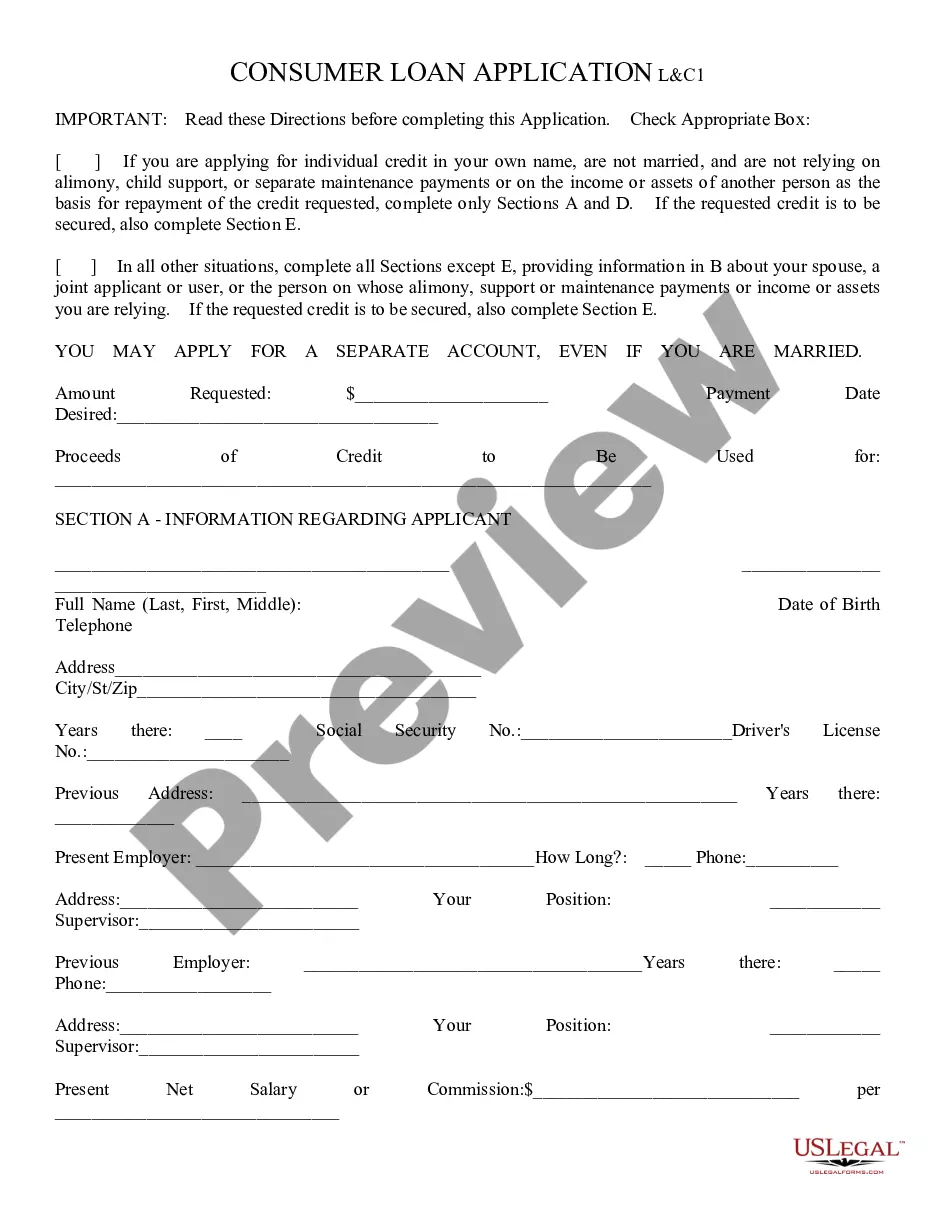

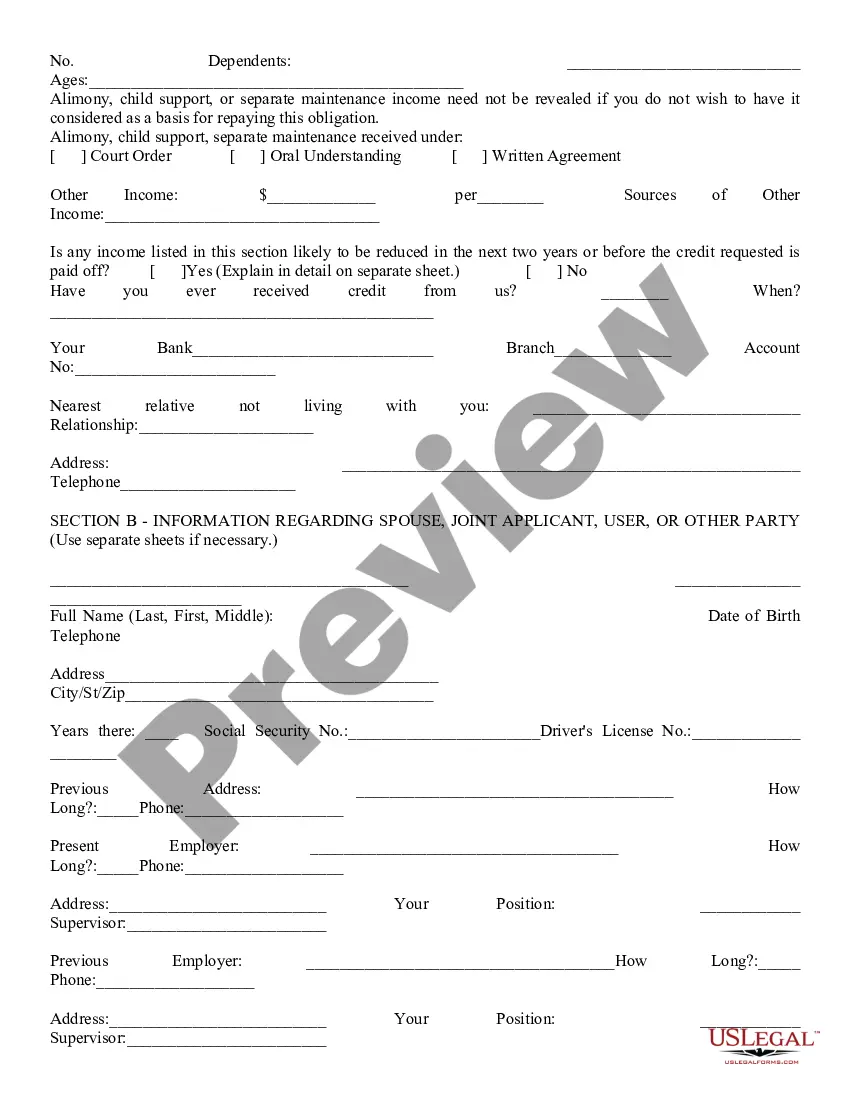

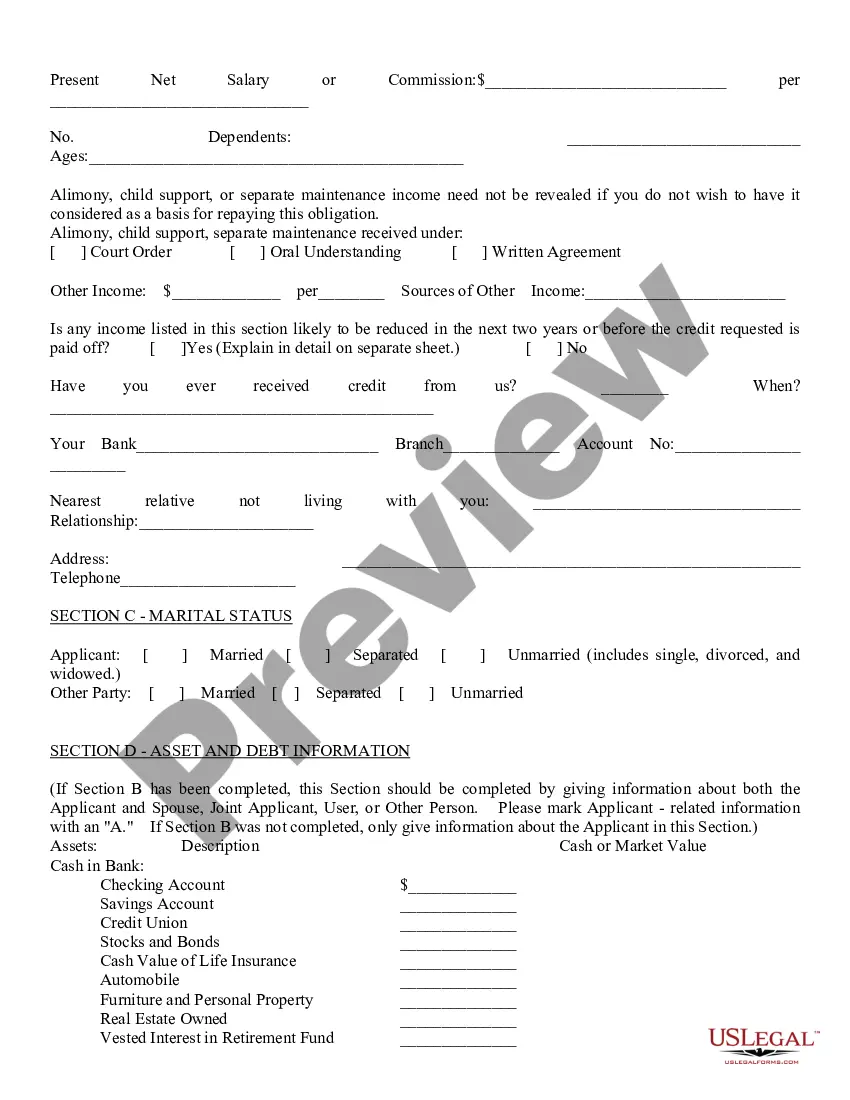

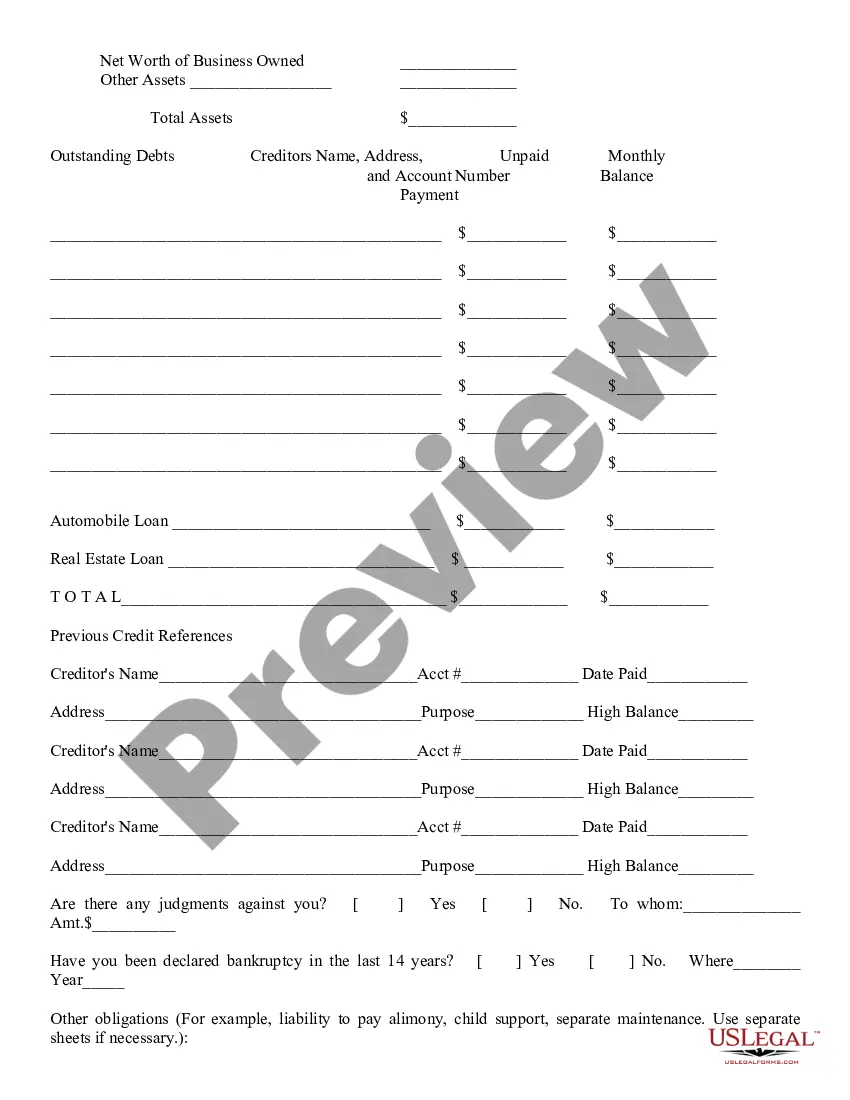

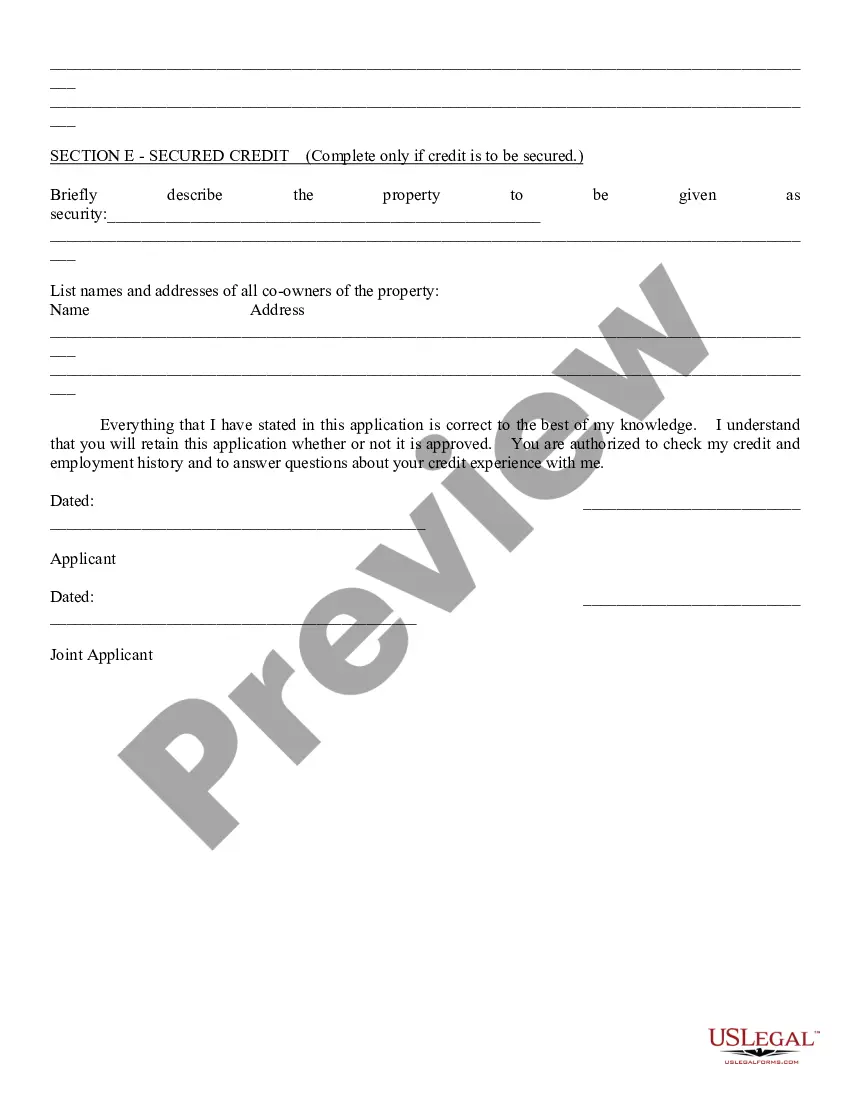

Consumer Loan Application: This is a general Consumer Loan Application which can be used in any instance where a consumer requests a loan. The application asks for all relevant personal and financial information of the applicant. This form is available for download in both Word and Rich Text formats.

Pima Arizona Consumer Loan Application

Description

How to fill out Arizona Consumer Loan Application?

Utilize the US Legal Forms to gain immediate access to any form example you require.

Our user-friendly platform, featuring a wide array of document templates, enables you to discover and obtain nearly any document example you might need.

You can export, complete, and sign the Pima Arizona Consumer Loan Application within minutes instead of spending hours online in search of the appropriate template.

Using our collection is an excellent method to enhance the security of your form submissions.

The Download option will be visible on all documents you access. Additionally, you can locate all your previously saved records in the My documents section.

If you haven't yet registered an account, follow these instructions.

- Our experienced attorneys routinely review all documents to ensure that the forms are pertinent to a specific area and adhere to current regulations and policies.

- How can you acquire the Pima Arizona Consumer Loan Application.

- If you have a subscription, simply Log In to your account.

Form popularity

FAQ

Scholarships are a great way to offset the cost of tuition; Pima offers several institutional scholarships and tuition awards. You may apply for these scholarships and see current offerings using Pima's Scholarship Portal also known as ScholarshipUniverse.

General Financial Aid. Federal Pell Grant.Campus-Based Funding. How much aid you receive from campus-based programs depends on your financial need, the amount of other aid you'll receive and the availability of funds at Pima Medical Institute.Federal Direct Student Loan Programs.Scholarships.Financial Aid Assistance.

It's your one-stop-shop to: Register for classes. Pay your tuition bill. Check your financial aid. View your class homepages. See your class schedule. Find textbooks. Access your PCC email. View college-wide announcements.

Contact ADR You can email Access and Disability Resources (ADR) at ADRhelp@pima.edu, or call ADR at 520-206-6688.

At Pima, we encourage all students to apply for financial aid by completing the Free Application for Federal Student Aid (FAFSA) through the Department of Education. Pima's Financial Aid Office offers a step-by-step guide to applying for financial aid.

Pima's online classes give you the ability to earn your degree from anywhere. We offer a broad range of online classes, certificates, and degree programs. You'll receive a high-quality education, no matter where you live and work.

At Pima, the following loans are available: Student Direct Stafford Loans (Subsidized and Unsubsidized) Parent Direct PLUS Loan. Private Student Loans for Higher Education.

At Pima, we encourage all students to apply for financial aid by completing the Free Application for Federal Student Aid (FAFSA) through the Department of Education. Pima's Financial Aid Office offers a step-by-step guide to applying for financial aid.

For General Information and After Hours Support Phone: 520.206.6408 (available 24/7) Email: virtualsupport@pima.edu.

Pima offers students a flexible option for paying for school. Students wanting to pay their tuition and fees in installments can self-enroll in the payment plan each semester after charges post to their student account.