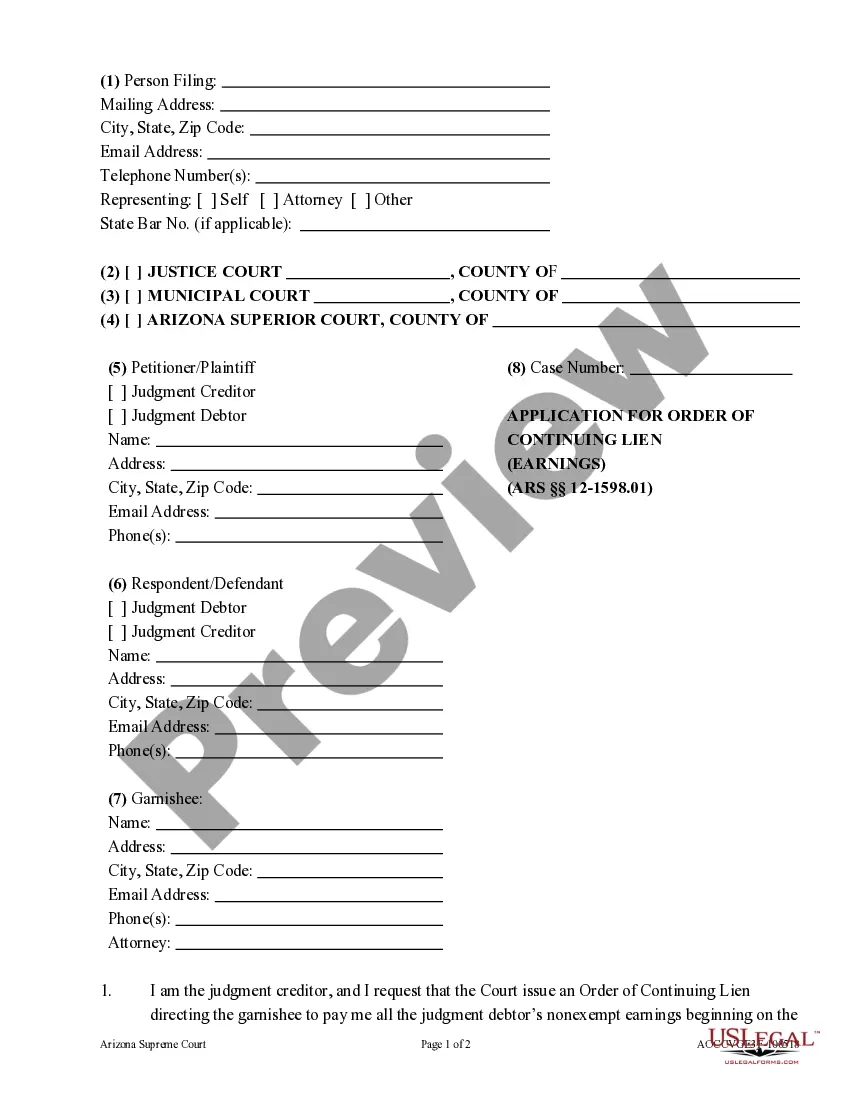

Application and Order of Continuing Lien: An Application for Continuing Lien is filed when the Debtor has not completely satisfied the judgment owed a Creditor. The Creditor uses this form to ask the court to continue the lien on a Debtor's property until such time that the judgment is satisfied. This form is available for download in both Word and Rich Text formats.

Mesa Arizona Application for Order of Continuing Lien

Description

How to fill out Arizona Application For Order Of Continuing Lien?

Do you require a reliable and affordable provider of legal documents to purchase the Mesa Arizona Application and Order of Continuing Lien? US Legal Forms is your top option.

Whether you need a straightforward agreement to establish guidelines for living together with your partner or a collection of paperwork to facilitate your separation or divorce in court, we have you covered. Our platform offers over 85,000 current legal document templates for personal and business needs. All the templates we provide are not generic and tailored according to the specifications of individual states and regions.

To obtain the form, you must Log In to your account, search for the desired template, and click the Download button adjacent to it. Please keep in mind that you can redownload your previously acquired document templates at any time in the My documents section.

Is this your first visit to our platform? No problem. You can set up an account in just a few minutes, but first, ensure you do the following.

Now you can create your account. Then select the subscription plan and proceed to payment. Once the payment is processed, download the Mesa Arizona Application and Order of Continuing Lien in any of the available formats. You can revisit the website whenever necessary and easily redownload the form at no additional cost.

Locating current legal documents has never been simpler. Try US Legal Forms today, and say goodbye to wasting your precious time looking for legal paperwork online forever.

- Verify if the Mesa Arizona Application and Order of Continuing Lien meets the criteria of your state and local rules.

- Review the form’s specifics (if accessible) to determine who and what the form is meant for.

- Reinitiate the search if the template does not align with your legal circumstances.

Form popularity

FAQ

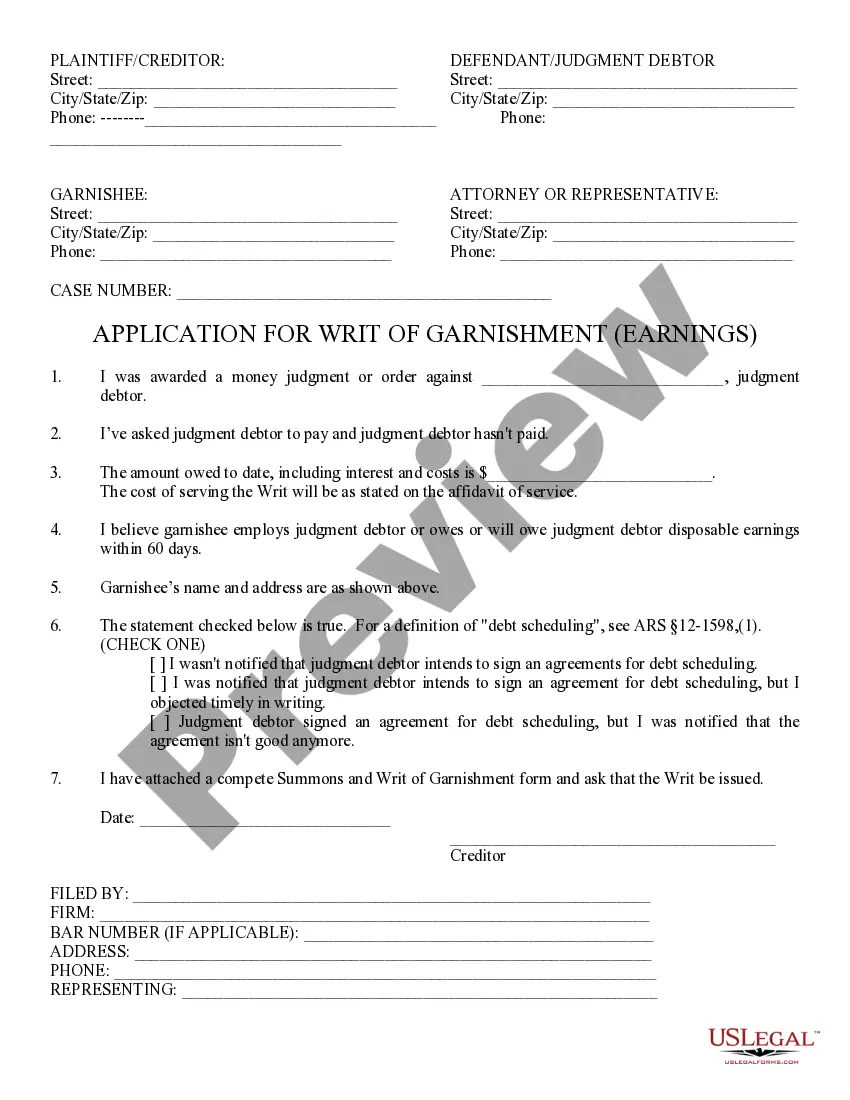

How do I stop a garnishment? Option 1: Don't allow a judgment to be entered against you. Option 2: Challenge the judgment. Option 3: Don't expose assets to garnishment. Option 4: Reduce the amount that is being garnished (wage garnishments only) Option 5: Settlement. Option 6: Bankruptcy.

The garnishment law allows up to 50% of a worker's disposable earnings to be garnished for these purposes if the worker is supporting another spouse or child, or up to 60% if the worker is not. An additional 5% may be garnished for support payments more than l2 weeks in arrears.

You can STOP the garnishment any time by paying the Clerk's Office what you owe. The Clerk will give you a receipt. Take the receipt to your employer right away. They should stop taking money from your pay as soon as they get the receipt.

Typically, judgment creditors collect outstanding debts through wage garnishments, but our laws do allow for levying bank accounts and/or non-exempt property.

The garnishment amount is limited to 25% of your disposable earnings for that week (what's left after mandatory deductions) or the amount by which your disposable earnings for that week exceed 30 times the federal minimum hourly wage, whichever is less.

Up to 25% of Wages Are Garnished Until Debt is Repaid Wage garnishment in Arizona is limited in accordance with the federal Consumer Credit Protection Act (CCPA). This means that garnishees may withhold no more than 25% of your non-exempt disposable earnings to be paid to a single judgment creditor.

Example: The federal minimum hourly wage is currently $7.25 an hour. If you make $500 per week after all taxes and allowable deductions, 25% of your disposable earnings is $125 ($500 × . 25 = $125).

Up to 25% of Wages Are Garnished Until Debt is Repaid Wage garnishment in Arizona is limited in accordance with the federal Consumer Credit Protection Act (CCPA). This means that garnishees may withhold no more than 25% of your non-exempt disposable earnings to be paid to a single judgment creditor.