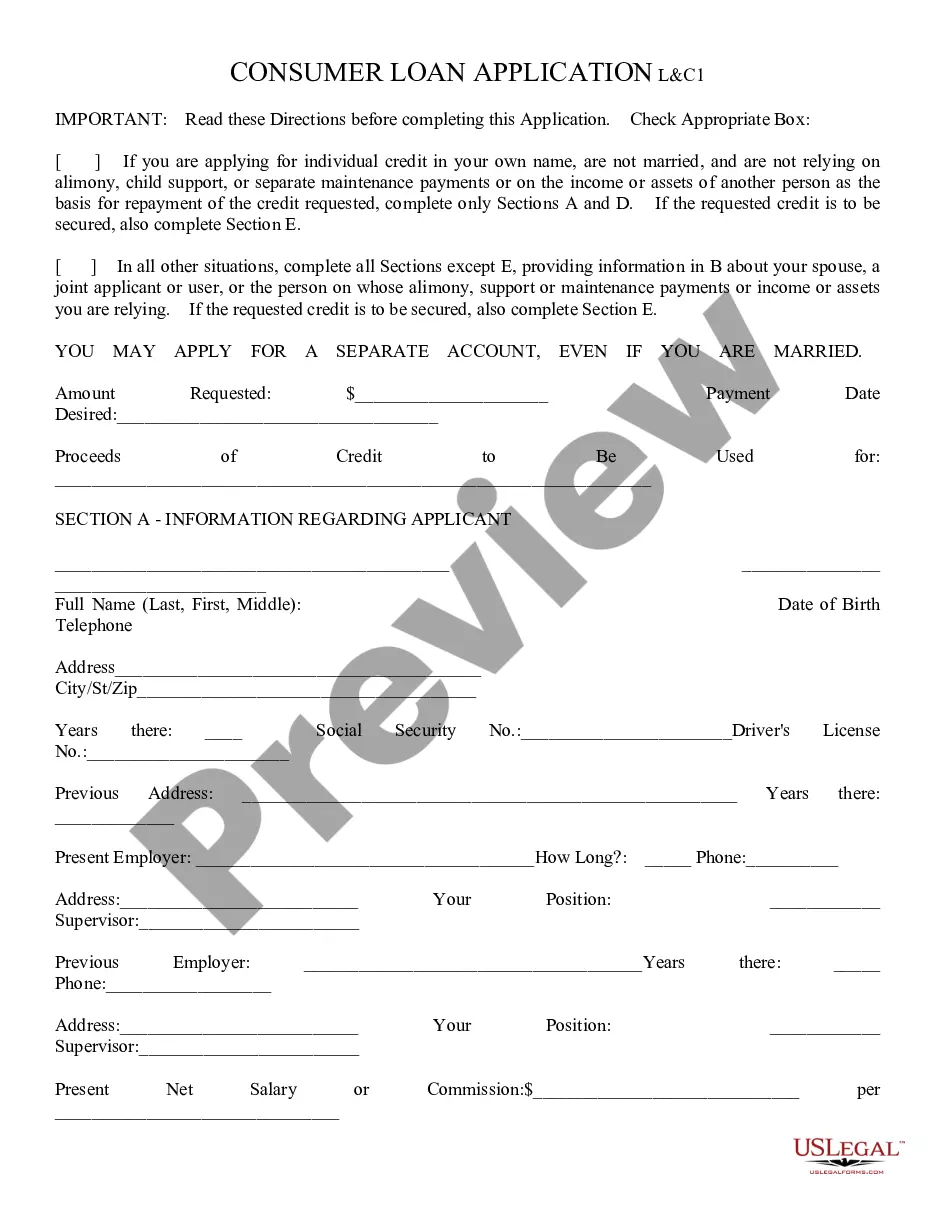

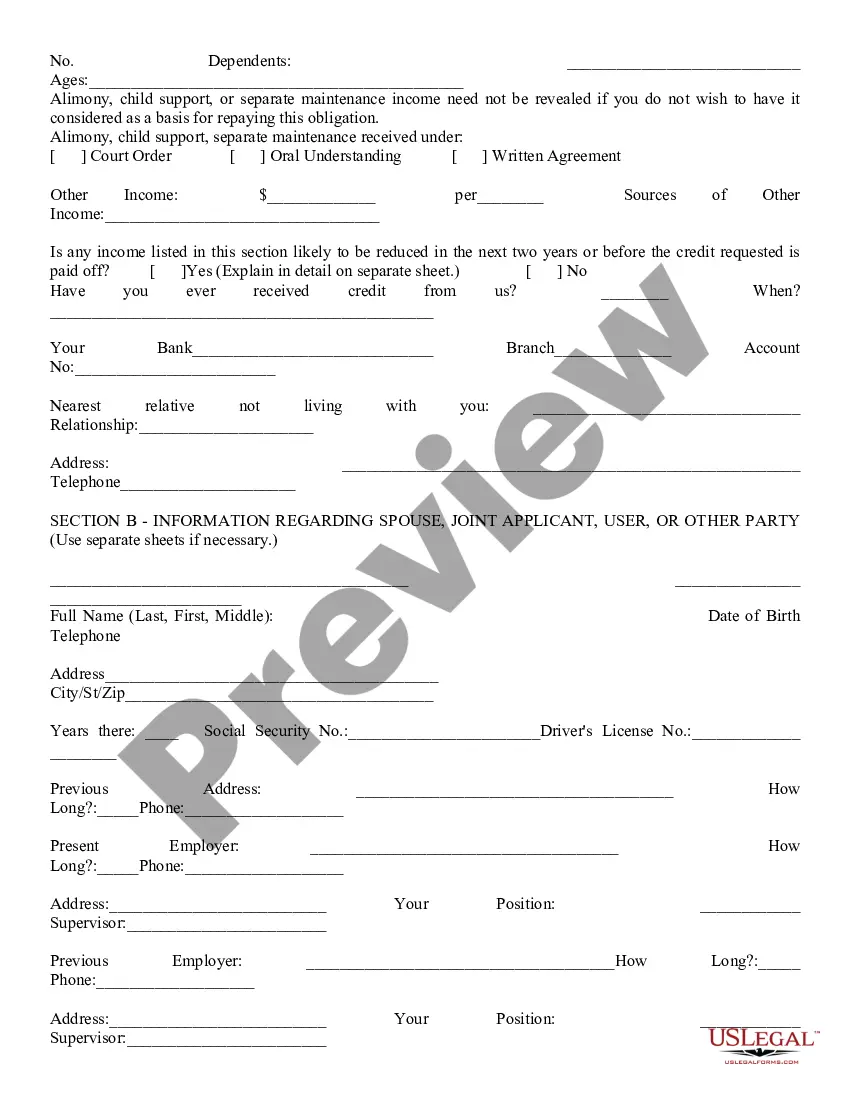

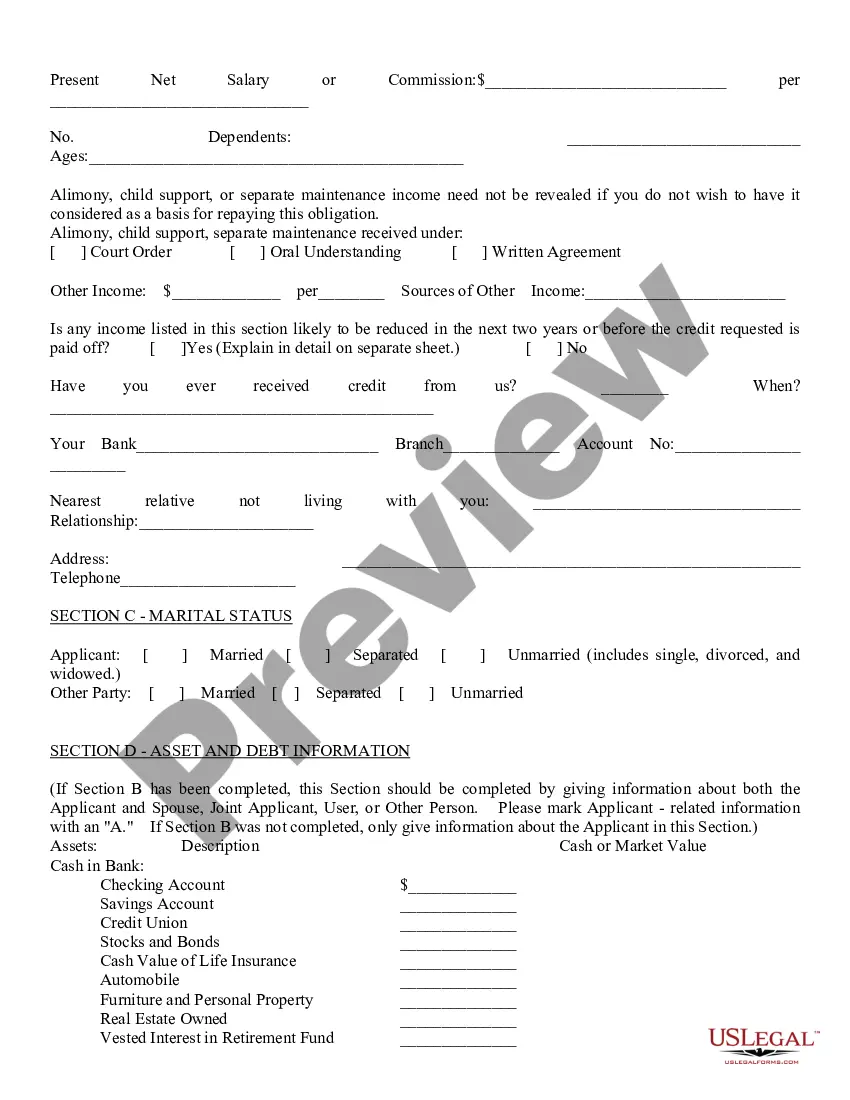

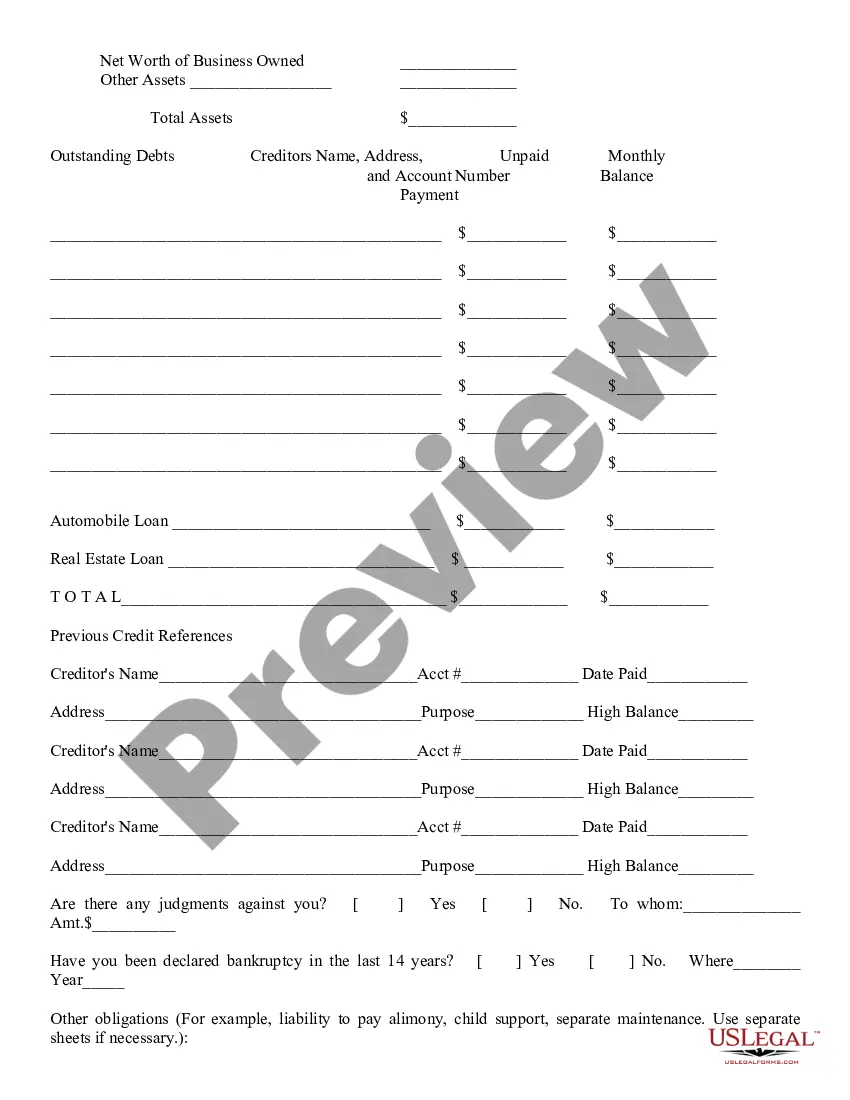

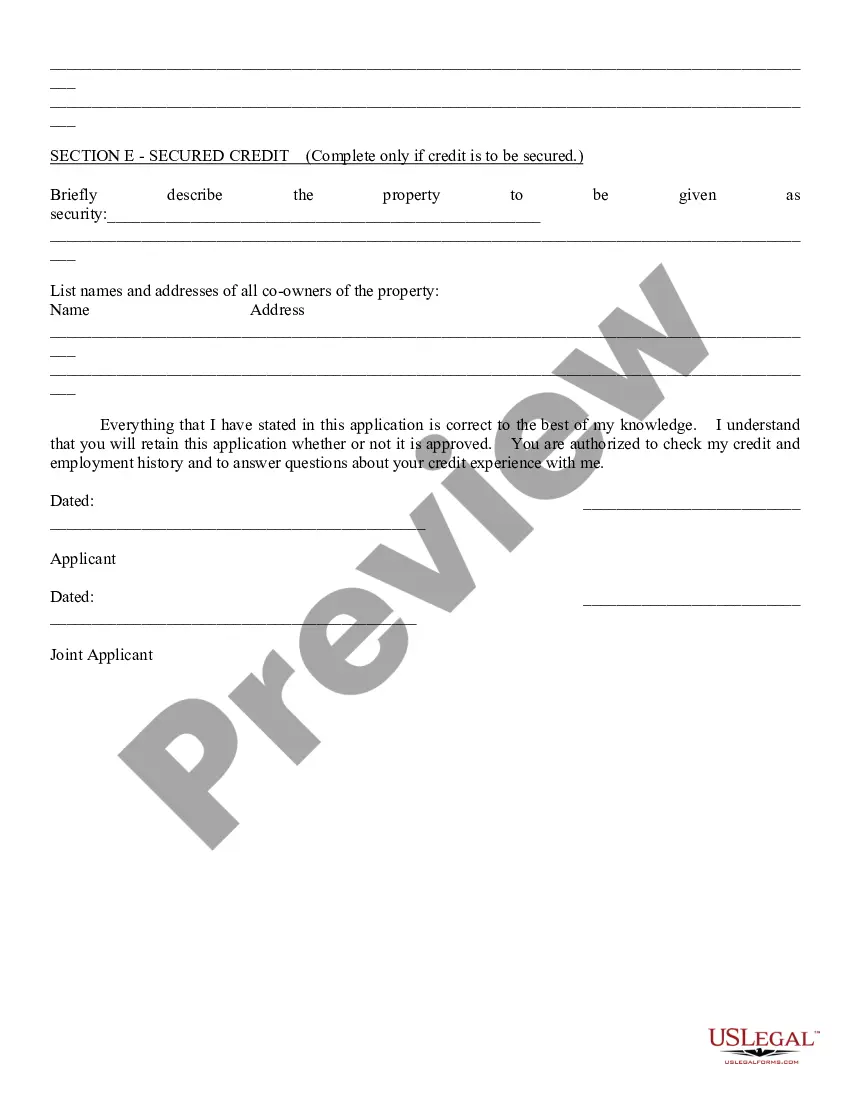

Consumer Loan Application: This is a general Consumer Loan Application which can be used in any instance where a consumer requests a loan. The application asks for all relevant personal and financial information of the applicant. This form is available for download in both Word and Rich Text formats.

Mesa Arizona Consumer Loan Application is a financial application process that allows residents of Mesa, Arizona to apply for various types of consumer loans. These loans are designed to help individuals meet their financial needs, whether it's for personal expenses, debt consolidation, medical bills, home improvements, or education. The Mesa Arizona Consumer Loan Application is a simple and straightforward process that can be done both online and in-person at designated financial institutions or lenders in Mesa. This application typically requires individuals to provide personal information, employment details, proof of income, and other relevant financial documents. There are several types of consumer loan applications available in Mesa, Arizona, catering to different needs and circumstances. Some common types of consumer loan applications include: 1. Personal Loans: These loans are unsecured and can be used for various purposes, such as debt consolidation, emergency expenses, or major purchases. 2. Auto Loans: Designed specifically for purchasing a car, auto loans enable individuals to finance the purchase of a new or used vehicle and pay it off over a set period. 3. Home Improvement Loans: If you are planning to renovate or upgrade your home in Mesa, applying for a home improvement loan can provide the necessary funds to cover the costs. 4. Education Loans: Students in Mesa, Arizona can apply for education loans to finance tuition fees, books, accommodation, and other educational expenses while pursuing their academic goals. 5. Debt Consolidation Loans: These loans are beneficial for individuals struggling with multiple debts. Debt consolidation loans allow borrowers to combine their outstanding debts into a single loan, simplifying repayment and potentially lowering the interest rate. By submitting the Mesa Arizona Consumer Loan Application, individuals give lenders access to review their financial history and credit score, which helps determine their eligibility and the terms of the loan. It is essential to provide accurate and complete information during the application process to expedite the loan approval process and secure favorable loan terms. In conclusion, the Mesa Arizona Consumer Loan Application is a convenient process that enables residents of Mesa, Arizona, to obtain various types of consumer loans to meet their specific financial needs. Whether it's for personal expenses, home improvement, education, or to consolidate debts, Mesa residents can explore different loan options and apply using this application to access necessary funds to achieve their financial goals.Mesa Arizona Consumer Loan Application is a financial application process that allows residents of Mesa, Arizona to apply for various types of consumer loans. These loans are designed to help individuals meet their financial needs, whether it's for personal expenses, debt consolidation, medical bills, home improvements, or education. The Mesa Arizona Consumer Loan Application is a simple and straightforward process that can be done both online and in-person at designated financial institutions or lenders in Mesa. This application typically requires individuals to provide personal information, employment details, proof of income, and other relevant financial documents. There are several types of consumer loan applications available in Mesa, Arizona, catering to different needs and circumstances. Some common types of consumer loan applications include: 1. Personal Loans: These loans are unsecured and can be used for various purposes, such as debt consolidation, emergency expenses, or major purchases. 2. Auto Loans: Designed specifically for purchasing a car, auto loans enable individuals to finance the purchase of a new or used vehicle and pay it off over a set period. 3. Home Improvement Loans: If you are planning to renovate or upgrade your home in Mesa, applying for a home improvement loan can provide the necessary funds to cover the costs. 4. Education Loans: Students in Mesa, Arizona can apply for education loans to finance tuition fees, books, accommodation, and other educational expenses while pursuing their academic goals. 5. Debt Consolidation Loans: These loans are beneficial for individuals struggling with multiple debts. Debt consolidation loans allow borrowers to combine their outstanding debts into a single loan, simplifying repayment and potentially lowering the interest rate. By submitting the Mesa Arizona Consumer Loan Application, individuals give lenders access to review their financial history and credit score, which helps determine their eligibility and the terms of the loan. It is essential to provide accurate and complete information during the application process to expedite the loan approval process and secure favorable loan terms. In conclusion, the Mesa Arizona Consumer Loan Application is a convenient process that enables residents of Mesa, Arizona, to obtain various types of consumer loans to meet their specific financial needs. Whether it's for personal expenses, home improvement, education, or to consolidate debts, Mesa residents can explore different loan options and apply using this application to access necessary funds to achieve their financial goals.