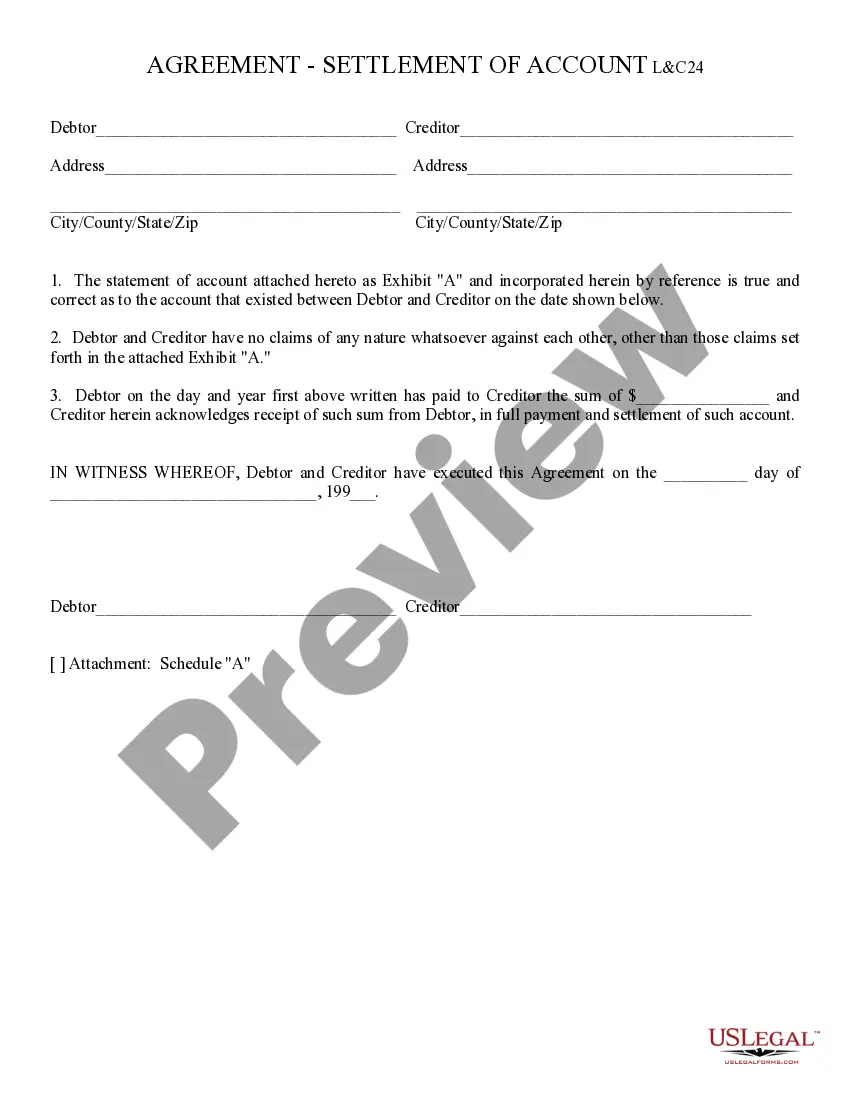

Settlement of Account: A Settlement of Account states that the Buyer and Seller previously had entered into a contract with one another; however, that contract has been fulfilled by both parties. Therefore, this a Statement that the account is settled and no other obligations are to be performed by either party. This form is available for download in both Word and Rich Text formats.

Glendale Arizona Settlement of Account is a legal process that involves resolving outstanding debts or financial obligations between a creditor and a debtor residing in Glendale, Arizona. It allows both parties to come to a mutually agreed settlement, which typically involves a reduced payment or a modified repayment plan. The settlement of account process ensures that the creditor receives a portion of the debt owed, while the debtor can resolve their financial burden in a more manageable way. There are several types of Glendale Arizona Settlement of Account, which are designed to cater to different situations and financial circumstances: 1. Credit Card Settlement: This type of settlement focuses on resolving outstanding balances on credit cards. Debtors who are struggling with high credit card debts can negotiate with creditors to reach a reduced settlement amount. 2. Medical Debt Settlement: This type of settlement specifically addresses medical debts accrued by individuals in Glendale, Arizona. Due to the rising costs of healthcare, many people find themselves overwhelmed by medical bills. Medical debt settlement offers a way to negotiate and potentially reduce the overall amount owed. 3. Personal Loan Settlement: Individuals who have taken out personal loans but are facing difficulties in meeting their payment obligations can opt for a personal loan settlement. This involves negotiating with the lender to agree on a reduced sum or new repayment terms that better suit the debtor's financial situation. 4. Mortgage Debt Settlement: In cases where individuals are struggling to pay their mortgages, a mortgage debt settlement can be pursued. This process allows homeowners to negotiate with their mortgage lender, potentially resulting in a modified payment plan or reduction in the outstanding balance. 5. Auto Loan Settlement: This type of settlement focuses on resolving outstanding debts related to auto loans. Individuals who are unable to keep up with their payments can negotiate a settlement with the lender, which may involve a reduced amount or a modified repayment plan. Glendale Arizona Settlement of Account provides an opportunity for debtors to address their financial burdens in a more manageable way, while also ensuring that creditors receive a portion of the amount owed. It is essential to seek professional assistance from debt settlement companies or attorneys in Glendale, Arizona, to navigate the legal intricacies of the settlement process and achieve the best possible outcomes.Glendale Arizona Settlement of Account is a legal process that involves resolving outstanding debts or financial obligations between a creditor and a debtor residing in Glendale, Arizona. It allows both parties to come to a mutually agreed settlement, which typically involves a reduced payment or a modified repayment plan. The settlement of account process ensures that the creditor receives a portion of the debt owed, while the debtor can resolve their financial burden in a more manageable way. There are several types of Glendale Arizona Settlement of Account, which are designed to cater to different situations and financial circumstances: 1. Credit Card Settlement: This type of settlement focuses on resolving outstanding balances on credit cards. Debtors who are struggling with high credit card debts can negotiate with creditors to reach a reduced settlement amount. 2. Medical Debt Settlement: This type of settlement specifically addresses medical debts accrued by individuals in Glendale, Arizona. Due to the rising costs of healthcare, many people find themselves overwhelmed by medical bills. Medical debt settlement offers a way to negotiate and potentially reduce the overall amount owed. 3. Personal Loan Settlement: Individuals who have taken out personal loans but are facing difficulties in meeting their payment obligations can opt for a personal loan settlement. This involves negotiating with the lender to agree on a reduced sum or new repayment terms that better suit the debtor's financial situation. 4. Mortgage Debt Settlement: In cases where individuals are struggling to pay their mortgages, a mortgage debt settlement can be pursued. This process allows homeowners to negotiate with their mortgage lender, potentially resulting in a modified payment plan or reduction in the outstanding balance. 5. Auto Loan Settlement: This type of settlement focuses on resolving outstanding debts related to auto loans. Individuals who are unable to keep up with their payments can negotiate a settlement with the lender, which may involve a reduced amount or a modified repayment plan. Glendale Arizona Settlement of Account provides an opportunity for debtors to address their financial burdens in a more manageable way, while also ensuring that creditors receive a portion of the amount owed. It is essential to seek professional assistance from debt settlement companies or attorneys in Glendale, Arizona, to navigate the legal intricacies of the settlement process and achieve the best possible outcomes.