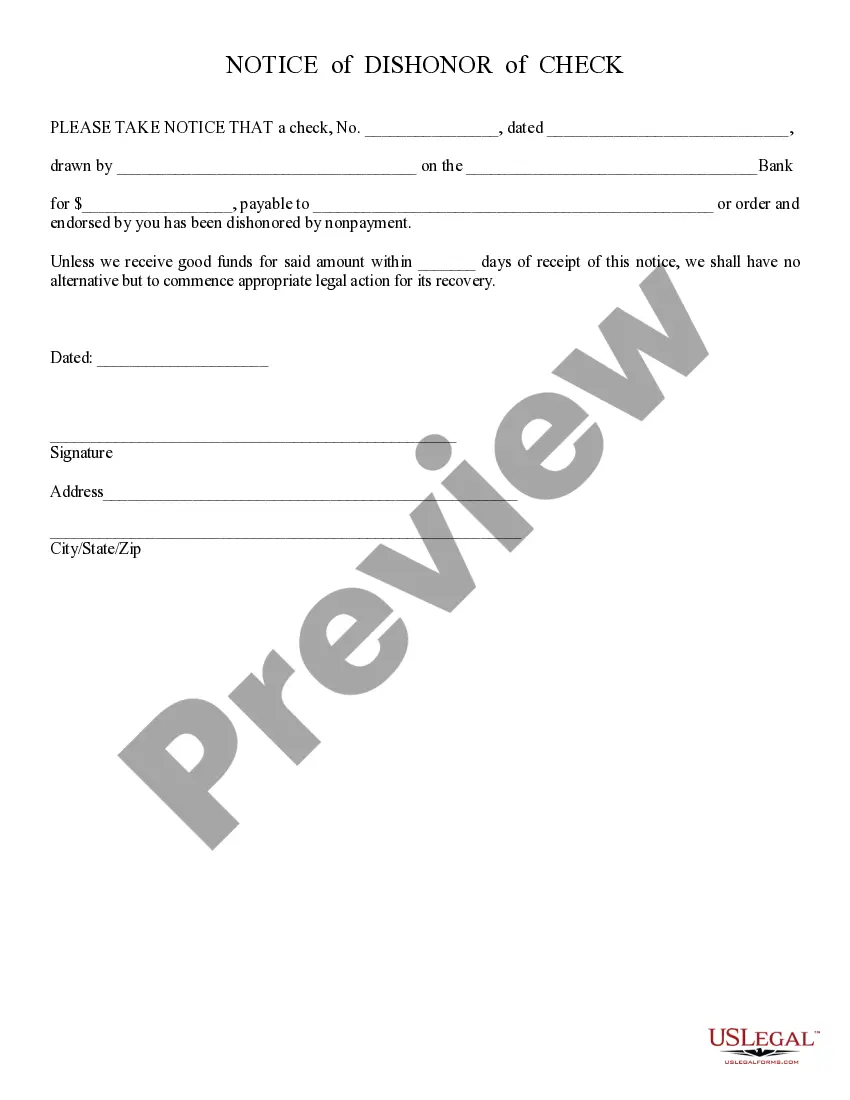

Dishonor Check: This Dishonored Check form serves as notice to the writer of the check: funds were insufficient. In addition, unless payment is made in full within a certain number of days, a lawsuit will be filed against him/her. This form is available for download in both Word and Rich Text formats.

Tempe Arizona Dishonor Check refers to a financial process aimed at detecting and resolving dishonored or bounced checks in the city of Tempe, located in Arizona. Dishonor checks occur when a payer's check is returned due to insufficient funds in their account, an account closure, or any other reason that results in the check not being honored by the bank. This state-specific dishonor check system in Tempe, Arizona helps businesses and individuals protect themselves from accepting bad checks as payment. It is a legal process that enables recipients of dishonored checks to take appropriate action to recover the amount owed to them. The main purpose of Tempe Arizona Dishonor Check is to provide a legal framework and assistance for those who have been affected by dishonored checks, ensuring that they have a means to seek compensation. This process also acts as a deterrent for potential check fraudsters by imposing consequences for issuing dishonored checks. Types of Tempe Arizona Dishonor Check: 1. Non-sufficient funds (NSF) checks: These are checks that are returned by the bank due to lack of sufficient funds in the payer's account to cover the check amount. 2. Account closure checks: These checks are bounced because the payer's bank account has been closed before the recipient attempts to deposit or cash the check. 3. Stolen or fraudulent checks: Dishonor checks can also result from stolen checks or checks that have been forged or altered, leading to their rejection by the bank when presented for payment. 4. Post-dated checks: Dishonored checks can occur when the payer writes a post-dated check, which means the recipient cannot deposit or cash the check until the specified future date. If the check is presented earlier or the payer has insufficient funds on the indicated date, it will be dishonored. 5. Counterfeit checks: Dishonor checks may arise if a recipient accepts a counterfeit check unknowingly and tries to deposit it, only to discover later that it is not genuine. Tempe Arizona Dishonor Check helps victims of dishonored checks by providing legal assistance and a mechanism for pursuing repayment. Through this system, individuals and businesses in Tempe can take action to recover funds owed to them, promoting financial stability within the community and discouraging fraudulent check activities.Tempe Arizona Dishonor Check refers to a financial process aimed at detecting and resolving dishonored or bounced checks in the city of Tempe, located in Arizona. Dishonor checks occur when a payer's check is returned due to insufficient funds in their account, an account closure, or any other reason that results in the check not being honored by the bank. This state-specific dishonor check system in Tempe, Arizona helps businesses and individuals protect themselves from accepting bad checks as payment. It is a legal process that enables recipients of dishonored checks to take appropriate action to recover the amount owed to them. The main purpose of Tempe Arizona Dishonor Check is to provide a legal framework and assistance for those who have been affected by dishonored checks, ensuring that they have a means to seek compensation. This process also acts as a deterrent for potential check fraudsters by imposing consequences for issuing dishonored checks. Types of Tempe Arizona Dishonor Check: 1. Non-sufficient funds (NSF) checks: These are checks that are returned by the bank due to lack of sufficient funds in the payer's account to cover the check amount. 2. Account closure checks: These checks are bounced because the payer's bank account has been closed before the recipient attempts to deposit or cash the check. 3. Stolen or fraudulent checks: Dishonor checks can also result from stolen checks or checks that have been forged or altered, leading to their rejection by the bank when presented for payment. 4. Post-dated checks: Dishonored checks can occur when the payer writes a post-dated check, which means the recipient cannot deposit or cash the check until the specified future date. If the check is presented earlier or the payer has insufficient funds on the indicated date, it will be dishonored. 5. Counterfeit checks: Dishonor checks may arise if a recipient accepts a counterfeit check unknowingly and tries to deposit it, only to discover later that it is not genuine. Tempe Arizona Dishonor Check helps victims of dishonored checks by providing legal assistance and a mechanism for pursuing repayment. Through this system, individuals and businesses in Tempe can take action to recover funds owed to them, promoting financial stability within the community and discouraging fraudulent check activities.