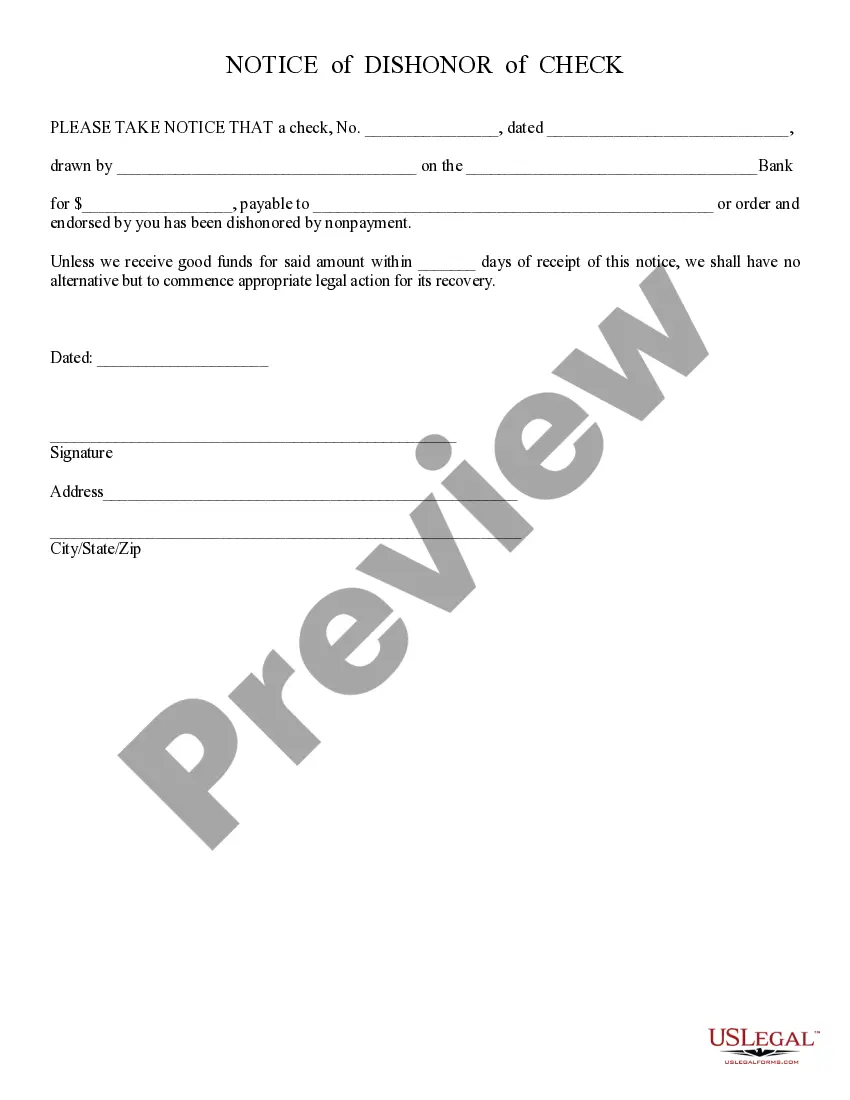

Dishonor Check: This Dishonored Check form serves as notice to the writer of the check: funds were insufficient. In addition, unless payment is made in full within a certain number of days, a lawsuit will be filed against him/her. This form is available for download in both Word and Rich Text formats.

Tucson Arizona Dishonor Check refers to a legal term used in the state of Arizona to describe cases where a check is returned by a bank due to insufficient funds or other related reasons. In simpler terms, it is when a check written by an individual or organization in Tucson, Arizona bounces or is not honored by the bank. This situation can occur when the person or entity who wrote the check does not have enough money in their account to cover the amount written on the check. In Tucson, Arizona, there are different types of dishonor checks, including: 1. NSF Dishonor Check: NSF stands for "non-sufficient funds," and it is one of the most common reasons for a check to be dishonored. This occurs when the account holder does not have enough money in their account to cover the check amount. 2. Closed Account Dishonor Check: This type of dishonor check happens when the check issuer has closed their bank account before the recipient has had a chance to deposit or cash the check. As a result, the bank cannot honor the check since the account has been closed. 3. Stop Payment Dishonor Check: A stop payment can be placed on a check by the account holder to prevent it from being cashed or deposited. If the recipient attempts to cash or deposit the check after a stop payment has been requested, it will be dishonored by the bank. 4. Alteration Dishonor Check: In some cases, individuals may try to alter the details of a check, such as the payee or the amount, in an attempt to deceive the recipient or defraud the bank. If these alterations are detected, the check will be dishonored. It is important to note that dishonored checks can have legal consequences in Tucson, Arizona. The person or entity who wrote the dishonored check may be subject to penalties, including paying additional fees and even facing criminal charges in certain cases. If you have received a Tucson Arizona Dishonor Check, it is advisable to consult with a legal professional who specializes in banking and financial matters to understand your rights and options.Tucson Arizona Dishonor Check refers to a legal term used in the state of Arizona to describe cases where a check is returned by a bank due to insufficient funds or other related reasons. In simpler terms, it is when a check written by an individual or organization in Tucson, Arizona bounces or is not honored by the bank. This situation can occur when the person or entity who wrote the check does not have enough money in their account to cover the amount written on the check. In Tucson, Arizona, there are different types of dishonor checks, including: 1. NSF Dishonor Check: NSF stands for "non-sufficient funds," and it is one of the most common reasons for a check to be dishonored. This occurs when the account holder does not have enough money in their account to cover the check amount. 2. Closed Account Dishonor Check: This type of dishonor check happens when the check issuer has closed their bank account before the recipient has had a chance to deposit or cash the check. As a result, the bank cannot honor the check since the account has been closed. 3. Stop Payment Dishonor Check: A stop payment can be placed on a check by the account holder to prevent it from being cashed or deposited. If the recipient attempts to cash or deposit the check after a stop payment has been requested, it will be dishonored by the bank. 4. Alteration Dishonor Check: In some cases, individuals may try to alter the details of a check, such as the payee or the amount, in an attempt to deceive the recipient or defraud the bank. If these alterations are detected, the check will be dishonored. It is important to note that dishonored checks can have legal consequences in Tucson, Arizona. The person or entity who wrote the dishonored check may be subject to penalties, including paying additional fees and even facing criminal charges in certain cases. If you have received a Tucson Arizona Dishonor Check, it is advisable to consult with a legal professional who specializes in banking and financial matters to understand your rights and options.