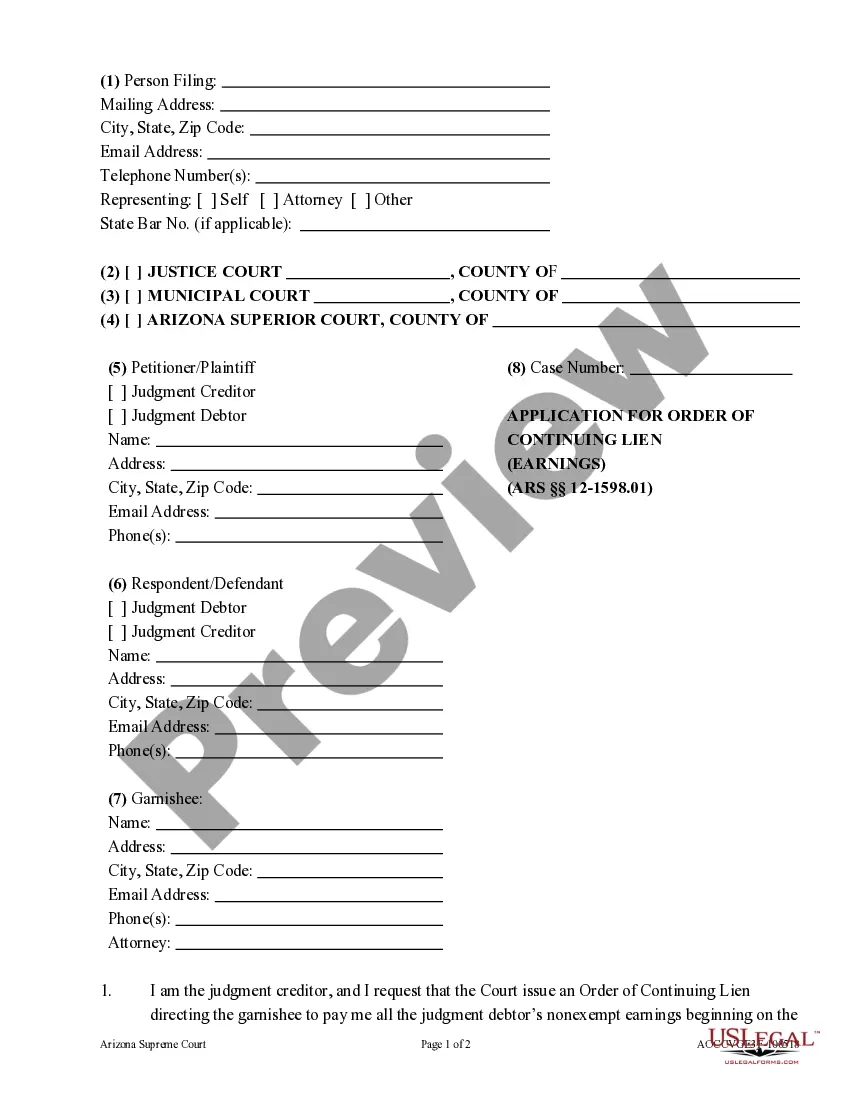

Application and Order of Continuing Lien: An Application for Continuing Lien is filed when the Debtor has not completely satisfied the judgment owed a Creditor. The Creditor uses this form to ask the court to continue the lien on a Debtor's property until such time that the judgment is satisfied. This form is available for download in both Word and Rich Text formats.

Phoenix Arizona Application for Order of Continuing Lien

Description

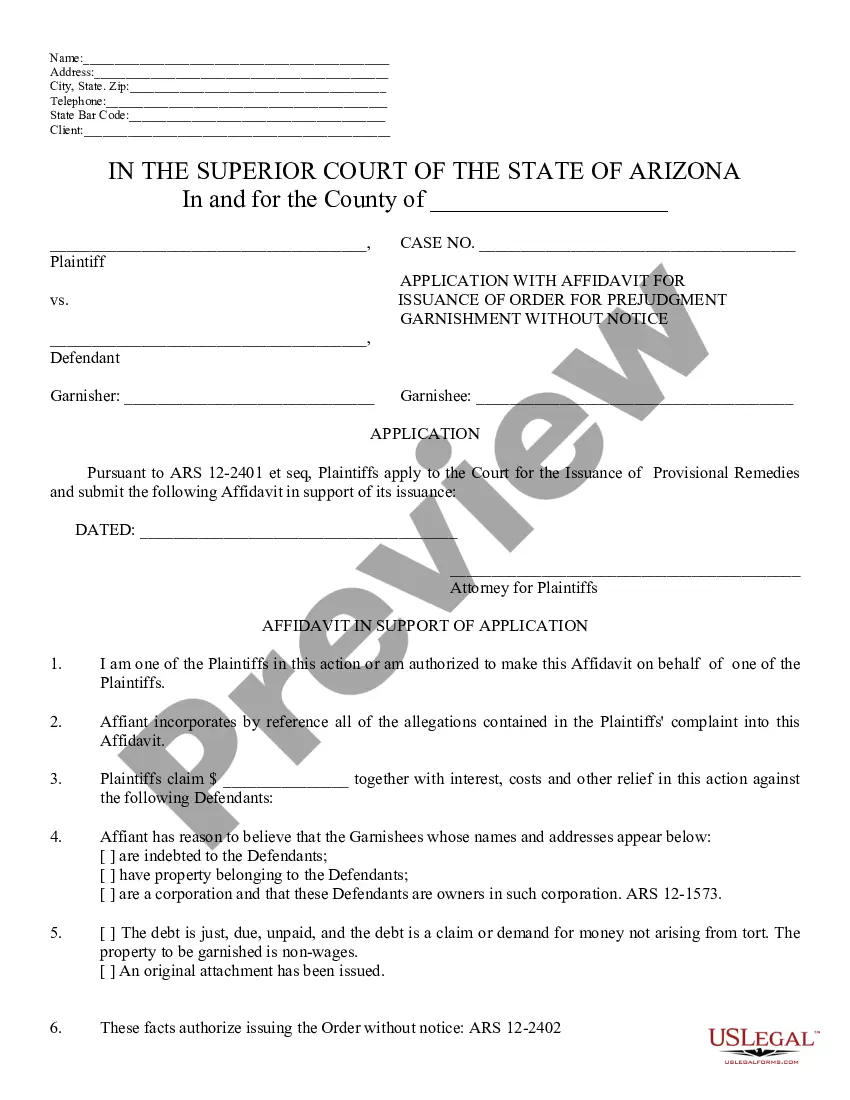

How to fill out Arizona Application For Order Of Continuing Lien?

Are you in search of a trustworthy and cost-effective provider of legal forms to obtain the Phoenix Arizona Application and Order of Continuing Lien? US Legal Forms is your ideal choice.

Whether you need a straightforward arrangement to establish guidelines for living together with your partner or a set of documents to progress your divorce through the judicial system, we have you covered.

Our platform features over 85,000 current legal document templates for both personal and business purposes. All templates we provide are not generic but tailored based on the specifications of individual states and counties.

To acquire the form, you must sign in to your account, locate the required template, and click the Download button adjacent to it. Please keep in mind that you can retrieve your previously purchased document templates at any time from the My documents section.

If the template doesn't suit your legal needs, start the search anew.

Now you are ready to create your account. After that, select the subscription plan and proceed with the payment. Once payment is completed, you can download the Phoenix Arizona Application and Order of Continuing Lien in any available file format. You can revisit the website at any time to redownload the form at no cost.

- Is it your first time visiting our site.

- No need to worry.

- You can create an account in just a few minutes.

- However, first ensure that the Phoenix Arizona Application and Order of Continuing Lien complies with the regulations of your state and locality.

- Review the form's specifics (if available) to understand who it is suitable for and its intended use.

Form popularity

FAQ

A judgment creditor may renew a judgment lien to extend its effectiveness beyond five years by recording a copy of the affidavit of renewal, certified by the clerk of the court, in the office of the county recorder for each county in which the judgment debtor has property subject to the lien. A.R.S. § 12-1613(C).

To attach the lien, the creditor files and records a judgment with the county recorder in any Arizona county where the debtor owns property now or where they may own property in the future.

A certified copy of the judgment of any court in this state may be filed and recorded in the office of the county recorder in each county where the judgment creditor desires the judgment to become a lien on the real property of the judgment debtor.

As discussed hereinbelow, a judgment may be renewed either by filing a suit on it or by filing an affidavit renewal with the clerk of the appropriate court. A.R.S. §§ 12-1611, 1612(A). Such a renewal, however, does not automatically extend the judgment lien created by the recording of the original judgment.

Judgments in Arizona must be renewed every five years. When a judgment creditor fails to properly renew, the result is the inability to enforce the judgment through a writ of execution or other process.

Pursuant to A.R.S. §§ 33-963 and 33-964(A), a judgment that is recorded in the manner prescribed by A.R.S. § 33-961 becomes a lien on the real property of the judgment debtor for a period of ten years from the date the judgment was given.

A judgment or judgment lien will be valid for ten years from its date of entry. A.R.S. § 12-1551. The deadline for renewing a judgment by filing a lawsuit or an affidavit will be ten years from the judgment's date of entry.

How long does a judgment lien last in Arizona? A judgment lien in Arizona will remain attached to the debtor's property (even if the property changes hands) for five years.

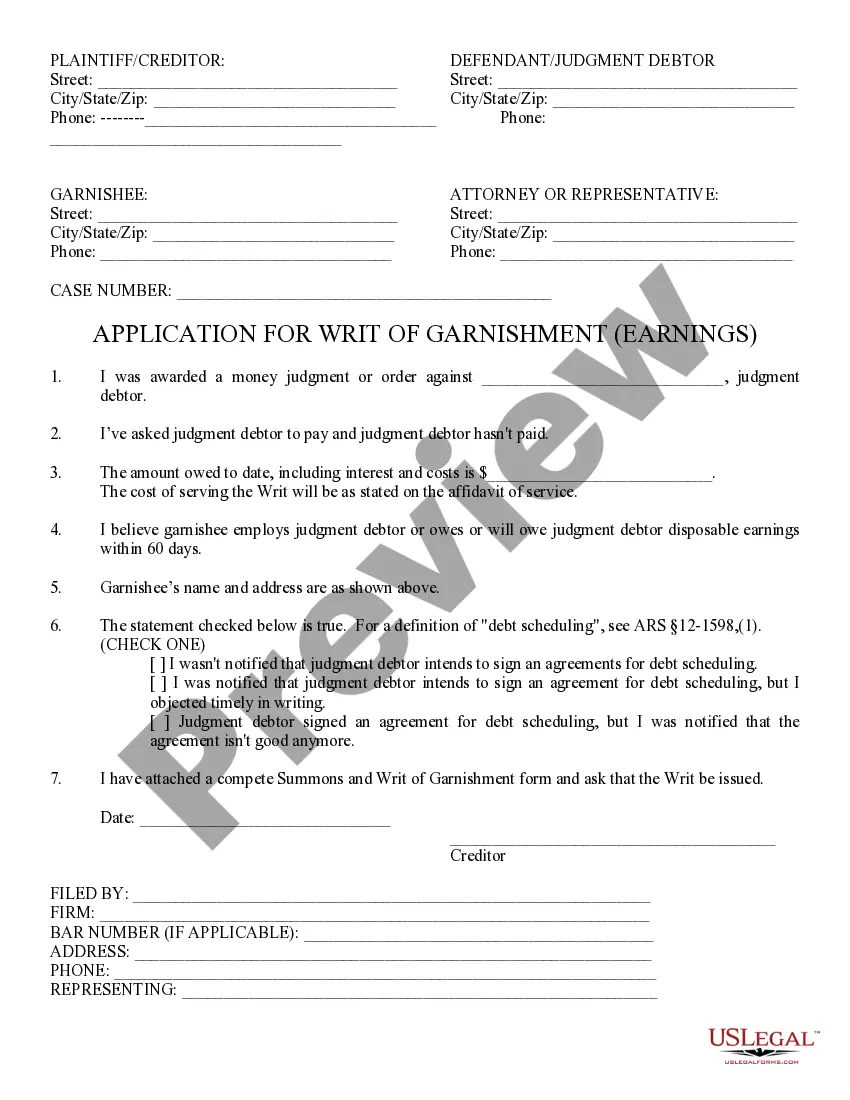

How do I stop a garnishment? Option 1: Don't allow a judgment to be entered against you. Option 2: Challenge the judgment. Option 3: Don't expose assets to garnishment. Option 4: Reduce the amount that is being garnished (wage garnishments only) Option 5: Settlement. Option 6: Bankruptcy.

Except as provided in sections 33-729 and 33-730, from and after the time of recording as provided in section 33-961, a judgment shall become a lien for a period of ten years after the date it is given on all real property of the judgment debtor in the county in which the judgment is recorded, whether the property is