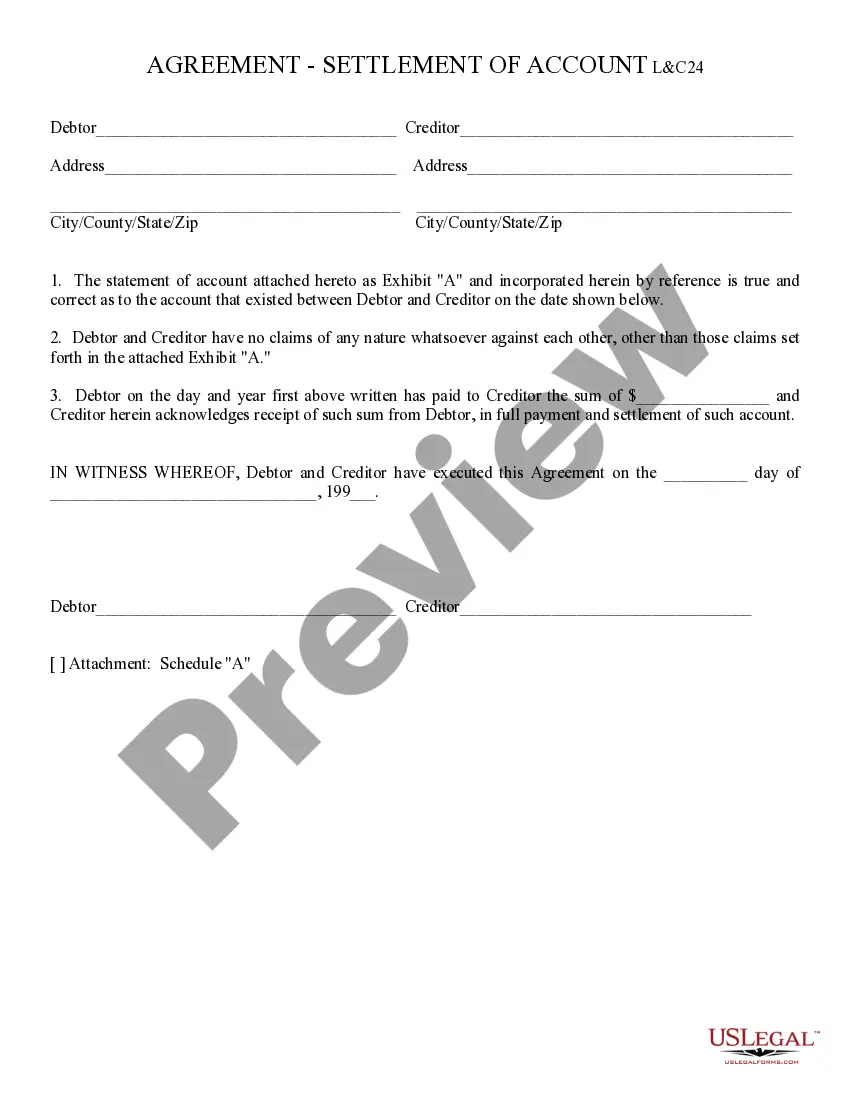

Settlement of Account: A Settlement of Account states that the Buyer and Seller previously had entered into a contract with one another; however, that contract has been fulfilled by both parties. Therefore, this a Statement that the account is settled and no other obligations are to be performed by either party. This form is available for download in both Word and Rich Text formats.

Maricopa, Arizona Settlement of Account is a legal process used to resolve outstanding debts between a debtor and a creditor in the city of Maricopa, Arizona. This procedure involves negotiating a payment plan or reaching an agreement to clear the debtor's financial obligations. The settlement of account process in Maricopa, Arizona begins when a debtor is unable to fulfill their financial commitments to a creditor. This could be due to various reasons such as job loss, medical expenses, or other unforeseen circumstances. The debtor and creditor can choose to engage in settlement negotiations to resolve the outstanding account and avoid further legal actions such as lawsuits or judgments. One type of settlement of account is a debt settlement, where the debtor negotiates with the creditor to reduce the total amount owed. In this case, the debtor might offer a partial payment to settle the remaining balance, which is typically lower than the original debt. Debt settlements are commonly used for credit card debt, medical bills, or personal loans. Another type of settlement of account is called a payday loan settlement, which specifically addresses outstanding payday loans. Payday loans are short-term, high-interest loans typically due on the borrower's next payday. In Maricopa, Arizona, settlement of payday loan debts allows debtors to negotiate a repayment plan or reduced total payment. It is important to note that each case of settlement of account in Maricopa, Arizona is unique, and the terms and potential outcomes can differ depending on the creditor, type of debt, and individual circumstances. The settlement process can be complex, and it is advisable for debtors to seek professional assistance, such as credit counseling, legal advice, or working with debt settlement companies. In conclusion, Maricopa, Arizona Settlement of Account refers to the process of resolving outstanding debts between debtors and creditors in the city. Different types of settlements exist, including debt settlements and payday loan settlements, to help debtors negotiate reduced total payments or favorable repayment plans. Seeking professional guidance is often recommended navigating the complexities of the settlement process effectively.Maricopa, Arizona Settlement of Account is a legal process used to resolve outstanding debts between a debtor and a creditor in the city of Maricopa, Arizona. This procedure involves negotiating a payment plan or reaching an agreement to clear the debtor's financial obligations. The settlement of account process in Maricopa, Arizona begins when a debtor is unable to fulfill their financial commitments to a creditor. This could be due to various reasons such as job loss, medical expenses, or other unforeseen circumstances. The debtor and creditor can choose to engage in settlement negotiations to resolve the outstanding account and avoid further legal actions such as lawsuits or judgments. One type of settlement of account is a debt settlement, where the debtor negotiates with the creditor to reduce the total amount owed. In this case, the debtor might offer a partial payment to settle the remaining balance, which is typically lower than the original debt. Debt settlements are commonly used for credit card debt, medical bills, or personal loans. Another type of settlement of account is called a payday loan settlement, which specifically addresses outstanding payday loans. Payday loans are short-term, high-interest loans typically due on the borrower's next payday. In Maricopa, Arizona, settlement of payday loan debts allows debtors to negotiate a repayment plan or reduced total payment. It is important to note that each case of settlement of account in Maricopa, Arizona is unique, and the terms and potential outcomes can differ depending on the creditor, type of debt, and individual circumstances. The settlement process can be complex, and it is advisable for debtors to seek professional assistance, such as credit counseling, legal advice, or working with debt settlement companies. In conclusion, Maricopa, Arizona Settlement of Account refers to the process of resolving outstanding debts between debtors and creditors in the city. Different types of settlements exist, including debt settlements and payday loan settlements, to help debtors negotiate reduced total payments or favorable repayment plans. Seeking professional guidance is often recommended navigating the complexities of the settlement process effectively.