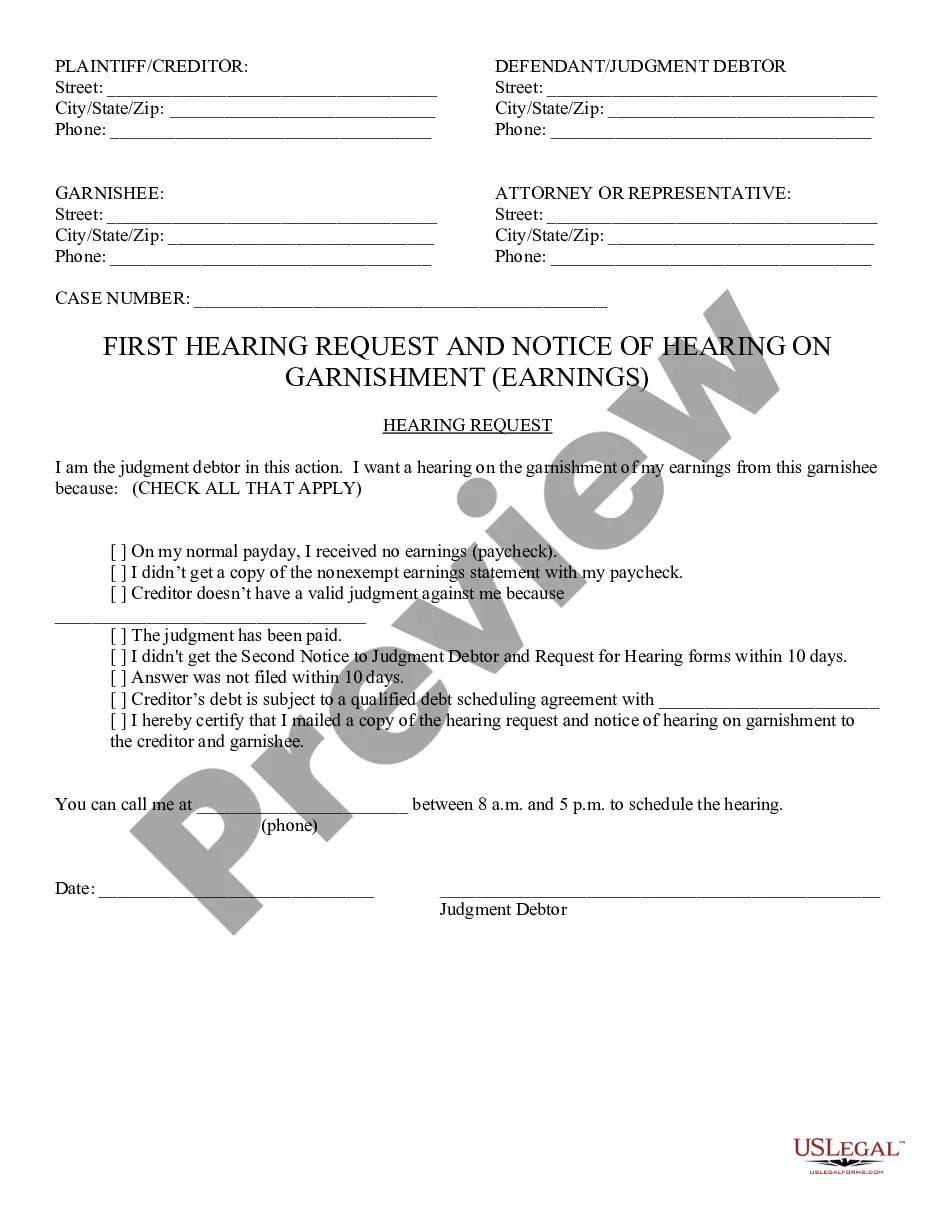

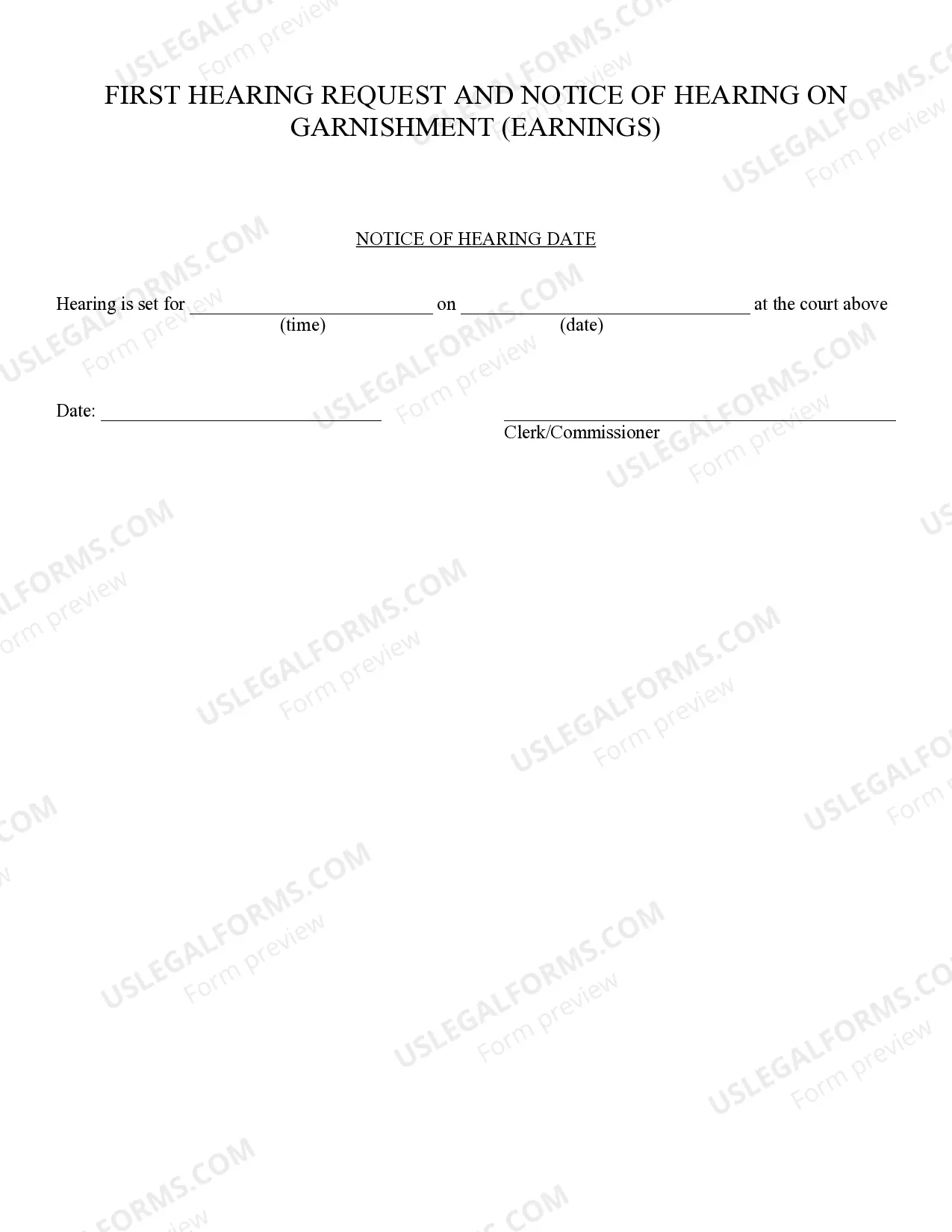

First Request and Notice of Hearing of Garnishment Earnings: This Notice informs the Judgment Debtor that as a result of his/her non-payment, the Judgment Creditor will now be garnishing his/her wages until such judgment is satisfied. If the Judgment Debtor disagrees with the garnishment proceedings, then he/she is advised to ask for a hearing on the matter. This form is available for download in both Word and Rich Text formats.

Glendale, Arizona 1st Request and Notice of Hearing of Garnishment Earnings is an important legal document that serves to notify individuals of an impending garnishment on their earnings. This notice indicates that a creditor has filed a request to garnish the wages or salary of the debtor to recover a debt owed to them. It outlines the legal process that will be followed in order to determine the amount and frequency of the garnishment. Keywords: Glendale, Arizona, 1st Request, Notice of Hearing, Garnishment Earnings. Different types of Glendale, Arizona 1st Request and Notice of Hearing of Garnishment Earnings can include: 1. Wage Garnishment: This is the most common form of garnishment where a certain portion of an individual's wages is withheld by their employer and paid directly to the creditor until the debt is satisfied. 2. Bank Account Garnishment: In some cases, if the debtor does not have a steady income or the creditor wants to recover the debt more quickly, they may opt for bank account garnishment. In this scenario, the funds from the debtor's bank account are directly withdrawn to repay the debt owed. 3. Federal Garnishment: This type of garnishment can be initiated by federal agencies, such as the Internal Revenue Service (IRS), to collect unpaid taxes or other federal debts. It follows specific protocols outlined by federal law. 4. Child Support Garnishment: When an individual fails to make court-ordered child support payments, the custodial parent may seek wage garnishment to ensure regular payments and support for their child. This type of garnishment is typically administered through the state's child support enforcement agency. 5. Judgment Garnishment: If a creditor successfully obtains a judgment against the debtor through a lawsuit, they can request a garnishment to collect the owed debt. This type of garnishment usually follows a court hearing to determine the debtor's ability to pay. It is essential to respond promptly to Glendale, Arizona 1st Request and Notice of Hearing of Garnishment Earnings. Failure to do so may result in further legal consequences and an increased financial burden. Seeking legal advice or representation is recommended if you have questions or concerns regarding the specific circumstances of the garnishment notice.