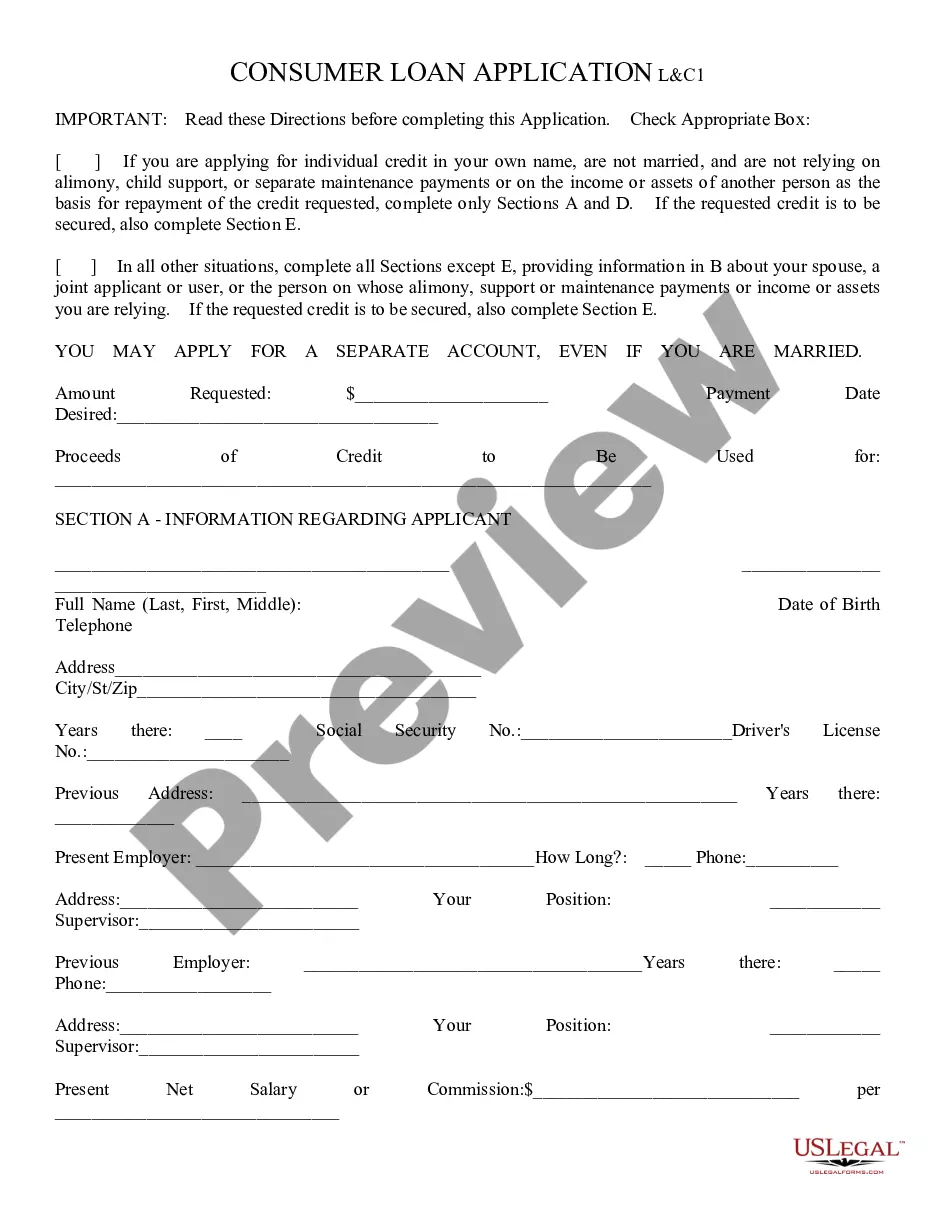

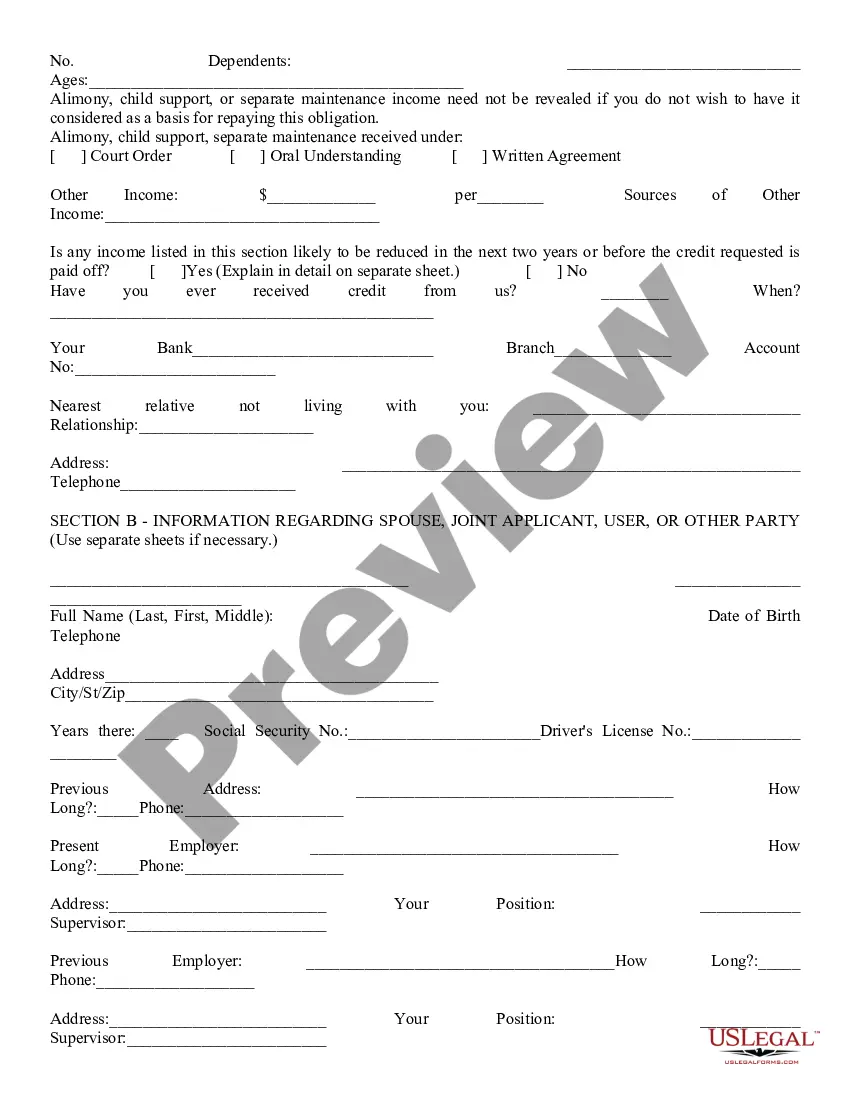

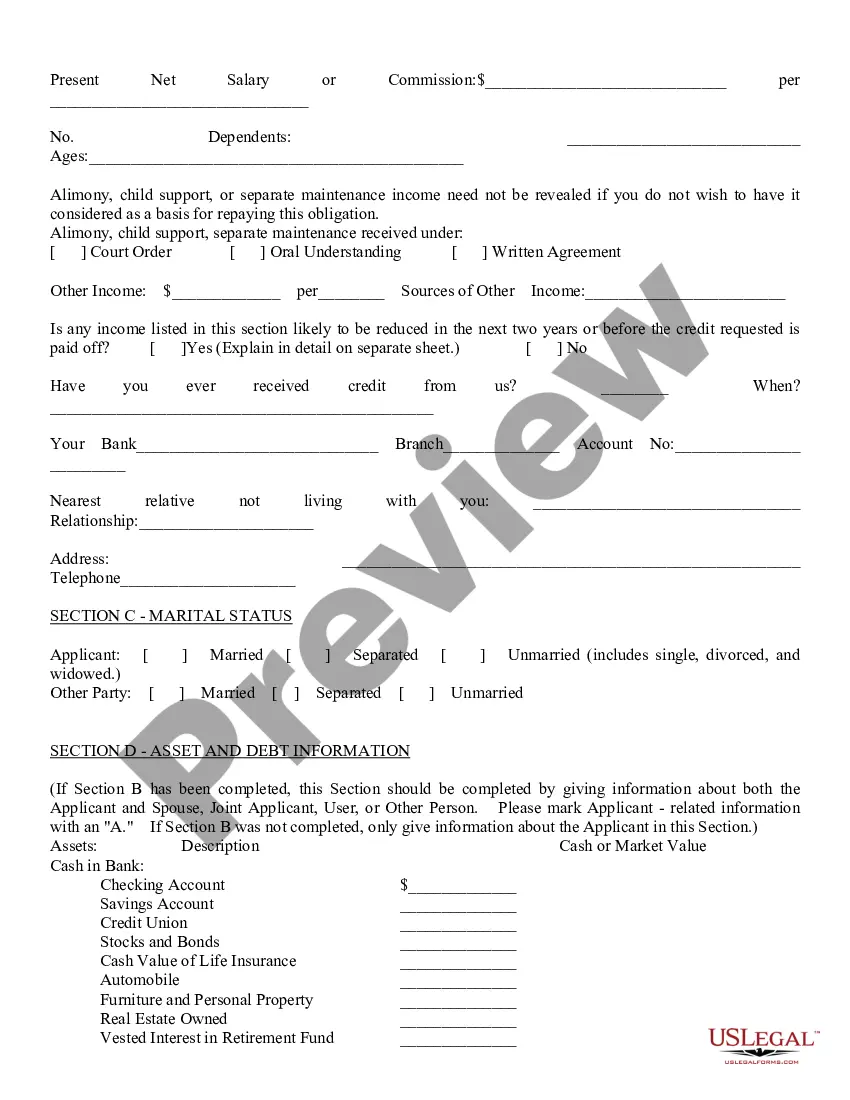

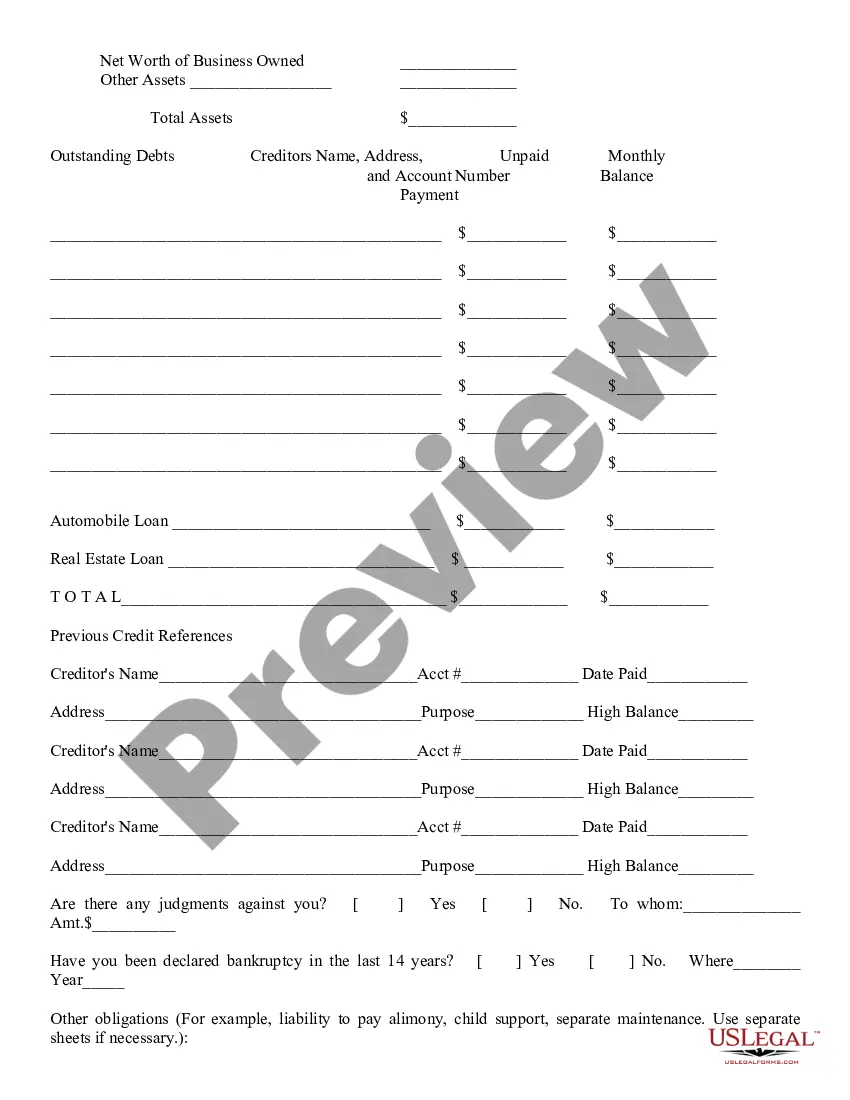

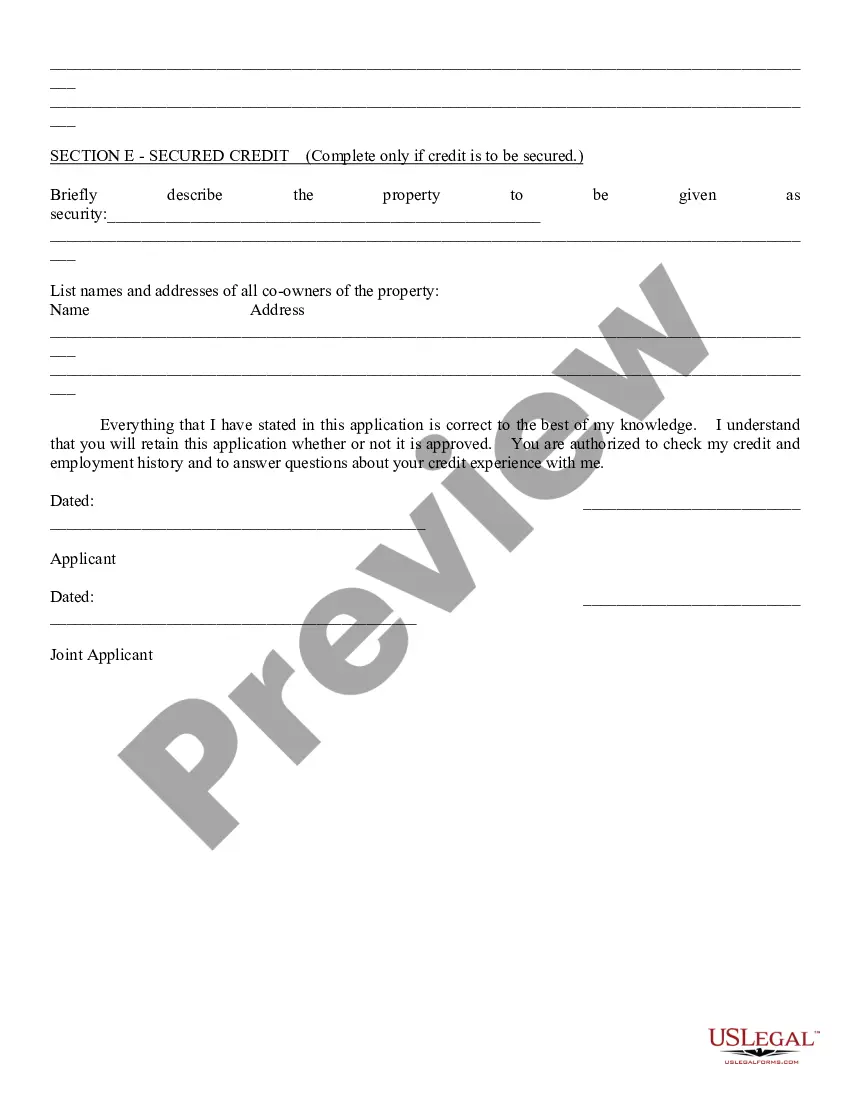

Consumer Loan Application: This is a general Consumer Loan Application which can be used in any instance where a consumer requests a loan. The application asks for all relevant personal and financial information of the applicant. This form is available for download in both Word and Rich Text formats.

Glendale Arizona Consumer Loan Application

Description

How to fill out Arizona Consumer Loan Application?

If you have previously engaged our service, sign in to your account and retrieve the Glendale Arizona Consumer Loan Application on your device by selecting the Download button. Ensure your subscription remains active. If not, renew it per your payment plan.

For your initial encounter with our service, complete these straightforward steps to obtain your document.

You maintain ongoing access to all documents you’ve purchased: they can be found in your profile under the My documents section whenever you wish to reuse them. Utilize the US Legal Forms service to quickly find and secure any template for your individual or business requirements!

- Confirm you’ve found an appropriate document. Review the details and utilize the Preview feature, if available, to ascertain if it aligns with your requirements. If it does not meet your standards, employ the Search tab above to locate the correct one.

- Acquire the template. Hit the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process a payment. Enter your credit card information or use the PayPal method to finalize the purchase.

- Obtain your Glendale Arizona Consumer Loan Application. Select the file format for your document and store it on your device.

- Complete your form. Print it or utilize specialized online editors to fill it out and e-sign it.

Form popularity

FAQ

There are over 100 banks and credit unions in Arizona, which may have good deals on personal loans.

Unfortunately both types of loans are now harder to get as the mortgage market is badly battered on several fronts due to the impact of the pandemic on the economy and employment. Mortgage credit availability in March fell to the lowest level in five years, according to a survey by the Mortgage Bankers Association.

The easiest loans to get approved for would probably be payday loans, car title loans, pawnshop loans, and personal installment loans. These are all short-term cash solutions for bad credit borrowers in need. Many of these options are designed to help borrowers who need fast cash in times of need.

The average time for formal approval takes about four to six weeks from submitting the application to your lender, to reaching settlement on the property.

It's not hard to get a personal loan in general, but some personal loans are much more difficult to get than others. Unsecured personal loans often require a credit score of 660+, and some are only available to people with scores of 700+.

It usually takes one and seven business days to get a personal loan ? though this will depend on which type of lender you work with. Here's how long it typically takes to get a personal loan: Online lenders: Less than 5 business days. Banks: 1-7 business days.

For the latest quarter assessed by the U.S. EPA (January 2021 - March 2021), tap water provided by this water utility was in compliance with federal health-based drinking water standards.

Boost Your Chances of Getting Your Personal Loan Approved Clean up your credit. Credit scores are major considerations on personal loan applications.Rebalance your debts and income.Don't ask for too much cash.Consider a co-signer.Find the right lender.