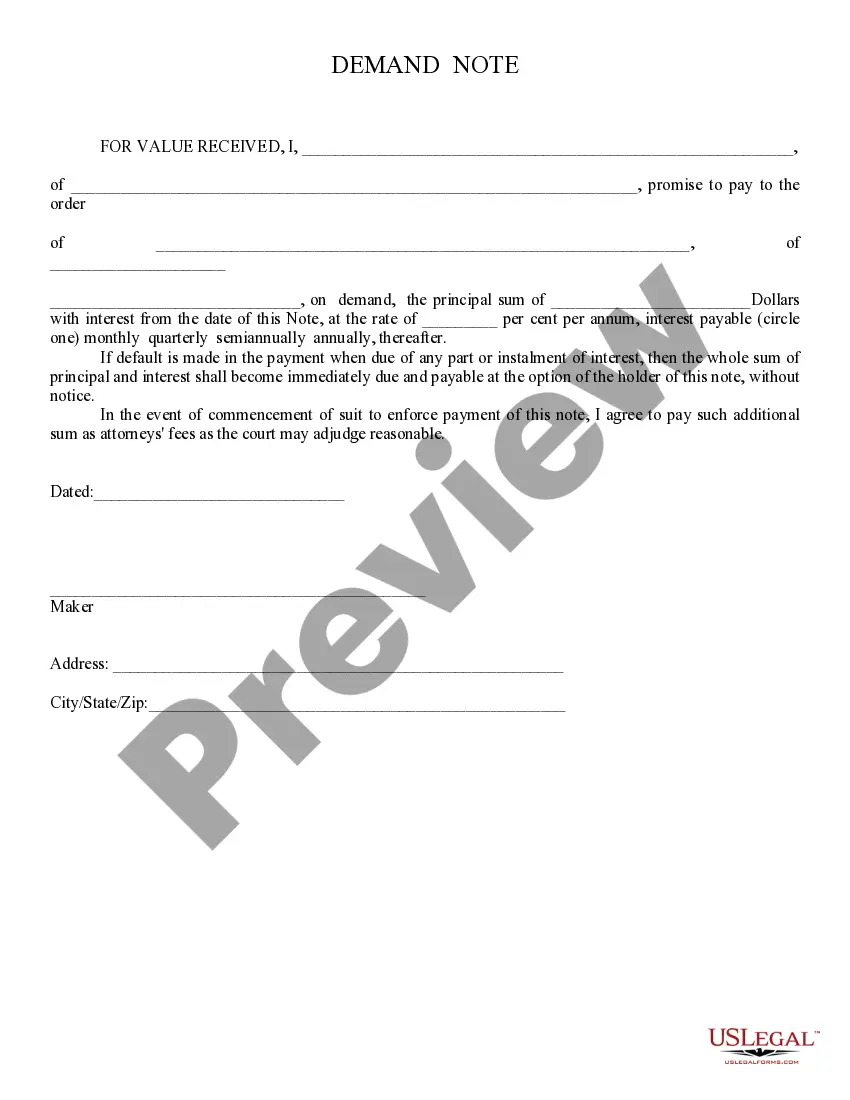

Demand Note: A Demand Note is signed by both the Borrower and the Lender. The note details and explains that if the Borrower misses any payments, the Lender can ask that he/she pay the entire amount, with interest, without prior warning. This form is available for download in both Word and Rich Text formats.

A Surprise Arizona Demand Note is a financial instrument that represents a loan made by an individual or entity to the city of Surprise in Arizona. This type of note is typically issued by the city to raise funds for various purposes, such as infrastructure improvements, public services, or economic development projects. It is considered a demand note because the city is required to repay the loan upon the demand of the lender. The Surprise Arizona Demand Note carries a fixed interest rate, which is agreed upon between the city and the lender at the time of issuance. The interest rate is usually determined based on prevailing market conditions and the creditworthiness of the city. The note may have a fixed maturity date or may be repayable on demand, depending on the terms negotiated between the parties involved. One of the main advantages of investing in a Surprise Arizona Demand Note is that it offers a potentially attractive rate of return compared to other investment options. Moreover, investing in municipal bonds like demand notes can provide tax advantages, as the interest earned on these bonds is often exempt from federal and state income taxes. It is worth mentioning that Surprise Arizona may have different types of Demand Notes based on the specific purpose of the loan or the source of repayment. For instance, the city might issue a General Obligation Demand Note (GOD) to finance public works projects that are backed by the full faith and credit of the city. Another type could be a Revenue Demand Note (RUN), which is repaid from the revenue generated by a specific project, such as a new toll road or a sports facility. Overall, a Surprise Arizona Demand Note can be an attractive investment option for individuals or entities looking to support the development and growth of the city while earning a competitive return on their investment. However, potential investors should carefully review the terms and conditions of the note and consider consulting with a financial advisor to assess the risks and rewards associated with this type of investment.A Surprise Arizona Demand Note is a financial instrument that represents a loan made by an individual or entity to the city of Surprise in Arizona. This type of note is typically issued by the city to raise funds for various purposes, such as infrastructure improvements, public services, or economic development projects. It is considered a demand note because the city is required to repay the loan upon the demand of the lender. The Surprise Arizona Demand Note carries a fixed interest rate, which is agreed upon between the city and the lender at the time of issuance. The interest rate is usually determined based on prevailing market conditions and the creditworthiness of the city. The note may have a fixed maturity date or may be repayable on demand, depending on the terms negotiated between the parties involved. One of the main advantages of investing in a Surprise Arizona Demand Note is that it offers a potentially attractive rate of return compared to other investment options. Moreover, investing in municipal bonds like demand notes can provide tax advantages, as the interest earned on these bonds is often exempt from federal and state income taxes. It is worth mentioning that Surprise Arizona may have different types of Demand Notes based on the specific purpose of the loan or the source of repayment. For instance, the city might issue a General Obligation Demand Note (GOD) to finance public works projects that are backed by the full faith and credit of the city. Another type could be a Revenue Demand Note (RUN), which is repaid from the revenue generated by a specific project, such as a new toll road or a sports facility. Overall, a Surprise Arizona Demand Note can be an attractive investment option for individuals or entities looking to support the development and growth of the city while earning a competitive return on their investment. However, potential investors should carefully review the terms and conditions of the note and consider consulting with a financial advisor to assess the risks and rewards associated with this type of investment.