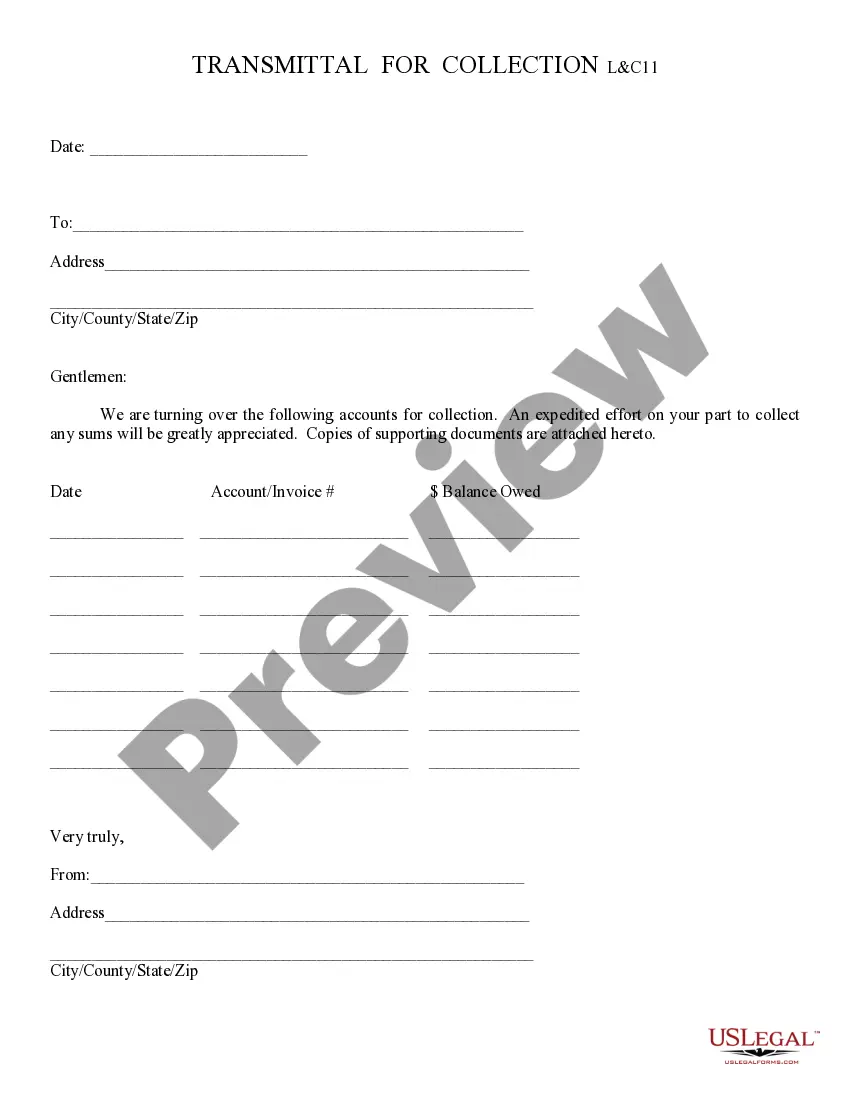

Transmittal for Collection: A Transmittal for Collection is used when a business, of any type, has not been able to collect on an account. After attempts for collection have failed, the business can enlist the help of a collections agency to follow-up with the Debtor. This form is available for download in both Word and Rich Text formats.

Surprise Arizona Transmittal for Collection is an official process in which the city of Surprise collects various fees, fines, taxes, and payments from businesses, organizations, and individuals. It serves as a means to ensure compliance with local regulations and timely remittance of funds to the city. The Surprise Arizona Transmittal for Collection encompasses different types of collections, each with its own distinct purpose. These can include: 1. Business licensing fees: Any business operating within the city limits of Surprise is typically required to obtain a business license. The transmittal process ensures that businesses submit their licensing fees promptly, allowing the city to maintain accurate records and support local economic growth. 2. Sales tax remittance: Businesses that make taxable sales within Surprise are obligated to collect and remit sales tax to the city. The Surprise Arizona Transmittal for Collection ensures that businesses accurately report their sales and remit the appropriate tax amounts, enabling the city to fund public services, infrastructure development, and community initiatives. 3. Utility payments: The transmittal process may also involve the collection of utility payments from residents or businesses within Surprise. These payments typically cover services such as water, sewer, trash, and electricity. The timely remittance of these payments ensures the uninterrupted provision of essential utility services. 4. Permit fees: Various types of permits, such as building permits, planning permits, and development permits, may be subject to the Surprise Arizona Transmittal for Collection. These fees contribute to the oversight, regulation, and maintenance of the city's physical structures, land use, and ongoing development. 5. Penalty fines: In cases where businesses or individuals violate city ordinances, codes, or regulations, penalty fines may be imposed. The Surprise Arizona Transmittal for Collection allows for the collection of these fines, acting as both a deterrent for non-compliance and a means to fund municipal services and projects. It is important for businesses, organizations, and individuals within Surprise to understand the different types of Surprise Arizona Transmittal for Collection and fulfill their financial obligations promptly. Failure to comply with the transmittal requirements may result in penalties, legal consequences, or disruption of services. By adhering to the transmittal process, entities contribute to the overall well-being of Surprise, supporting its growth, prosperity, and the quality of life for its residents.Surprise Arizona Transmittal for Collection is an official process in which the city of Surprise collects various fees, fines, taxes, and payments from businesses, organizations, and individuals. It serves as a means to ensure compliance with local regulations and timely remittance of funds to the city. The Surprise Arizona Transmittal for Collection encompasses different types of collections, each with its own distinct purpose. These can include: 1. Business licensing fees: Any business operating within the city limits of Surprise is typically required to obtain a business license. The transmittal process ensures that businesses submit their licensing fees promptly, allowing the city to maintain accurate records and support local economic growth. 2. Sales tax remittance: Businesses that make taxable sales within Surprise are obligated to collect and remit sales tax to the city. The Surprise Arizona Transmittal for Collection ensures that businesses accurately report their sales and remit the appropriate tax amounts, enabling the city to fund public services, infrastructure development, and community initiatives. 3. Utility payments: The transmittal process may also involve the collection of utility payments from residents or businesses within Surprise. These payments typically cover services such as water, sewer, trash, and electricity. The timely remittance of these payments ensures the uninterrupted provision of essential utility services. 4. Permit fees: Various types of permits, such as building permits, planning permits, and development permits, may be subject to the Surprise Arizona Transmittal for Collection. These fees contribute to the oversight, regulation, and maintenance of the city's physical structures, land use, and ongoing development. 5. Penalty fines: In cases where businesses or individuals violate city ordinances, codes, or regulations, penalty fines may be imposed. The Surprise Arizona Transmittal for Collection allows for the collection of these fines, acting as both a deterrent for non-compliance and a means to fund municipal services and projects. It is important for businesses, organizations, and individuals within Surprise to understand the different types of Surprise Arizona Transmittal for Collection and fulfill their financial obligations promptly. Failure to comply with the transmittal requirements may result in penalties, legal consequences, or disruption of services. By adhering to the transmittal process, entities contribute to the overall well-being of Surprise, supporting its growth, prosperity, and the quality of life for its residents.