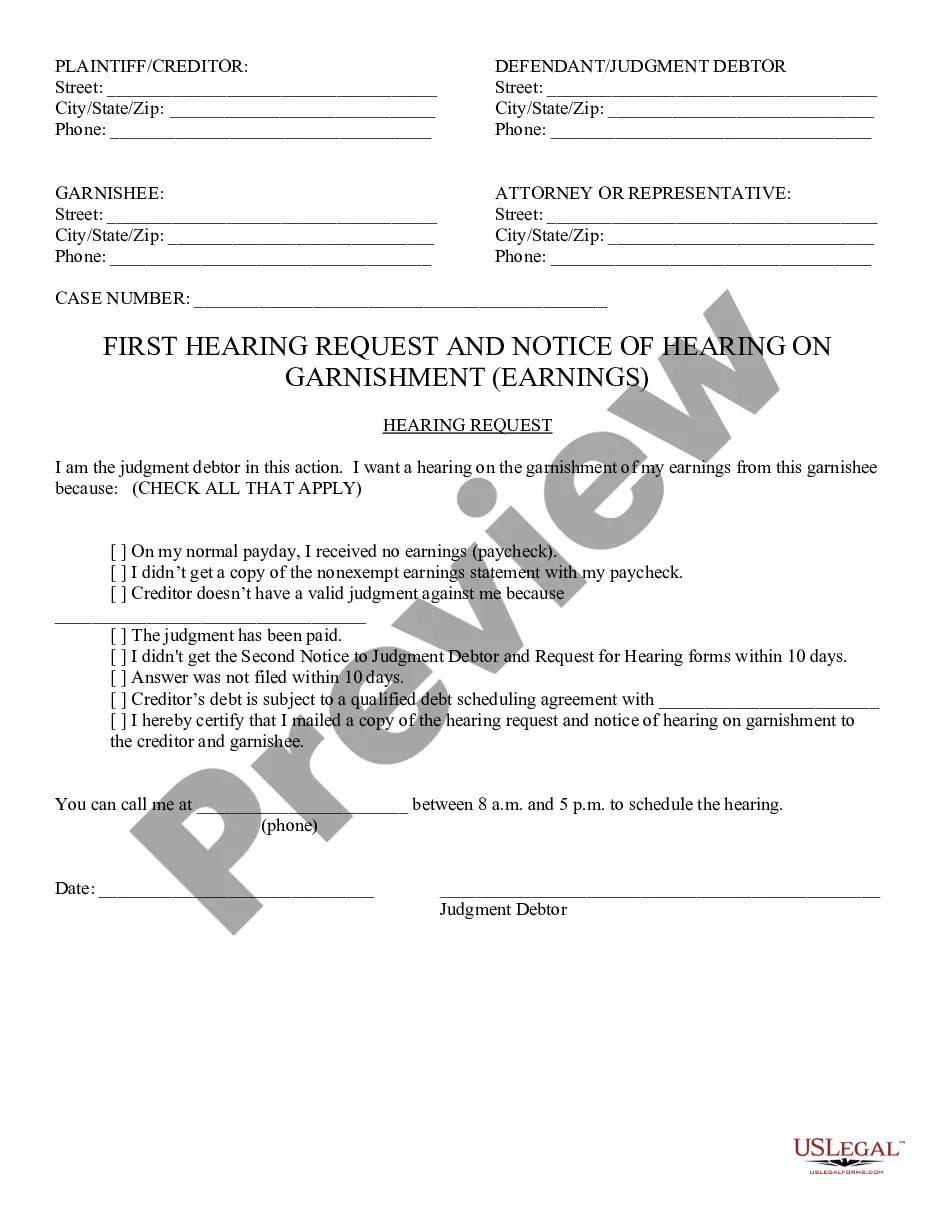

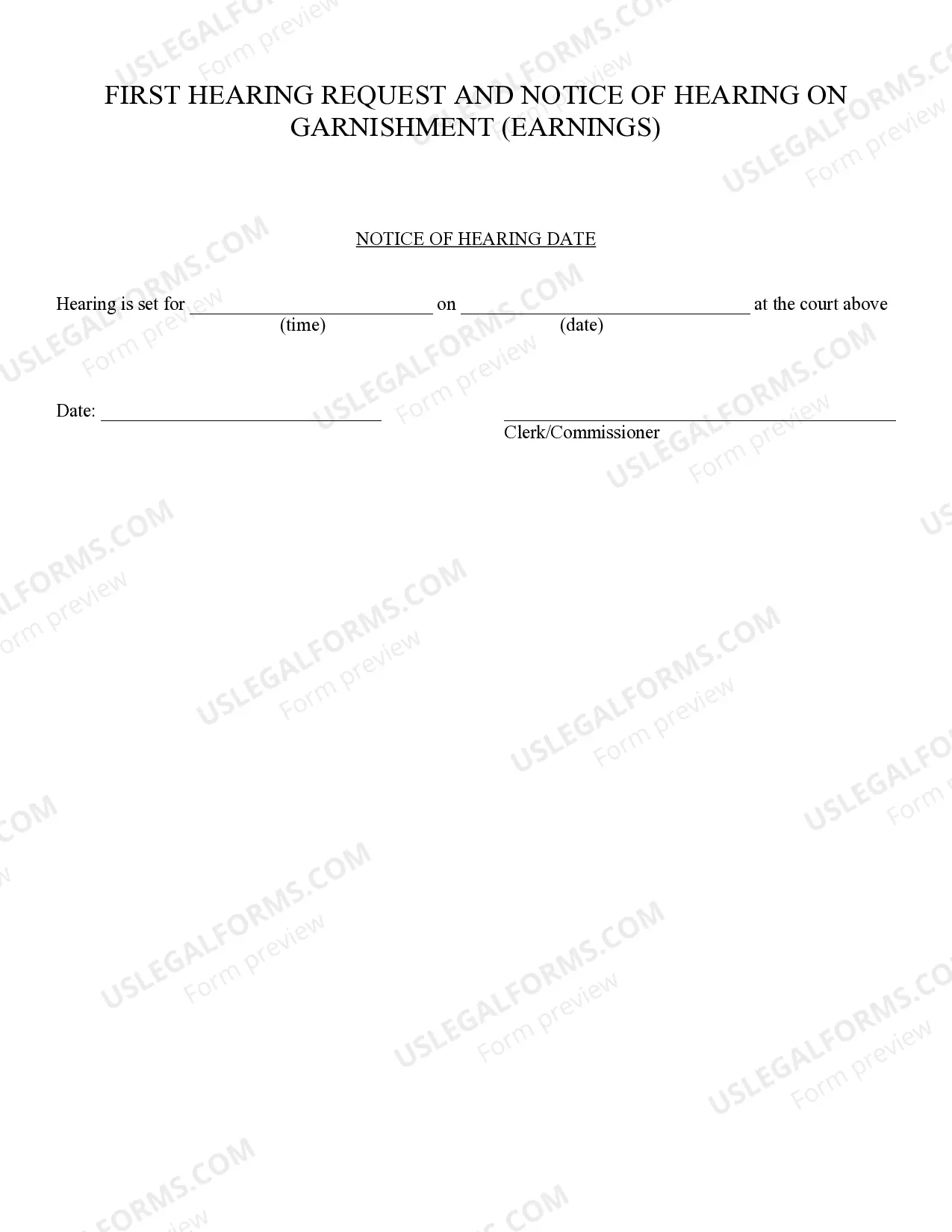

First Request and Notice of Hearing of Garnishment Earnings: This Notice informs the Judgment Debtor that as a result of his/her non-payment, the Judgment Creditor will now be garnishing his/her wages until such judgment is satisfied. If the Judgment Debtor disagrees with the garnishment proceedings, then he/she is advised to ask for a hearing on the matter. This form is available for download in both Word and Rich Text formats.

Tempe, Arizona: 1st Request and Notice of Hearing of Garnishment Earnings The Tempe, Arizona 1st Request and Notice of Hearing of Garnishment Earnings is a legal document that serves as an initial step in the process of garnishment. When an individual fails to fulfill their financial obligations, such as repaying debts or fulfilling court-ordered judgments, their wages or earnings can be subject to garnishment to satisfy the outstanding debt. This notice is typically sent by a creditor or the creditor's representative to the debtor and aims to notify them of the impending garnishment of their wages. It outlines the creditor's intention to collect the outstanding debt by deducting a portion of the debtor's earnings directly from their wage or salary. The Tempe, Arizona 1st Request and Notice of Hearing of Garnishment Earnings includes several important components: 1. Creditor Information: It starts by providing the creditor's details, including their name, contact information, and often their legal representative's information. 2. Debtor Information: The notice then specifies the debtor's name, address, and any known information necessary for identification. 3. Amount Owed: This critical section outlines the specific amount owed by the debtor to the creditor, including any interest, penalties, or fees that have accumulated. 4. Garnishment Calculation: The notice calculates the garnishment amount, typically based on a percentage of the debtor's disposable earnings, as allowed by Arizona state laws. 5. Earnings Withholding Order: Many times, the 1st Request and Notice of Hearing of Garnishment Earnings will include an earnings withholding order to be submitted to the debtor's employer. This instructs the employer to withhold the designated amount from the debtor's wages and remit it to the creditor. Types of Tempe, Arizona 1st Request and Notice of Hearing of Garnishment Earnings: 1. Wage Garnishment: This is the most common form of garnishment, where a portion of the debtor's earnings is deducted from their paycheck until the debt is satisfied. The 1st Request and Notice of Hearing of Garnishment Earnings in this case would specifically mention wage garnishment. 2. Bank Account Garnishment: In certain situations, if the debtor does not have sufficient wages to be garnished, their bank accounts may be subject to garnishment. This type of garnishment involves freezing the debtor's bank account(s) and withdrawing the owed amount directly from their account. 3. Federal Benefits Garnishment: Some federal benefits, such as Social Security and veterans' benefits, are protected to a certain extent from garnishment. However, if the debtor owes specific types of debts, including federal tax debts, child support, or defaulted student loans, these benefits can be subjected to garnishment. Please note that this information serves as a general overview and does not constitute legal advice. If you have concerns or questions about the Tempe, Arizona 1st Request and Notice of Hearing of Garnishment Earnings, it is recommended to consult with an attorney or a legal professional familiar with Arizona state laws.Tempe, Arizona: 1st Request and Notice of Hearing of Garnishment Earnings The Tempe, Arizona 1st Request and Notice of Hearing of Garnishment Earnings is a legal document that serves as an initial step in the process of garnishment. When an individual fails to fulfill their financial obligations, such as repaying debts or fulfilling court-ordered judgments, their wages or earnings can be subject to garnishment to satisfy the outstanding debt. This notice is typically sent by a creditor or the creditor's representative to the debtor and aims to notify them of the impending garnishment of their wages. It outlines the creditor's intention to collect the outstanding debt by deducting a portion of the debtor's earnings directly from their wage or salary. The Tempe, Arizona 1st Request and Notice of Hearing of Garnishment Earnings includes several important components: 1. Creditor Information: It starts by providing the creditor's details, including their name, contact information, and often their legal representative's information. 2. Debtor Information: The notice then specifies the debtor's name, address, and any known information necessary for identification. 3. Amount Owed: This critical section outlines the specific amount owed by the debtor to the creditor, including any interest, penalties, or fees that have accumulated. 4. Garnishment Calculation: The notice calculates the garnishment amount, typically based on a percentage of the debtor's disposable earnings, as allowed by Arizona state laws. 5. Earnings Withholding Order: Many times, the 1st Request and Notice of Hearing of Garnishment Earnings will include an earnings withholding order to be submitted to the debtor's employer. This instructs the employer to withhold the designated amount from the debtor's wages and remit it to the creditor. Types of Tempe, Arizona 1st Request and Notice of Hearing of Garnishment Earnings: 1. Wage Garnishment: This is the most common form of garnishment, where a portion of the debtor's earnings is deducted from their paycheck until the debt is satisfied. The 1st Request and Notice of Hearing of Garnishment Earnings in this case would specifically mention wage garnishment. 2. Bank Account Garnishment: In certain situations, if the debtor does not have sufficient wages to be garnished, their bank accounts may be subject to garnishment. This type of garnishment involves freezing the debtor's bank account(s) and withdrawing the owed amount directly from their account. 3. Federal Benefits Garnishment: Some federal benefits, such as Social Security and veterans' benefits, are protected to a certain extent from garnishment. However, if the debtor owes specific types of debts, including federal tax debts, child support, or defaulted student loans, these benefits can be subjected to garnishment. Please note that this information serves as a general overview and does not constitute legal advice. If you have concerns or questions about the Tempe, Arizona 1st Request and Notice of Hearing of Garnishment Earnings, it is recommended to consult with an attorney or a legal professional familiar with Arizona state laws.