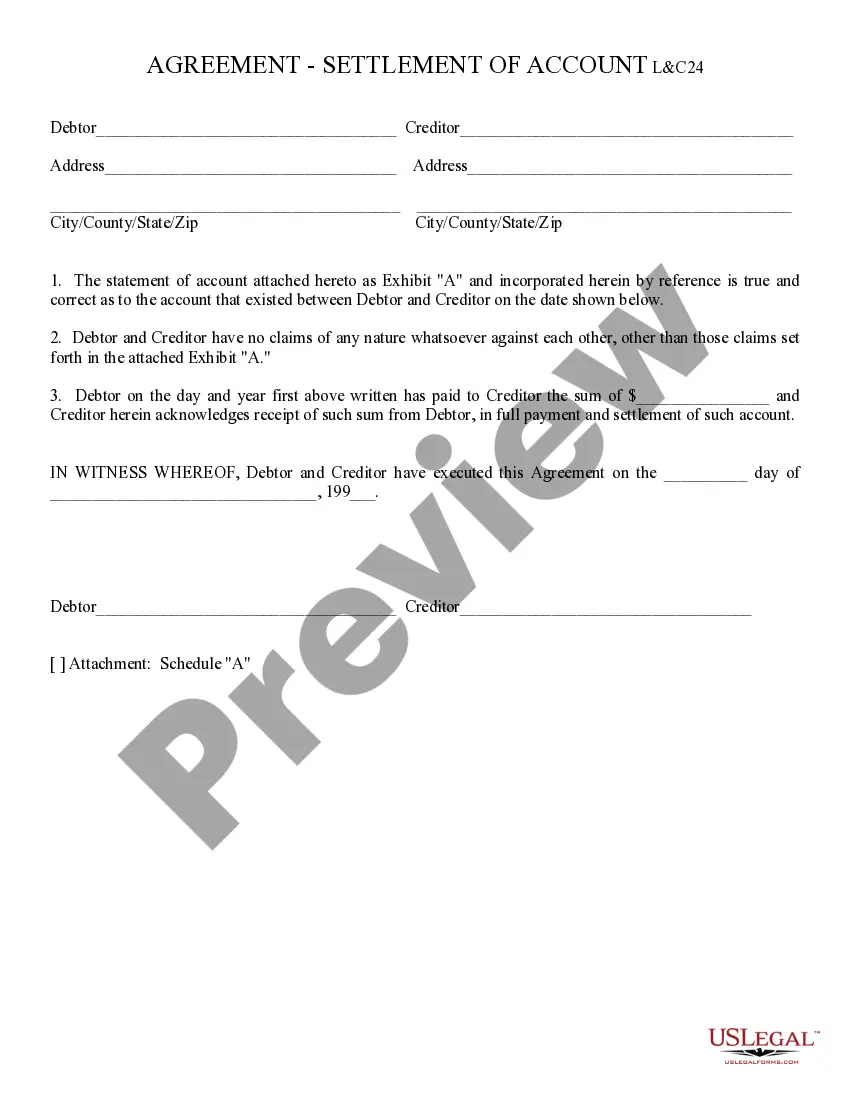

Settlement of Account: A Settlement of Account states that the Buyer and Seller previously had entered into a contract with one another; however, that contract has been fulfilled by both parties. Therefore, this a Statement that the account is settled and no other obligations are to be performed by either party. This form is available for download in both Word and Rich Text formats.

Lima Arizona Settlement of Account is a legal process that involves resolving outstanding debts or disputes between a creditor and debtor in the town of Lima, Arizona. This settlement is typically reached through negotiation or legal intervention, and it aims to find a mutually agreed-upon resolution that satisfies both parties involved. The primary goal of a Lima Arizona Settlement of Account is to close an account by either paying the debt in full or agreed upon partial payment. This settlement can be reached between individuals, businesses, or even between a person and a financial institution. It helps to resolve issues such as unpaid loans, credit card debts, medical bills, or any other outstanding financial obligations. There can be different types of Lima Arizona Settlement of Account, each with its own unique characteristics and circumstances. Some common types include: 1. Debt settlement: This type of settlement occurs when a debtor negotiates with their creditor to pay a reduced amount of the outstanding debt. Creditors may agree to accept a partial payment as a compromise to recover at least a portion of the debt. 2. Mediation or arbitration: In some cases, when both parties are unable to come to an agreement through negotiation, they may opt for mediation or arbitration to reach a settlement. A mediator or arbitrator acts as a neutral third party who helps facilitate discussions and suggests fair resolutions. 3. Loan modification: This type of settlement is often pursued for mortgages or other large loans. It involves modifying the terms of the loan to make it more affordable for the debtor. Modifications may include lowering interest rates, extending the loan duration, or forgiving a portion of the principal amount. 4. Lump-sum payment: In certain instances, a debtor may have the means to settle the debt in a single, lump-sum payment. This type of settlement provides a quick resolution, allowing the debtor to avoid further interest charges or legal actions. 5. Installment agreement: When a debtor is unable to make a one-time payment, an installment agreement can be reached. It allows the debtor to pay the debt in smaller, regular installments over an agreed-upon period, typically with interest. In conclusion, a Lima Arizona Settlement of Account is a crucial process for resolving outstanding debts or disputes in a mutually agreed-upon manner. The different types of settlements mentioned above demonstrate the flexibility and various approaches that can be taken to find a suitable resolution between a creditor and debtor.Lima Arizona Settlement of Account is a legal process that involves resolving outstanding debts or disputes between a creditor and debtor in the town of Lima, Arizona. This settlement is typically reached through negotiation or legal intervention, and it aims to find a mutually agreed-upon resolution that satisfies both parties involved. The primary goal of a Lima Arizona Settlement of Account is to close an account by either paying the debt in full or agreed upon partial payment. This settlement can be reached between individuals, businesses, or even between a person and a financial institution. It helps to resolve issues such as unpaid loans, credit card debts, medical bills, or any other outstanding financial obligations. There can be different types of Lima Arizona Settlement of Account, each with its own unique characteristics and circumstances. Some common types include: 1. Debt settlement: This type of settlement occurs when a debtor negotiates with their creditor to pay a reduced amount of the outstanding debt. Creditors may agree to accept a partial payment as a compromise to recover at least a portion of the debt. 2. Mediation or arbitration: In some cases, when both parties are unable to come to an agreement through negotiation, they may opt for mediation or arbitration to reach a settlement. A mediator or arbitrator acts as a neutral third party who helps facilitate discussions and suggests fair resolutions. 3. Loan modification: This type of settlement is often pursued for mortgages or other large loans. It involves modifying the terms of the loan to make it more affordable for the debtor. Modifications may include lowering interest rates, extending the loan duration, or forgiving a portion of the principal amount. 4. Lump-sum payment: In certain instances, a debtor may have the means to settle the debt in a single, lump-sum payment. This type of settlement provides a quick resolution, allowing the debtor to avoid further interest charges or legal actions. 5. Installment agreement: When a debtor is unable to make a one-time payment, an installment agreement can be reached. It allows the debtor to pay the debt in smaller, regular installments over an agreed-upon period, typically with interest. In conclusion, a Lima Arizona Settlement of Account is a crucial process for resolving outstanding debts or disputes in a mutually agreed-upon manner. The different types of settlements mentioned above demonstrate the flexibility and various approaches that can be taken to find a suitable resolution between a creditor and debtor.