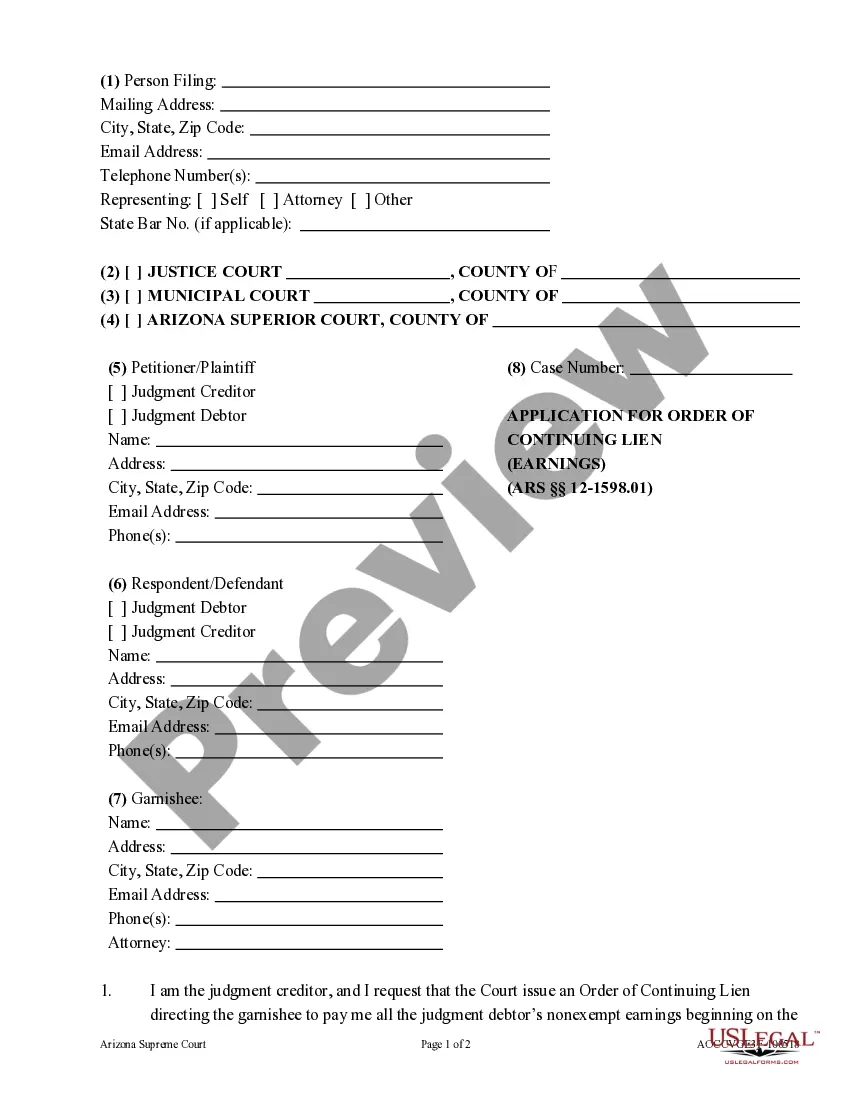

Application and Order of Continuing Lien: An Application for Continuing Lien is filed when the Debtor has not completely satisfied the judgment owed a Creditor. The Creditor uses this form to ask the court to continue the lien on a Debtor's property until such time that the judgment is satisfied. This form is available for download in both Word and Rich Text formats.

Pima Arizona Application for Order of Continuing Lien

Description

How to fill out Arizona Application For Order Of Continuing Lien?

We consistently endeavor to reduce or evade legal complications when engaging with intricate legal or financial matters.

To achieve this, we seek attorney services that, as a general rule, are highly costly.

However, not all legal issues possess the same level of complexity. The majority of them can be managed independently.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Just Log In to your account and click the Get button next to it. If you misplace the form, you can always redownload it in the My documents tab.

- Our platform empowers you to handle your affairs independently without consulting a lawyer.

- We offer access to legal document templates that aren't always readily accessible.

- Our templates are specific to states and regions, which greatly simplifies the search process.

- Take advantage of US Legal Forms whenever you need to acquire and download the Pima Arizona Application and Order of Continuing Lien or any other document promptly and securely.

Form popularity

FAQ

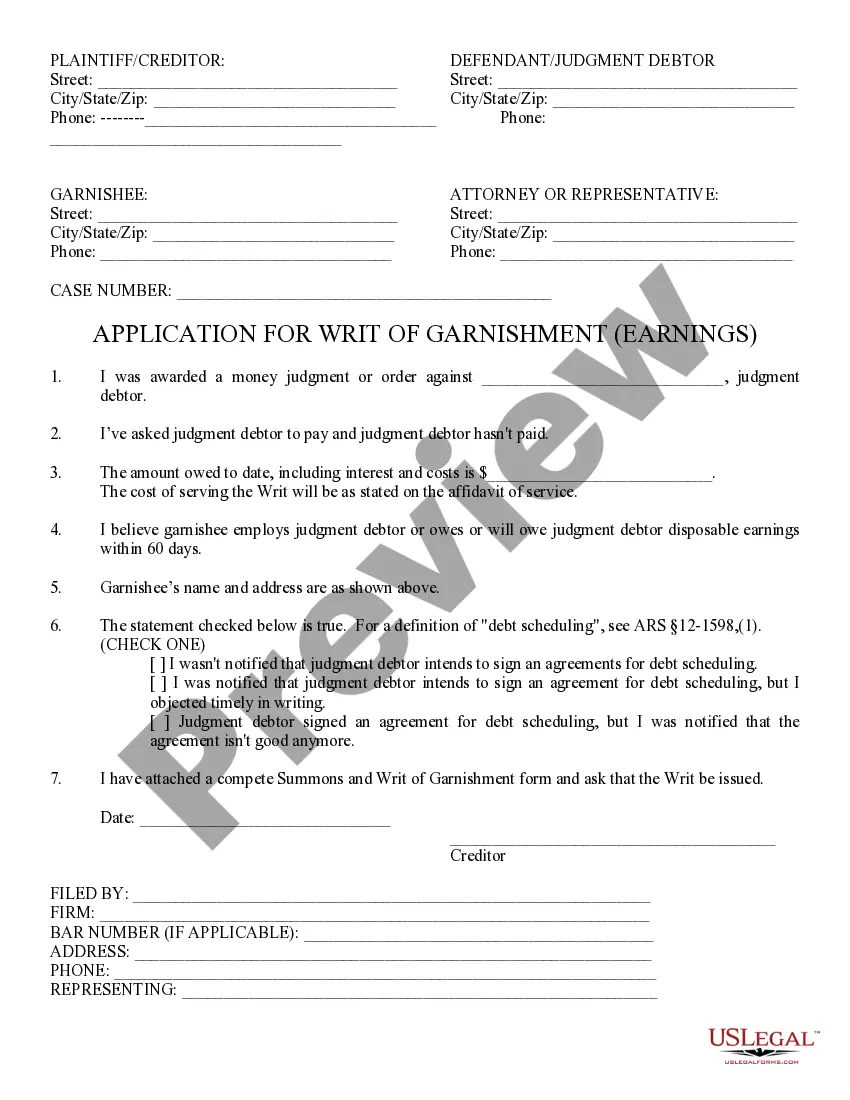

The release of a writ of garnishment indicates that the creditor can no longer legally withdraw funds from the debtor’s earnings or accounts. This release can happen after the debtor pays off their debt or secures a court ruling. In Pima, Arizona, it is important to understand the implications of such a release on your financial relationships.

The time it takes to release a garnishment can vary based on the circumstances, but typically, it depends on the debtor’s payments or court decisions. In Pima, Arizona, once the debt is satisfied or cleared legally, a release may be issued promptly. For those using our services, we simplify this process through our Pima Arizona Application for Order of Continuing Lien.

exempt earnings statement outlines the income of an employee that is subject to garnishment. In Pima, Arizona, this statement is crucial for creditors when applying for an Order of Continuing Lien. Nonexempt earnings can be taken to satisfy debts, while exempt earnings remain protected.

After a writ of garnishment is issued, a creditor can collect debts directly from a debtor's wages or bank accounts. This legal action can significantly impact a debtor's financial situation, making it crucial to understand your rights in Pima, Arizona. You may consider applying for an Order of Continuing Lien to secure your debt further.

Nonexempt earnings are portions of your income that are subject to garnishment under state and federal law. These earnings can be wages from a job, tips, or commissions, and typically include everything above certain exempt amounts. Knowing what constitutes nonexempt earnings is vital when you face wage garnishment. To manage your situation, consider using the resources provided by uslegalforms related to the Pima Arizona Application for Order of Continuing Lien.

Earnings refer to the income you receive from employment or other sources, while non-earnings include income that is not paycheck-related, like social security or unemployment benefits. The distinction is important, especially when dealing with garnishments and the Pima Arizona Application for Order of Continuing Lien, as different rules may apply to each category. Understanding these definitions can assist you in navigating your financial situation more effectively.

To determine if your wages are being garnished, check your paystub for a notation or deduction reflecting garnishment. Typically, a creditor must notify you about the garnishment through a court order. If you suspect your wages are affected, consider looking into the Pima Arizona Application for Order of Continuing Lien to understand your rights. Consulting with uslegalforms may provide further clarity on your situation.

The application of a writ of garnishment involves legally seizing a debtor's assets or wages to satisfy a debt. In Pima, Arizona, this is part of the broader Pima Arizona Application for Order of Continuing Lien. The garnishment allows creditors to recover amounts directly from a debtor's paycheck or bank account. To understand the nuances of this process, uslegalforms offers comprehensive resources.

In Arizona, a lien typically lasts for a period of five years, after which it may require renewal to remain valid. However, depending on the nature of the lien and the circumstances surrounding it, different rules may apply. By utilizing the Pima Arizona Application for Order of Continuing Lien, you can effectively manage and maintain the enforcement of your liens, ensuring they remain enforceable as long as necessary.

A continuing lien refers to a legal claim that remains in place on a debtor's property until a specific obligation is fulfilled. This ensures that the creditor retains a right to the property, enabling them to collect what is owed over time. The Pima Arizona Application for Order of Continuing Lien simplifies the process of establishing such liens, making it easier for creditors to secure their interests.