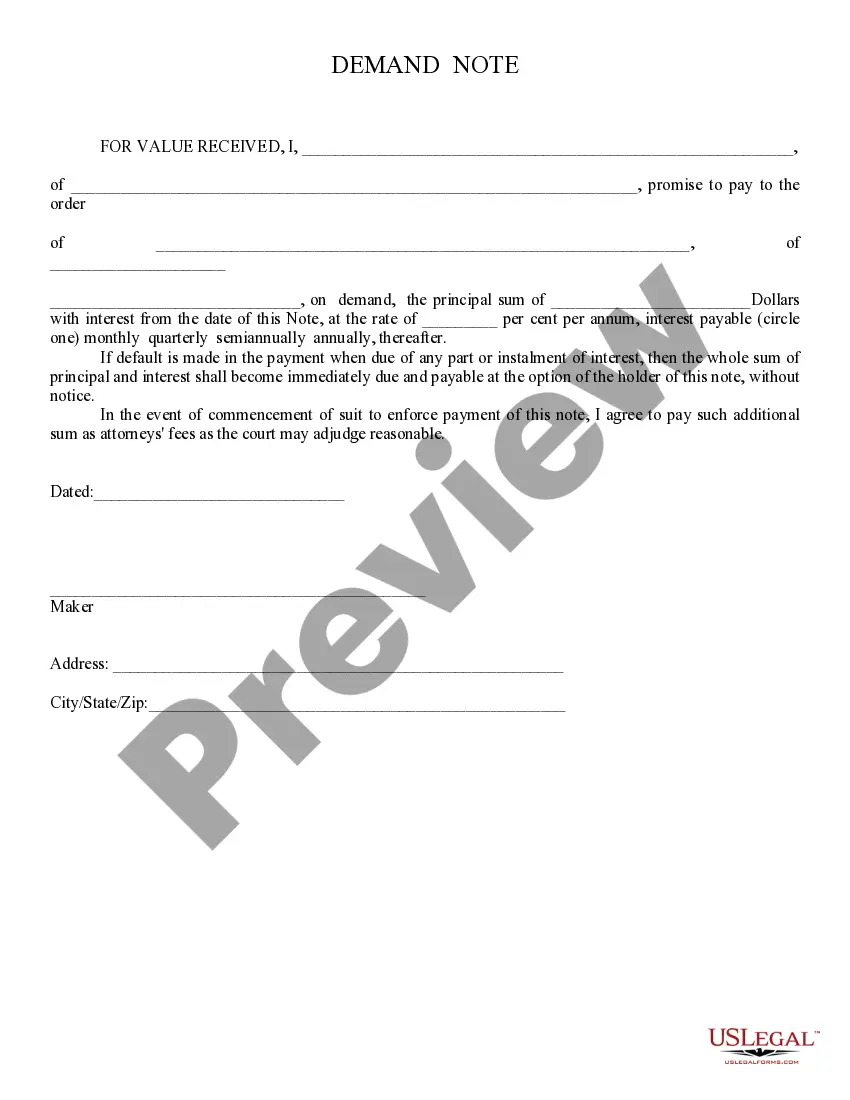

Demand Note: A Demand Note is signed by both the Borrower and the Lender. The note details and explains that if the Borrower misses any payments, the Lender can ask that he/she pay the entire amount, with interest, without prior warning. This form is available for download in both Word and Rich Text formats.

The Lima Arizona Demand Note is a financial instrument that offers investors the opportunity to invest in the Lima area of Arizona. This note allows individuals or institutions to lend funds to borrowers in the Lima region and earn interest on their investment. The Lima Arizona Demand Note is considered a flexible investment option as it allows lenders to request repayment of their principal balance and accrued interest whenever they desire. This feature makes it a convenient choice for those who require immediate access to their funds or those who prefer short-term lending arrangements. Investing in a Lima Arizona Demand Note means that lenders will be providing funds to various borrowers located in the Lima area. These borrowers can be individuals, small businesses, or other entities seeking financial assistance for a variety of purposes. Some common reasons borrowers may seek a Lima Arizona Demand Note include funding for business expansion, home renovations, education expenses, or financing other personal ventures. While there may not be specific types of Lima Arizona Demand Notes, the terms and conditions of the note can vary based on various factors. These factors include the amount of investment, interest rates, repayment terms, and qualifications for borrowers. Investors in Lima Arizona Demand Notes can expect to receive a competitive interest rate on their investment, which rewards them for providing essential financial support to borrowers within the Lima area. The interest earned on the note can be a reliable source of passive income, making it an appealing option for those looking to diversify their investment portfolio. In conclusion, the Lima Arizona Demand Note serves as a flexible and lucrative investment opportunity in the region. By providing funds to borrowers in Lima, investors can earn competitive interest rates while contributing to the growth and development of individuals, small businesses, and the local economy.The Lima Arizona Demand Note is a financial instrument that offers investors the opportunity to invest in the Lima area of Arizona. This note allows individuals or institutions to lend funds to borrowers in the Lima region and earn interest on their investment. The Lima Arizona Demand Note is considered a flexible investment option as it allows lenders to request repayment of their principal balance and accrued interest whenever they desire. This feature makes it a convenient choice for those who require immediate access to their funds or those who prefer short-term lending arrangements. Investing in a Lima Arizona Demand Note means that lenders will be providing funds to various borrowers located in the Lima area. These borrowers can be individuals, small businesses, or other entities seeking financial assistance for a variety of purposes. Some common reasons borrowers may seek a Lima Arizona Demand Note include funding for business expansion, home renovations, education expenses, or financing other personal ventures. While there may not be specific types of Lima Arizona Demand Notes, the terms and conditions of the note can vary based on various factors. These factors include the amount of investment, interest rates, repayment terms, and qualifications for borrowers. Investors in Lima Arizona Demand Notes can expect to receive a competitive interest rate on their investment, which rewards them for providing essential financial support to borrowers within the Lima area. The interest earned on the note can be a reliable source of passive income, making it an appealing option for those looking to diversify their investment portfolio. In conclusion, the Lima Arizona Demand Note serves as a flexible and lucrative investment opportunity in the region. By providing funds to borrowers in Lima, investors can earn competitive interest rates while contributing to the growth and development of individuals, small businesses, and the local economy.