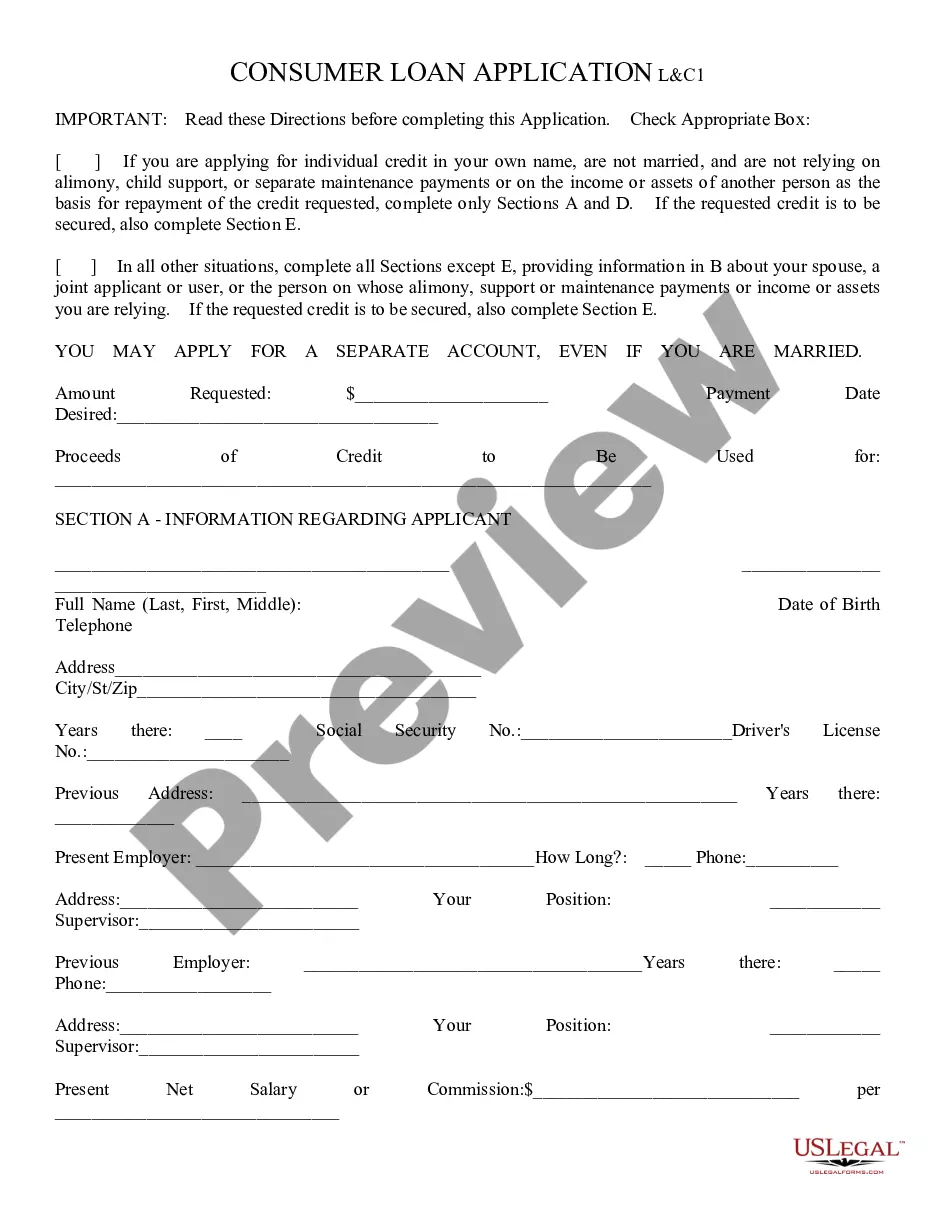

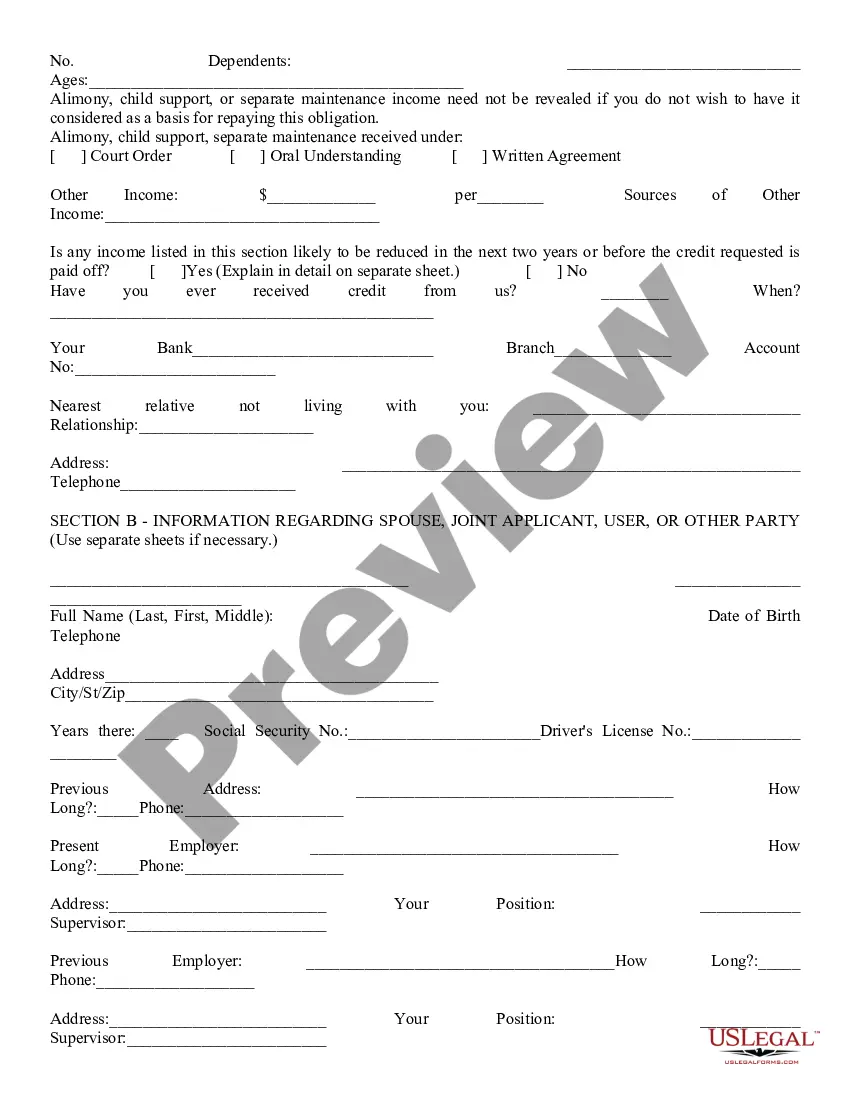

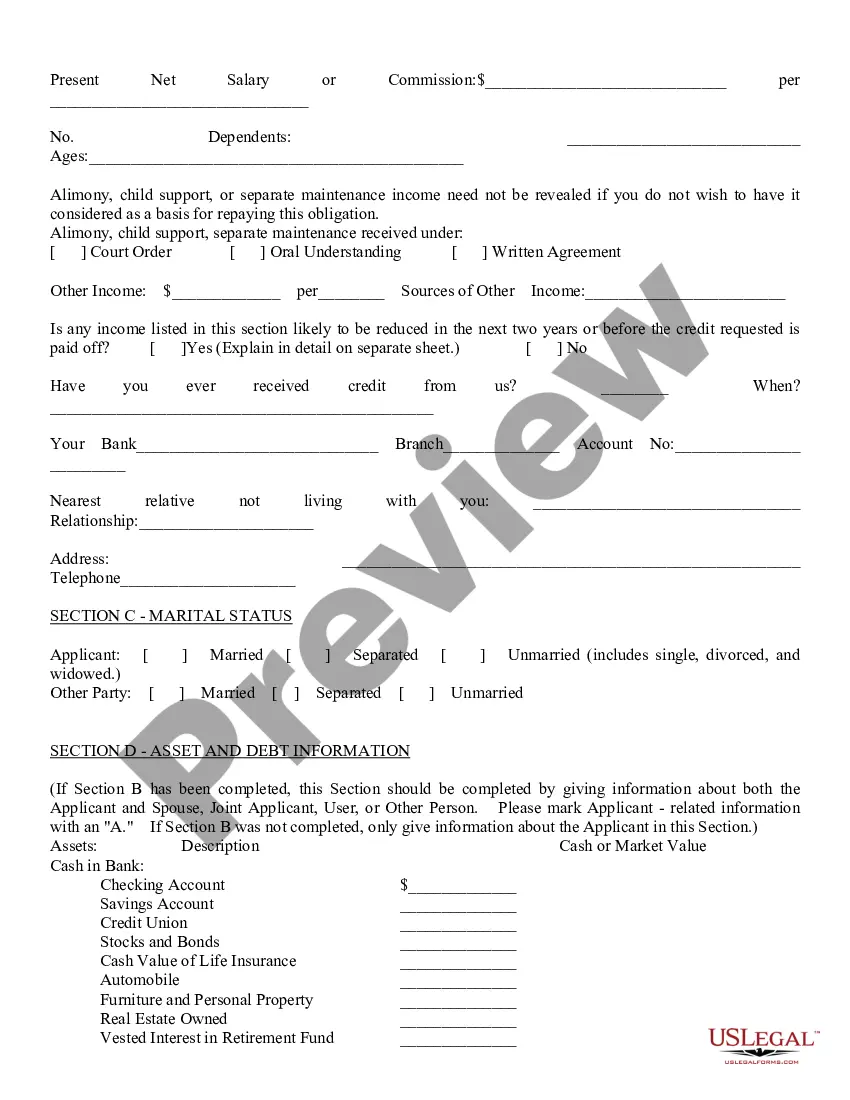

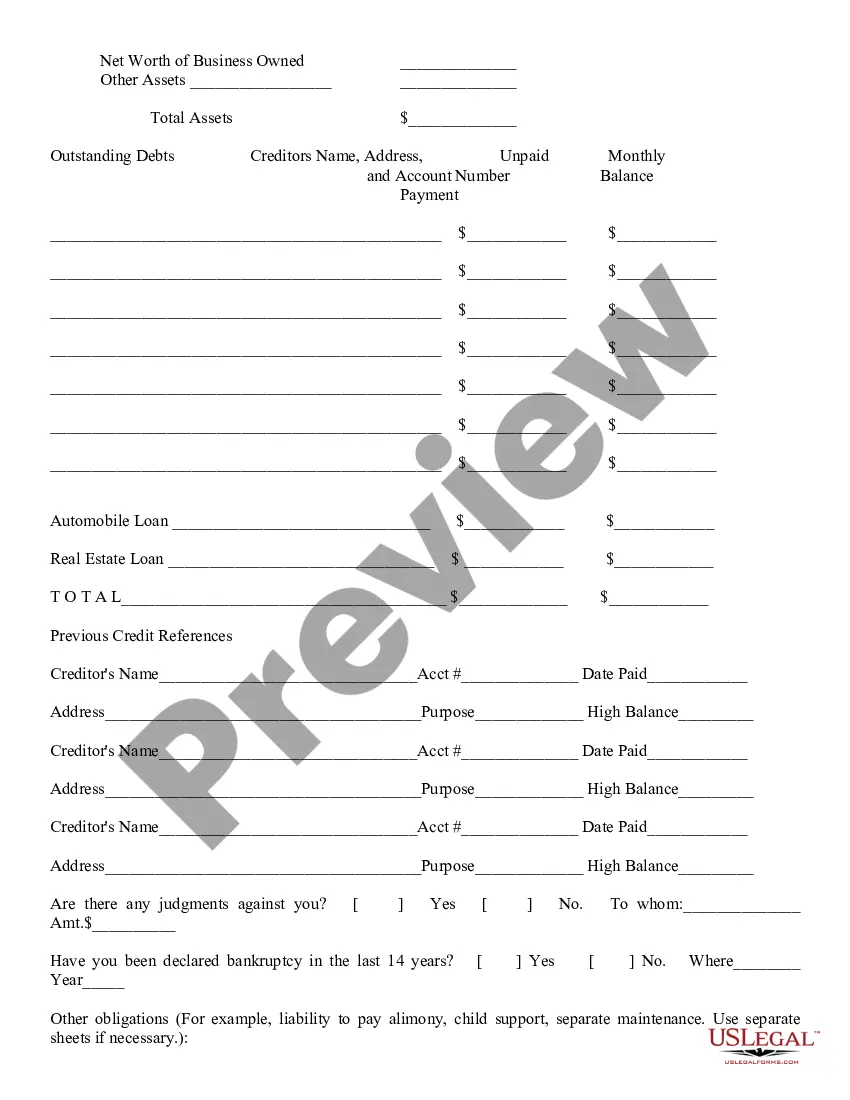

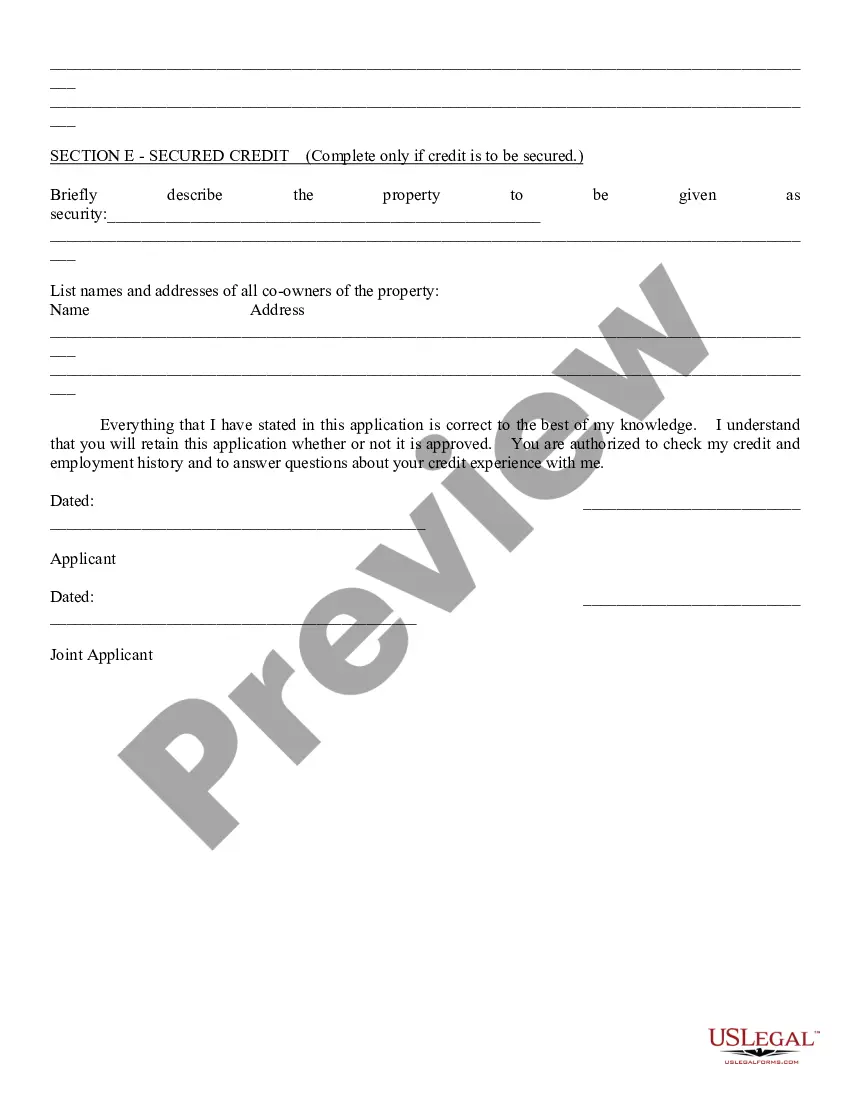

Consumer Loan Application: This is a general Consumer Loan Application which can be used in any instance where a consumer requests a loan. The application asks for all relevant personal and financial information of the applicant. This form is available for download in both Word and Rich Text formats.

Phoenix Arizona Consumer Loan Application

Description

How to fill out Arizona Consumer Loan Application?

Utilize the US Legal Forms and have instant access to any form sample you require.

Our helpful website with a vast collection of templates simplifies the process of locating and acquiring nearly any document sample you may need.

You can export, complete, and authenticate the Phoenix Arizona Consumer Loan Application in a few minutes rather than spending hours online trying to locate a suitable template.

Using our library is an excellent method to enhance the security of your form submissions.

If you haven't set up a profile yet, follow these steps.

Access the page with the form you need. Verify that it is the form you were looking for: confirm its title and description, and make use of the Preview feature if available. Otherwise, utilize the Search bar to discover the correct one.

- Our knowledgeable attorneys regularly review all documents to ensure that the forms are applicable for a specific state and adhere to recent laws and regulations.

- How do you access the Phoenix Arizona Consumer Loan Application? If you possess a subscription, simply Log In to your account. The Download button will be visible on every sample you examine.

- Additionally, you can retrieve all previously saved files in the My documents menu.

Form popularity

FAQ

Consumer Lenders - DFI DIFI. This license is required of any person that advertises to make or procure, solicits, or holds themselves out as willing to make or procure or makes or procures a loan of $10,000 or less or a revolving loan of not more than $10,000.

A Consumer Loan is a loan that banks offer to customers to buy household goods and appliances and even personal devices.

Consumer Loan Application Checklist Last two years of W2's (or 1099's) for each borrower. Most recent paystub with year-to-date earnings for each borrower. Last two years of federal tax returns and all schedules (only needed if self-employed)

A consumer loan is a loan given to consumers to finance specific types of expenditures. In other words, a consumer loan is any type of loan made to a consumer by a creditor. The loan can be secured (backed by the assets of the borrower) or unsecured (not backed by the assets of the borrower).