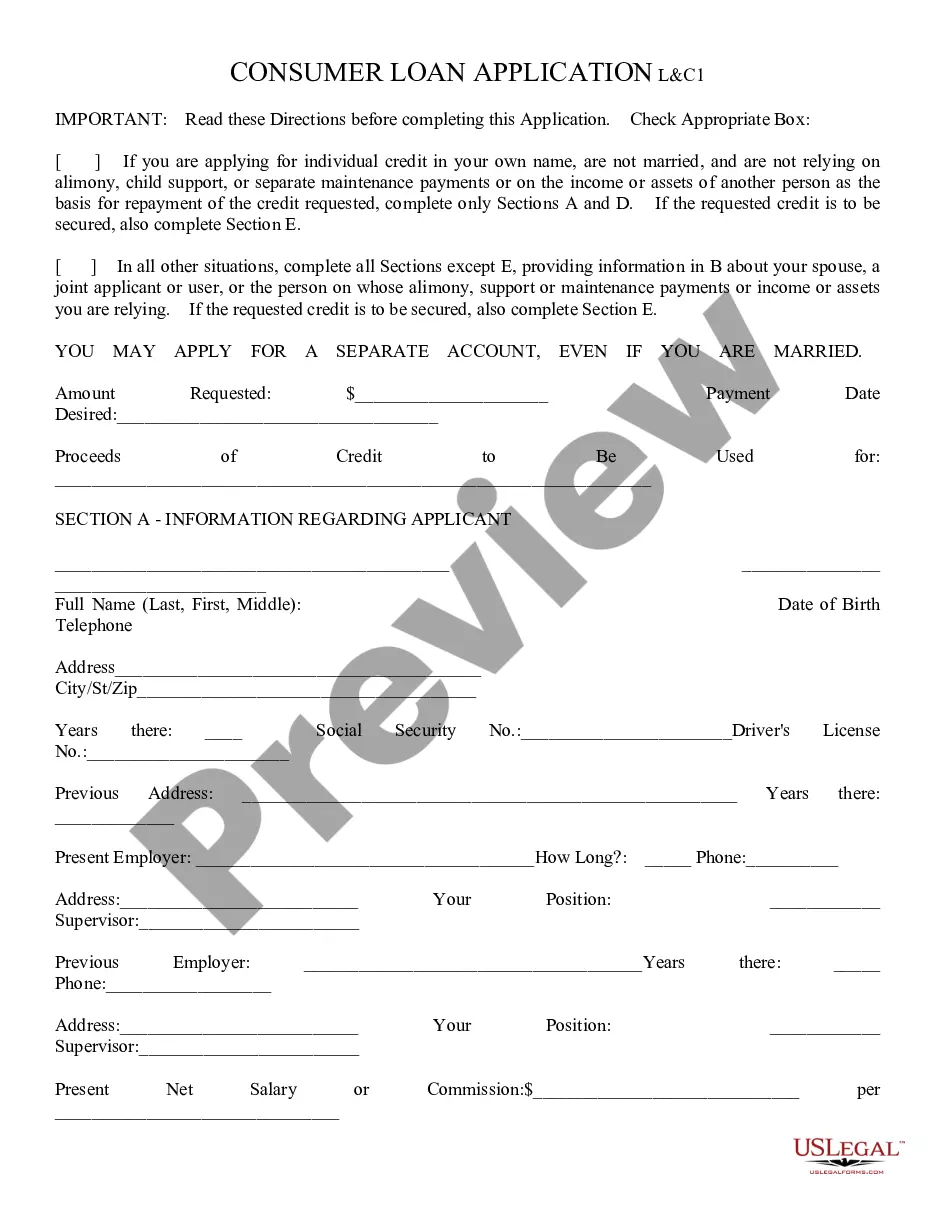

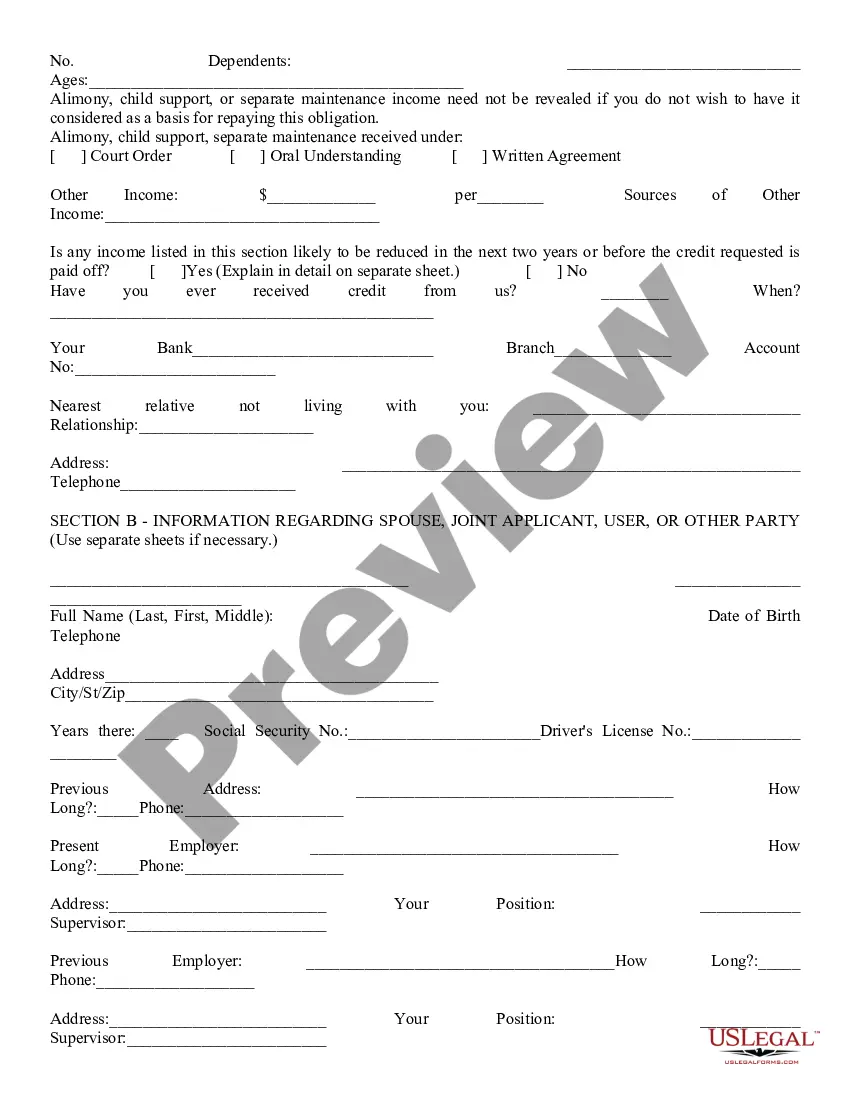

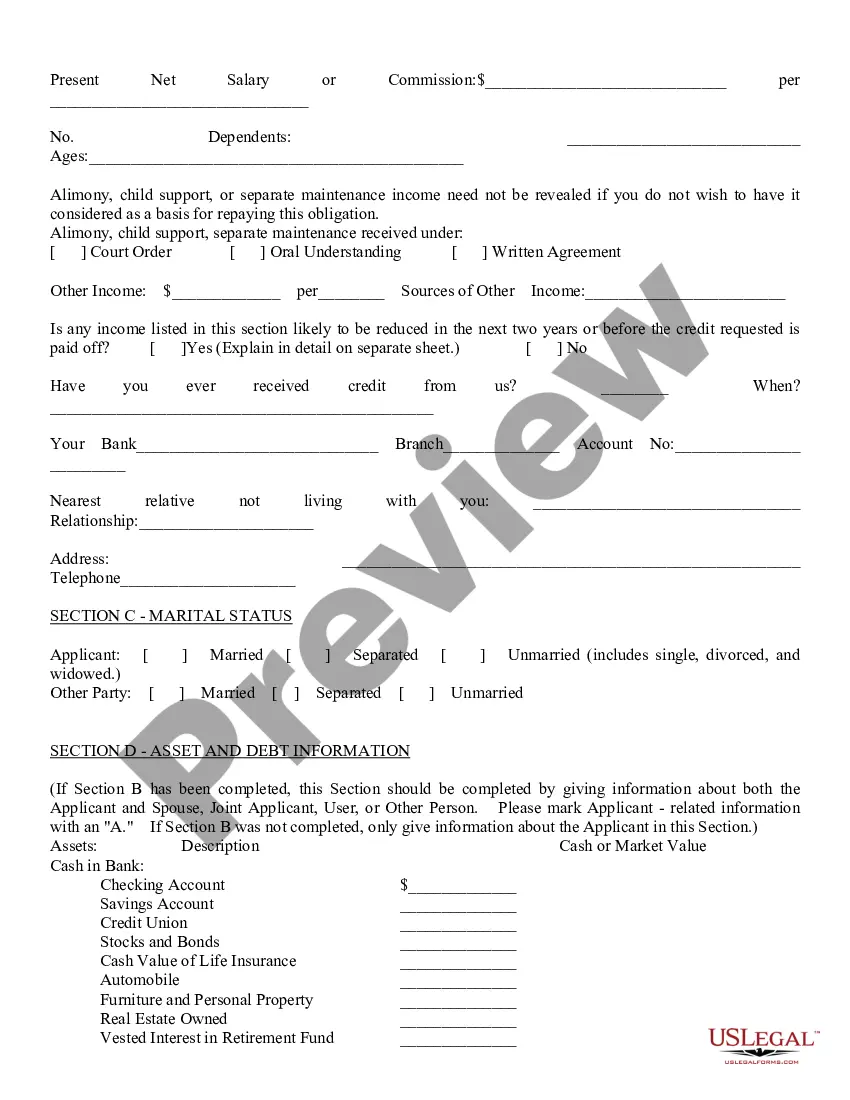

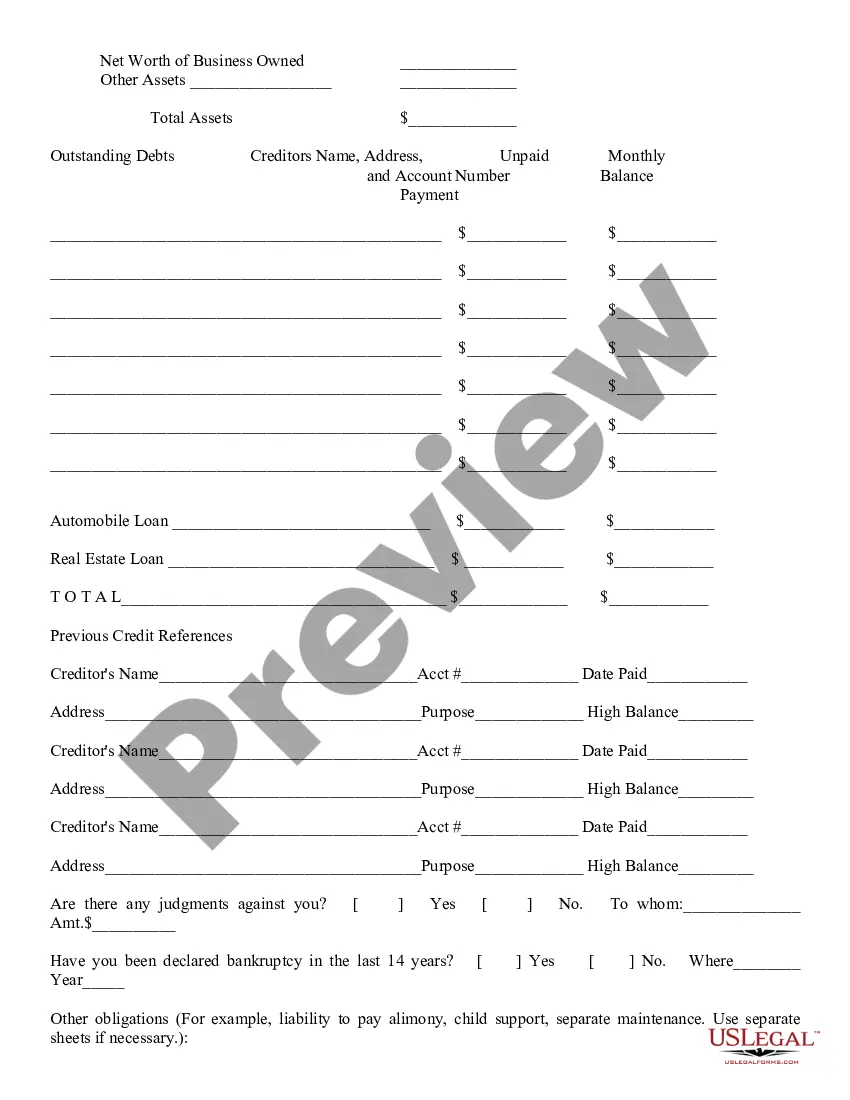

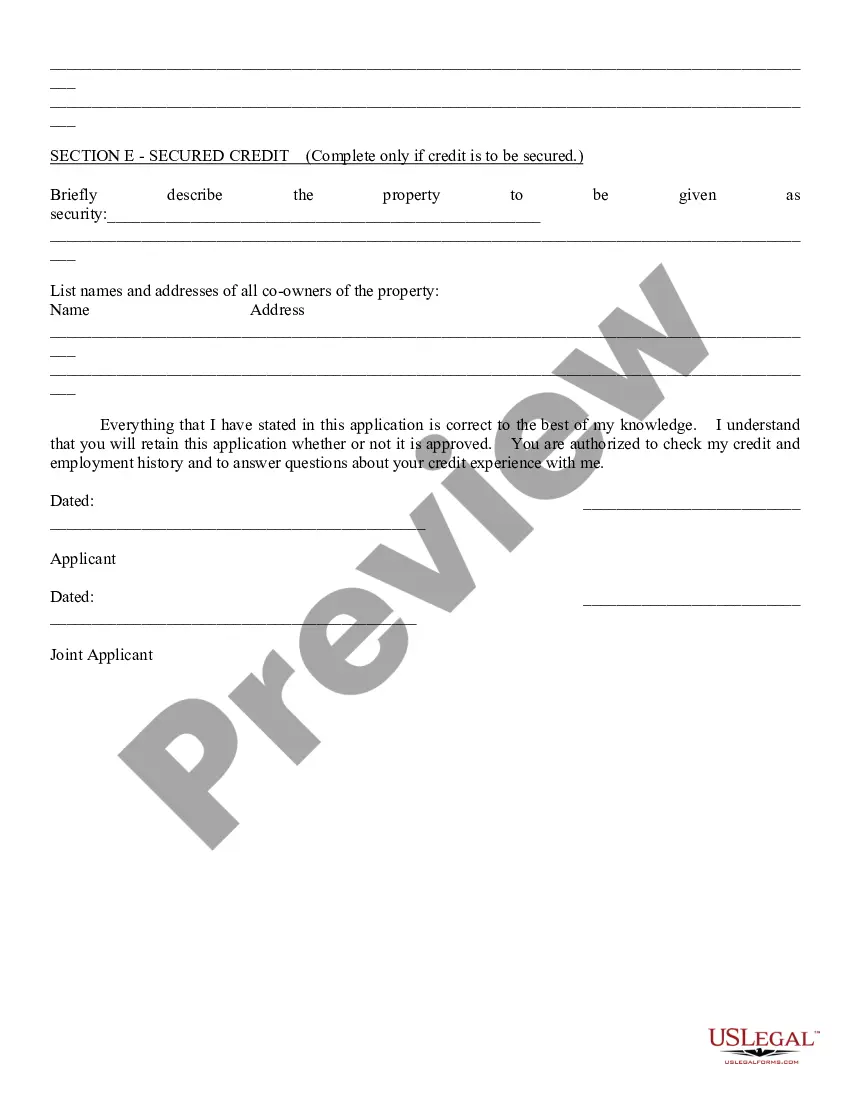

Consumer Loan Application: This is a general Consumer Loan Application which can be used in any instance where a consumer requests a loan. The application asks for all relevant personal and financial information of the applicant. This form is available for download in both Word and Rich Text formats.

Tempe, Arizona Consumer Loan Application: A Detailed Description If you are a resident of Tempe, Arizona, and in need of financial assistance, a consumer loan may be an ideal solution. A Tempe consumer loan is a type of financing tailored to meet personal expenses, such as purchasing a car, consolidating debt, paying for educational expenses, or covering unexpected medical bills. This loan application process aims to provide residents with a stress-free experience while securing the funds needed. Multiple types of consumer loan applications are available to Tempe residents, each designed to cater to different financial needs. Some common types include: 1. Personal Loan Application: This type of loan can be used for a wide range of purposes, such as funding a dream vacation, wedding expenses, or home renovations. It typically offers flexible repayment options and can be either secured or unsecured, depending on the lender's requirements. 2. Auto Loan Application: Suitable for individuals interested in buying a car, an auto loan application enables you to finance your vehicle purchase. Potential borrowers can access competitive interest rates and repayment terms based on factors like credit score, down payment, and the car's value. 3. Student Loan Application: Geared towards students pursuing higher education, a student loan application assists with financing tuition fees, textbooks, and other educational expenses. Tempe offers various student loan options, including federal loans, private loans, and loans specifically designed for parents. 4. Payday Loan Application: Intended for individuals facing short-term financial emergencies, a payday loan application lets borrowers access quick cash to cover immediate expenses. Typically, these loans have high-interest rates and must be repaid by the borrower's next payday. 5. Mortgage Loan Application: For those interested in purchasing or refinancing a home in Tempe, a mortgage loan application is essential. It involves a detailed assessment of the borrower's financial background, credit history, and property evaluation to determine eligibility and loan terms. To begin the Tempe, Arizona consumer loan application process, individuals should gather relevant documentation, including identification proof, employment details, income statements, credit score reports, and any other supporting documents requested by the lender. Once the necessary paperwork is ready, applicants can either visit local banking institutions, credit unions, or utilize online platforms to initiate the loan application. The lender will review the application, conduct a thorough credit check, and assess the applicant's financial suitability. Depending on the loan type, approval may involve collateral evaluation, verification of supporting documents, and creditworthiness analysis. Once approved, the borrower will receive the loan amount, either as a lump sum or in installment payments, depending on the loan terms. In conclusion, Tempe, Arizona consumer loan applications encompass various financing options tailored to meet the diverse financial needs of residents. With different loan types available, borrowers can choose the one that aligns with their requirements and financial situation. It's crucial to provide accurate documentation and information during the application process to increase the chances of approval.Tempe, Arizona Consumer Loan Application: A Detailed Description If you are a resident of Tempe, Arizona, and in need of financial assistance, a consumer loan may be an ideal solution. A Tempe consumer loan is a type of financing tailored to meet personal expenses, such as purchasing a car, consolidating debt, paying for educational expenses, or covering unexpected medical bills. This loan application process aims to provide residents with a stress-free experience while securing the funds needed. Multiple types of consumer loan applications are available to Tempe residents, each designed to cater to different financial needs. Some common types include: 1. Personal Loan Application: This type of loan can be used for a wide range of purposes, such as funding a dream vacation, wedding expenses, or home renovations. It typically offers flexible repayment options and can be either secured or unsecured, depending on the lender's requirements. 2. Auto Loan Application: Suitable for individuals interested in buying a car, an auto loan application enables you to finance your vehicle purchase. Potential borrowers can access competitive interest rates and repayment terms based on factors like credit score, down payment, and the car's value. 3. Student Loan Application: Geared towards students pursuing higher education, a student loan application assists with financing tuition fees, textbooks, and other educational expenses. Tempe offers various student loan options, including federal loans, private loans, and loans specifically designed for parents. 4. Payday Loan Application: Intended for individuals facing short-term financial emergencies, a payday loan application lets borrowers access quick cash to cover immediate expenses. Typically, these loans have high-interest rates and must be repaid by the borrower's next payday. 5. Mortgage Loan Application: For those interested in purchasing or refinancing a home in Tempe, a mortgage loan application is essential. It involves a detailed assessment of the borrower's financial background, credit history, and property evaluation to determine eligibility and loan terms. To begin the Tempe, Arizona consumer loan application process, individuals should gather relevant documentation, including identification proof, employment details, income statements, credit score reports, and any other supporting documents requested by the lender. Once the necessary paperwork is ready, applicants can either visit local banking institutions, credit unions, or utilize online platforms to initiate the loan application. The lender will review the application, conduct a thorough credit check, and assess the applicant's financial suitability. Depending on the loan type, approval may involve collateral evaluation, verification of supporting documents, and creditworthiness analysis. Once approved, the borrower will receive the loan amount, either as a lump sum or in installment payments, depending on the loan terms. In conclusion, Tempe, Arizona consumer loan applications encompass various financing options tailored to meet the diverse financial needs of residents. With different loan types available, borrowers can choose the one that aligns with their requirements and financial situation. It's crucial to provide accurate documentation and information during the application process to increase the chances of approval.