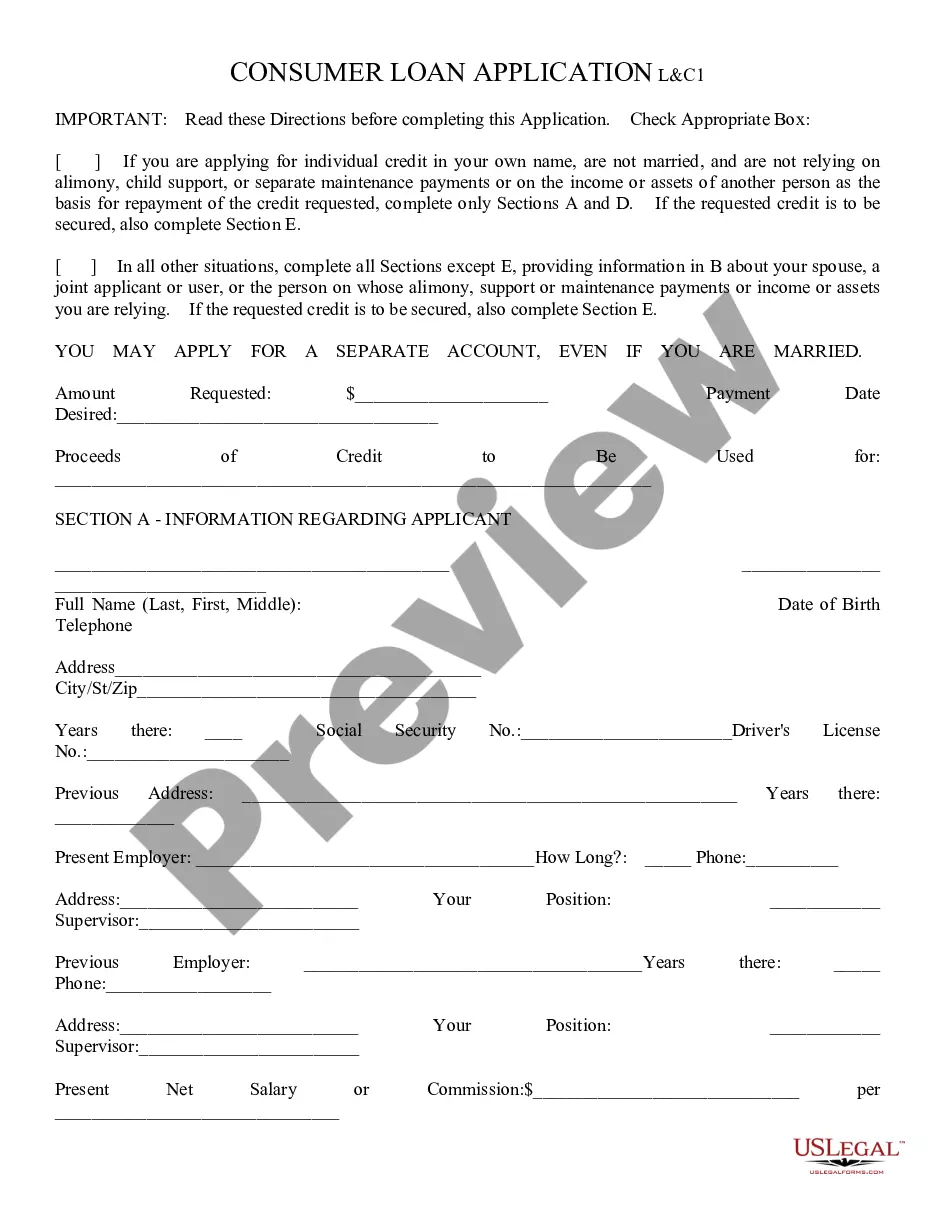

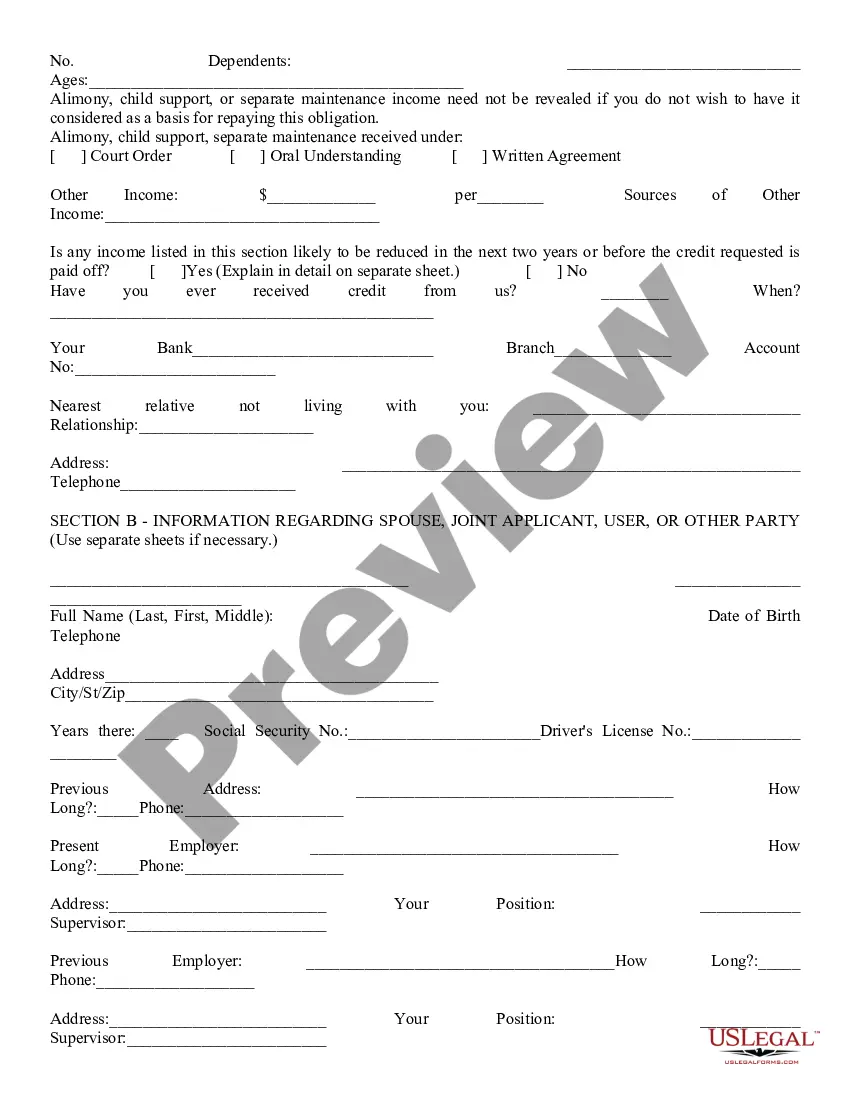

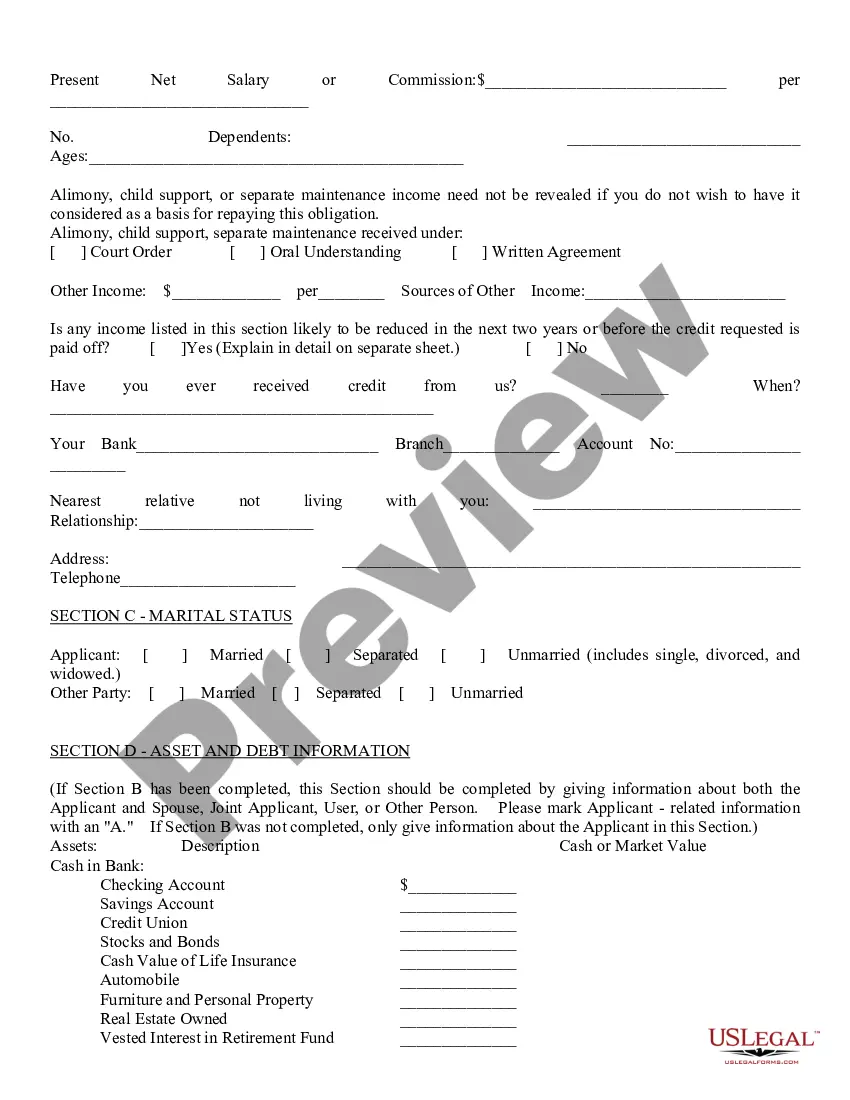

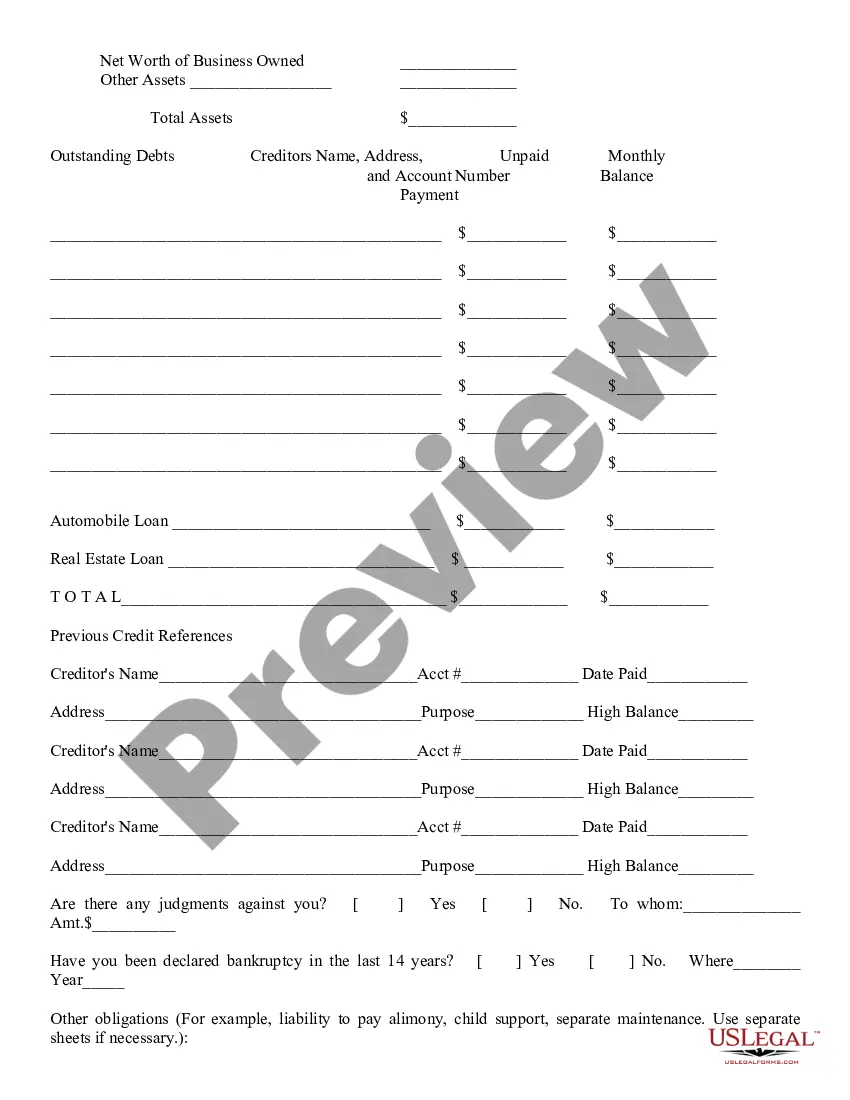

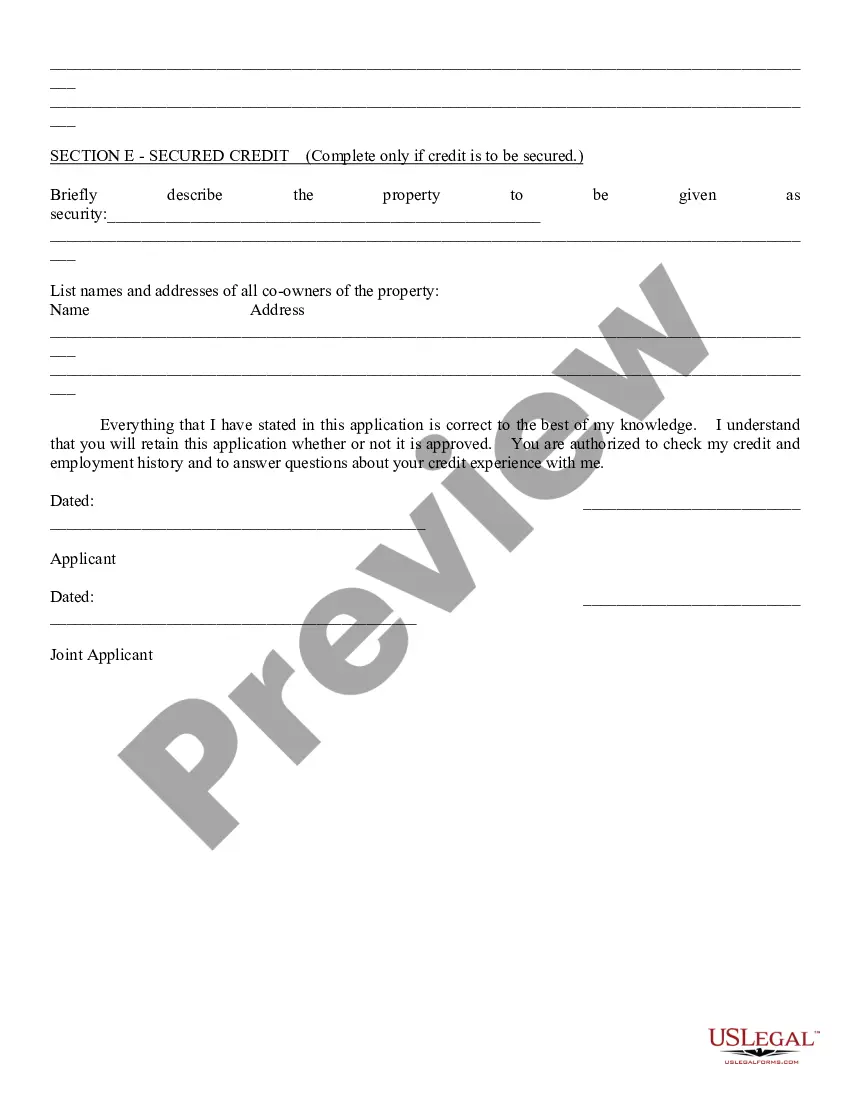

Consumer Loan Application: This is a general Consumer Loan Application which can be used in any instance where a consumer requests a loan. The application asks for all relevant personal and financial information of the applicant. This form is available for download in both Word and Rich Text formats.

Maricopa Arizona Consumer Loan Application is a comprehensive financial service offered to residents of Maricopa, Arizona, to apply for consumer loans. These loans are designed to fulfill various personal needs such as debt consolidation, home improvements, education expenses, medical bills, and more. Maricopa Arizona Consumer Loan Application provides individuals with an easy and convenient way to access funds by submitting a personalized application for loan approval. This application process typically involves the following steps: 1. Personal Information: Applicants are required to provide their personal details such as full name, contact information, current address, social security number, date of birth, and employment details. 2. Loan Amount and Purpose: Applicants need to specify the loan amount they are seeking and provide a detailed explanation of the purpose of the loan. 3. Employment and Income Verification: Applicants are asked to provide proof of employment and income, which may include recent pay stubs, tax returns, or bank statements. 4. Credit History: The Maricopa Arizona Consumer Loan Application may require individuals to disclose their credit history by authorizing a credit check, which helps determine their creditworthiness. 5. Collateral Details (if applicable): Some consumer loan options may require collateral, such as a vehicle or property. In such cases, applicants will need to provide details about the collateral being offered. 6. Terms and Conditions: Applicants will review and agree to the terms and conditions associated with the loan, including interest rates, repayment terms, and any additional fees or charges. Maricopa Arizona Consumer Loan Application aims to simplify the borrowing process for residents of Maricopa, providing them with a range of consumer loan options tailored to their individual needs. Some different types of consumer loans available through this application may include: 1. Personal Loans: These loans are typically unsecured and can be used for various purposes such as debt consolidation, home improvements, medical expenses, or vacations. 2. Auto Loans: Maricopa Arizona Consumer Loan Application may offer auto loans to help individuals purchase a new or used vehicle. These loans may require the vehicle itself to be used as collateral. 3. Home Equity Loans: Homeowners may apply for a home equity loan, utilizing the equity in their property as collateral. These loans are commonly used for major expenses like home renovations or education expenses. 4. Debt Consolidation Loans: This type of loan allows individuals to consolidate multiple smaller loans into a single, more manageable loan, often with a more favorable interest rate. By providing a user-friendly application process, Maricopa Arizona Consumer Loan Application addresses the financial needs of residents efficiently, offering a plethora of loan options to help individuals achieve their goals. It ensures transparency, security, and convenience throughout the loan application and approval process.Maricopa Arizona Consumer Loan Application is a comprehensive financial service offered to residents of Maricopa, Arizona, to apply for consumer loans. These loans are designed to fulfill various personal needs such as debt consolidation, home improvements, education expenses, medical bills, and more. Maricopa Arizona Consumer Loan Application provides individuals with an easy and convenient way to access funds by submitting a personalized application for loan approval. This application process typically involves the following steps: 1. Personal Information: Applicants are required to provide their personal details such as full name, contact information, current address, social security number, date of birth, and employment details. 2. Loan Amount and Purpose: Applicants need to specify the loan amount they are seeking and provide a detailed explanation of the purpose of the loan. 3. Employment and Income Verification: Applicants are asked to provide proof of employment and income, which may include recent pay stubs, tax returns, or bank statements. 4. Credit History: The Maricopa Arizona Consumer Loan Application may require individuals to disclose their credit history by authorizing a credit check, which helps determine their creditworthiness. 5. Collateral Details (if applicable): Some consumer loan options may require collateral, such as a vehicle or property. In such cases, applicants will need to provide details about the collateral being offered. 6. Terms and Conditions: Applicants will review and agree to the terms and conditions associated with the loan, including interest rates, repayment terms, and any additional fees or charges. Maricopa Arizona Consumer Loan Application aims to simplify the borrowing process for residents of Maricopa, providing them with a range of consumer loan options tailored to their individual needs. Some different types of consumer loans available through this application may include: 1. Personal Loans: These loans are typically unsecured and can be used for various purposes such as debt consolidation, home improvements, medical expenses, or vacations. 2. Auto Loans: Maricopa Arizona Consumer Loan Application may offer auto loans to help individuals purchase a new or used vehicle. These loans may require the vehicle itself to be used as collateral. 3. Home Equity Loans: Homeowners may apply for a home equity loan, utilizing the equity in their property as collateral. These loans are commonly used for major expenses like home renovations or education expenses. 4. Debt Consolidation Loans: This type of loan allows individuals to consolidate multiple smaller loans into a single, more manageable loan, often with a more favorable interest rate. By providing a user-friendly application process, Maricopa Arizona Consumer Loan Application addresses the financial needs of residents efficiently, offering a plethora of loan options to help individuals achieve their goals. It ensures transparency, security, and convenience throughout the loan application and approval process.