probate. This timeframe can be extended under certain circumstances, such as if the deceased left behind minor children.

The Probate Filing Counter is located at 201 W. Jefferson in Phoenix, or at our Southeast location, 222 E. Javelina in Mesa, or at our Northwest Regional Court Center location at 14264 W. Tierra Buena Lane in Surprise, or at our Northeast Regional Court Center at 18380 N.

Informal probate requires that the deceased had a valid will at the time of death that has not been challenged and died less than 2 years before probate is opened. In an informal probate process, a personal representative is appointed by the court to administer the estate with minimal court supervision.

How to Start Probate for an Estate Open the Decedent's Last Will and Testament.Determine Who Will be the Personal Representative.Compile a List of the Estate's Interested Parties.Take an Inventory of the Decedent's Assets.Calculate the Decedent's Liabilities.Determine if Probate is Necessary.Seek a Waiver of Bond.

In the state of Arizona, probate is only required if the decedent has any assets that did not transfer automatically upon their death. These assets tend to be titled individually in the decedent's name and will require a probate court to transfer the title of ownership to the intended beneficiary.

Since a will is public record in Arizona, if the estate is in probate, Carson has a few options to find out if he's named in the will.

Informal probates typically last between 6-8 months, depending on how quickly the Personal Representative completes their required duties. Formal and Supervised probates can last a year, or longer, depending on the complexity of the case.

Contact the County Probate Court To find out if an estate is in probate, you can check with the county probate court. Probate proceedings are public, so there aren't any privacy laws that would prevent you from contacting the court for information.

Four Ways to Avoid Probate in Arizona Establish a Trust.Title Property with Rights of Survivorship.Make Accounts Payable on Death or Transfer of Death.Provisions for Small Estates.

A typical flat fee for an informal probate would be between $1000 and $1500. If a probate is contested, or if you need a formal probate, the fees may well be substantially higher.