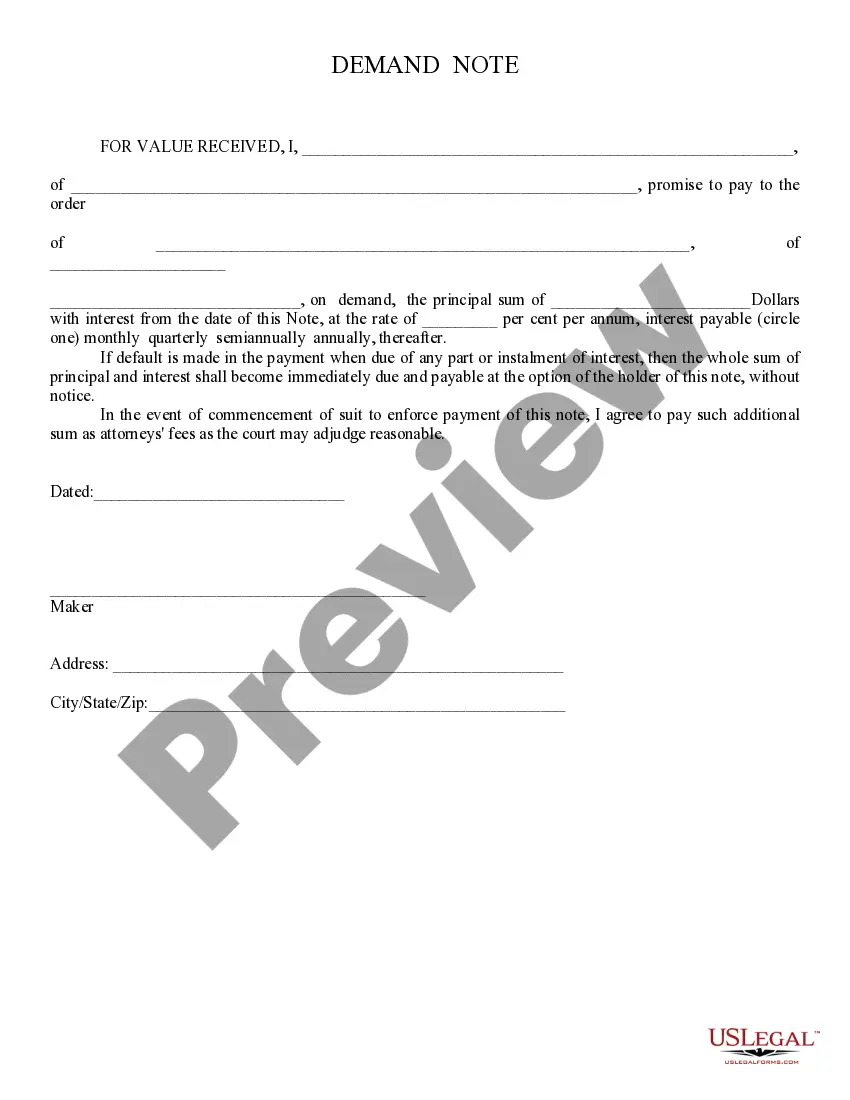

Demand Note: A Demand Note is signed by both the Borrower and the Lender. The note details and explains that if the Borrower misses any payments, the Lender can ask that he/she pay the entire amount, with interest, without prior warning. This form is available for download in both Word and Rich Text formats.

A Maricopa Arizona Demand Note is a legal document that serves as evidence of debt owed by one party, referred to as the "issuer," to another party, commonly known as the "payee." This financial instrument is widely used in Maricopa, Arizona, and serves as a means to borrow funds for various purposes. Demand notes are typically short-term loans that have no fixed maturity date but can be called in for repayment by the payee at any time, hence the term "demand." The Maricopa Arizona Demand Note is a flexible financial tool that allows individuals, businesses, or organizations to access immediate capital by borrowing funds from another party. These notes are typically unsecured, meaning they do not require collateral, making them an attractive option for borrowers who may not have assets to pledge as security. The Maricopa Arizona Demand Note may vary in terms and conditions, interest rates, and repayment terms, depending on the parties involved and the nature of the borrowing arrangement. It is crucial for both the issuer and the payee to establish mutually agreed-upon terms before executing the note to avoid any misunderstandings or disputes in the future. Different types of Maricopa Arizona Demand Notes may include: 1. Personal Demand Note: This refers to a loan between individuals, often family members or friends, where one party borrows money from another on a non-commercial basis. 2. Business Demand Note: This type of demand note is utilized by businesses to obtain short-term financing for operational needs, such as inventory purchase, payroll expenses, or equipment acquisition. 3. Promissory Demand Note: This variation of the Maricopa Arizona Demand Note includes a promissory clause that outlines specific terms and conditions, such as interest rate, repayment schedule, and penalties for non-compliance. 4. Demand Note for Real Estate Transactions: In real estate transactions, parties may use demand notes as a way to secure immediate funding for property purchases or construction projects, with the intention of obtaining long-term financing later on. In conclusion, a Maricopa Arizona Demand Note is a legally binding document that facilitates short-term borrowing between parties in Maricopa, Arizona. It offers flexibility and quick access to funds for various purposes, with different types of demand notes available to cater to specific requirements and circumstances.A Maricopa Arizona Demand Note is a legal document that serves as evidence of debt owed by one party, referred to as the "issuer," to another party, commonly known as the "payee." This financial instrument is widely used in Maricopa, Arizona, and serves as a means to borrow funds for various purposes. Demand notes are typically short-term loans that have no fixed maturity date but can be called in for repayment by the payee at any time, hence the term "demand." The Maricopa Arizona Demand Note is a flexible financial tool that allows individuals, businesses, or organizations to access immediate capital by borrowing funds from another party. These notes are typically unsecured, meaning they do not require collateral, making them an attractive option for borrowers who may not have assets to pledge as security. The Maricopa Arizona Demand Note may vary in terms and conditions, interest rates, and repayment terms, depending on the parties involved and the nature of the borrowing arrangement. It is crucial for both the issuer and the payee to establish mutually agreed-upon terms before executing the note to avoid any misunderstandings or disputes in the future. Different types of Maricopa Arizona Demand Notes may include: 1. Personal Demand Note: This refers to a loan between individuals, often family members or friends, where one party borrows money from another on a non-commercial basis. 2. Business Demand Note: This type of demand note is utilized by businesses to obtain short-term financing for operational needs, such as inventory purchase, payroll expenses, or equipment acquisition. 3. Promissory Demand Note: This variation of the Maricopa Arizona Demand Note includes a promissory clause that outlines specific terms and conditions, such as interest rate, repayment schedule, and penalties for non-compliance. 4. Demand Note for Real Estate Transactions: In real estate transactions, parties may use demand notes as a way to secure immediate funding for property purchases or construction projects, with the intention of obtaining long-term financing later on. In conclusion, a Maricopa Arizona Demand Note is a legally binding document that facilitates short-term borrowing between parties in Maricopa, Arizona. It offers flexibility and quick access to funds for various purposes, with different types of demand notes available to cater to specific requirements and circumstances.