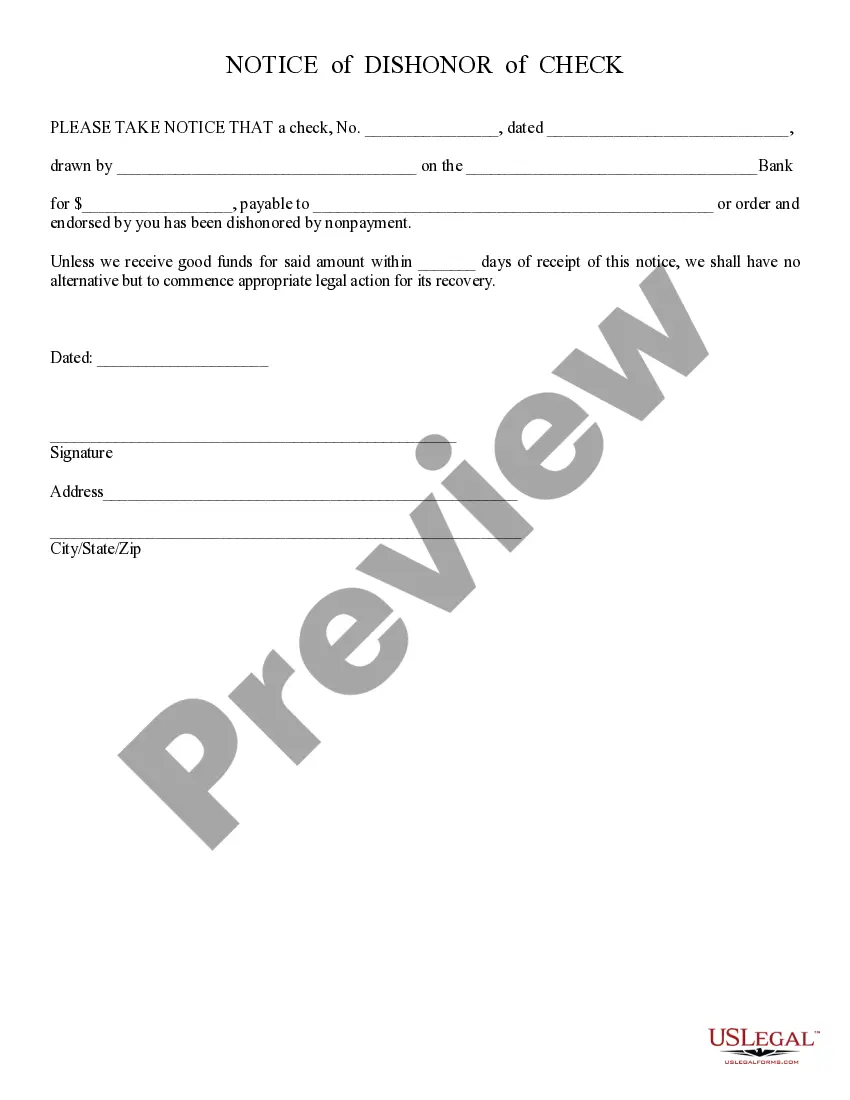

Dishonor Check: This Dishonored Check form serves as notice to the writer of the check: funds were insufficient. In addition, unless payment is made in full within a certain number of days, a lawsuit will be filed against him/her. This form is available for download in both Word and Rich Text formats.

The term "Phoenix Arizona Dishonor Check" refers to a legal document or check issued by a person located in Phoenix, Arizona that has been dishonored for various reasons. When a check is dishonored, it means that the financial institution responsible for processing the check has refused to honor the payment due to insufficient funds, a closed account, or other reasons. In the context of Phoenix, Arizona, dishonor checks may be categorized into different types based on the specific circumstances of their dishonor: 1. Insufficient Funds Check: This type occurs when the check writer does not have enough money in their account to cover the amount written on the check. The financial institution then refuses to honor the payment and returns the check to the recipient as dishonored. 2. Closed Account Check: If the account from which the check was drawn has been closed, the check will be considered dishonored. This usually happens when the account holder closes their account without notifying the payee, leading to the financial institution rejecting the payment. 3. Stop Payment Check: A stop payment order is a request made by the check writer to their bank, instructing them not to honor a specific check. If a stop payment order is placed and the recipient attempts to deposit or cash the check, it will be dishonored. 4. Forgery Check: Dishonor checks can also occur when a check has been forged or altered. If the bank or the account holder discovers that a check has been tampered with or is unauthorized, it will be dishonored. When a dishonor check is received in Phoenix, Arizona, the recipient usually receives notification from their bank informing them of the dishonor, along with the reason for dishonor. In many cases, fees are charged by the bank to the recipient for processing the dishonor check. In conclusion, Phoenix Arizona Dishonor Checks are checks issued in Phoenix, Arizona, that have been dishonored by financial institutions due to insufficient funds, closed accounts, stop payment orders, or forgery. Understanding the different types of dishonor checks can help individuals and businesses navigate the legal and financial implications associated with them.The term "Phoenix Arizona Dishonor Check" refers to a legal document or check issued by a person located in Phoenix, Arizona that has been dishonored for various reasons. When a check is dishonored, it means that the financial institution responsible for processing the check has refused to honor the payment due to insufficient funds, a closed account, or other reasons. In the context of Phoenix, Arizona, dishonor checks may be categorized into different types based on the specific circumstances of their dishonor: 1. Insufficient Funds Check: This type occurs when the check writer does not have enough money in their account to cover the amount written on the check. The financial institution then refuses to honor the payment and returns the check to the recipient as dishonored. 2. Closed Account Check: If the account from which the check was drawn has been closed, the check will be considered dishonored. This usually happens when the account holder closes their account without notifying the payee, leading to the financial institution rejecting the payment. 3. Stop Payment Check: A stop payment order is a request made by the check writer to their bank, instructing them not to honor a specific check. If a stop payment order is placed and the recipient attempts to deposit or cash the check, it will be dishonored. 4. Forgery Check: Dishonor checks can also occur when a check has been forged or altered. If the bank or the account holder discovers that a check has been tampered with or is unauthorized, it will be dishonored. When a dishonor check is received in Phoenix, Arizona, the recipient usually receives notification from their bank informing them of the dishonor, along with the reason for dishonor. In many cases, fees are charged by the bank to the recipient for processing the dishonor check. In conclusion, Phoenix Arizona Dishonor Checks are checks issued in Phoenix, Arizona, that have been dishonored by financial institutions due to insufficient funds, closed accounts, stop payment orders, or forgery. Understanding the different types of dishonor checks can help individuals and businesses navigate the legal and financial implications associated with them.