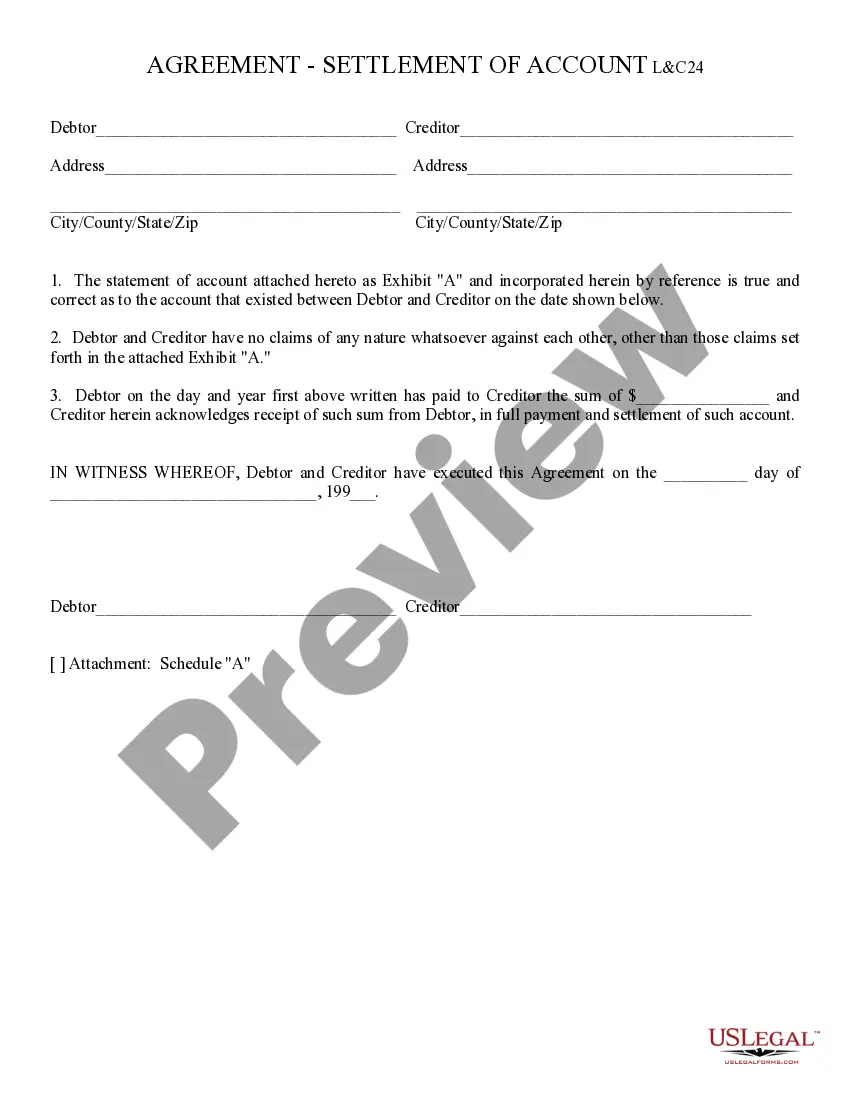

Settlement of Account: A Settlement of Account states that the Buyer and Seller previously had entered into a contract with one another; however, that contract has been fulfilled by both parties. Therefore, this a Statement that the account is settled and no other obligations are to be performed by either party. This form is available for download in both Word and Rich Text formats.

Phoenix Arizona Settlement of Account

Description

How to fill out Arizona Settlement Of Account?

Utilize the US Legal Forms and gain immediate access to any template you need.

Our user-friendly website, featuring a vast array of templates, enables you to locate and acquire nearly any document sample you seek.

You can download, fill out, and sign the Phoenix Arizona Settlement of Account in just a few minutes instead of spending hours online searching for the right template.

Leveraging our collection is a smart approach to enhance the security of your document submissions.

If you haven't created an account yet, follow the instructions below.

Locate the template you require. Verify that it is the correct form: review its title and details, and use the Preview feature if available. Otherwise, utilize the Search box to find the suitable one.

- How can you obtain the Phoenix Arizona Settlement of Account.

- If you possess an account, simply Log In to access it. The Download option will be visible for all documents you open.

- Moreover, you can access all your previously saved documents in the My documents section.

Form popularity

FAQ

It costs $16.00 to file a small claims complaint and $9.00 for a defendant to file an answer. Other filings or actions in the case may have additional fees. For those with low incomes, the filing fee may be waived by filling out a fee waiver form.

The Sheriff, Constable, or Process Server serves the Defendant where the Defendant lives, or works, or anywhere else the Defendant can be found. You must give the Sheriff, Constable, or Process server the exact address, and times of day the Defendant will be at the location to be served.

The Decedent's Creditors May Take Action Creditors have two years to file a valid claim against a decedent's estate if probate hasn't been opened. If the estate's beneficiaries and heirs fail to take action, the decedent's creditors can file a petition to start the estate settlement proceedings.

If you are suing a city, serve the city clerk or agent authorized to accept service. You can find the address and phone number on the government or the City website. If you are suing a county, serve the county clerk or agent authorized to accept service.

According to Arizona Code 14-3108, probate must be filed within two years of the person's death. There are a few exceptions to this deadline, including timelines for contesting a will or when a previous proceeding has been dismissed.

Civil Law The plaintiff files a document (complaint) with the clerk of the court stating the reasons why the plaintiff is suing the defendant, and what action the plaintiff wants the court to take. A copy of the complaint and a summons are delivered to (served on) the defendant.

I. Background Rule 4.2(c), Arizona Rules of Civil Procedure, authorizes service of the civil summons and complaint to the defendant outside of Arizona but within the United States by specific types of U.S. Mail or nationwide delivery services such as FedEx or UPS.

Probate Process For Informal Probate Proceedings: The Petition must be filed with the Superior Court in the county where the decedent resided at the time of death. The petition must include the names and addresses of the decedent's heirs and beneficiaries, as well as a list of the decedent's assets and liabilities.

Probate is required by Arizona law unless all of a decedent's assets are placed in trust or the decedent has listed beneficiaries for all their assets. However, Arizona has a more straightforward, streamlined probate process for smaller estates.

How to Start Probate for an Estate Open the Decedent's Last Will and Testament.Determine Who Will be the Personal Representative.Compile a List of the Estate's Interested Parties.Take an Inventory of the Decedent's Assets.Calculate the Decedent's Liabilities.Determine if Probate is Necessary.Seek a Waiver of Bond.