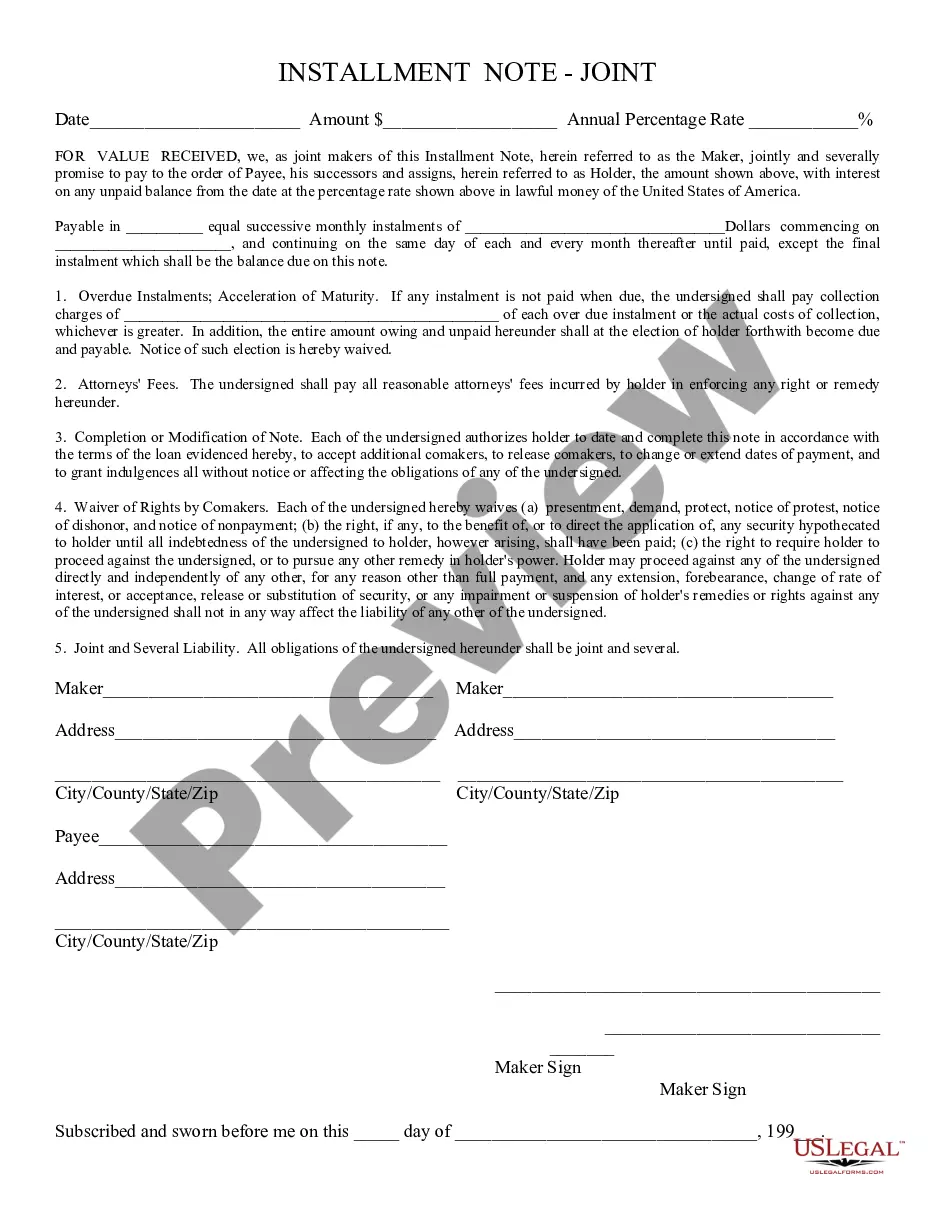

Installment Note - Joint: An Installment Note simply devises a schedule for payment on either a monthly, quartlerly, etc., basis. If at any time the Payor does not make a payment as scheduled, the Note will become immediately due in its entirety, along with any interest accrued. This form is available for download in both Word and Rich Text formats.

In Scottsdale, Arizona, an installment note joint is a type of legal agreement commonly used in financing options for purchasing real estate properties. It involves two or more individuals sharing the responsibility to make regular payments towards the loan amount, typically disbursed by a lending institution or seller. The Scottsdale Arizona Installment Note Joint may have different types, including: 1. Traditional Installment Note Joint: This type of joint installment note commonly involves two individuals, such as a couple or business partners, agreeing to jointly finance and make payments towards a property loan. Both parties are equally liable for the debt and share ownership rights and responsibilities. 2. Fractionalized Installment Note Joint: In this type of joint installment note, multiple individuals, often unrelated, come together to collectively fund the purchase of a property. Each individual contributes a specific percentage towards the loan, and their ownership share directly corresponds to their investment. Fractionalized installment note joint arrangements are common in real estate investments and allow individuals to pool their resources for larger transactions. 3. Tenant-In-Common Installment Note Joint: This type of joint installment note structure is commonly used by individuals or entities who wish to purchase a property together but maintain separate ownership interests. Each tenant-in-common holds a distinct share of ownership, which can vary in percentage. The installment note joint agreement specifies the payment responsibility of each tenant-in-common towards the loan. 4. Installment Note Joint with Guarantor: In certain cases, where one or more individuals do not meet the lender's credit requirements or financial criteria, a guarantor may be included in the installment note joint agreement. The guarantor assumes the responsibility of making loan payments should one or more parties default. This arrangement provides additional financial security for the lending institution and may improve the chances of loan approval. When employing any type of Scottsdale Arizona Installment Note Joint, it is crucial for all parties involved to understand the terms and conditions, payment obligations, interest rates, and the consequences of defaulting on payments. Consideration should also be given to consulting legal professionals to ensure compliance with local laws and regulations that may vary.In Scottsdale, Arizona, an installment note joint is a type of legal agreement commonly used in financing options for purchasing real estate properties. It involves two or more individuals sharing the responsibility to make regular payments towards the loan amount, typically disbursed by a lending institution or seller. The Scottsdale Arizona Installment Note Joint may have different types, including: 1. Traditional Installment Note Joint: This type of joint installment note commonly involves two individuals, such as a couple or business partners, agreeing to jointly finance and make payments towards a property loan. Both parties are equally liable for the debt and share ownership rights and responsibilities. 2. Fractionalized Installment Note Joint: In this type of joint installment note, multiple individuals, often unrelated, come together to collectively fund the purchase of a property. Each individual contributes a specific percentage towards the loan, and their ownership share directly corresponds to their investment. Fractionalized installment note joint arrangements are common in real estate investments and allow individuals to pool their resources for larger transactions. 3. Tenant-In-Common Installment Note Joint: This type of joint installment note structure is commonly used by individuals or entities who wish to purchase a property together but maintain separate ownership interests. Each tenant-in-common holds a distinct share of ownership, which can vary in percentage. The installment note joint agreement specifies the payment responsibility of each tenant-in-common towards the loan. 4. Installment Note Joint with Guarantor: In certain cases, where one or more individuals do not meet the lender's credit requirements or financial criteria, a guarantor may be included in the installment note joint agreement. The guarantor assumes the responsibility of making loan payments should one or more parties default. This arrangement provides additional financial security for the lending institution and may improve the chances of loan approval. When employing any type of Scottsdale Arizona Installment Note Joint, it is crucial for all parties involved to understand the terms and conditions, payment obligations, interest rates, and the consequences of defaulting on payments. Consideration should also be given to consulting legal professionals to ensure compliance with local laws and regulations that may vary.